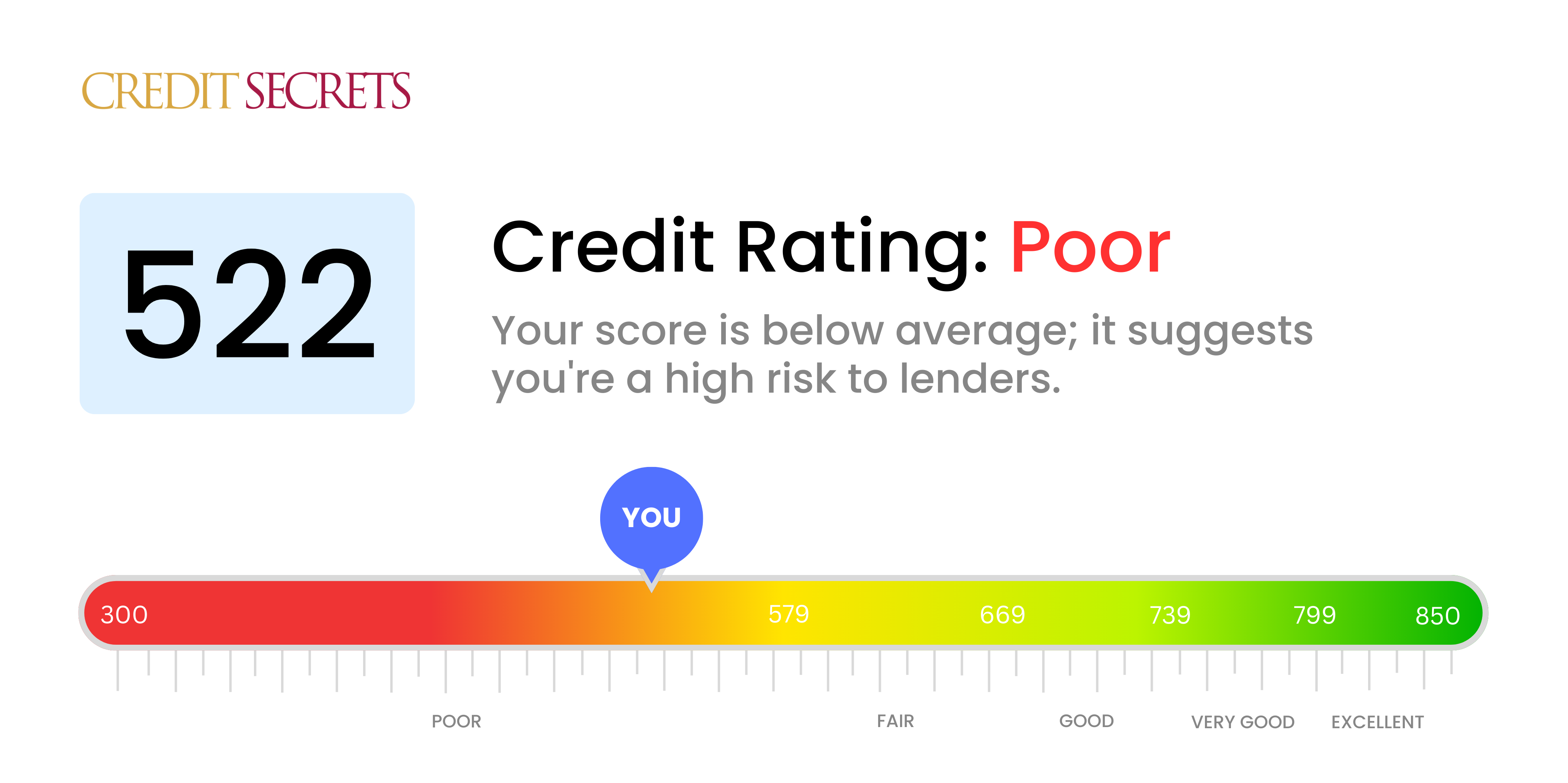

Is 522 a good credit score?

With a credit score of 522, you're currently within the 'Poor' category. This score may create some challenges and chances are that lenders will consider you as a significant risk. This often translates into higher interests rates for loans and a chance that your applications will be denied.

That doesn't mean you're out of options. Plenty of people have improved from this position. By careful management of your credit, it's possible to lift your score and gradually increase your likelihood of lending approval. There's always hope for a healthier financial future.

Can I Get a Mortgage with a 522 Credit Score?

With a credit score of 522, acquiring a mortgage may be quite challenging. Most mortgage lenders consider this score to be subpar, and it often suggests that you may have had some financial missteps like late payments or defaults on loans.

Being in this situation can feel disheartening, yet there are still paths forward. One alternative may be to explore FHA loans, which are backed by the federal government and have more lenient credit requirements. Also, private lenders sometimes offer programs for borrowers with lower credit scores, although these might carry higher interest rates.

Whilst your current score might prevent you from securing a traditional mortgage, it does not define your financial future. Committing to timely repayments, reducing existing debts, and responsibly managing new credit can gradually increase your score. The journey to credit improvement can be tough, but your consistent effort will be vital to achieving your financial goals.

Can I Get a Credit Card with a 522 Credit Score?

With a credit score of 522, getting approved for a conventional credit card can be quite a challenge. This score is typically seen as risky by lenders, often indicating some financial missteps in the past. Such a truth might be tough to swallow, but acknowledging your current credit situation is the first crucial step on your road to financial recovery.

The situation isn’t without alternatives, though. One potential path to consider is a secured credit card. These cards require a deposit, which then becomes your credit limit. They're easier to get and can gradually help rebuild your credit. Exploring the idea of having a co-signer or using prepaid debit cards can also be helpful options. Do remember, however, the available credit options for a score of 522 typically come with higher interest rates due to the perceived risk to the lender. While these alternatives won't instantly improve your situation, they are valuable tools to use on your journey to financial stability.

Experiencing a credit score of 522 can be challenging, and it may affect your ability to secure a personal loan. Generally, lenders view a score in this range as a higher risk, so approval for conventional loans could be difficult. Although this news can be tough to hear, it's crucial to understand the impact of your credit score on your borrowing options.

While traditional loans may currently be out of reach, you do still have possibilities to explore. Secured loans, which require collateral, or co-signed loans, which require a co-signer with a better credit score, could be potential alternatives. Peer-to-peer lending platforms could also be considered as these sometimes have less stringent credit score requirements. However, it is important to remember that these options often come with higher interest rates and more strict terms due to the increased risk for the lenders involved.

Can I Get a Car Loan with a 522 Credit Score?

Your credit score of 522 can certainly make securing a car loan a bit of a hurdle. Most lenders feel more comfortable approving loans to individuals with a credit score of 660 or higher. With a credit score falling below 600, you fall into what is often viewed as a subprime category. This just means that your credit score presents a higher level of risk to lenders; it's a predictor that could imply potential repayment issues. It’s a tough spot to be in, but that doesn’t mean you're out of options completely.

The good news is that some car loan providers specifically focus on serving those with lower credit scores. It's important to be aware, however, that these loans typically include higher interest rates. These higher rates are meant as a protection for lenders against the higher risk they are assuming. While this might feel wholly challenging, securing a car loan isn't off the table. It just requires careful thought and understanding the terms thoroughly. The journey might come with a few twists and turns, but getting that car loan is absolutely a possibility.

What Factors Most Impact a 522 Credit Score?

Getting a grasp on a credit score of 522 is key to embarking on a path towards better financial health. Recognizing and managing the factors associated with this score is the first step towards a financially stable future. Each person's financial journey is distinct, and filled with potential progress and lessons.

Payment History

Your payment history greatly affects your credit score. Late or missed payments could largely be responsible for this score.

How to Find Out: Look over your credit report for any late or missed payments. Think about any occasions where you may have not paid on time, as these will impact your score.

Credit Utilization

A high credit utilization ratio could harm your score. If your credit cards are almost maxed out, it might be a factor in your score.

How to Find Out: Look over your credit card statements. Are the balances almost at their limits? Keeping balances low relative to the limit can aid in improving your score.

Credit History

A lack of long-standing credit history can negatively affect your score.

How to Find Out: Check your credit report to see the age of your credit, including your oldest, newest, and the average age of all your accounts. Think about if you've recently opened any new accounts.

Credit Diversity and New Credit

Maintaining various types of credit and handling new credit judiciously are important for a healthier score.

How to Find Out: Assess your variety of credit accounts, such as credit cards, retail credit accounts, installment loans, and home loans. Reflect on how much new credit you have been taking on.

Public Records

Public records such as bankruptcy or tax liens could substantially affect your score.

How to Find Out: Check your credit history for any public records. Remedy any item listed here that may require resolution.

How Do I Improve my 522 Credit Score?

A credit score of 522 is considered less than ideal, but don’t stress, it’s never too late to start improving it. Following these relevant and specific steps can help get you started on your journey to a stronger credit score:

1. Prioritize Late Payments

Take immediate action toward any overdue accounts you may have. Ensuring these are paid off as soon as possible will eliminate any further damage to your credit score. Contact your creditors to discuss a realistic repayment plan.

2. Manage Your Credit Card Usage

Try to lower your credit card balances to below 30% of your credit limit. Keeping them under this benchmark can have a significant improvement on your score. Focus first on the cards with the highest usage rates.

3. Consider a Secured Credit Card

With a credit score of 522, getting approval for a standard credit card may be tough. A secured credit card, which requires a cash deposit, can be a beneficial alternative. Regularly use this card for small purchases and ensure to pay the balance in full each month, demonstrating a pattern of responsible credit usage.

4. Leverage Trusted Credit-History

Consider having a close friend or family member with a good credit score add you as an authorized user on one of their existing credit cards. Remember though, it’s vital to ensure the card provider reports authorized user activity to the credit bureaus.

5. Diversify Your Credit Usage

While establishing a secured card, consider diversifying your credit by exploring options like credit builder loans. Careful management of diverse credit sources can lead to an improved credit score.