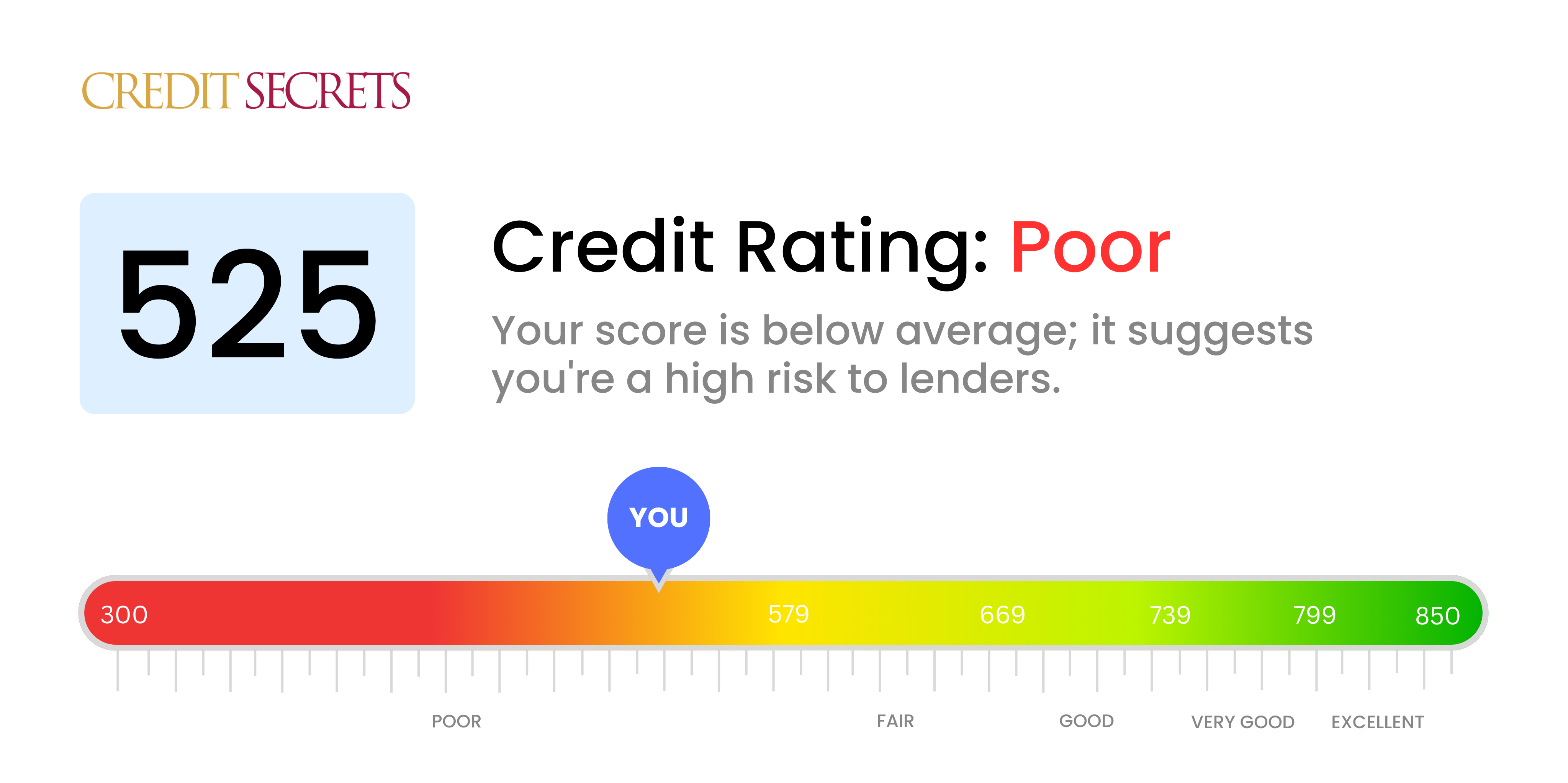

Is 525 a good credit score?

Unfortunately, a credit score of 525 falls into the 'Poor' category. This could mean that you may face difficulty in getting approved for loans and credit cards, and if approved, the terms might not be as favorable to you. However, don't be discouraged, as there are steps you can take to improve this score and move towards your financial goals.

Keep in mind that credit is a journey and not a destination. With diligence and the right strategy, it's entirely possible to significantly raise your score over time. The Credit Secrets program is designed to educate and guide you along this path, giving you the information you need to make smarter decisions and improve your credit. Remember, no matter your current credit score, improvement is always possible.

Can I Get a Mortgage with a 525 Credit Score?

Having a credit score of 525 likely means you may struggle to secure a mortgage. A score in this range typically suggests past financial hardships or missed payments, which are red flags to lenders. In general, the lower your credit score, the higher a risk you are perceived to be.

Though this news may be disappointing, it doesn't mean homeownership is out of reach forever. Instead of applying for a mortgage right away, you could potentially consider renting while working to enhance your credit score. Take time to manage and pay down existing debts consistently, and ensure future bill payments are on time. This will help to gradually increase your credit rating over time. It's worth noting that lower credit scores can result in higher interest rates if you are approved for a loan. Please remember that the journey to improving your credit score is a process, but with commitment and diligence, a better financial future is possible.

Can I Get a Credit Card with a 525 Credit Score?

With a credit score of 525, it's unlikely to get approved for most standard credit cards. This score is seen as a potential risk by lenders because it generally indicates past financial struggles or lack of proper credit management. It might be tough to swallow, but facing this reality head-on is a crucial step towards improving your financial health. Remember, the awareness of your credit score is part of your path to a better financial future.

Given the challenges related to a low credit score, considering alternatives like secured credit cards could be beneficial. These cards often require a deposit, which then becomes your credit limit, and can be easier to obtain. Alternatively, you might contemplate options like finding a co-signer or seeking out pre-paid debit cards. Keep in mind, these solutions don't instantly improve a credit score, but they can assist in its gradual recovery. Additionally, be prepared to face higher than average interest rates on any credit option available to you, as lenders account for perceived risk with such scores.

With a credit score of 525, attaining a personal loan from most traditional lenders may prove to be a hurdle. This score is highly likely to be seen as risky to lenders. While this fact might be tough to acknowledge, understanding what your score indicates about your borrowing possibilities is crucial.

Exploring alternatives could be a viable route. Secured loans, for instance, involve offering collateral, and co-signed loans require that someone with a higher credit score vouch for you. You may also want to check out peer-to-peer lending sites, which sometimes provide more flexible credit requirements. However, bear in mind that such alternatives may often come packaged with higher interest rates and less favorable terms, reflecting the lender's increased risk.

Can I Get a Car Loan with a 525 Credit Score?

With a credit score of 525, it might be a bit tough to get approval for a car loan. Why so? That's because lenders are often keen on credit scores above 660 to get favorable loan terms, and unfortunately, a score of 525 is categorised as subprime. This means it falls below what's generally considered good credit and presents a higher risk to lenders. The reason being, a lower credit score suggests possible challenges in repaying borrowed money in the past.

Don't lose hope, though! There are lenders who specialize in car loans for people with less-than-perfect credit scores. However, it is important to note that these loans may come with higher interest rates due to the perceived risk on the lender's part. So, it's essential to thoroughly understand the loan terms before you proceed. Yes, the journey might seem difficult right now, but with diligence and careful thought, the dream of purchasing a car can still become a reality.

What Factors Most Impact a 525 Credit Score?

Having a credit score of 525 means that there are a myriad of factors that require your consideration in order to achieve financial growth. Identifying and working on these elements will aid in turning your finances around. Each journey toward better credit is distinctive, holding opportunities for learning and advancement.

Credit History

Your credit history's length can negatively affect your credit score. A shorter credit history may be an influencing factor to your current score.

Checking Tips: Explore your credit report. Look at the age of your newest and oldest accounts and note the average age of your accounts. Reflect on whether you have opened new accounts.

Bills Payment

Your bill payment record significantly influences your credit score. Late payments or defaults could have led to your score dropping.

Checking Tips: Go through your credit report. Find and address any late payments or defaults as these could be affecting your score.

Credit Utilisation

Maxing out your credit limits can negatively impact your credit score. Your score might have been influenced if your credit balances are near their limits.

Checking Tips: Review your credit card statements. How close are your balances to their limits? Keeping balances low relative to the available credit is advantageous.

Credit Diversity

Maintaining a diversified mix of credit types contributes to a healthier score. Having limited types of credit could potentially be a factor affecting your score adversely.

Checking Tips: Consider your mix of credit accounts, be they credit cards, retail accounts, installment loans, or mortgage loans. Evaluate how conservative you have been in applying for new credit.

Public Records

Public records like tax liens or bankruptcies can cause your score to plummet.

Checking Tips: Analyse your credit report for any public records and resolve any listed items that need attention.

How Do I Improve my 525 Credit Score?

With a credit score of 525, you fall into the range considered as ‘poor’. However, by implementing certain strategies effectively, bettering your credit score is within reach. Here’s what you can do today:

1. Tackle Defaulted Accounts

Accounts that have been defaulted directly impact your credit score. Work towards clearing any defaulted accounts that may be in your name. Going forward, ensure timely payments to prevent future defaults. If required, connect with your creditors and establish a flexible payment plan.

2. Prioritize Credit Card Utilization

Your balance-to-limit ratio on credit cards, also known as ‘credit card utilization’, is a significant factor in determining your credit score. Strive to keep this ratio below 30% of each credit card’s limit, and eventually aim to bring it down to under 10%. Start with the card that is closest to its limit.

3. Consider A Secured Credit Card

With a low credit score, traditional credit cards may be hard to come by. Think about getting a secured credit card, which uses a cash deposit as collateral. By making regular, small purchases and clearing the balance promptly, you can build a history of responsible credit use.

4. Request to be an Authorized User

Being an authorized user on the credit card of someone with a robust credit history can aid in improving your own. However, ensure that the card provider will report this arrangement to the credit bureaus.

5. Expand Your Credit Variety

Diversifying your credit accounts showcases your ability to manage various forms of credit. Once you’ve displayed good financial behavior with the secure credit card, consider exploring other credit options like retail cards or credit builder loans. Proceed cautiously and remember to only borrow what you can pay back.