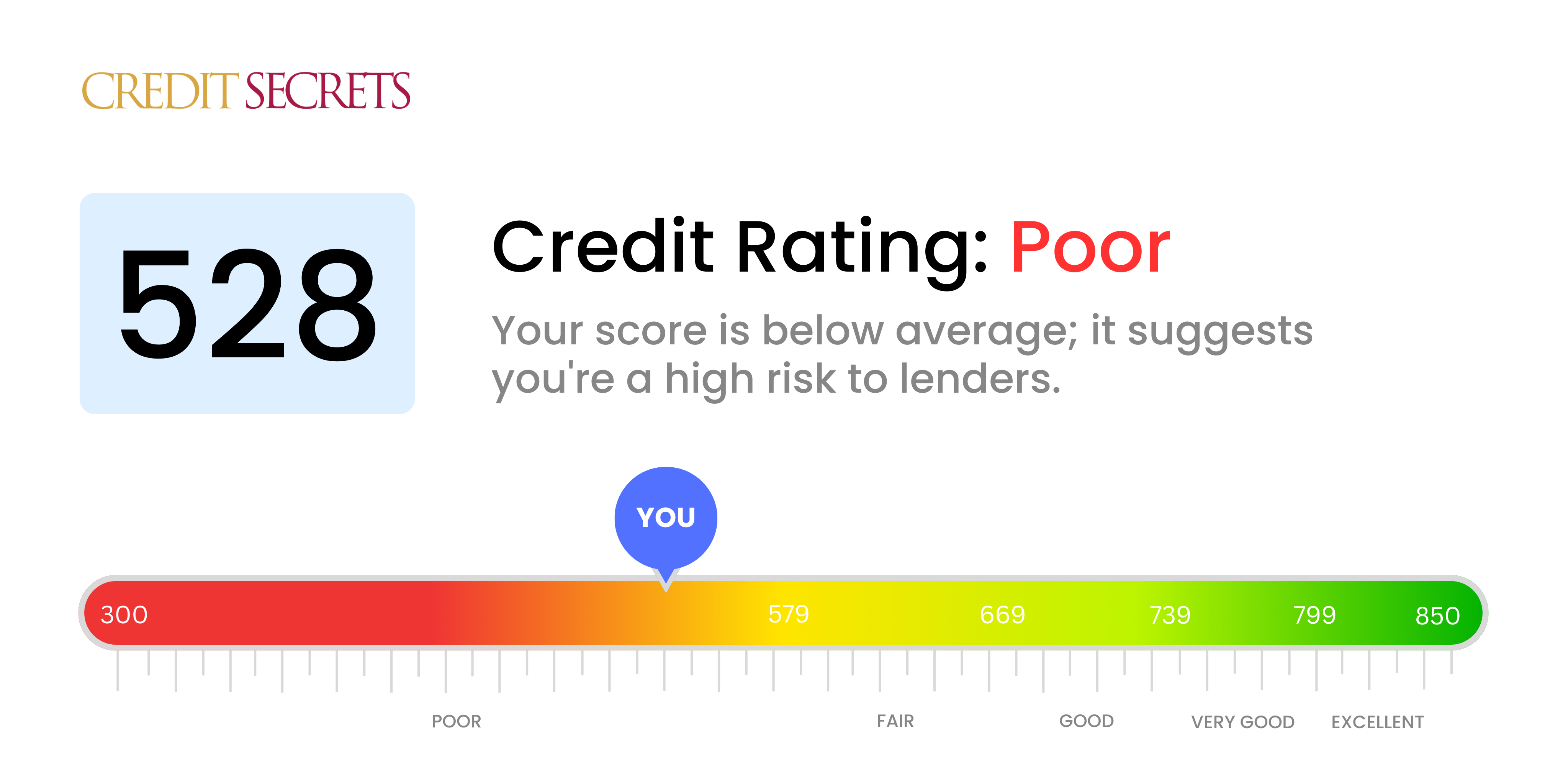

Is 528 a good credit score?

If your credit score is 528, it falls within the 'poor' category, but don't worry; there's ample opportunity for improvement. With this score, you may face difficulties securing loans or credit, and if you do, interest rates may be rather high. However, taking reliable steps to fix your credit can begin to shift your score towards the 'fair' range and beyond.

Remember, your credit score isn't definitive of your financial potential. It just reflects your past financial behaviors and not your future possibilities. Making wise financial decisions moving forward can help improve your credit score significantly, enabling you to reach your financial goals.

Can I Get a Mortgage with a 528 Credit Score?

With a credit score of 528, it may be quite difficult for you to be approved for a mortgage. This score is significantly below the minimum level that most lenders are comfortable with, indicating potential financial issues such as missed payments or defaults. It is understandable that this can be a tough place to be in.

The good news is, there are other paths to homeownership that you can explore. Some government programs, for instance, may have more lenient credit requirements. Consider researching options like FHA loans, which tend to have lower credit score requirements. While the interest rates for these alternative loans may be somewhat higher, they can still provide an attainable route to acquiring a home while you work on improving your credit standing. Remember, a higher credit score will offer better loan conditions in the future. Achieving a better score is a measure of gradual progress, but with dedication, it is possible.

Can I Get a Credit Card with a 528 Credit Score?

Having a credit score of 528 may make it a bit tough to get approved for a typical credit card. This score can indicate to lenders that there's a considerable uncertainty associated with your creditworthiness, which might make them hesitate. Though it might feel overwhelming, acknowledging this reality is a bold step toward regaining control of your financial situation. It's crucial to remember, this doesn't define you, it's simply a challenge to overcome.

While it may seem like the odds are against you, there are other ways to navigate this. Secured credit cards may be something to consider as they require a deposit that becomes your limit and can be simpler to qualify for. These have the added benefit of helping to establish a better credit history over time. Additionally, you might want to think about a co-signer or consider options like pre-paid debit cards. Remember, any form of credit you may qualify for at this point is likely to come with higher interest rates due to the risk assigned by lenders to lower credit scores. Although difficult now, with consistent effort, your credit situation will improve.

Your credit score of 528 falls notably below the average range deemed acceptable by most conventional lenders for loan approval. This score conveys a significant risk level to these institutions, making it hard for you to get approval for a personal loan. It's indeed a tough predicament, but it's essential to acknowledge the harsh reality of this score's implications for your future borrowing prospects.

When traditional loans are not viable, you may explore alternate routes such as secured loans where you give some collateral, or co-signed loans where a person with a favorable credit score acts as your guarantor. You might also consider trying online peer-to-peer lending platforms which often present a softer stance towards credit score criteria. However, it is important to understand that these alternatives usually involve higher interests and less favorable terms reflecting your higher perceived risk to the lender.

Can I Get a Car Loan with a 528 Credit Score?

With a credit score of 528, you may face some hurdles while applying for a car loan. This score is considered to be in the 'poor' range, as lenders typically prefer scores above 670. Since your score is below 600, it is categorized as subprime, suggesting that there may be a higher risk involved for the lender. The riskier you appear to a lender, the harder it may be to secure a loan due to the likelihood of delayed payments or default.

Though challenging, it's not impossible to get a car loan with a lower credit score. There are lenders who cater to individuals with subprime credit scores. However, it's vital to recognize that these loans tend to come with higher interest rates. This is lenders' way to balance the risk they're assuming. It's crucial to understand the terms before moving forward. It might not be an easy ride, but with careful thought and thorough understanding, a car loan could still be within your reach.

What Factors Most Impact a 528 Credit Score?

A credit score of 528 indicates that there are areas of your financial picture to improve. By recognizing and tackling these factors, you'll be able to work your way towards a more balanced financial score. Always remember – the road to improving your financial health is a personal and educational journey.

Payment History

Your payment history influences your credit score significantly. Late payments or non-payments may be potential reasons for your current score.

How to Check: Analyze your credit statement for any late payments or defaults. Think about your past behavior regarding payments, which could have influenced your score.

Amounts Owed

Carrying high balances can negatively reflect on your credit score. If your credit card balances are high, this may be adversely affecting your score.

How to Check: Check your credit card statements. Are there any outstanding balances? Try to keep your balances low relative to your limit for better credit health.

Length of Credit History

An insufficient credit history may be lowering your credit score.

How to Check: Scrutinize your credit report to determine the age of your accounts. Evaluate if you've recently established new lines of credit which could be impacting your score.

Types of Credit Used

Lack of diverse credit can negatively affect your credit score. Managing different types of credit can be beneficially reflected in your score.

How to Check: Assess your mix of accounts like credit cards, personal loans, and student loans. Reflect on your strategy related to opening new lines of credit.

Public Records

Public records such as foreclosures or bankruptcies could significantly be weighing down your score.

How to Check: Look into your credit report for any public records. Rectify any of those recorded items as a priority to aid in your score improvement.

How Do I Improve my 528 Credit Score?

With a credit score of 528, navigating your financial situation might feel daunting. But fear not! With the right plan of action, you can steadily improve your credit score. Let’s focus on the best moves for your current standing:

1. Settle Debts in Collections

For a score at this level, it’s possible you might have debts in collections. If it’s feasible, start addressing these debts. Get in touch with the collection agencies to discuss your options – they might even offer a settlement for a portion of the original amount.

2. Keep Credit Utilization Low

Credit utilization is how much of your available credit you’re using. Aim to keep your utilization below 30% for each individual credit card as well as in total. In your case, it might mean paying down outstanding balances or asking for credit limit increases on your existing cards.

3. Apply for a Secured Credit Card

Considering your score, a secured credit card can be a great step. A secured card requires a refundable deposit, and timely payments on this card can progress your credit score growth.

4. Request to be an Authorized User

Look into becoming an authorized user on a responsible friend or family member’s credit card. This arrangement can enhance your credit history provided the card owner maintains a positive payment record. Check beforehand if the card company reports authorized users to the credit bureaus.

5. Explore Credit Builder Loans

One more option to consider is a credit builder loan. As the name suggests, these loans are great for rebuilding credit. The loan amount is held in a secured savings account while you make payments. This positive payment history helps uplift your credit score.

In summary, your credit score may be low now, but with a strategic approach, a better financial future awaits you!