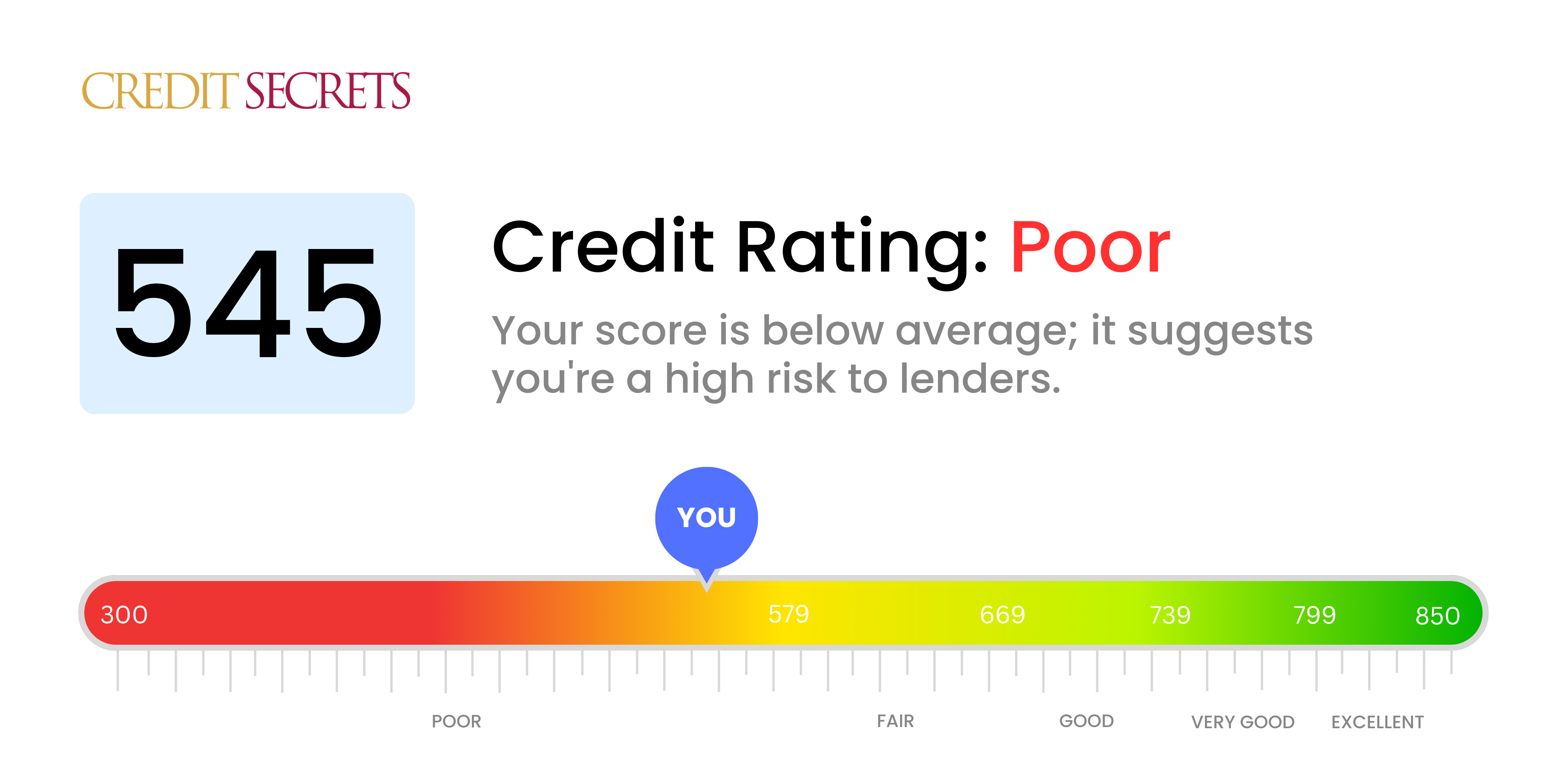

Is 545 a good credit score?

Having a credit score of 545 places you in the Poor credit category. This can pose challenges when trying to secure loans, mortgages or credit cards, as lenders see this as a high-risk score.

But remember, your financial story isn't over. People with this score can take steps to improve it. By focusing on consistent, responsible credit behavior, such as paying bills on time and keeping balances low, you can gradually increase your score. Your journey to a better credit future starts today.

Can I Get a Mortgage with a 545 Credit Score?

If you have a credit score of 545, chances are it may be challenging to get approved for a mortgage. This is because most lenders typically prefer a score above 620 to consider an application feasible. Owning a score in the mid-500s may suggest past credit difficulties such as late payments or other financial missteps.

While this situation might seem demanding, it's not impossible to turn things around. Begin by concentrating on paying all your bills and debts on time. This includes not only your credit cards but also rent, utilities, or any other monthly dues. Gradually, with careful monetary decisions and sustained effort, your credit score can be rebuilt. In terms of alternatives, you might look into Federal Housing Administration loans. This government-backed mortgage offers more flexible qualification requirements and might approve lower credit scores.

Keep in mind, lower credit scores could also mean higher interest rates. So, improve your credit score will not only increase your chances of getting a mortgage but can also help to secure better loan terms. Remember, progress may be slow, but every small step matters.

Can I Get a Credit Card with a 545 Credit Score?

With a credit score of 545, you might find it quite challenging to get approved for a traditional credit card. This score is often considered high-risk by lenders, perhaps reflecting past financial difficulties or mismanagement. This might feel discouraging, but facing your credit situation honestly is the first step towards financial recovery. Remember, understanding your credit status, no matter how unpleasant, is a crucial part of overcoming finance-related hurdles.

Since acquiring a traditional credit card may be tough with this score, it might be helpful to consider alternative avenues. Secured credit cards, which demand a deposit equating to your credit limit, could be a good place to start. They're typically easier to acquire and can aid in gradually rebuilding credit. Alternatively, you might explore having a co-signer or using pre-paid debit cards. While these options won't solve the problem instantly, they are beneficial tools on the path towards financial stability. Importantly, remember that with a score like 545, interest rates on any form of credit you do get might be higher, reflecting the increased risk to lenders.

Having a credit score of 545, it's crucial to understand that most traditional lenders might see this as a significant risk. Typically, this score falls well below the standard range lenders normally consider comfortable for granting a personal loan. This doesn't mean it's impossible, but it could certainly present some difficulties.

Traditional personal loans might be harder to obtain with a score of 545, but there are other lending options that could accommodate your situation. These could include secured loans, where collateral is used, or loans that are co-signed by another individual with a higher credit score. There are also peer-to-peer lending services that can propose more relaxed credit requirements. However, it's important to recognize that these alternatives may come with steeper interest rates and less agreeable terms due to the increased risk presented to the lender.

Can I Get a Car Loan with a 545 Credit Score?

With a credit score of 545, securing a car loan might seem like a strenuous task. Most lenders prefer a score above 660, and anything below 600 is typically seen as subprime. Your score of 545 falls into the subprime range. This could mean higher interest rates, or even a denial of the loan. The reason is simple: a lower credit score signifies a higher risk to lenders, because it suggests that there could be issues with paying back the borrowed money.

But don't be disheartened. A lower credit score doesn't close all avenues. There are lenders who are willing to work with individuals with lower credit scores. However, keep in mind that these loans usually come with more substantial interest rates. This safeguards lenders against the heightened risk they perceive. By making thoughtful choices and understanding the loan terms carefully, getting a car loan could still be very much achievable, despite the hurdles.

What Factors Most Impact a 545 Credit Score?

Deciphering your credit score of 545 is a vital step in embarking on your journey to financial improvement. Recognizing the critical factors that contribute to this score will set the foundation for a better credit future. Remember that every person's financial path is distinct with its unique set of challenges and lessons.

Payment History

Payment history is one of the key components in figuring your credit score. Late payments or defaults could be a significant reason for your current score.

What You Can Do: Obtain your credit report and check for any late payments or defaults. Think about any occasions when you may have postponed payments, as these could have lowered your score.

Credit Utilization

High credit utilization, having credit card balances close to their limits, could be contributing to your score.

What You Can Do: Go over your credit card statements. If your balances are close to the limits, devise a plan to lower them. This will help improve your score.

Credit History Length

A short credit history might be negatively impacting your score.

What You Can Do: Examine your credit report to gauge the age of your older and newer accounts, and the overall age of your accounts. Keep in mind any recent new accounts could have lowered your score.

Types of Credit and New Credit

Having a diverse mix of credit and maintaining new credit responsibly are key factors in a good score.

What You Can Do: Evaluate your mix of credit accounts. If you have been applying for new credit frequently, this could be affecting your score negatively.

Public Records

Public records such as bankruptcies, tax liens or court decisions can seriously lower your score.

What You Can Do: Review your credit report for any public records. Address any issues that need resolving to improve your score.

How Do I Improve my 545 Credit Score?

Having a credit score of 545 can be quite challenging, but it’s not the end of the route to financial freedom. With a focused and strategized approach tailored to your circumstances, improvement awaits. Here are a few of the most practical measures immediately accessible to you:

1. Scrutinize Your Credit Reports

Start working on improving your 545 credit score by fully understanding your credit reports. Ensure there are no errors or inaccuracies that could erroneously be lowering your score. Any discrepancies should immediately be reported to the relevant credit bureau for correction.

2. Tackle High Interest Debt First

Try to pay down your high-interest debts as quickly as possible. This not only reduces your overall debt but can also have a positive impact on your credit score. Avoid taking on additional debt while you’re concentrating on this effort.

3. Consider a Credit-Builder Loan

Given the current state of your score, credit-builder loans could be an asset. They’re designed specifically for people looking to improve their credit. As you gradually repay the loan, your timely payments are reported to credit bureaus, boosting your credit history.

4. Timely Payment of Bills

Consistently paying all your bills on time is vital. Late or missed payments can significantly damage your credit score. Set up alerts or automatic payments to ensure timely payment.

5. Opt for a Secured Credit Card

You may face challenges gaining approval for a standard credit card due to your score. A secured credit card, however, is attainable and can help you build a better payment history and improve your credit score, if you manage it responsibly.