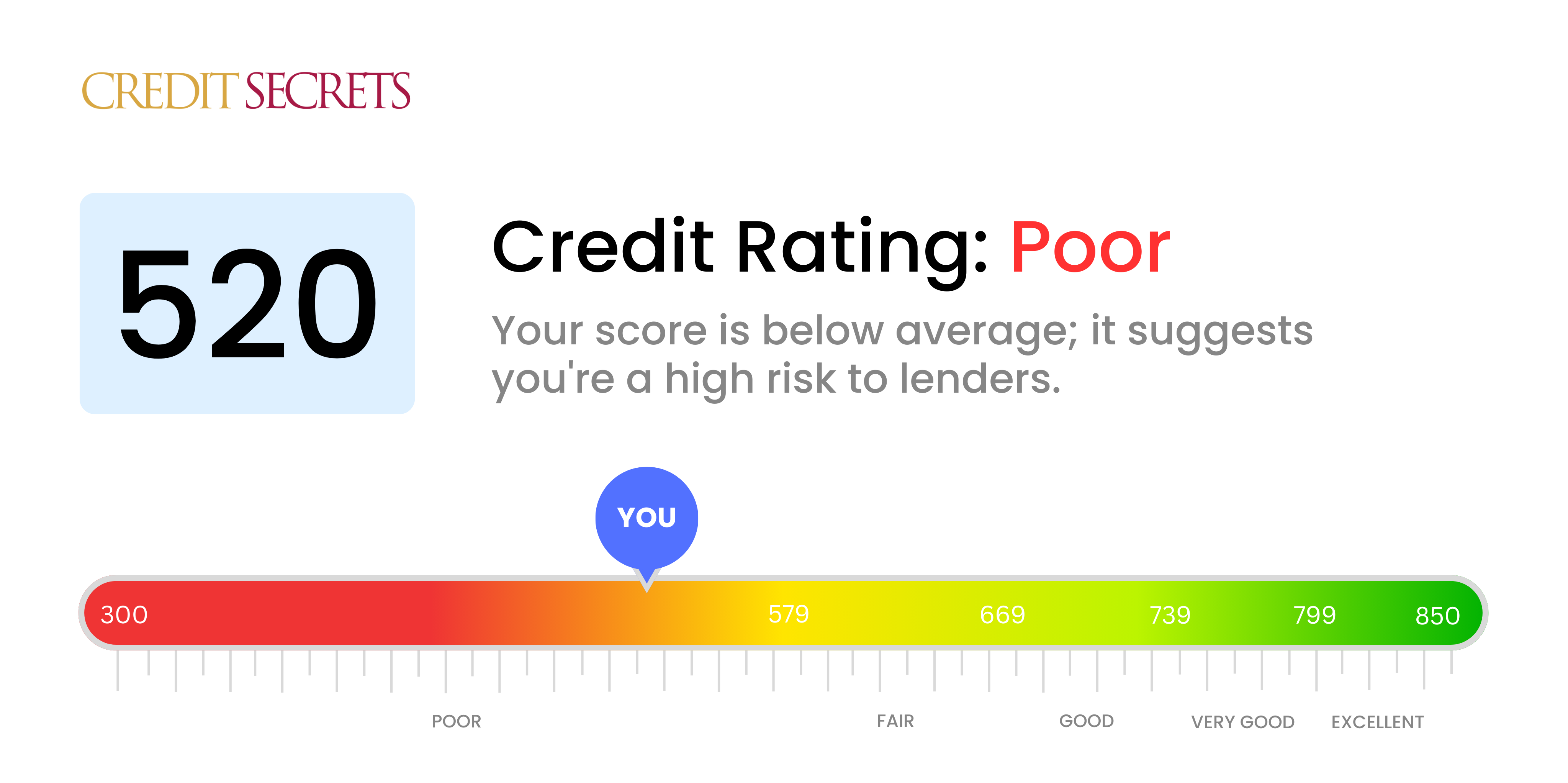

Is 520 a good credit score?

A credit score of 520 falls into the 'Poor' category. This isn't optimal, but understanding the implications of this score is the key step to moving forward.

With a score of 520, you might often encounter difficulties while applying for loans and credit cards. Lenders may deem you as a risky borrower, leading to higher interest rates or even denial of your application. Yet, there's no need to fret. It's entirely possible to elevate your credit score with disciplined financial habits and patience.

Start by regularly checking your credit report for any possible errors to dispute, and do remember to make all your payments on time. While enhancing a credit score might seem like a daunting task, it's important to break it down into manageable tasks. Remember, improving your credit score is a journey and not a race.

Can I Get a Mortgage with a 520 Credit Score?

With a credit score of 520, it is difficult for you to be approved for a mortgage. This score is significantly below the acceptable range that most lenders look for. A credit score of 520 could suggest to lenders that you have had financial struggles or inconsistent payment history in the past.

Being in this situation can feel overwhelming, however, alternatives are available. It is important to first address any outstanding or defaulted payments that might be causing your low score. Another alternative could be considering different types of home loans that might be less stringent about credit scores, like Federal Housing Administration (FHA) loans. However, even these options often require a score higher than 520, and those with lower scores usually face higher interest rates. Progress may seem slow, but remember, each step you take towards improving your credit score moves you closer towards your financial goals.

Can I Get a Credit Card with a 520 Credit Score?

Having a 520 credit score is undoubtedly a tough place to be when it comes to securing a credit card. Most lenders view this score as an indicator of potential risk, suggesting that there might have been past financial hurdles. Facing this reality can feel daunting, yet it's a crucial step to acknowledge your financial standings, even if it seems hard.

Given the challenges that come with a score of 520, you might want to explore other practical options such as secured credit cards. These cards typically require a deposit that becomes your credit limit, making them an easier choice to get and a useful resource in gradually rebuilding your credit score. Other paths could be finding someone to co-sign for you or considering pre-paid debit cards. Do bear in mind that any credit you do manage to obtain at this score level might have a higher interest rate. This often reflects the lender's assumed risk in extending credit to someone with a score like 520. However, don't lose hope. This is just a phase in your financial journey to a better credit score.

Having a credit score of 520 will likely pose a barrier if you're looking to secure a personal loan from traditional lenders. This credit score is significantly below the range that is deemed acceptable for most lenders, and so, might make it difficult for your loan application to get approved. A credit score in this range often suggests a higher risk of defaulting on the loan, which can make lenders apprehensive.

Although this may sound discouraging, there are potential alternatives available. Some loan options exist, such as secured loans where you offer collateral, or co-signed loans where a person with a solid credit score guarantees your loan. You could also explore platforms that specialize in peer-to-peer lending, which may potentially have more flexible credit requirements. It's crucial to note, though, that these alternative loan options often have higher interest rates and terms that might not be as favourable, illustrating the increased risk linked with a lower credit score.

Can I Get a Car Loan with a 520 Credit Score?

With a credit score of 520, getting approved for a car loan might prove quite difficult. Lenders generally anticipate a score of at least 660 from borrowers. A credit score below 600 is viewed as subprime, which is where your 520 score falls. Higher interest rates or even an outright denial may occur as a result of this. It's challenging because a lower credit score may indicate to the lender a greater risk, suggesting that there might have been issues with paying back borrowed money in the past.

However, it's important to remember that a less-than-ideal credit score doesn't completely eliminate all chances of a car loan. There are lenders who specifically assist those with lower credit scores. Yet, caution is advised since these car loans often bear higher interest rates. The inflated rates are a protective measure for the lenders, given the risk they consider when granting the loan. Remember, although the journey may appear daunting, with patience and a detailed examination of the offered terms, there is still a chance to secure a car loan.

What Factors Most Impact a 520 Credit Score?

Analyzing a score of 520 is the first step to improving your financial health. The factors that have the most impact on this score should be identified and addressed to achieve one's financial goals. Keep in mind, every credit improvement journey is unique with its own challenges and opportunities for growth.

Payment History

Payment history greatly influences your credit score. Late or missed payments can significantly lower your score.

How to Check: Examine your credit report for any late payments or defaults. Contemplate any instances where you may have made late payments and how this may have impacted your score.

Credit Utilization Ratio

The proportion of your available credit that you’re using, known as credit utilization ratio, can adversely affect your score. If you're frequently close to your credit limit, this can be a major factor.

How to Check: Check your credit card statements. Are you constantly nearing your limits? Keeping balances low in relation to your limit can help improve your score.

Age of Credit

Holding credit accounts for a longer period can positively affect your score. A shorter credit history may negatively impact your score.

How to Check: Look at your credit report to determine the age of your oldest and youngest accounts and the average age of all your credit accounts. Consider if new accounts have been opened recently.

Type of Credit and Recent Credit Applications

Holding a mix of different types of credit and limiting new credit applications can lead to a higher score.

How to Check: Evaluate the types of credit accounts you have, like credit cards, loans, etc. Also, consider if you've been making frequent credit applications.

Public Records

Public records like bankruptcies, tax liens or civil judgments can severely impact your score.

How to Check: Review your credit report for any public records. Address and resolve any listed items.

How Do I Improve my 520 Credit Score?

With a credit score of 520, you’re in a challenging position, but absolutely not a helpless one. Here are the practical and highly effective strategies tailor-made for your current credit situation:

1. Rectify Outstanding Debts

If you hold any debts that are long overdue, your focus should first be to settle these. Overdue accounts are detrimental to credit scores; tackle the most overdue first. Should you require, negotiate a feasible repayment plan with your creditors.

2. Manage Your Credit Card Utilization

Keeping your credit card utilisation low is vital. Ideally, aim to use less than 30% of your limit, with a long-term goal of maintaining it below 10%. Prioritize settling the card or cards with the highest utilisation first.

3. Consider a Secured Credit Card

Given your current credit score, an secured credit card might be a sensible option. A cash deposit that functions as your credit line is required for this account. By consistently making timely payments, you can begin to rebuild a positive credit history.

4. Seek Authorized User Status

If possible, ask someone with a healthy credit history to add you as an authorized user on their credit card. This could give your score a boost by integrating their good payment habits into your report. It’s essential that the card issuer reports activity of authorized users to credit bureaus.

5. Foster a Variety of Credit

Cultivating a diverse credit portfolio can improve your credit score. Once you’ve proven responsible usage with a secured card, investigate other forms of credit like retail credit cards or credit builder loans, and maintain them responsibly.