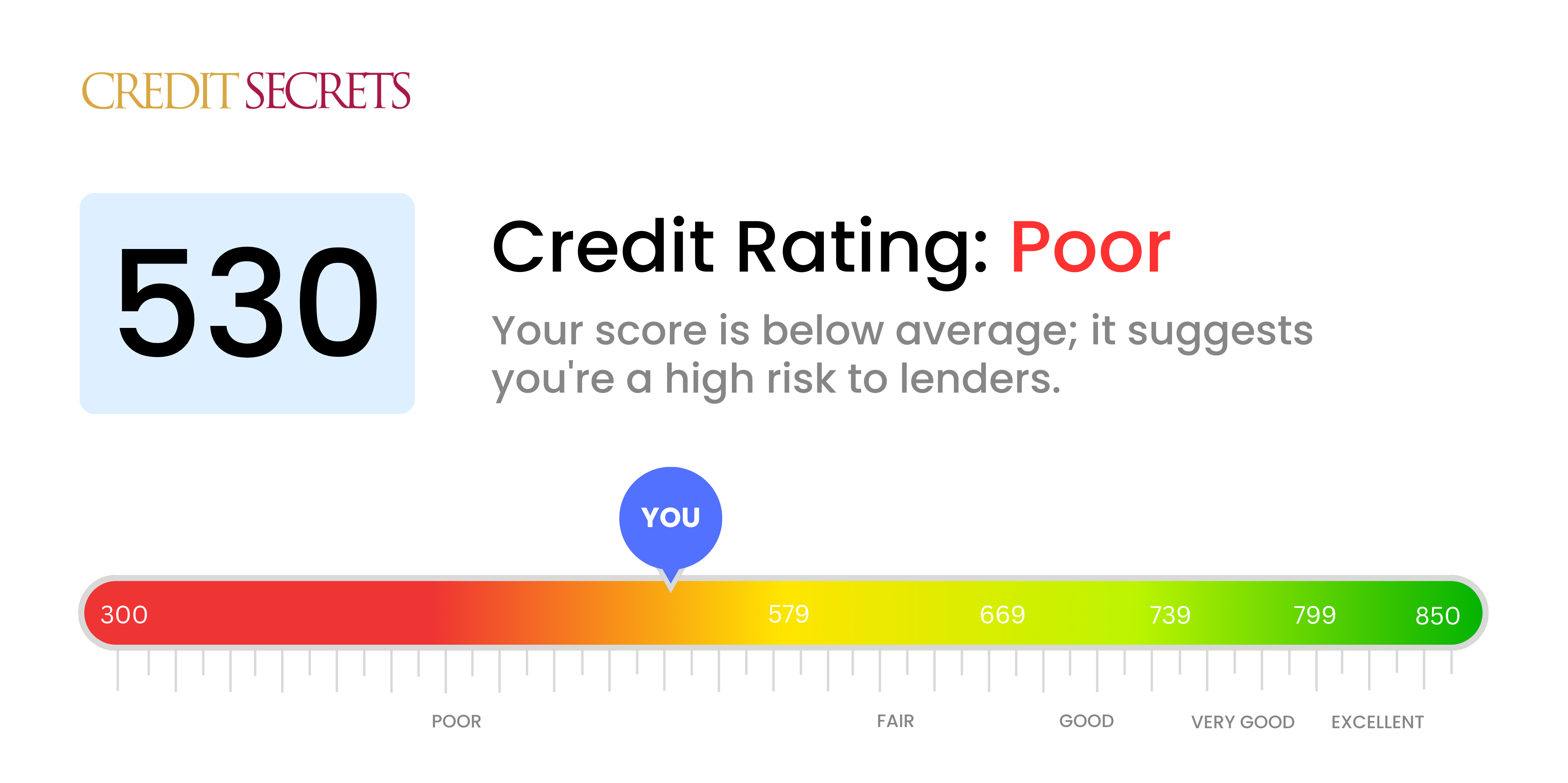

Is 530 a good credit score?

Having a credit score of 530 falls into the "Poor" range. Don't lose hope though, as this doesn't mean you're stuck in this situation forever. Although the options and offers for credit cards or loans might be limited and at higher interest rates, there are always strategies and good practices to improve your credit score.

Improving credit calls for both time and diligent management of your credit. It can seem daunting, but remember, it's a journey that many have successfully navigated. You can indeed work towards achieving your financial goals and gradually move up the credit scale by consistently making payments on time and responsibly managing your debts.

Can I Get a Mortgage with a 530 Credit Score?

With a credit score of 530, it's unfortunately unlikely that you'll be approved for a mortgage. This score is significantly below the typical minimum many mortgage lenders require. A score in this zone often reflects a history of missed or late payments, maxed-out credit cards, or perhaps even prior bankruptcies—all of which raise red flags for potential lenders.

While it might feel discouraging now, it is not the end of your homeownership dreams. Alternative ways to home ownership could be rent-to-own arrangements or looking for private lenders who might be more lenient with lower credit scores, but tend to offer mortgages at higher interest rates. Alternatively, certain government programs like the Federal Housing Administration (FHA) may provide loans to individuals with lower scores, but these often carry higher insurance costs. It will be important to explore all options carefully before committing.

Can I Get a Credit Card with a 530 Credit Score?

Having a credit score of 530 will make it tough to get approved for most traditional credit cards. This score might seem like a barrier, but it's also an opportunity to take a hard look at your financial health. Remember that lenders may see this score as indicating greater financial risk. It's essential to understand this and strategize accordingly.

Secured credit cards could be a suitable option for someone with a credit score of 530. These cards involve paying a deposit, and this deposit acts as your credit limit. They are generally easier to get and can be a significant stepping stone to rebuilding credit over time. Another option could be to find a reliable co-signer or even look into prepaid debit cards. While these won't magically fix your score, they might help in steadily improving it over time. Interest rates for any credit you do get are likely to be higher, because of the perceived risk your score presents to lenders. But with time, patience and consistent effort, you can aim to improve your score.

With a credit score of 530, it may be challenging for you to secure a personal loan from most traditional lenders. This score is considered subpar, and it suggests to financial institutions that lending money to you carries substantial risk. The reality of obtaining a loan with your current credit score may seem daunting, but it's important to understand the playing field.

While traditional personal loans might not be an option, there are other paths you could explore. Consider secured loans where tangible assets serve as collateral, or co-signed loans that involve a person with a high credit score vouching for your reliability. Peer-to-peer lending is another potential avenue, as these platforms may have more flexible criteria. Be aware that alternatives like these often carry higher interest rates due to increased risk for the lender. Therefore, consider these options carefully and understand the terms completely before proceeding.

Can I Get a Car Loan with a 530 Credit Score?

Having a credit score of 530 can certainly create obstacles when trying to secure a car loan. It's common for lenders to prefer a credit score that's at least 660 and a score of 530 is considered to be subprime. Due to this classification, getting favorable loan terms might prove challenging. Lenders tend to view this score as an indication of higher risk due to past difficulties in repaying loans.

Notwithstanding your credit score, there are still opportunities for securing a car loan. Some lenders specialize in providing loans to those with lower credit ratings. However, it's essential to tread carefully, as such loans are usually accompanied by comparatively high-interest rates, seen as a method to mitigate the risks. After a detailed examination of the loan terms and a careful decision-making process, obtaining a car loan remains achievable despite a lower credit score.

What Factors Most Impact a 530 Credit Score?

Grasping the implications of a 530 credit score is integral to initiating the first steps towards financial wellness. By examining and dealing with factors affecting your score, you carve the path towards a more secure financial lifestyle. Keep in mind that each person's financial voyage is unique, lined with chances for growth and understanding.

Payment History

The impact of payment history on your credit score is considerable. Late payments or defaults are probable culprits of your present score.

How to Check: Inspect your credit report for any signs of late payments or defaults. Think about any situations where payments may have been postponed as these could have influenced your score.

Credit Utilization

High credit utilization can depreciate your score. If your credit cards are near their maximum capacity, this might be a determinant in your score.

How to Check: Analyze your credit card statements. Are your debts high in comparison to your limits? Keeping balances low in relation to your limit is advisable.

Credit History Length

A brief credit history might be a negative influence on your score.

How to Check: Look into your credit report and determine the age of your oldest and latest accounts, as well as the average life across all accounts. Give thought to any recent openings of new accounts.

Type of Credit and New Credit

Having diverse credit types and handling new credit wisely are vital for a favorable score.

How to Check: Assess your collective credit accounts, including credit cards, retail accounts, installment loans, and mortgage loans. Consider if you have been judicious in applying for new credit.

Public Records

Public records encompassing bankruptcies or tax liens can severely impact your score.

How to Check: Check your credit report for any public records. Attend to any listed items that may require resolution.

How Do I Improve my 530 Credit Score?

A score of 530 is considered below average, but it’s important to remember you’re not alone and there are effective paths to recovery. Below are some tailored strategic changes you can make to increase your score:

1. Review and Rectify Your Credit Reports

Misinformation on your credit reports could be dragging your score down. Request a free report from each of the credit bureaus (Equifax, Experian, and TransUnion), review them for errors, and dispute any inaccuracies.

2. Prioritize Delinquent Accounts

Delinquent accounts severely damage your credit score. Prioritize bringing these accounts current either through payment plans or settlements, and ensure all future payments are on time.

3. Use a Secured Credit Card

Acquiring a traditional credit card with a score of 530 may be challenging. Opt for a secured credit card instead, which requires a refundable deposit. Use it regularly, but responsibly – with the intention of paying it off monthly to foster a good payment history.

4. Leverage an Authorized User Status

Find a trustworthy person with good credit to add you as an authorized user on their credit account. This adds their good habits to your credit history. Verify that the card issuer reports authorized user activity to credit bureaus.

5. Explore Credit Building Loans

Once you have shown good account management with a secured card, consider a credit builder loan from your bank or credit union – these loans are specifically aimed to help boost credit scores.

By acting on these steps, you can see significant improvements in your credit score.