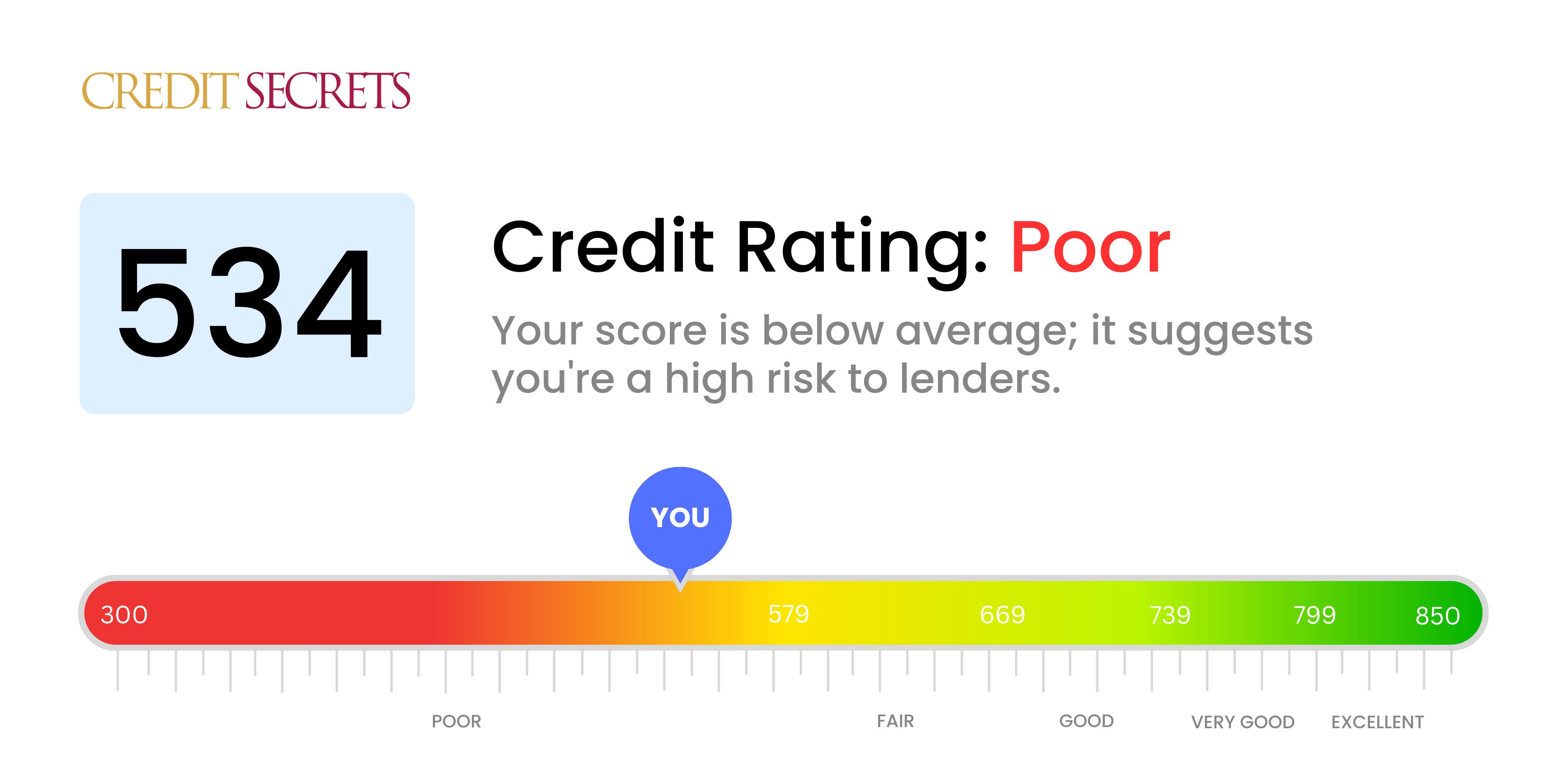

Is 534 a good credit score?

A credit score of 534 falls into the 'poor' category, which implies some difficulty in obtaining credit or loans from many lenders. However, it's critical to remember that improving this score is not an impossible task, there exist multiple methods to steadily increase your credit health.

With a score of 534, you might face higher interest rates or stringent terms on credit cards, loans, or other lines of credit. But remember, every step taken towards improving your credit score gets you closer to better financial opportunities and greater financial freedom. It's a journey, and every journey starts with a single step.

Can I Get a Mortgage with a 534 Credit Score?

If your credit score is 534, securing a mortgage might be a challenge as most lenders require a higher score for approval. A credit score in this range typically indicates past financial issues, including missed or late payments. This might lead lenders to consider you a higher risk, which can impact your ability to qualify for a mortgage loan.

But don't lose hope. There are alternatives if a conventional mortgage loan is not currently within reach. Look into programs designed for individuals with lower credit scores, like FHA loans. However, kindly note that even these programs will still require a certain minimum credit score, and higher interest rates might apply due to the elevated perceived risk. It's essential to keep moving forward and focus on improving your credit score to lay the groundwork for your future financial goals. Remember, change is a gradual process, but with patience, understanding and careful planning, it is absolutely possible.

Can I Get a Credit Card with a 534 Credit Score?

Having a credit score of 534 presents some challenges when seeking approval for a traditional credit card. This score is often seen as risky by lenders, indicating possible past financial struggles or ineffective credit management. Dealing with these circumstances can be disheartening, but acknowledging the reality of the situation is a crucial step toward achieving better financial health. It can be a difficult pill to swallow, but having an honest understanding of your credit status is an important start.

Secured credit cards offer a potential solution for those struggling with lower credit scores. These types of cards require a deposit which then sets your credit limit. They're typically easier to get and can help improve a credit score over time. Co-signers or prepaid debit cards may also be considered. While these won't fix the situation quickly, they serve as tools in working toward improved financial stability. It's also worth noting that with a lower credit score, any credit available will likely come with higher interest rates due to increased risk to lenders.

Having a credit score of 534 can make obtaining a personal loan from traditional lenders a bit challenging. This score falls below the usual range deemed acceptable by many financial institutions for approving personal credit. To them, a score this low indicates a high likelihood of financial risk. Unfortunately, with a credit score in this range, it's improbable you'd qualify for a traditional personal loan.

Although this might seem disheartening, there are other avenues to explore. One option could be secured loans, where you offer an asset as collateral. Co-signed loans are another alternative, which requires a person with a higher credit rating to co-sign your application, acting as a guarantor. You could also consider peer-to-peer loans, where individuals, rather than banks, lend money. But remember, these options may have higher interest rates and less favorable conditions due to the elevated lending risk. Despite the hurdles, it's essential to remain hopeful and explore all your options.

Can I Get a Car Loan with a 534 Credit Score?

Navigating the realm of car loans with a credit score of 534 can be tricky, but not impossible. Typically, lenders favor scores above 660 for car loans and a score lower than 600 is often labeled as subprime. So, your score of 534 fits into this subprime band. This shows lenders that there might be a higher risk involved as your credit score implies a history of potential repayment challenges.

On the bright side, your journey towards owning a car isn't at a roadblock just yet. You might still be able to explore lenders who are ready to work with lower credit scores. Keep in mind, these loans may come with higher interest rates as lenders need a way to protect their investments. Pursuing car ownership might seem a bit challenging with a lower credit score, but by fully understanding and thoughtfully considering the loan terms, driving away with your dream car is still a reachable goal. Staying informed and careful will be the key to your success.

What Factors Most Impact a 534 Credit Score?

Holding a credit score of 534 should be seen as an opportunity for growth and development towards sustained financial health. It's necessary to highlight some key areas that may have led to this score and provide actionable steps to improvement.

Past-Due Payments

Missed or past-due payments can significantly lower your credit score. Are there any on your credit report?

How to Check: Look at your credit history. If there are overdue payments, make an effort to ameliorate this situation by prioritizing consistent and timely payments.

Credit Utilization

Maxing out your credit limits might be one of the factors pushing your score down as it suggests you're over-reliant on credit.

How to Check: Scan your credit card statements to see how much of your full credit limit you're using. Keeping the usage below 30% can enhance your score overtime.

Length of Credit History

A brief or non-existent credit history could be a contributor to a lower score.

How to Check: Inspect your credit report to ascertain how long you've had your accounts open. Be mindful when opening new accounts, as this reduces the average age of your credit history.

Collection Accounts

Accounts that have been handed over to collection agencies have a significant negative impact on your score.

How to Check: Scrutinize your credit report for any collection accounts. If you find any, seek to resolve them promptly.

Public Records

Public records such as foreclosures, bankruptcies or tax liens leave a heavy dent in your credit score.

How to Check: Review your credit report to see if it contains any of these records. Efforts to resolve these major issues can bring about significant improvement.

How Do I Improve my 534 Credit Score?

Having a credit score of 534 falls under the poor credit range but this is not the end of your financial journey. Focused steps and strategies can help boost your score. Here are some pathways to consider:

1. Deal with Past-Due Accounts

Your first step should be to address past-due accounts. These greatly affect your credit score and could be causing it to sink. Approach your creditors to renegotiate payment terms and make an effort to start clearing these debts, prioritizing the ones that are the most overdue.

2. Pay down High Credit Card Debt

High credit card debt versus your credit limit is another major factor pulling your score down. Aim to repay your debts and bring your balances lower than 30% of your total credit limits. Later, you may put a goal to keep it under 10%.

3. Opt for a Secured Credit Card

A low score may make it difficult to get a traditional credit card. Consider getting a secured credit card that uses a cash deposit as your credit line. Be sure to handle it responsibly by clearing balances each month, which builds a record of regular payments.

4. Leverage being an Authorized User

If a family member or friend has a good credit score, ask if they can add you as an authorized user. This allows sharing of their good credit habits, and you’ll benefit if their card issuer reports authorized user’s activity to credit bureaus.

5. Explore Different Types of Credit

Having a mix of the credit types you handle can positively impact your score. Once you establish a good secured card history, venture into other forms of credit like retail cards or credit builder loans. Manage them responsibly to further boost your score.