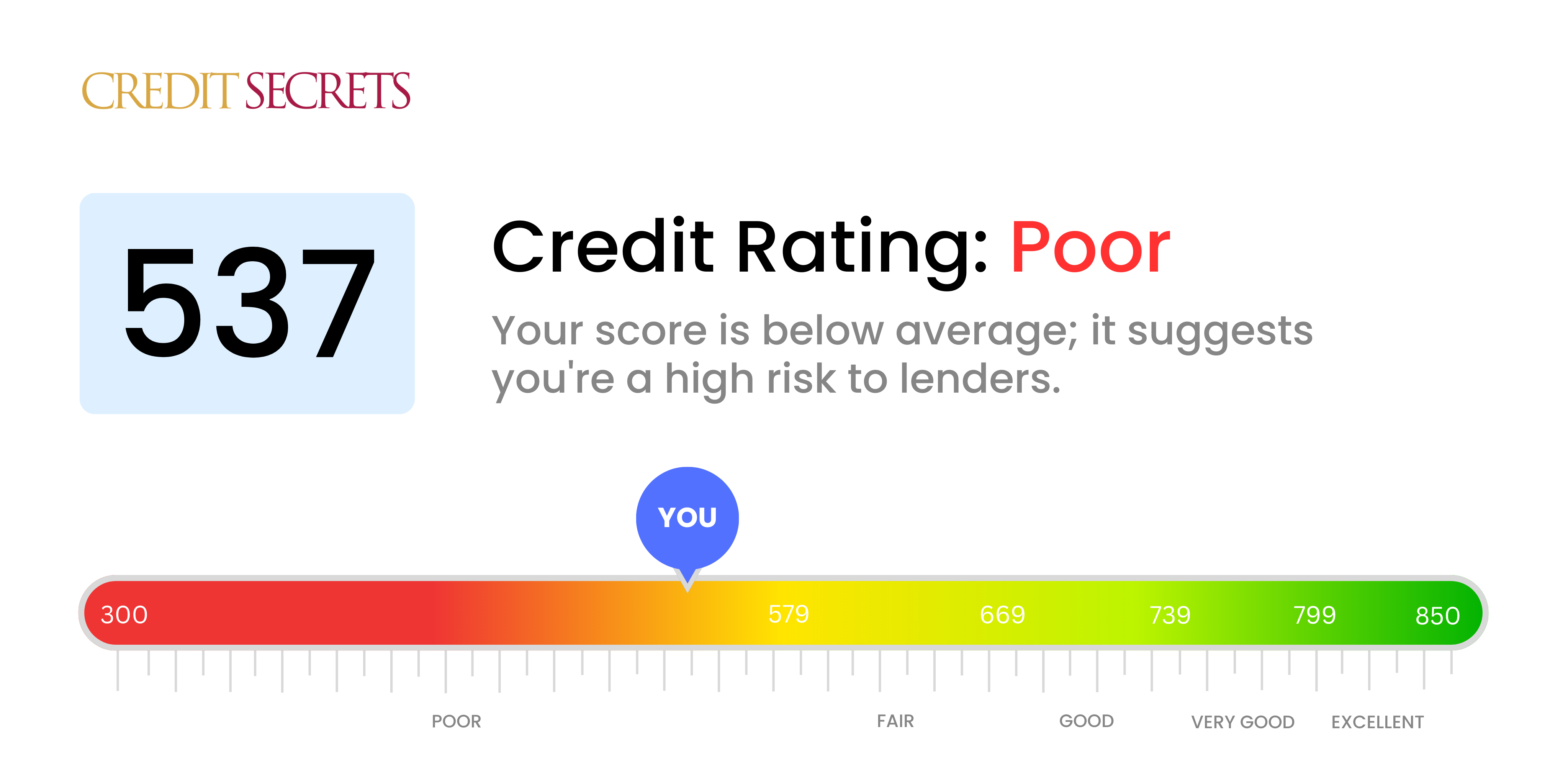

Is 537 a good credit score?

A credit score of 537 falls within the poor category. It's not an easy position to be in, but it's important to remember it isn't permanent. With this score, you may face difficulties gaining approval for loans or credit cards, and if approved, interest rates may be high. But with commitment and diligence, improving your score is entirely possible.

As a member of Credit Secrets, taking steps to improve your credit score can help open up more financial opportunities. Our program offers proven strategies to help you work toward a higher credit score. Though the journey to improving your credit may seem overwhelming, every step forward is a step towards achieving your financial goals.

Can I Get a Mortgage with a 537 Credit Score?

Having a credit score of 537, unfortunately, might make it quite difficult for you to secure a mortgage. Generally speaking, most lenders prefer a minimum score of 580 to consider a mortgage approval. A credit score as such often signifies a track record of fiscal stress, such as missed payments or other financial mishaps.

Although this situation might seem daunting, there are alternative routes to home ownership. Several loan programs cater specifically to those with lower credit scores, but they may come with higher interest rates. You could also explore government-backed loans or work directly with sellers for owner-financed arrangements. It might take some creative searching to find these opportunities, but they do exist. It's important to remain optimistic and diligent in your efforts as you maneuver through this financial obstacle. With time, perseverance and responsible financial habits, improving your credit score and securing a mortgage is within your reach.

Can I Get a Credit Card with a 537 Credit Score?

If you have a credit score of 537, you may find it challenging to get approval for a conventional credit card. This score tends to be seen as high risk by lenders, indicating past financial hardships or potential mismanagement. It's understandable if this news is disheartening, but remain hopeful. Acknowledging your credit reality is an important first step on the path to financial recovery.

Given this scenario, you might consider alternative options like secured credit cards. Secured cards require a deposit, which serves as your credit limit. This type of card is typically easier to get and can help gradually rebuild credit. Other possibilities include seeking a co-signer or using prepaid debit cards as an alternative method of payment. Remember, while these options may not provide an immediate fix, they are essential tools in the overall journey to restore financial health. Keep in mind, if you are able to acquire any form of credit, interest rates will likely be higher as lenders view lower scores as a greater risk.

Having a credit score of 537 unfortunately falls below the range that many traditional lenders consider safe for approving a personal loan. This score may signal a higher level of risk to lenders, making it less likely you'll be approved for a loan using standard criteria. It can feel daunting, but it's crucial to acknowledge the implications this credit score may have on your borrowing options.

Though conventional loans may not be an option, alternatives such as secured loans, where collateral is provided, or co-signed loans, where another person with a higher score co-signs the loan, could be viable. Peer-to-peer lending platforms may also serve as an alternative thanks to their often more flexible credit requirements. keep in mind, these alternatives often come with higher interest rates and less favorable terms as a result of the elevated risk for the lender. Securing a personal loan with a credit score of 537 isn't impossible, but does require careful consideration of the alternatives and their terms.

Can I Get a Car Loan with a 537 Credit Score?

With a credit score of 537, getting approved for a car loan could be a tough task. Most lenders want to see a credit score above 660, and scores below 600 usually fall into the category known as 'subprime'. Since your score is 537, unfortunately, it's in that subprime range. This can affect your approval chances or potentially lead to higher interest rates as your score signals a higher risk to lenders; it suggests there may have been difficulties repaying loans in the past.

Nonetheless, there's no need to lose hope entirely. Some lenders offer loans specifically to individuals with lower credit scores. But watch out: these can come with much steeper interest rates as a way for lenders to make sure they're protected. Even though your credit score puts some bumps on the road, after carefully scrutinizing the loan terms and considering all factors, a car loan remains a possibility. Remember, it's just a bit more challenging, not impossible.

What Factors Most Impact a 537 Credit Score?

Determining the key factors influencing a score of 537 is instrumental in crafting your roadmap to better financial health. By pinpointing and addressing these crucial factors, strides can be made towards enhancing your financial state. Every financial path is distinct, replete with challenges and triumphs.

Amounts Owed

How much you owe on your accounts significantly affects your credit score. An accumulation of outstanding balances can potentially be driving down your score.

How to Check: Scan your credit report for any outstanding balances. Any high outstanding balances may have negatively impacted your score.

Payment History

A tarnished payment history can also play a key role in your current score. Missed or late payments are often the culprits in such scenarios.

How to Check: Analyze your payment history. Reflect on past payments, as missed or late ones could have contributed to your score.

Credit History Length

A brief credit history may be negatively influencing your score. The shorter the credit history, the harder it is to prove creditworthiness.

How to Check: Look at your credit report for the age of your oldest and newest credit accounts along with the average age of all your accounts. Consider if you have opened new ones recently.

Credit Types Diversity

Having a diverse mix of credit types positively affects a credit score. Limited diversity may be impacting your score negatively.

How to Check: Look at your mix of credit accounts. A lack of varied credit types such as credit cards, installment loans and mortgage loans may be pulling your score down.

Public Record Information

Public records like legal judgments or bankruptcies can notably affect your credit score.

How to Check: Review your credit report for any public records. Resolving any listed items could improve your score considerably.

How Do I Improve my 537 Credit Score?

A credit score of 537 falls into the ‘poor’ category, but steps can be taken to quickly elevate that score. Let’s highlight the most effective and attainable actions for your current situation:

1. Address Late Payments

Having late payments on your credit report can drastically lower your score. Make an effort to pay your bills on time moving forward. If you find yourself unable to meet payment deadlines, reach out to your creditors to discuss modifying your payment plan.

2. Lower Your Credit Utilization Ratio

Credit utilization ratio – the percentage of your total credit limit that you’re using – is a crucial factor in determining your credit score. Aim to keep all credit card balances below 30% of your total limit. Focus firstly on the cards with highest utilization.

3. Consider a Secured Credit Card

With your current credit score, a secured credit card could be beneficial. This card uses a cash deposit as collateral for your line of credit. By using it responsibly (keeping a low balance and paying it off on time), you can start boosting your payment history and score.

4. Seek to Become an Authorized User

Request a trusted individual, with a strong credit history, to add you as an authorized user on their credit card. This provides an opportunity to piggyback off their positive credit, but ensure the card issuer reports authorized user activity to the credit bureaus.

5. Gradually Expand Your Credit Portfolio

Once a positive payment track-record is established with a secured card, begin introducing a wider mix of credit into your portfolio, such as a credit builder loan or a store card.

Remember, the journey to a healthy credit score is a marathon, not a sprint. Patience, perseverance, and consistent financial habits are key!