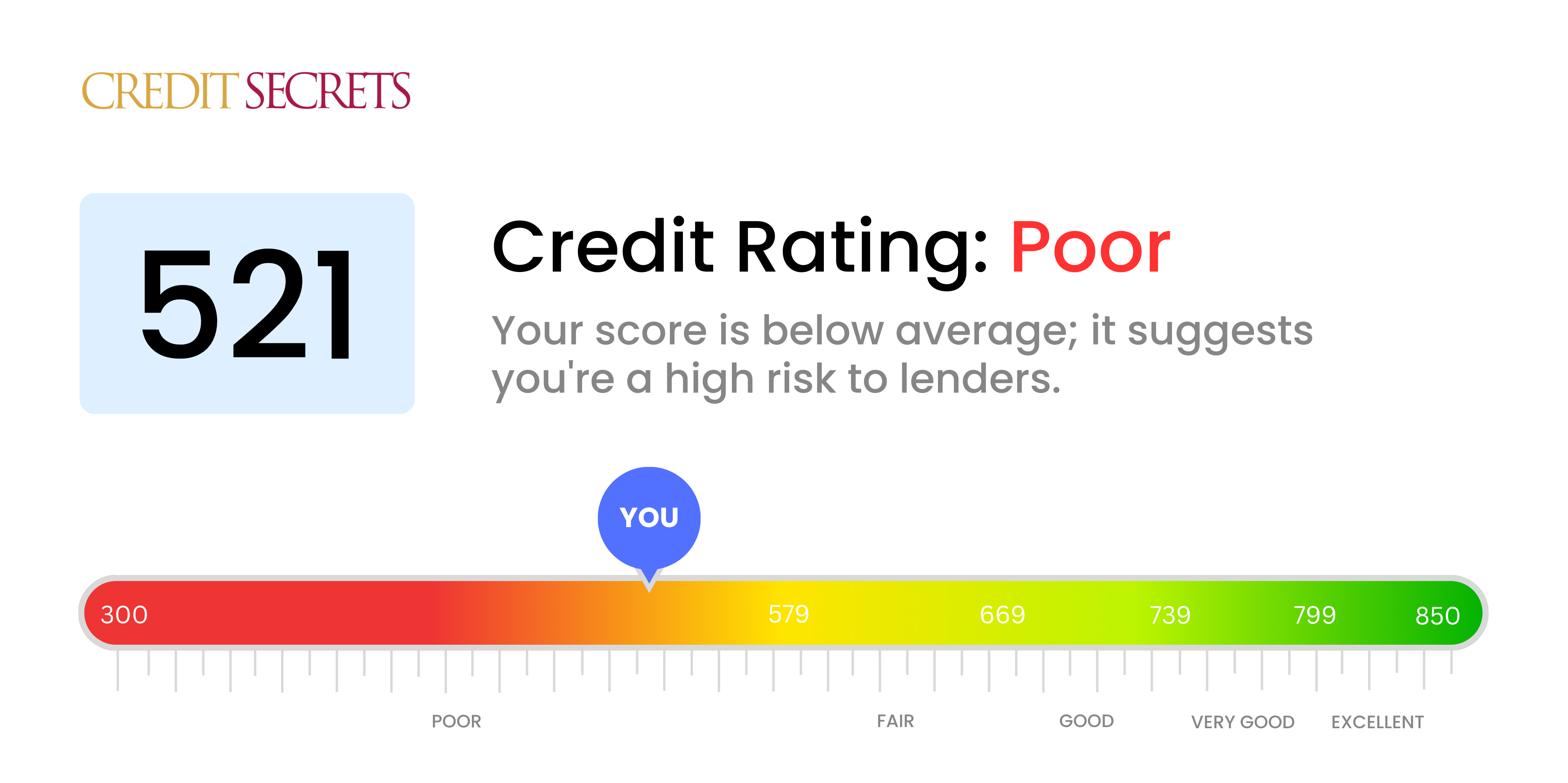

Is 521 a good credit score?

A score of 521 falls into the 'Poor' credit score range. Unfortunately, your credit score is not in a good place at this moment, but remember, it doesn't permanently define your financial health.

With a 521 score, you may find it challenging to get approved for loans and credit cards, and when you do, it's likely to be at higher interest rates. Raising your credit score will take some time and effort, but it will open up more financial opportunities and let you secure loans at a more favorable interest rate. Take small, consistent steps towards your financial health. There's always room for improvement.

Can I Get a Mortgage with a 521 Credit Score?

Given a credit score of 521, it's unlikely that mortgage approval will come easily. Typically, potential borrowers with a credit score in this range face difficulties in securing mortgages from lenders, who often require scores well above this mark. A score of 521 suggests that there might have been financial missteps in the past, such as late payments or debt issues, which could be raising concerns amongst lenders.

When facing a less-than-perfect credit score, alternative approaches may need to be considered. One option could be looking into government-backed loans, like an FHA loan, which are designed for borrowers with lower credit scores. Keep in mind, though interest rates for such loans can be higher than those for conventional mortgages. Another potential pathway is working on improving your credit score; sound financial habits such as paying bills on time, cutting down your debt, and ensuring you don't max out your credit limit can help with this endeavor. Patience is key in this process, and remember that every small step will get you closer to your goal of home ownership.

Can I Get a Credit Card with a 521 Credit Score?

With a credit score of 521, getting approval for a standard credit card can be a tough task. This score is generally viewed by lenders as a red flag that suggests past financial hiccups or issues in keeping up with payments. It can be distressing to face these facts, but understanding your credit status is an essential part of your journey towards financial health.

Even though it might be hard to qualify for conventional credit cards, there's no need to feel disheartened. There are other options which might suit your situation better. Secured credit cards, for example, require a deposit and this deposit becomes your credit limit. These can be a practical starting point to slowly uplift your credit score. Making timely payments on these cards can gradually help to improve your standing. Additionally, a prepaid-debit card could be another way to manage your finances – however, these don't impact your credit score. Note, when dealing with lower credit scores, any credit that is available usually comes with a higher interest rate. Remember, this is just a phase and eventually, with consistency and discipline, your score can improve. Financial health is an attainable goal!

With a credit score of 521, approval for a traditional personal loan may be challenging. This score is notably below what most lenders typically consider a good credit risk. For lenders, a number like this symbolizes a high possibility of default, making loan approval unlikely. It's difficult facing this situation but understanding your options will help you navigate your next steps.

While mainstream personal loans might prove inaccessible, there are other avenues you can explore. Secured loans, for instance, require collateral as a fallback for lenders. You might also consider co-signed loans, where someone with a better credit score vouches for your reliability. Alternatively, peer-to-peer lending platforms might be an option, as they can sometimes offer more lenient credit requirements. It's important to be aware though that these options may come with higher interest rates and less favorable terms due to the perceived risk associated with low credit scores.

Can I Get a Car Loan with a 521 Credit Score?

If your credit score is at 521, it's likely to be difficult getting approved for a car loan. Creditors often see a score above 660 as a sign of financial stability and a lower risk for lending, implying that someone is more likely to honor their repayment commitments. A score of 521 falls into what banks often view as the subprime category, implying higher risk to lenders and a possibility of problems repaying borrowed funds.

That being said, a lower credit score should not deter you from pursuing car ownership. There are lenders who cater specifically to people with lower credit scores. Please be aware, though, these loans may carry notably higher interest rates. This is because by lending to an individual with a lower credit score, the lender is assuming a greater risk. Therefore, the higher interest rate acts as a safety measure to protect their investment. Carefully examine the terms and conditions, and remember that even with a bumpier ride, obtaining a car loan may still be viable.

What Factors Most Impact a 521 Credit Score?

Having a credit score of 521 indicates some financial difficulties but understanding the factors that contribute to this can guide you to improving your financial health. Your financial journey is personal and offers invaluable lessons.

Consistent Late Payments

One of the primary suspects for your credit score could be a history of delayed or inconsistent payments. Your payment history impacts your credit score significantly.

To investigate: Go through your credit report and look for any repeated late payments or defaults. Think about the times when you might have paid late, as this could potentially be bringing down your score.

Close-to-Limit Credit Utilization

If your credit utilization is high, particularly if you're close to your limits on multiple cards, this can adversely affect your score.

To review: Check your credit card balances. If they're routinely near their limits, this could be impacting your score negatively. Keeping your balances low compared to their limits will help improve your score.

Short Credit History

Your score may be affected if you have only a short history of handling credit.

To check: Assess the longevity of your credit history by looking at the age of your oldest and newest accounts, as well as the average age of all your accounts on your credit report. Have you opened new accounts recently? This may cause a temporary dip in your score.

Lack of Credit Diversity

Your score may be impacted if you do not have a diverse mix of different types of credit, such as credit cards, installment loans, and mortgage loans.

To check: Evaluate your credit portfolio. A combination of different types of credit can aid in enhancing your credit score.

Damaging Public Records

Public records such as bankruptcies, foreclosures, or tax liens can have a substantial negative influence on your score.

To look into this: Look for any public records mentioned on your credit report. Prioritize addressing any such issues for a better financial outlook.

How Do I Improve my 521 Credit Score?

Having a credit score of 521 may seem discouraging, but there are specific, methodical steps you can take to turn this situation around. Here are the most beneficial and achievable actions you can take:

1. Pay Off Past-Due Debts

If you have any debts that are past their due date, focus on repaying them. These accounts can seriously damage your credit score. Discussing a manageable repayment plan with your creditors could be a vital first step.

2. Keep Credit Utilization Low

If you’re using a substantial portion of your available credit, this could be affecting your score. Aim to keep your credit card balances below 30% of your limit. Even better, try to keep them below 10% whenever possible.

3. Opt for a Secured Credit Card

With a score of 521, getting a standard credit card can be tough. A secured credit card, which requires a deposit that’s equivalent to your credit limit, could be one option to consider. Be sure to make regular purchases and pay off the balance in full each month to establish a good payment record.

4. Seek to be an Authorized User

Trustworthy friends or family members with a robust credit history may agree to have you as an authorized user on their credit card. This could enhance your score by adding their good payment history to your credit profile. Prompt the card provider to report the authorized user activity to the credit bureaus.

5. Boost Your Credit Diversity

Having a variety of credit types can enhance your score. After building a good payment history with a secured card, try incorporating other types of credit like a retail card or a credit builder loan into your mix and manage them responsibly.