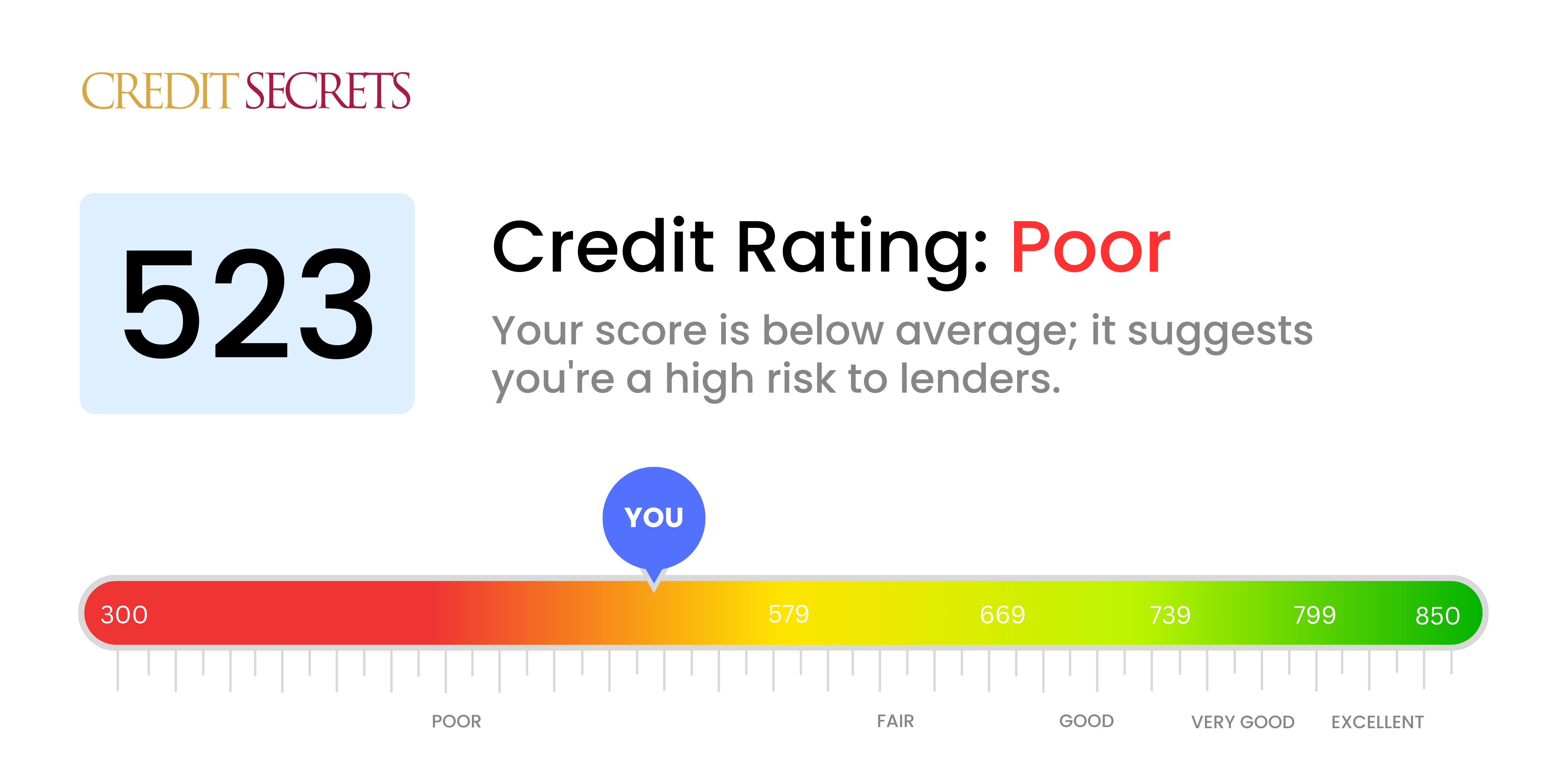

Is 523 a good credit score?

With a score of 523, your credit falls into the 'poor' category on the scale provided. When credit scores measure this low, it often indicates substantial difficulty obtaining credit or loans, and it's a sign that you should take immediate action to address any underlying causes contributing to the low score.

Although this situation may feel overwhelming, remember this isn't a life sentence. With commitment and discipline, it's completely possible to improve your credit score. Start by understanding what factors are affecting your credit, then work on managing your financial habits in a way that positively impacts your score. This might mean paying all bills on time, not maxing out credit cards and reducing your overall debt. It's a journey that takes time but will certainly lead to better financial opportunities in the long run.

Can I Get a Mortgage with a 523 Credit Score?

Having a credit score of 523 indicates that approval for a mortgage may be challenging to attain. This score is below the average rating, which most lenders find comfortable to lend to. It's likely reflecting instances of late payments, defaults, or other financial mishaps in the past. This isn't an easy place to be, but it's not the end of your financial journey.

Reworking your financial strategy can make a significant difference in improving your credit score. Prioritize paying off any current debts that could be dragging your score down. Additionally, cultivate good credit habits moving forward, like regularly paying your bills on-time and keeping your credit usage low. You might consider exploring alternatives like Federal Housing Administration (FHA) loans, which offer more lenient credit requirements. Remember that enhancing your credit score isn't an overnight feat, but a steady and dedicated approach can set you on a favorable path towards achieving your financial goals.

Can I Get a Credit Card with a 523 Credit Score?

Having a score of 523 puts you in the challenging situation of making it difficult to secure approval for a standard credit card. This type of score indicates risk to lenders, which often results from a history of financial obstacles or struggles. It's disappointing, but it's crucial to tackle your credit issues with honesty and perspective. Understanding where you stand financially is the first stepping-stone on your path towards better financial health.

Alternative financial tools could be considered for those facing challenges with lower scores. Secured credit cards can be a viable option, as they require a deposit equivalent to your credit limit. This type of card is often easier to attain and can assist in credit score improvement over time. Contemplating a co-signer or pre-paid debit cards may also be worth exploring. Remember, these options don’t magically fix the problem, but they are instrumental in your journey towards financial security in the long run. Interest rates for these alternatives may be higher due to the perceived higher risk for lenders. However, they can be instrumental tools in your pursuit of a healthier credit status.

Having a credit score of 523 can make it difficult to get approved for a personal loan. Traditional lenders typically view such a low score as a strong indication of risk, implying that loan repayment might not be forthcoming. While this might feel disheartening, it's essential to remain realistic about what your credit score means for your loan approval chances.

Though getting a traditional personal loan may not be probable, other avenues might still be accessible. Secured loans are an option—to get these, you'd have to offer some form of collateral. Alternatively, co-signed loans could be a possibility if you can find someone with a better credit standing to vouch for you. Peer-to-peer lending platforms might also be an avenue worth exploring, as they can sometimes be more accommodating towards lower credit scores. But, always remember, these alternatives tend to carry higher interest rates and terms may not be as favorable, reflecting the increased risk to the lender.

Can I Get a Car Loan with a 523 Credit Score?

A credit score of 523 may create some hurdles if you're trying to secure a car loan. In general, lenders prefer to see scores above 660 when offering favorable loan terms. Being below 600, unfortunately, your score of 523 falls into the subprime category. This can potentially result in higher interest rates or even outright denial of the loan application. Lenders view lower credit scores as an elevated risk due to a history that may suggest difficulties in paying back the borrowed money.

That said, a credit score of 523 doesn't entirely dash your hopes of obtaining a car loan. There are lenders who cater specifically to individuals with lower credit scores. Proceed with caution though, as these loans typically come with substantially higher interest rates. This is a measure taken by lenders to protect their investment because of the perceived higher risk associated with lower credit scores. Even though it may be tougher, obtaining a car loan isn't impossible. But it will require diligence and careful understanding of the loan terms on your part.

What Factors Most Impact a 523 Credit Score?

Unlocking the mystery behind a score of 523 is pivotal in laying a firm foundation for your financial growth journey. Learning about the elements that may have influenced this score is key to overhauling your credit status. Always bear in mind, every financial journey tells a unique story, but each one provides invaluable lessons and opportunities for growth.

Credit Utilization Ratio

Having over-utilized credit could significantly drag down your credit score. If your loan balances and card debt are consistently close to the maximum limit, this could explain your current score.

How to Check: Go through your credit card statements and loan balances. Are they habitually close to their limits? Strive to maintain relatively low balances in relation to your credit limits.

Derogatory Marks

Alluding to negative occurrences such as bankruptcy, charge-offs, and loan defaults can adversely affect your credit score. This may be a likely contributor to a 523 score.

How to Check: Look over your credit report for any derogatory marks. Make arrangements to deal with any outlined issues.

Credit History Length

If you don't have a lengthy credit history, this could potentially impact your score.

How to Check: Check your credit report to ascertain the age of your oldest and youngest accounts, and the average age of all your accounts. Evaluate whether you may have opened too many new accounts recently.

Credit Account Type Diversity

A balanced credit portfolio with a good spread of types of credit (credit cards, mortgages, auto loans, etc.) is looked upon favorably. If you lack variety in credit types, that could affect your score.

How to Check: Take a close look at the types of credit accounts you have. Do you have a diversified blend of credit types?

How Do I Improve my 523 Credit Score?

Having a credit score of 523 is less than ideal, but take heart because it’s not irreversible. For this specific score range, the following strategies are best suited to improving your credit score quickly and effectively:

1. Settle Outstanding Collections

Pay any outstanding collections or judgments swiftly. Not paying these off can severely affect your credit score. Don’t hesitate to negotiate some form of payment plan if full settlement is not possible at once.

2. Tackling High-interest Debt First

Your credit score will benefit greatly from paying down high-interest debt, particularly credit card debt. Aim to maintain your credit card balances at no more than 30% of your credit limit.

3. Apply for a Credit Builder Loan

If qualifying for a regular credit card is difficult due to your current score, a credit builder loan could be a viable option. This type of loan allows you to build credit history by making regular payments.

4. Request Credit Limit Increase

Another way to improve your credit score at this level is by asking for a credit limit increase. This can help lower your credit utilization rate, which is beneficial to a credit score

5. Create Variety In Your Credit Portfolio

Having a diverse range of credit instruments, like an installment loan or retail store card, along with consistent responsible usage can significantly boost your credit score.