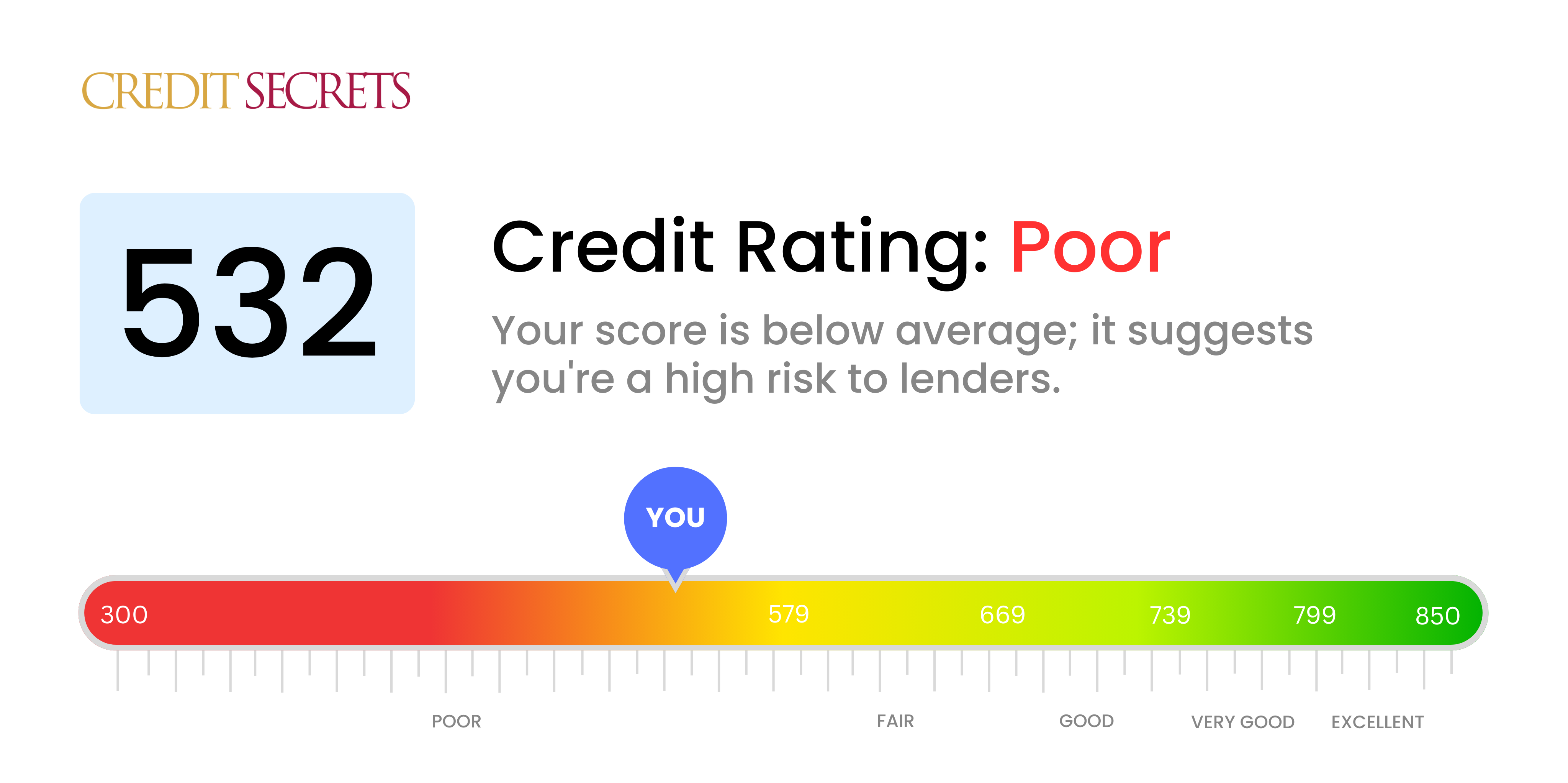

Is 532 a good credit score?

A score of 532 is indeed considered a poor credit score. It's important to take this situation seriously, but don't lose hope, as it's entirely possible to improve your financial standing from here.

With this score, you may find that getting approved for new credit or loans can be a challenge, and potentially come with higher interest rates. However, it's essential to remember that this doesn't define your financial future. By exploring our Credit Secrets program, you can find effective strategies and techniques that can help raise your credit score and achieve your financial goals in the long run.

Can I Get a Mortgage with a 532 Credit Score?

With a credit score of 532, it may be challenging to get approval for a mortgage. This score is notably below what most mortgage lenders require. This typically indicates that there may be some financial missteps in your past, such as late payments or not meeting financial commitments.

A score like this, however, does not mean a mortgage door is completely shut. While traditional lenders might not be willing to approve a mortgage, there are alternatives. For example, FHA loans, designed for low-to-moderate income earners, have a lower minimum credit score requirement and could be a viable option. Consider also exploring local first-time homebuyer programs which may be less stringent about credit scores. Alternatively, you can focus on boosting your credit score for the time being. This is a gradual process, but every little bit helps to put you in a better position to achieve your home ownership dream. Remember, this is a temporary setback and not a permanent deterrent. Your financial future can still be bright with the correct steps.

Can I Get a Credit Card with a 532 Credit Score?

Securing approval for a traditional credit card with a credit score of 532 can be rather tough. This score is generally seen as risky by lenders, indicating past financial struggles or mismanagement. Facing this reality is undoubtedly unsettling, but it's crucial to view it with a sense of understanding. Acknowledging one's current credit situation is the inaugural step towards financial recovery, even if it means accepting some harsh realities.

Given the constraints associated with a lower score like this, seeking out alternatives like secured credit cards could be a worthwhile option. Secured cards necessitate a deposit that serves as your credit limit, making them feasibly accessible and a potential tool to help reconstruct credit gradually. Considering becoming an authorized user on a family member’s card, or exploring pre-paid debit cards, are also potentially viable paths. It's essential to remember these routes won't offer immediate remedy, but they can be instrumental in the quest towards financial betterment. Credit options accessible to individuals with such scores generally carry considerably higher interest rates, reflecting the higher perceived risk to lenders.

With a credit score of 532, it may be difficult to secure approval for a personal loan from standard lending institutions. Often, this score indicates a significant risk to lenders, which can make it challenging to obtain a loan under typical conditions. While your situation might feel tough, it's crucial to be informed about what a credit score of 532 signifies for your borrowing possibilities.

If traditional personal loans seem out of reach, you could explore other avenues such as secured loans or co-signed loans. In the case of a secured loan, you would be required to offer collateral. For co-signed loans, another person with a robust credit rating would pledge to cover the loan if you're unable to. Peer-to-peer lending is another possible alternative, as they can sometimes exhibit more flexible credit requirements. Bear in mind, though, that these alternative methods often come with higher interest rates and less favorable terms. These conditions are due to the enhanced risk associated with lending to individuals with lower credit scores.

Can I Get a Car Loan with a 532 Credit Score?

Having a credit score of 532 might put a hurdle in your path towards getting approved for a car loan. Often, lenders look for credit scores above 660 for approval and favorable loan terms. A score under 600, like your score of 532, is typically classified as subprime. This signals a higher risk to lenders and suggests potential issues with loan repayment based on your credit history. This could result in higher interest rates or even in your loan application being turned down.

But it's important to remember that a lower score doesn't necessarily prevent you from buying a car. It might just make the journey a bit tougher. Some lenders are equipped to work with lower credit scores, but tread lightly. These loans can often carry hefty interest rates due to the increased risk to the lender. Examine the terms carefully and weigh your options. Despite the challenges, a car loan isn't entirely out of reach with a 532 credit score.

What Factors Most Impact a 532 Credit Score?

Grasping your 532 credit score is the first step to financial freedom. Evaluating and rectifying the factors at play is key to getting back on track financially. Let's delve into what may be affecting this score.

Late Payments

Delayed or missed payments play a part in driving your credit score. A pattern of such behaviour may negatively impact your score.

How to Check: Scrutinize your credit report for any late payments. Reflect on any scenarios where you might have delayed or forgotten to pay on time.

Credit Card Utilization

Maxing out your credit cards? High credit usage may be an influential component of this score.

How to Check: Go through your credit card statements. Are your balances close to the max? Keeping lower balances relative to your limit is advantageous.

Credit History Duration

The length of your credit history may also affect your score. A brief credit history can bring down your score.

How to Check: Analyze your credit report to establish the lifespan of your oldest and recent accounts and the average age of all your accounts. Assess if you have opened new accounts recently.

Type and Quantity of New Credit

A broader mix of credit types and managing new credit judiciously contributes to a healthier score.

How to Check: Review your mix of credit accounts such as credit cards, retail accounts, auto loans, and home loans. Consider whether you have been applying for new credit carefully.

Derogatory Marks

Major derogatory marks like bankruptcies or tax liens can significantly bring down your score.

How to Check: Look through your credit report for any derogatory marks. Attend to any listed items promptly.

How Do I Improve my 532 Credit Score?

With a credit score of 532, improvement may seem distant but it is entirely possible. The following steps are accessible and impactful measures for your current situation:

1. Settle Outstanding Debts

If there are unpaid balances on your report, focusing on tackling these debts should be your starting point. It is valuable to pay off these accounts quickly, beginning with the most overdue ones. If required, confidently approach your creditors to discuss alternate repayment strategies.

2. Keep Credit Card Balances Low

High credit card balances can adversely affect your credit score. Aim for maintaining your credit card balances below 30% of your credit limit to improve this score. Prioritize the cards with the highest balances. If possible, try to keep these balances below 10% in the long run.

3. Apply for a Secured Credit Card

Given your present score, obtaining an ordinary credit card might not be easy. A secured credit card, which requires a cash collateral deposit equivalent to the credit limit, could be a great start. Use it modestly while paying off the full balance routinely to develop a history of positive payments.

4. Seek to be an Authorized User

Request a reliable friend or relative with a good credit track record to add you as an authorized user on their card. This can enhance your credit score by reflecting their positive payment record onto your report. Ensure the card provider shares the account activity with the credit bureaus.

5. Broaden Your Credit Types

Including a mix of credit types in your profile can help to enhance your credit score. Once a good payment behavior is established with a secured card, consider adding other credit forms like a retail card or credit builder loan, and handle them responsibly.