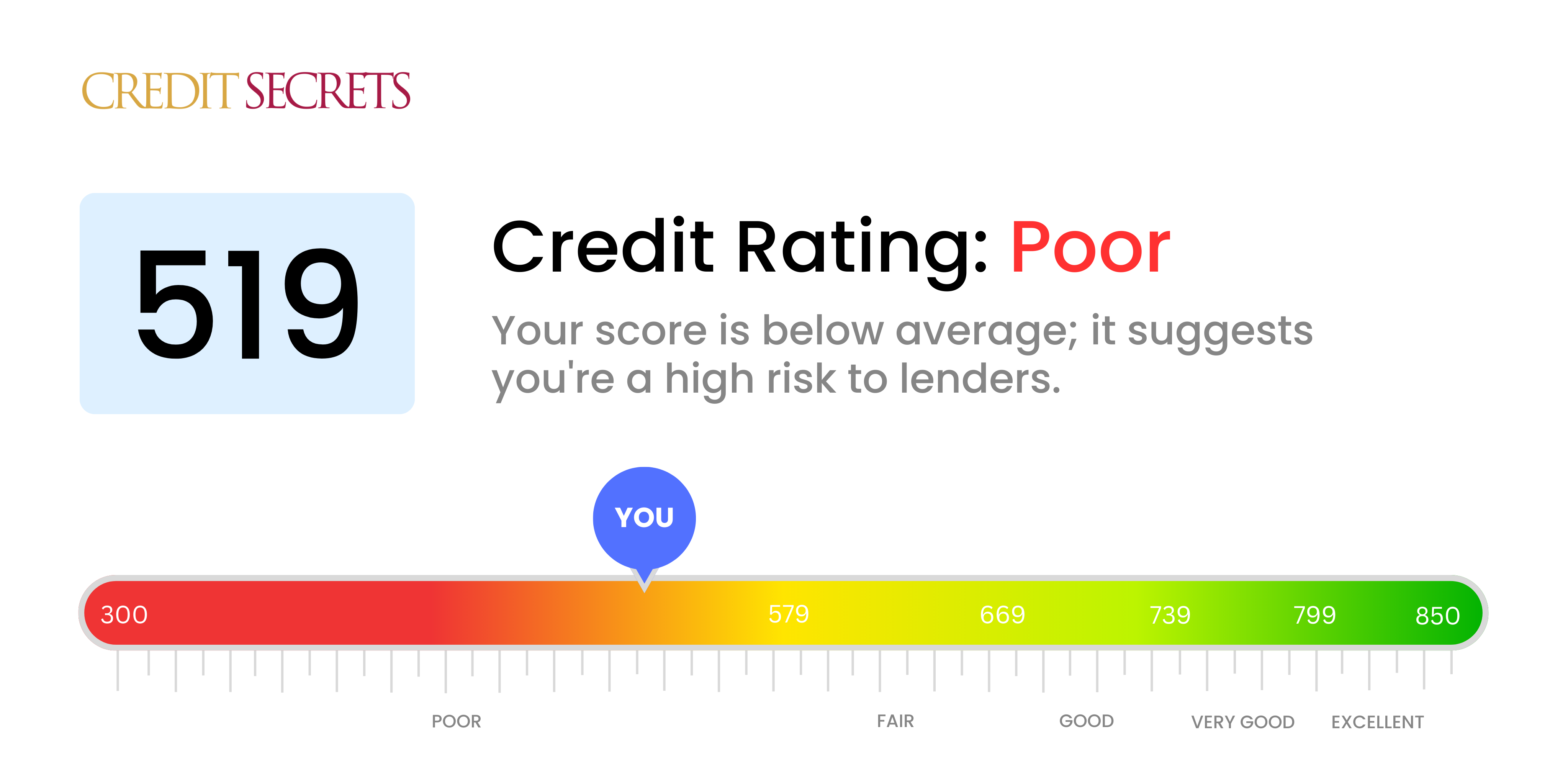

Is 519 a good credit score?

If your credit score is 519, this falls into the 'Poor' credit range. It's not the ideal situation, but don't let this get you down. It's just a snapshot of your current financial situation and not a lifelong sentence.

With a score of 519, you may encounter challenges securing loans or credit cards, and if you are offered credit, it may be at higher interest rates. But bear in mind, this isn't an end of the road. By coupling responsible financial behavior like paying your bills on time and not maxing out your credit cards, with financial literacy, you can pave the path toward improving your score. Remember, your credit score is always in motion, so you can work towards a better score starting today.

Can I Get a Mortgage with a 519 Credit Score?

Having a credit score of 519 likely makes it difficult to get approved for a mortgage. Most lenders require a higher score to consider you as a potential borrower, because it's a sign that you are a responsible user of credit. Your current score suggests you may have had some financial hiccups in the past, such as late payments or a higher debt level. It's important to be aware of this, even though it's a tough pill to swallow.

Despite this, it's not completely impossible to get a mortgage with this score. Some lenders may still approve, but they may charge you a higher interest rate due to the increased risk. This means your monthly payments and overall cost of borrowing would be significantly higher. Alternatively, you could consider a FHA (Federal Housing Administration) loan which has more lenient credit requirements. Remember, everyone's financial situation is unique and requires a tailored approach to navigate. Stay positive! Improving your credit score and financial condition takes time, but it's definitely achievable.

Can I Get a Credit Card with a 519 Credit Score?

A credit score of 519 makes it challenging to be approved for a typical credit card. This score is often viewed as risky by lenders as it might indicate previous financial hardships or issues with money management. This doesn't necessarily mean giving up hope, though. Recognizing where you stand is the crucial first step to getting your financial health back on track, even if that means coming to terms with some less than stellar realities.

If acquiring a conventional credit card is difficult, it may be worth considering alternatives, such as secured credit cards. These cards are easier to get approved for as they require an upfront deposit which then acts as your credit limit. Additionally, you might regard options like finding a co-signer or using prepaid debit cards as practical substitute strategies. It's important to remember that these alternatives don't offer an immediate resolution, but they can serve as valuable tools on the road towards a more stable financial future. Keep in mind, however, that interest rates for any credit you are able to obtain with a 519 score may be much higher because of the significant risk perceived by lenders.

Having a credit score of 519 suggests that securing approval for a personal loan might be quite challenging. Ordinarily, lenders regard this score as high-risk, thereby diminishing your chances of obtaining a traditional personal loan. Dealing with this truth may be tough, but it's crucial to understand what this score indicates for your borrowing possibilities.

Nonetheless, other lending options might be feasible for you. Consider secured loans, where you offer collateral, or co-signed loans, where another person with a robust credit score backs you. There are also peer-to-peer lending platforms, which may have more flexible credit qualifications. Keep in mind that these alternatives usually come with steeper interest rates and not-so-friendly terms, due to the increased risk posed to the lender. Even under these circumstances, there are still possibilities for you to explore, and with careful consideration and responsible repayments, you can work towards improving your financial situation.

Can I Get a Car Loan with a 519 Credit Score?

If you find yourself with a 519 credit score, obtaining a car loan may present some difficulties. This is because financial institutions usually seek scores above 660 to offer favourable loan terms, and any score under 600 falls within what they call a 'subprime' category. This unfortunate label means you might face higher interest rates or even have your loan application denied. The reasoning behind this is that a lower score often signals a higher risk level for the lender, indicating that there may have been struggles with debt repayment in the past.

Don't worry, though. Possessing a lower score doesn't entirely eliminate the possibility of purchasing a car. Certain lenders are prepared to work specifically with those who have lower credit scores. But be alert, these particular loans more often than not come with much higher interest rates. These inflated rates exist to protect the lender against the perceived risk they are taking. By comprehending the terms and considering all your options, you can still secure a car loan, even with the bumpy road your credit score might present.

What Factors Most Impact a 519 Credit Score?

Importance of a 519 Credit Score

Unveiling the constituents of a 519 credit score will aid in your financial development. Recognizing and resolving these factors lead the way to a promising financial future. Every financial lifespan is distinctive, filled with moments to learn and grow.

On-time Payment

Consistent payment substantially influences your credit score. Late payments or skipped ones might be causing your score to drop.

How to Check: Take a look at your credit report for any payments that missed the deadline. Think back on the possible instances where payments were delayed, this could have a significant impact on your score.

Total Credit Usage

Higher credit usage can lessen your score. If your credit usage is above 30% of your total credit limit, this may be a major contributing factor.

How to Check: Scan your credit card statements. If the balances are near to the limits, it's better start lowering them as soon as possible.

Credit Account History

A shorter credit history could be bringing your score down.

How to Check: Examine your credit report to see the age of your oldest and newest accounts along with the average age of all your credit accounts. Consider whether you've opened new accounts in the recent past.

Credit Diversity and Fresh Credit

Holding diverse credit forms and handling new credit responsibly are vital for enhancing your score.

How to Check: Reflect on your array of credit accounts which might encompass credit cards, retail accounts, loans, etc. Reconsider if you've been applying for new credit often.

Publicly Recorded Data

Public records like unpaid taxes or bankruptcies can massively affect your score negatively.

How to Check: Check your credit report for any listings of public records. If found, work on solving those issues urgently.

How Do I Improve my 519 Credit Score?

Carrying a credit score of 519 falls into the poor category, but there are practical actions you can take to start improving your credit standing. Take a look at the following recommendations that are tailored to your current situation:

1. Rectify Defaults and Collections

Address any defaults or collections on your credit report right away, as these significantly lower your score. Reach an agreement with your creditors and make consistent payments to resolve these negative marks.

2. Keep Credit Card Balances Low

Your credit card usage plays a major role in your credit score. Strive at first to keep your credit card balances below 50% of your credit limit, and gradually aim for less than 30%. Lower balances show responsible use of credit.

3. Consider a Secured Credit Card

Secured credit cards can be effective for building positive credit history. They require a refundable deposit, which sets your credit limit. Remember to use this card wisely by maintaining a low balance and paying it off every month.

4. Investigate Authorized User Status

There are benefits to becoming an authorized user on a trustful individual’s credit card account. Their existing credit behavior will be reflected in your credit report. Remember to ensure that the credit card provider reports to the credit bureaus.

5. Gradually Broaden Your Credit Portfolio

Once you’ve improved your credit habits and increased your score, consider adding different types of credit to your portfolio, like an installment loan or a retail store card. This will show you can manage various types of credit responsibly, further improving your score.