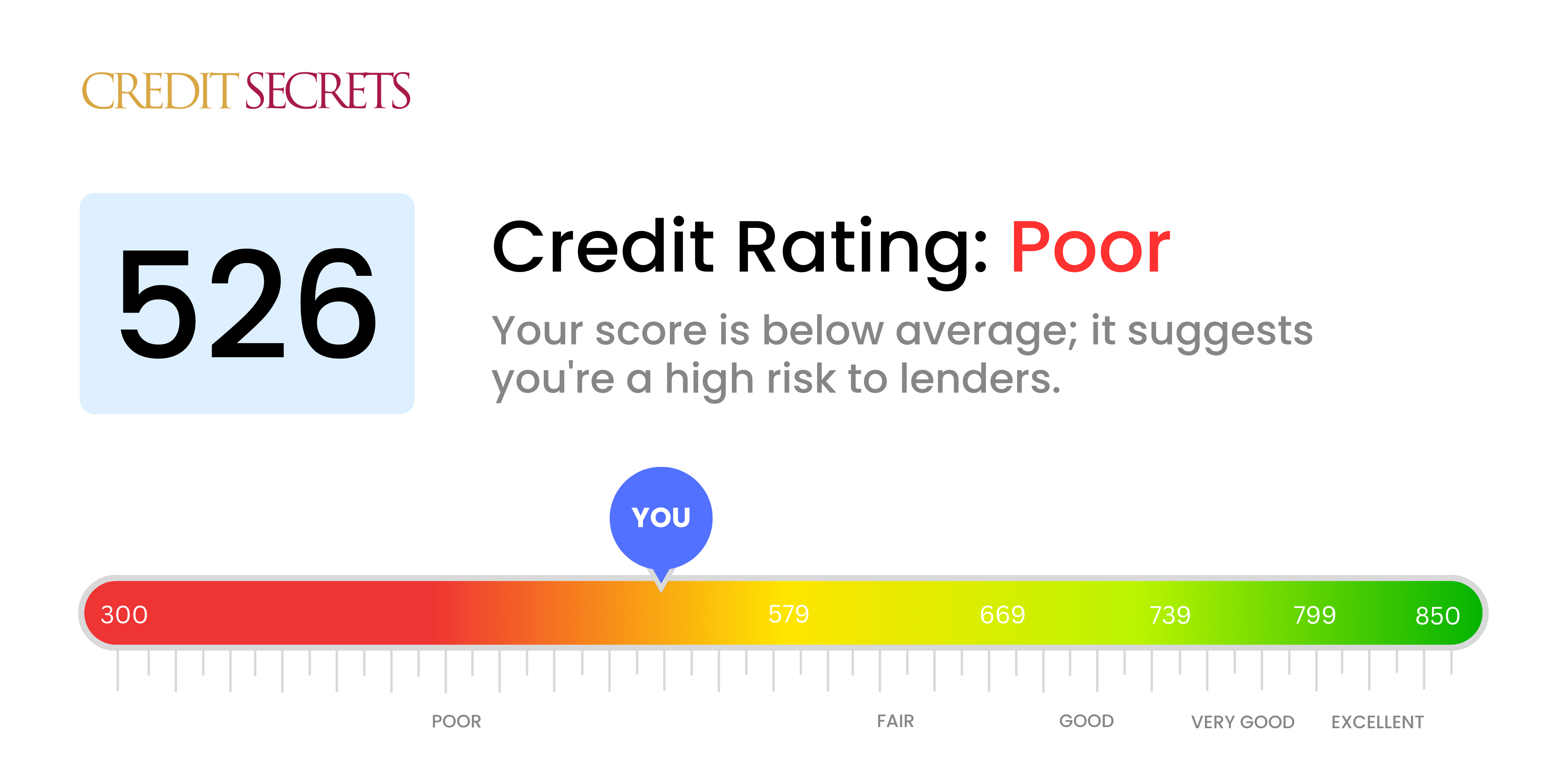

Is 526 a good credit score?

A credit score of 526 is categorized as poor. With a score in this range, you may face difficulties getting approved for loans or credit cards, high interest rates if approved, and it may even impact your ability to secure housing or employment.

Despite these challenges, it's important to remember that a credit score is not static and can be improved. Arranging your finances responsibly, paying bills on time, and reducing debt are all strategies that can better your score. Remember, a score isn't forever - it reflects your credit history at this moment and can change as you reshape your credit habits.

Can I Get a Mortgage with a 526 Credit Score?

If you have a credit score of 526, it is quite challenging for you to get approved for a mortgage. This score is considered below average by most lenders and suggests a pattern of missed payments or other financial difficulties. It is essential to recognize that your current score can make it tough to secure a loan with reasonable interest rates.

A credit score is a critical factor in determining whether you're a risk for lenders, and a score in this range indicates significant risk. That being said, it doesn't mean there aren't alternatives. Some mortgage programs are specifically designed for individuals with lower credit scores, although the trade-off might be higher interest rates or additional requirements. It is vital to consider all available options, and remember, today's situation is just a starting point. Progress may take time, but it is entirely possible to improve your financial standing and move toward your home ownership goals.

Can I Get a Credit Card with a 526 Credit Score?

For those with a credit score of 526, it can be rather tough getting approved for a typical credit card. This score is usually seen as higher-risk for lenders, usually hinting towards previous financial issues or oversight. This fact might be hard to swallow, but it's better to approach it with empathy, transparency, and realism. Knowing where you stand credit-wise is a great first step towards repairing it, even when that truth can be a bit tough.

Alternatives may be needed due to the challenges attached to such a low credit score. You might want to look at options like secured credit cards, which need a deposit that serves as your credit limit. These types of cards can be easier to obtain and can help rebuild your credit gradually. Moreover, you could think about locating a co-signer or opting for pre-paid debit cards. Even if they don't offer an immediate fix, they can be productive tools for your financial revival journey. Keep in mind, the interest rates offered to such scores are usually higher, indicating the increased risk lenders perceive.

Having a credit score of 526 may present significant challenges if you're seeking a standard personal loan. Lenders often see such a score as risky because it lies considerably below the typical range they consider safe. Pessimistic as the situation may appear, it's essential to understand the implications of your credit score to navigate your financial decisions accurately.

When traditional loans feel out of reach, you may have to explore other lending possibilities such as secured loans that require collateral, or co-signed loans where a trusted individual with a better credit score becomes your guarantor. Alternatively, peer-to-peer lending platforms can also offer some concession in credit score requirements. However, it's vital to remember that these substitute routes often mean higher interest rates and less favorable terms due to the increased risk carried by the lender. Though challenging, understanding these realities will empower your financial journey.

Can I Get a Car Loan with a 526 Credit Score?

Your credit score of 526 sadly falls into the subprime range. This implies that acquiring approval for a car loan could be a challenging venture. Lenders generally favor applicants with credit scores above 660, and anything below 600 is considered less attractive. This is mainly because the lower the credit score, the higher the risk to the lender based on the credit repayment history shown.

Nevertheless, having a low credit score doesn’t completely dash your hopes for getting a car loan. There are lenders who specifically cater for individuals with lower credit scores. It is essential to be careful when dealing with such offers, as they often come with significantly higher interest rates. These increased rates are put in place due to the risk lenders take with lower credit scores. It's their way of protecting their investment. It might be a bit of a tightrope to walk, but with thoughtful consideration and a deep understanding of the loan terms, it's not impossible to secure a car loan. Keep the faith and take time to analyze your options.

What Factors Most Impact a 526 Credit Score?

Understanding a credit score of 526 is key for proactive financial management. Recognizing the elements influencing this score empowers you to navigate towards a better financial standing. Here are the elements that play a crucial role in your score.

Credit Payment History

Your credit payment history strongly influences your credit score. If you have a history of overdue payments, it's likely contributing to your current score.

What to Do: Inspect your credit report for any late payments or missed payments. Delayed or missed payments can gravely impact your score.

Level of Debt

A high level of debt relative to your income can weigh down your credit score. If you have high balances on your credit cards, this is most likely affecting your score.

What to Do: Inspect your debt levels and consider paying off some balances. Attempt to use no more than 30% of your available credit.

Length of Credit History

Limited credit history might be a reason your score is what it is. More specifically, if your accounts are relatively new, this could be affecting your credit score.

What to Do: Examine your credit report to gauge the age of your oldest and newest credit lines. Properly managing older accounts can greatly boost your credit.

New Credit

If you’ve been applying for multiple new credit accounts within a short period of time, this frequent credit activity can hurt your score.

What to Do: Limit applications for new credit and focus on managing current accounts.

Negative Public Records

Public records, such as bankruptcies or liens, can impact your score negatively.

What to Do: Check your credit report for any negative public records. Discussion with the issuers or a legal financial advisor can guide towards resolving these matters.

How Do I Improve my 526 Credit Score?

With a credit score of 526, you fall into the ‘poor’ category, yet with decisive actions tailored to your specific situation, you can boost it substantially. Here are some targeted strategies:

1. Inspect Your Credit Report

Order your credit reports and scrutinize them for any errors or discrepancies. Incorrect information can drag down your credit score. Dispute any inaccuracies you find with the credit bureau and the institution that provided the information.

2. Negotiate with Creditors

Reach out to your creditors to negotiate overdue accounts. Some creditors may be open to restructuring your repayment plan, temporarily reducing interest rates, or even settling for less than you owe if it means getting paid.

3. Rectify Late Payments

Attempt to rectify any late payments on your credit report. Creditors may be willing to remove late payment entries if you’ve been a loyal customer. Each timely payment you make helps to enhance your credit history.

4. Limit Hard Inquiries

Each new credit application leads to a hard inquiry on your credit report, which can lower your score. Therefore, avoid applying for new credit cards, loans, or other forms of credit unless absolutely necessary.

5. Implement Credit-Boosting Programs

Participating in credit-boosting programs can show additional positive payment history on your credit report. For instance, rent payments are typically not reported to the credit bureaus, but some rent-reporting services can add them.

Remember that improving your credit score is a marathon, not a sprint. Patience and consistency with these strategies will be key to your progress.