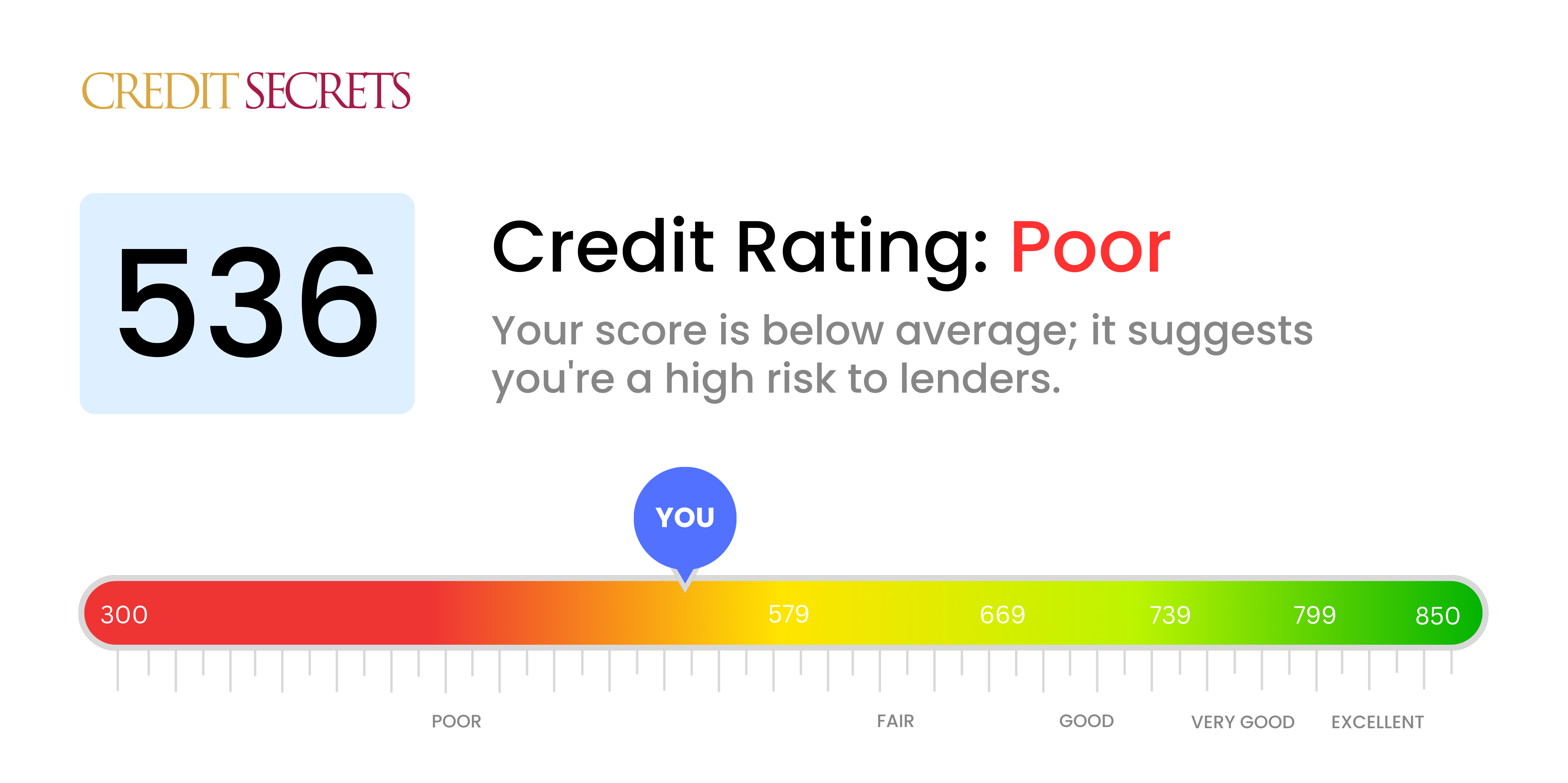

Is 536 a good credit score?

With a credit score of 536, you're currently classified in the 'poor' credit range. This lackluster scoring may make securing leases, loans, or favorable interest rates quite a challenge, but it's important to remember there are always steps you can take to improve it.

Your score is not engraved in stone, and while it may take time and discipline, boosting your credit is entirely possible. By doing things like settling any outstanding debts, paying bills on time, and only utilizing a small portion of your available credit, you can gradually increase your score and open up a world of financial opportunities.

Can I Get a Mortgage with a 536 Credit Score?

With a credit score of 536, your likelihood of mortgage approval is rather low. Most mortgage lenders require a higher score, and this figure suggests you've experienced financial hardships like late payments or defaults. It's understandable how tough this situation can be; unfortunately, the financial world often appears unsympathetic to individual circumstances.

Given your score, it is important to start rebuilding your credit. Start by addressing any past due amounts and resolving defaults. Building a clear history of timely payments and prudent credit usage can positively impact your score over time. It is important to remember that improvement doesn't happen overnight, yet with regular effort and discipline, you can strengthen your credit standing for future possibilities. The path to a better financial future may seem long and full of challenges, but remember that better credit behaviors can lead to higher scores and broader opportunities.

Can I Get a Credit Card with a 536 Credit Score?

Having a credit score of 536 suggests you'll likely encounter hurdles when trying to be approved for a traditional credit card. A score in this realm is often seen by lenders as risky, indicating past financial struggles and lending issues. Dealing with this reality can be challenging, but it's important to face it with a grounded mindset and to see it as a starting point towards building a stronger financial future.

Given the obstacles tied to a lower credit score, you might want to consider alternatives, such as secured credit cards. These require a deposit up front that sets your credit limit and can be an achievable way to start rebuilding your credit. Another option could be getting a co-signer or exploring prepaid debit cards. While these options don't offer an immediate fix, they can be constructive elements in your road to better financial stability. Be aware that interest rates on any credit you may qualify for will likely be higher, as lenders are compensating for the perceived risk associated with a lower credit score.

Having a credit score of 536 presents a real challenge when applying for a personal loan from traditional lenders. Generally, this score is seen as a strong indication of high risk, making it less likely for you to receive approval. While it's a tough circumstance, understanding what this credit score means for your loan options is key to making the best financial decisions.

Traditional loans might not be a viable option, but there are alternatives you can explore. Secured loans, which require collateral, may be one potential avenue. Alternatively, you might consider a co-signer loan, where another individual with a better credit score guarantees your loan. Another option could be peer-to-peer lending, as these platforms sometimes have less stringent credit requirements. However, these alternatives usually come with higher interest rates and terms that are less favorable due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 536 Credit Score?

With a credit score of 536, it could be a bit tough to get approval for a car loan. Most lenders prefer to work with individuals who have scores above 660 as they are associated with a lower risk. Hence, a credit score below 600, just like yours, is usually seen as subprime. This means that you could face higher interest rates or even a straight-up denial of your loan application. Why? Simply because this score may convey to lenders that you could have challenges repaying the loan.

But don't lose heart. Even with a less than perfect credit score you could still potentially secure a car loan. Some lenders do specialize in working with people with lower credit scores. However, tread carefully. Loans from these lenders often come attached with significantly higher interest rates, as a response to the increased risk they believe they're taking on. So, it might not be a smooth ride, but with some careful thought and understanding of the loan terms, a car loan is still achievable.

What Factors Most Impact a 536 Credit Score?

Grasping a score of 536 is a crucial first step in your financial growth journey. By identifying contributing factors, you can create a pathway to a higher credit score and a richer financial future.

Payment History

One of the core factors affecting your credit score is your payment history. Late payments or defaults can significantly influence your score.

How to Check: Scan your credit report for any late or defaulted payments. Reflect on your payment practices and identify where you can make changes.

Credit Utilization

Having a high credit utilization – or using a high percentage of your available credit – can lower your score. If your credit cards are frequently maxed out, this is likely affecting your score.

How to Check: Refer to your credit card statements. Consider your balance-to-limit ratios and aim to reduce your balances if possible.

Length of Credit History

If your credit history is relatively short, it might not give lenders the confidence they need and, in turn, may negatively affect your score.

How to Check: Consult your credit report to understand the longevity of your credit history. Remember, it's not just about having credit, but about how long you've managed it responsibly.

Credit Mix

The types of credit you own, i.e., your credit mix, influences your credit score. Balancing between credit cards, retail accounts, and different types of loans show your ability to manage variety.

How to Check: Analyze your credit report for the mix of credit types. Balance is key.

Public Records

Public records such as bankruptcies or liens can bring down your score significantly.

How to Check: Your credit report will list any public records. Work towards resolving these, where possible.

How Do I Improve my 536 Credit Score?

Having a credit score of 536 means there’s room for improvement. With targeted actions, enhancing your score from this level is certainly feasible. Below we outline some accessible and substantial strategies for this score range:

1. Verify Credit Report Accuracy

Errors can occur on your credit report and negatively impact your score. Ensure all information reported is accurate. If you find any mistakes, request corrections with the credit bureaus and the company that provided the erroneous information.

2. Prioritize Outstanding Debts

Outstanding debt, particularly ones in collections, can severely impact your credit score. Start by focusing on these debts. Get in contact with your debt collectors to negotiate reasonable payment terms.

3. Make Timely Payments

On-time payment history is crucial in improving your credit score. Ensure you’re current on all existing accounts and continue to pay bills on time moving forward.

4. Consider a Secured Loan

Obtaining new credit may be challenging with your current score. A secured loan could be a viable option. This requires collateral (like a car or money in a savings account) but can showcase responsible borrowing when paid on time.

5. Limit New Credit Applications

Applying for new credit may lower your score and generate a hard inquiry on your report. So, avoid unnecessary credit applications. Only apply when it’s essential and beneficial to your financial profile.

6. Maintain Low Credit Card Utilization

High credit card utilization often leads to a lower score. Keep your card balances low, ideally under 30% of your total credit limit to signal responsible credit use.