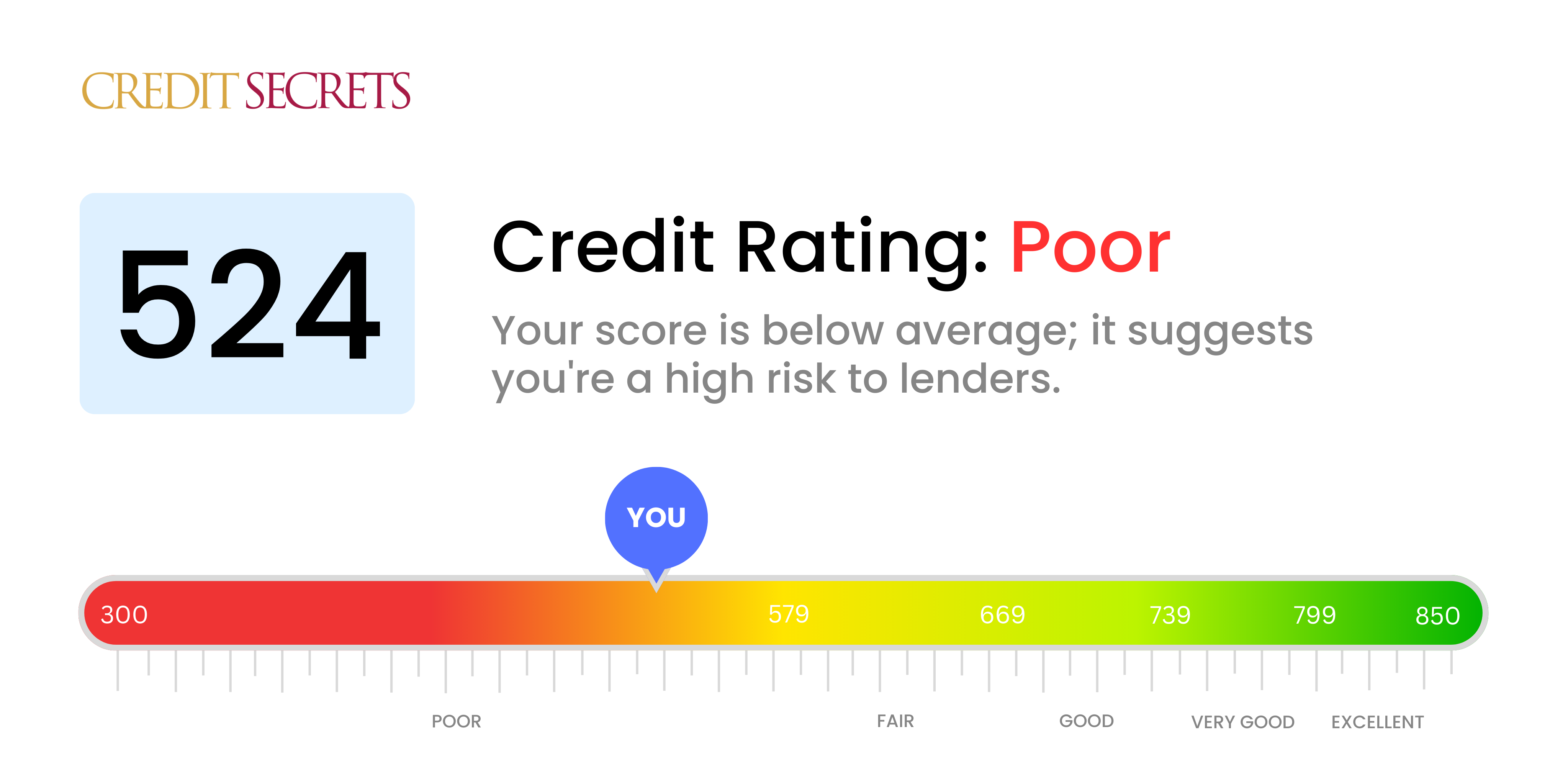

Is 524 a good credit score?

A credit score of 524 falls under the "Poor" category, which may pose challenges in accessing financial opportunities. However, it's important to remember that your current situation is not permanent and can be improved with informed decisions and proper financial management.

Having a score of 524 typically means that lenders may judge it as a significant risk to offer credit, and therefore, you may find difficulty in securing loans or getting credit cards. You may also face higher interest rates or require more substantial security deposits. Despite the drawbacks, remember that it is entirely within your power to raise your credit score and better your financial health.

Can I Get a Mortgage with a 524 Credit Score?

Having a credit score of 524, unfortunately, places you in a difficult position to be approved for a mortgage. This score is significantly below what many lenders typically consider acceptable. This low score often suggests there may have been some financial complications in the past, like defaults or late payments.

Although this scenario seems discouraging, it's not impossible to turn things around. The path to improving your position may be through addressing the factors that are negatively impacting your score. Begin by dealing with any existing debts or past-due accounts. Building up a consistent pattern of on-time payments can also contribute positively to your credit score. Although it requires time and discipline, improving your credit score is an achievable task. This will not only enhance your chances of mortgage approval in the future but will also likely secure you a more favorable interest rate. Remember to stay focused and patient, and you'll be on your way to achieving your financial goals.

Can I Get a Credit Card with a 524 Credit Score?

With a credit score of 524, getting approved for a traditional credit card could be quite tricky. This score is considered below average by most lenders, which may see it as a sign of prior monetary challenges or inconsistent repayment habits. Although this is not the most favorable situation, it's essential to view it with pragmatism and maintain an optimistic perspective. Recognizing the current state of your credit is the first stride towards better financial health, even if facing the reality seems tough.

When dealing with a 524 credit score, there may be other viable avenues to explore. Secured credit cards, for instance, ask for a deposit that doubles as your credit limit and can be easier to qualify for. These cards can help establish and improve credit history gradually. Another alternative can be considering a trustworthy co-signer or a pre-paid debit card. Remember, while these options don't drastically or immediately change the situation, they are efficient tools on your path to financial stability. It is also important to understand that the interest rates on any accessible credit for individuals with such scores will likely be higher. This mirrors the heightened risk perceived by lenders.

With a credit score of 524, securing a personal loan from a traditional lender can be a tough task. This specific score is significantly lower than what's typically deemed acceptable for personal loan approval. Lenders, likely, will see this score as an indication of high risk, which unfortunately reduces the probability of successful loan approval. This situation might feel daunting, but acknowledging the implications of this credit score on loan opportunities is crucial.

However, don't lose hope. There are alternatives you could explore. Secured loans, which involve providing collateral, or co-signed loans, where you have someone with a better credit score co-sign for you, might be options. Peer-to-peer lending platforms could also be considered, as they sometimes feature more relaxed credit score requirements. It's important to note, though, that these options typically come with higher interest rates and less user-friendly terms, due to the increased risk the lender faces. Finding a solution might not be easy, but it's definitely possible.

Can I Get a Car Loan with a 524 Credit Score?

With a credit score of 524, it can be tough to get approved for a car loan. Many lenders usually prefer a score hovering above 660, and often, credit scores below 600 are considered subprime. Yours, sadly, falls in the subprime category which could increase your chances of loan denial or higher interest rates. This is due to the fact that a low credit score signals higher risk to lenders, who might assume potential difficulties in receiving payments on time.

But remember, a lower score doesn't mean it's impossible to buy a car. Some loan providers work specifically with those who have lower credit scores. However, these loans often come with a catch: typically, they carry high interest rates to counterbalance the perceived risk. The path may seem rocky, but by carefully assessing the terms, getting a car loan is an achievable goal. Just remember to thoroughly comprehend the conditions and potential repercussions before making this financial commitment.

What Factors Most Impact a 524 Credit Score?

Understanding your credit score of 524 is the first step towards reaching your financial aspirations. Your unique financial path carries with it the chance to learn and expand your knowledge.

Payment History

One major influence on your credit score is payment history. Late or missed payments might've played a substantial role in bringing you to your current score.

How to Check: Begin by examining your credit report for any payment mishaps. Look through whether you may have had any delayed or missed payments and resolve to improve in the future.

Credit Utilization Rate

A high credit utilization rate could be impacting your score negatively. If you notice that your credit limit is being maxed out, this could explain the score.

How to Check: Scan your credit card statements. Do the balances lean too close to the set limits? Remember, maintaining low balances against your limit enhances your score.

Length of Credit History

Having a short credit history can impact your score. If you're new to credit or have closed your older credit accounts, you might be feeling the effects on your score.

How to Check: Scrutinize your credit report to evaluate the age of your oldest, newest and average age of all your accounts. Consider if you've recently added new credit.

Previous Credit and Credit Mix

Maintaining diverse types of credit and responsibly managing them is essential for a healthy score. A lack of variety might impact your credit score.

How to Check: Check your portfolio of credit accounts like credit cards, retail accounts, installment loans, and mortgage loans. Consider if you've been prudent in managing and applying for new credit.

Public Records

Public records such as bankruptcy or tax lien could greatly bring down your score.

How to Check: Scour your credit report for any public records. Take steps to resolve any listed items.

How Do I Improve my 524 Credit Score?

A 524 credit score falls into the poor category; yet, this is not an irrevocable situation. There are immediate, executable steps tailored to your precise circumstances that can help improve your credit score—from poor to fair, and eventually from good to excellent. Let’s focus on the most impactful and achievable strategies at this stage:

1. Clearing Collections and Charge-offs

Collections or charge-offs on your credit report can significantly harm your score. If feasible, aim to clear these debts. In some instances, lenders may be willing to negotiate a settlement. Remember, the target is to reduce your overall debt burden.

2. Balance Your Credit Utilization

A high percentage of borrowed credit to your total available credit is a major reason for a low score. Strive to maintain your utilization below 30%. Prioritize your high-interest credit cards to avoid additional debt accumulation.

3. Opt for a Secured Credit Card

Secured credit cards, backed by a cash deposit equal to the card’s limit, are accessible to those with lower scores. Using one responsibly can help you build a positive credit history—remember to make payments on time and in full.

4. Autopay Setup

Setting up autopay ensures timely payments of all bills and prevents missed payments that could affect your score. Remember, your payment history contributes significantly to your credit score.

5. Broaden Your Credit Portfolio

Once you’ve managed to improve your credit with a secured card, consider diversifying your credit types—a retail card or a credit builder loan could be effective. However, ensure you continue to manage these responsibly.