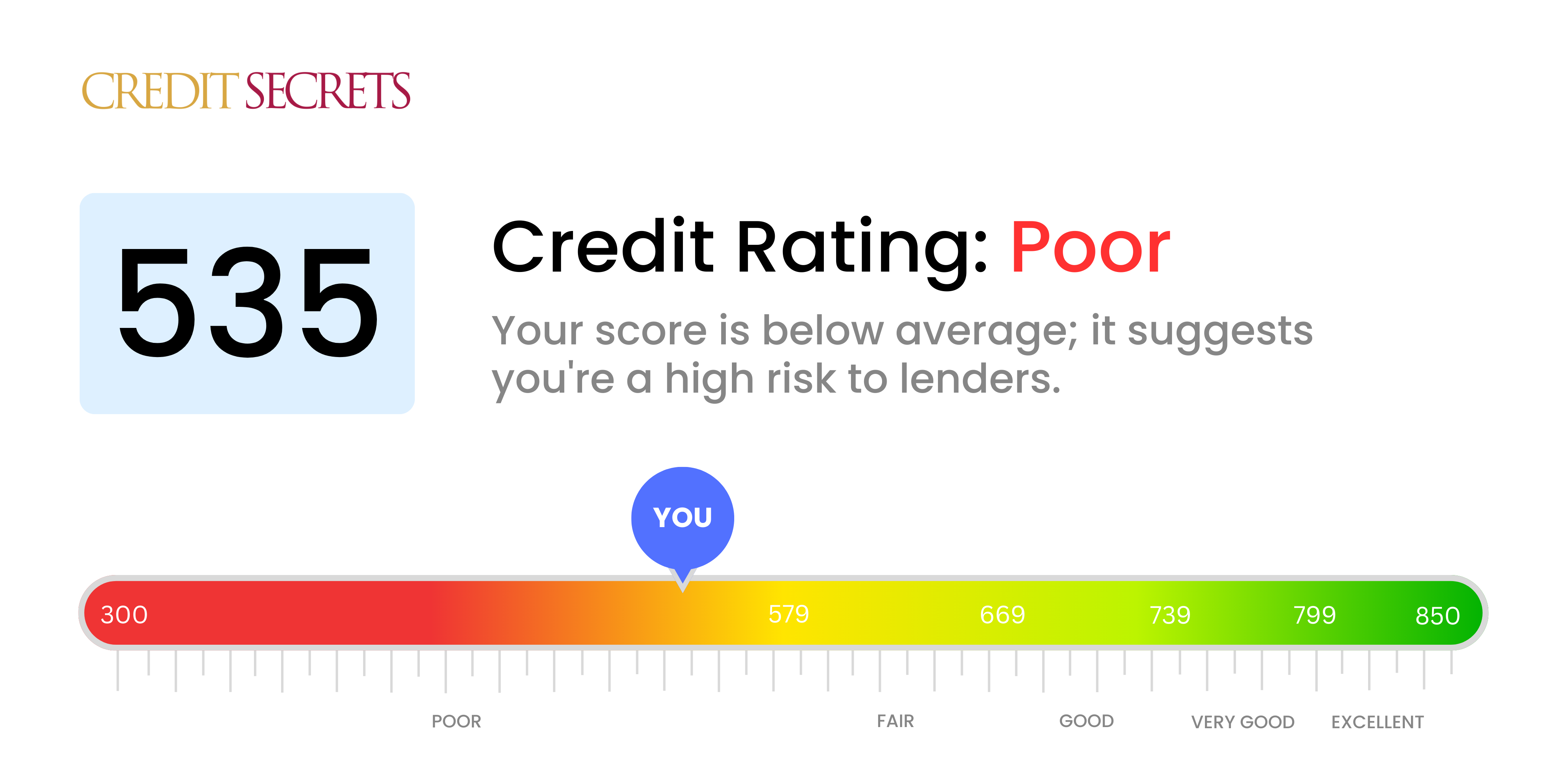

Is 535 a good credit score?

With a credit score of 535, you're currently in the 'poor' category. This might make it challenging for you to secure loans or credit cards and if you do qualify, you may face higher interest rates.

However, don't lose heart. Many have improved their credit scores from this point and so can you. Understanding your credit report and making timely payments can steadily raise your score over time and open doors to better financial opportunities.

Can I Get a Mortgage with a 535 Credit Score?

If you have a credit score of 535, getting approved for a mortgage may prove difficult. Generally, lenders look for scores of at least 620, and a score of 535 implies there may have been past financial struggles such as late payments, or even previous defaults on loans.

While this might feel discouraging, there are options to consider. One alternative can be improving one's credit score before approaching lenders for a mortgage. This might involve addressing any outstanding debts, making future payments consistently on time, and using credit responsibly. Remember, elevating a credit score takes time and consistency. Those with a low credit score might also explore non-qualified mortgage programs or government-insured loans like FHA loans, which have more lenient credit requirements. However, it's important to note that these alternatives often come with higher interest rates.

Can I Get a Credit Card with a 535 Credit Score?

With a credit score of 535, it's likely to be tough to secure approval for a regular credit card. This score is often seen as high-risk by lenders, indicating past financial turbulence or difficulties keeping up with payments. This might be a tough pill to swallow, but acknowledging the situation head-on is a critical step towards financial recovery. It's important to face the score with a sense of optimism and a firm grasp on reality.

Despite the hurdles that come with a low credit score, there are other avenues to explore. One option could be a secured credit card, which requires a refundable deposit equalling your credit limit. This card can be easier to get and help rebuild your credit score gradually. You might also consider getting a co-signer or using prepaid debit cards as a short-term solution. It's key to remember that these solutions won't offer an immediate fix, but they can be vital tools on your path towards financial stability. Bear in mind that any credit option available to people with a 535 credit score is likely to carry a higher interest rate, due to the increased risk lenders associate with such scores.

Having a credit score of 535 is well below what most lending institutions typically consider acceptable for a personal loan. To these lenders, a score this low reflects a high degree of risk, which makes it quite unlikely for you to be approved for a conventional loan. Facing the reality that this low credit score imposes on your loan options might seem daunting, but there are still possible avenues to explore.

When conventional loans don't appear viable, it's worth considering alternatives. Secured loans, which involve providing a form of collateral, or co-signed loans, which require the support of someone with a higher credit score, can be possible pathways. Another option includes peer-to-peer lending platforms, which sometimes have more relaxed credit needs. Keep in mind, however, that these alternatives often come with steeper interest rates and less favorable terms, as the lenders take on more risk.

Can I Get a Car Loan with a 535 Credit Score?

With a credit score of 535, the prospect of obtaining a car loan can present certain challenges. Most lenders often fancy scores above 660 for better loan terms and regard a score below 600 as subprime. Your credit score of 535 unfortunately falls into this latter group, which could mean higher interest rates or even a decline of your loan application. This is grounded on the perception that a low credit score translates to greater risk for lenders, suggesting possible complications in the repayment of loans.

But don't be disheartened. Despite a low credit score, the possibility of getting a car loan isn't completely off the table. There are some lenders who specialize in dealing with customers with lower credit scores. However, one must tread cautiously as these loans might come with noticeably high interest rates. This is due to the perceived risk lenders are accepting and serves as a means to safeguard their funds. It could be a rocky path, but with careful thought and a thorough understanding of the terms, acquiring a car loan remains a conceivable outcome.

What Factors Most Impact a 535 Credit Score?

Comprehending a credit score of 535 is critical to plotting your path towards better financial health. By tackling the areas influencing this score, you create a strong foundation for a prosperous financial future. No two financial journeys are alike, but each presents opportunities for growth and understanding.

Payment Record

Your payment history prominently impacts your credit score. If your records show missed or late payments, it's likely affecting your score.

How to Check: Look at your credit report, take note of any late payments or missed ones. Remember that even a single late payment could negatively impact your score.

Credit Usage

Excessive utilization of your credit facilities can negatively affect your score. Using a substantial portion of your credit limit could be a contributory factor to your score.

How to Check: Review your credit card statements - are the balances close to their caps? It's advisable to maintain low balances relative to your credit limit.

Credit History Span

A relatively short credit history could be influencing your score adversely.

How to Check: Study your credit report to determine the oldest, newest, and the average age of all your accounts. Think about any recent actions you may have taken, like opening new accounts.

Types of Credit and Recent Credit

Maintaining mixed types of credit and handling new credit with responsibility is crucial for a healthier score.

How to Check: Review your range of credit accounts: credit cards, retail accounts, personal loans, mortgages, etc. Reflect on how often you apply for new credit - moderation is key.

Public Records

Public records such as bankruptcies, foreclosures, or tax liens can heavily affect your score.

How to Check: Check your credit report for any such public records. Seek to resolve any listed items that need attention.

How Do I Improve my 535 Credit Score?

With a credit score of 535, you are in the ‘poor’ category, but that doesn’t mean it’s permanent. Here are some key steps tailored to your current situation to realistically boost your score.

1. Resolve Negative Marks

Review your credit report for outstanding debts or derogatory marks. Address these issues swiftly, pay what you can and if possible, communicate with your creditors to establish a manageable payment plan.

2. Lower Outstanding Balance

Implement a strategy to decrease your credit card balances to less than 30% of your credit limit. It’s beneficial to first target the card with the highest balance in relation to its limit.

3. Consider a Secured Credit Card

At this score level, applying for a secured credit card can be a strategic move. Though these cards require a cash deposit, they offer a platform to build a positive payment history, which will impact your score positively.

4. Seek Authorized User Status

If possible, become an authorized user on the credit card of a trusted individual with a good credit history. Be sure that the card provider reports authorized user activity to credit bureaus, this can strengthen your credit record considerably.

5. Add Variety to Credit Type

Varying the types of credit you have can positively impact your credit score. Once you establish a good payment record with your secured card, you may wish to explore other types of credit like a credit builder loan to further enhance it.