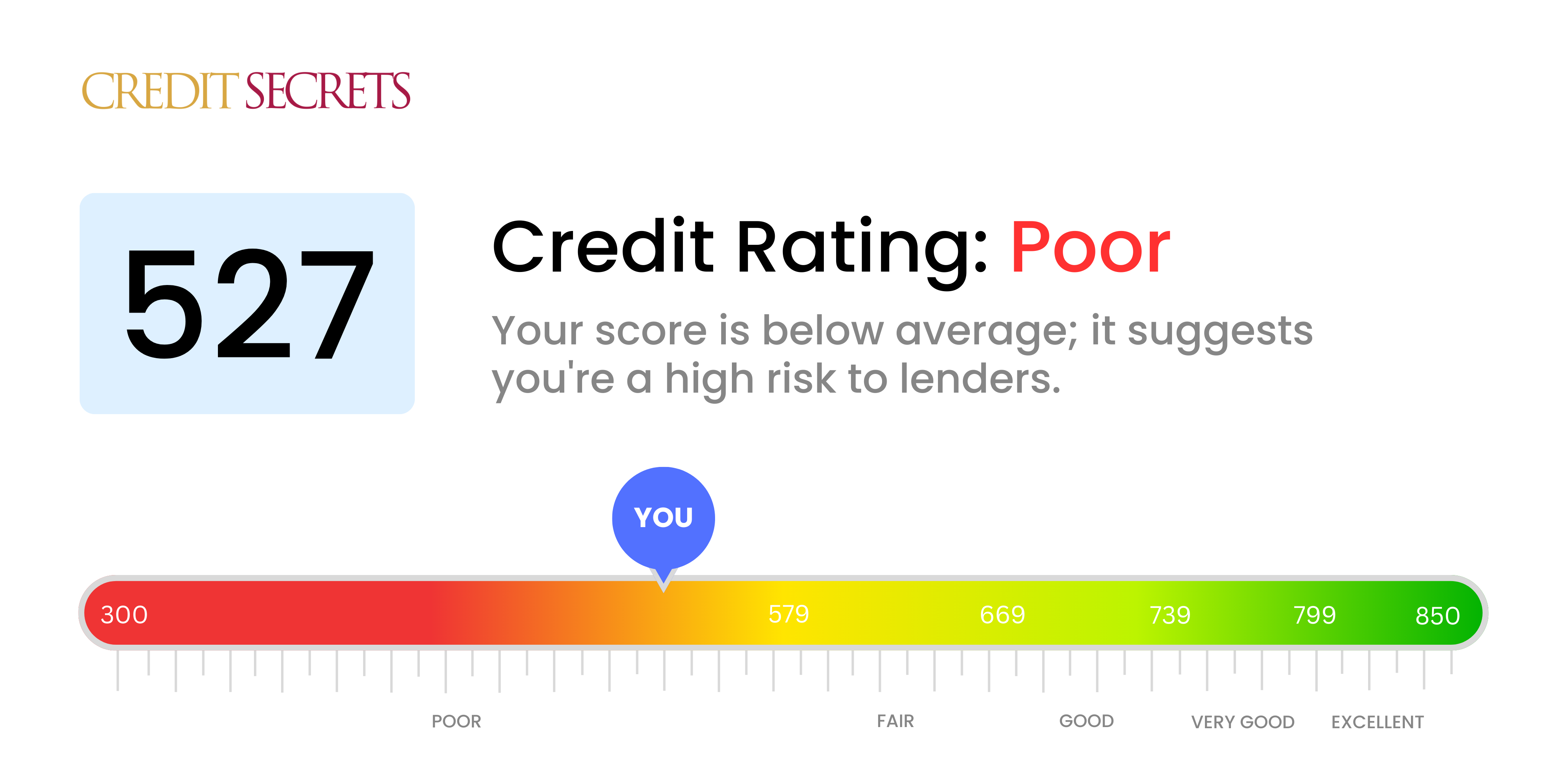

Is 527 a good credit score?

With a credit score of 527, it's evident that you're currently in the 'Poor' category, which can make it challenging to secure beneficial financial deals. It doesn't present an optimistic outlook, but there's no need to lose hope—there are actionable steps you can take to raise your credit score.

Being in this bracket usually implies that you might struggle to get approval for new credit, and when you do, the terms might not be as favorable. Higher interest rates and less advantageous loan terms are probable consequences of this score. However, by understanding your credit situation and working towards improving it, you can eventually move up the credit score ladder.

Can I Get a Mortgage with a 527 Credit Score?

Unfortunately, having a credit score of 527 makes it improbable that you'll be approved for a mortgage. This is below the minimum threshold set by most lenders as a credit score in this range indicates some past financial missteps, such as delayed payments or even defaults. It's a tough situation, but it's not impossible to navigate through.

Key to improving your chances for a mortgage approval in the future is addressing what's impacting your credit score the most. This could be settling any outstanding debts or accounts in collection. It's equally important to start demonstrating regular, timely payments to gradually improve your credit standing. Interest rates are usually higher for low score borrowers, so improving your score can also lead to better mortgage rates. It's a slow process, but every step you take towards improving your score takes you closer to achieving your goal of owning a home. Keep moving forward, future homeowner.

Can I Get a Credit Card with a 527 Credit Score?

With a credit score of 527, chances are quite slim for a traditional credit card approval. This score tends to signify a level of risk to lenders, possibly due to past financial hiccups or lapses in money management. Despite the seriousness of this situation, it's essential to view it with clarity and resourcefulness. Acknowledging your credit position is key in beginning your journey to financial recovery, though it implies confronting some uncomfortable realities.

In light of the challenges with such a score, it's worth looking into other options such as a secured credit card. These cards need a deposit that functions as your credit limit and, compared to standard cards, are easier to acquire. This can significantly contribute to credit score improvement. Consider engaging a co-signer or using pre-paid debit cards. Though these alternatives might not provide an immediate solution, they serve as pivotal stepping stones towards enhanced financial secureness. And, it's also important to be aware that the interest rates attached to any credit forms accessible to people with such credit scores are often considerably higher, reflecting lenders' perceived risk.

A credit score of 527 is notably lower than what most traditional lenders require for approving a personal loan. This score casts a shadow of risk that makes it quite difficult for you to be considered for a loan with conventional lenders. Don't get discouraged, it's essential to understand this credit score's significance and how it affects your borrowing options.

As the doors of traditional loans might seem closed, other options like secured loans or co-signed loans might be worth considering. Secured loans typically require collateral, while co-signed loans need someone with a higher credit score to back your application. You might also explore peer-to-peer lending platforms, which often have more flexible credit requirements. But caution is essential, these alternative options often carry higher interest rates and less flexible terms due to the increased risk for the lender.

Can I Get a Car Loan with a 527 Credit Score?

Navigating the financial world with a credit score of 527 can seem challenging, especially when it comes to securing a car loan. In general, lenders prefer to work with applicants who have a score above 660. Since your score is lower, it's considered 'subprime', a term often attributed to credit scores under 600. Regrettably, this category can lead to steeper interest rates or lack of loan approval due to your score being considered a higher risk to lenders.

Don't despair entirely, though. Even with a lower credit score, there might still be options for you. While it can be more difficult, some lenders do cater to individuals with less advantageous credit scores. However, because these lenders are assuming a higher risk, they often compensate with elevated interest rates. It's crucial you thoroughly understand and evaluate the terms before agreeing. Whilst the journey to car ownership may be a little rockier, know that it's not necessarily out of reach.

What Factors Most Impact a 527 Credit Score?

Grasping the factors behind a score of 527 is key to paving your way to financial growth and resilience. Investigating and rectifying the causes of this score can foster progress towards healthier credit. Your financial journey is distinctive and laden with chances for advancement and understanding.

Late Payments

Payment punctuality bears a considerable influence on your credit score. Late payments and failed repayments can be a major contributor.

How to Check: Inspect your credit report for any signs of late payments or defaults. Think about times when payments were delayed, as these could have negatively impacted your score.

Credit Card Utilization

A high level of credit card utilization can harm your score. If your credit cards are frequently maxed out, this could be a significant factor.

How to Check: Study your credit card statements. Are the balances often at their limits? Keeping balances lower than the limit can help.

Credit History Duration

A brief credit history can negatively affect your score.

How to Check: Assess your credit report to determine the age of your oldest and newest accounts, along with the average age for all accounts. Question if any new accounts have been added recently.

Variety of Credit and New Credit

Maintaining various types of credit and responsibly handling new credit are crucial for achieving a high score.

How to Check: Examine your blend of credit accounts like credit cards, in-store accounts, installment loans, and mortgages. Evaluate your new credit applications frequency.

Legal Judgements

Legal judgements such as bankruptcies or tax liens can severely impact your score.

How to Check: Review your credit report for any legal judgments. Seek to resolve any listed items that require attention.

How Do I Improve my 527 Credit Score?

A credit score of 527 falls into the category of bad credit, but don’t lose hope. By focusing on some practical strategies, you can begin to rebuild your credit health. Let’s concentrate on some steps tailored to your specific situation.

1. Resolve Outstanding Debts

If you have any outstanding debts, it’s time to settle them. These debts are creating a significant dent in your credit score. Create a repayment plan that starts with the most impactful debts. If needed, liaise with your creditors for a manageable payment schedule.

2. Keep Credit Balances Low

Compared to your credit limit, high card balances can negatively impact your score. Strive to keep your credit card balances under 30% of your credit limit. Ultimately, aim at bringing them down to less than 10%.

3. Apply for a Secured Credit Card

With a score of 527, obtaining a regular credit card could be tough. Consider a secured credit card which needs a cash collateral deposit equal to the credit line for that account. Make small purchases and clear the balance every month to build a good payment history.

4. Leverage Authorized User Status

Request a friend or family member with good credit to add you as an authorized user on their card. This helps your score through their positive payment patterns. Confirm that the card issuer communicates authorized user activities to the credit bureaus.

5. Diversify Your Credit Portfolio

Holding a variety of credit accounts may positively impact your credit score. After building a commendable payment record with the secured card, consider other credit types such as retail credit cards or credit builder loans. Ensure you manage them responsibly to boost your credit score.