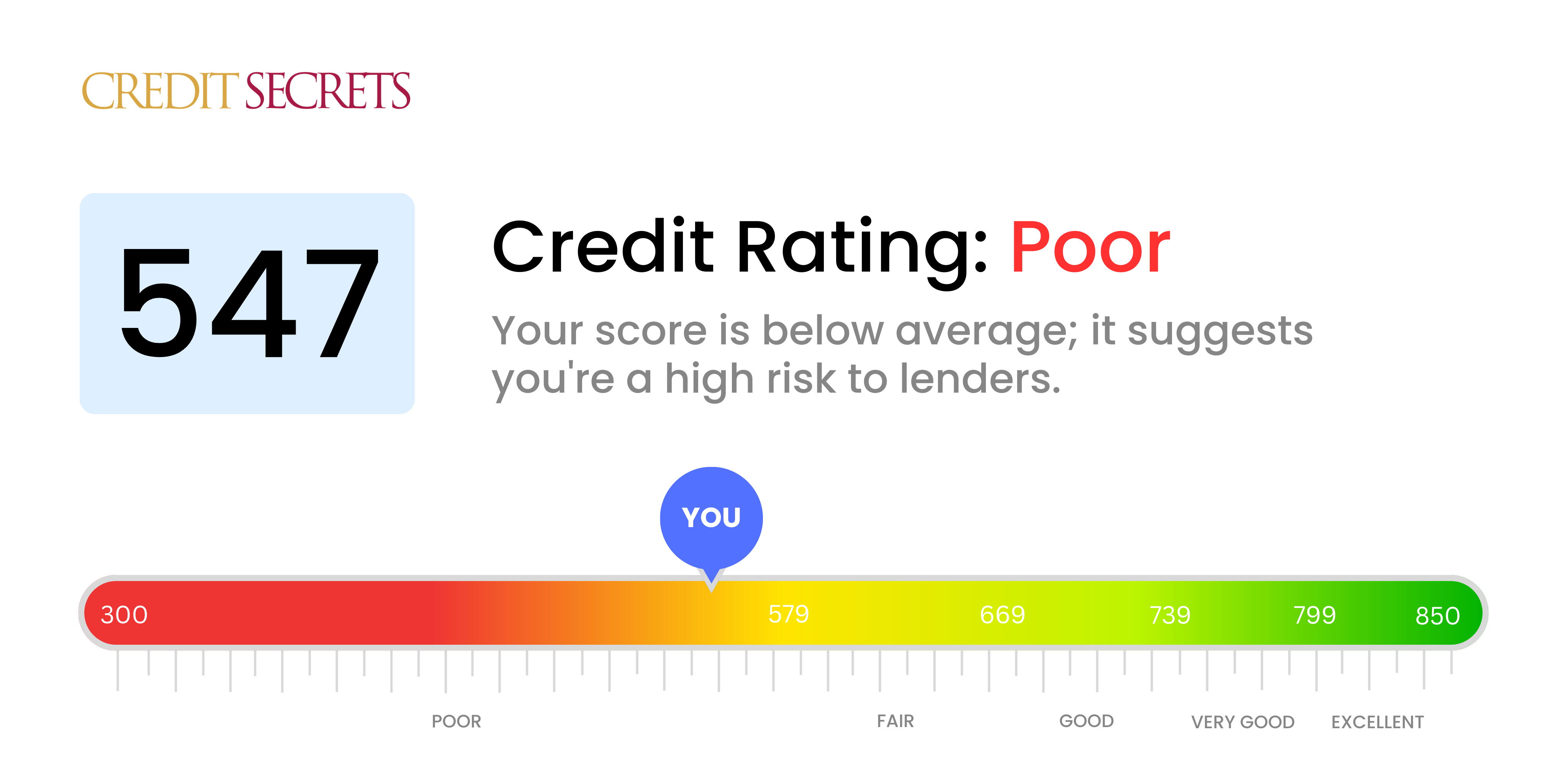

Is 547 a good credit score?

With a credit score of 547, you're currently in the 'poor' category. This may make it tough for you to qualify for loans or credit cards, and if approved, you may face higher interests rates or heavy fees. However, it's important to remember that this isn't a permanent situation. With focused action and careful financial behavior, you can improve this score over time.

It might feel like an uphill task, but rest assured there are strategies that can help you boost your credit score. Regularly paying bills on time, reducing your overall debt, and checking your credit report for any errors, are constructive steps in the right direction. Remember, progress may take some time, but perseverance can help create a brighter financial future for you.

Can I Get a Mortgage with a 547 Credit Score?

If your credit score is 547, securing approval for a mortgage could be difficult. This score is typically considered poor, and most lenders seek higher scores to indicate financial reliability. Low scores like this often suggest past financial issues, such as missed payments or defaulted loans, that can make mortgage lenders hesitant to take you on as a borrower.

However, the situation is not entirely hopeless. Though mainstream lenders may be reluctant to approve a mortgage, you may have other options available. Some specialized lenders and government programs offer mortgages designed for those with lower credit scores. Be prepared - the terms on these loans may not be as favorable, and you may face higher interest rates as creditors are taking on more risk. Alternatively, if you're not in a hurry, focusing on improving your credit score could open the doors to more competitive mortgage options. Remember to make consistent, timely payments and manage your credit responsibly to see improvements over time.

Can I Get a Credit Card with a 547 Credit Score?

Having a credit score of 547 tends to be seen as higher risk in the eyes of lenders, potentially making it difficult to be approved for a traditional credit card. This score shows lenders that there may have been some past financial missteps, thus making them cautious. This news may feel a bit disheartening, but acknowledging your credit status is crucial in working towards better financial health.

Given the nature of this score, looking into alternatives like secured credit cards could be a sensible avenue to explore. These cards require a deposit upfront that serves as your credit limit, and can often be easier to get approved for. They can also help build back up your credit over time. You might also think about getting a co-signer or using prepaid debit cards, as these are methods to handle finances while rebuilding credit. It's important to keep in mind that interest rates on these kinds of credit offerings can be quite high due to the higher perceived risk among lenders. Nonetheless, these are options that could ease the path to greater financial stability.

With a credit score of 547, it's challenging to secure approval for a personal loan from traditional lenders, because this score falls well below the standard acceptable range. This score suggests to lenders that providing a loan could be risky, due to the potential for loan default. It's certainly a tough predicament, but it's essential to recognize the truth about your credit score and its implications for your borrowing options.

Even though the doors to regular loans may be closed, consider looking at possible alternatives. Options like secured loans, where you supply an asset as collateral, or co-signed loans, where a higher credit score individual guarantees the loan for you. Another option to consider is peer-to-peer lending platforms as they occasionally demonstrate more flexible credit standards. Regardless, it's vital to be aware these alternatives typically come with higher interest rates and less advantageous conditions. This is due to the increased risk these lenders are taking in providing loans to individuals with lower credit scores.

Can I Get a Car Loan with a 547 Credit Score?

Having a 547 credit score can make getting approved for a car loan a bit tough. Ideally, lenders prefer scores above 660. Anything less than 600 is commonly seen as subprime, and unfortunately, a score of 547 fits into this category. This could result in higher interest rates or, in some cases, a rejection of your loan application. Because, from a lender's perspective, a lower score indicates the potential for repayment difficulties.

But don't lose hope. You still have options when looking to purchase a car. Some loan providers focus on assisting those with lower credit scores. However, bear in mind these loans often have much higher interest rates. This is because lenders view lower scores as a higher risk, and the increased rates help protect their investment. The journey might not be easy, but with care, understanding, and assessment of the terms, getting a car loan remains a possibility.

What Factors Most Impact a 547 Credit Score?

Understanding a credit score of 547 is critical to steer your financial trajectory positively. By pinpointing and addressing the factors leading to this score, you can map out a strategic plan towards a stronger credit standing. Keep in mind that everyone's financial journey is different, presenting numerous opportunities for growth and learning.

Credit Payment History

The primary most impactful factor pertains to your payment history. If you've had any late or missed payments, these occurrences could be significantly contributing to your current score.

How to Check: Scrutinize your credit report for any indications of missed or late payments. Reflect and correct your payment habits as needed.

Credit Utilization

High utilization of available credit is another significant determinant of your score. If you're consistently maxing out your credit cards, this could be impacting your score.

How to Check: Inspect your credit card statements. Are your balances nearing their limits? Strive to keep your balance well within your credit limit.

Length and Diversity of Credit History

Shorter and non-diverse credit histories can negatively affect your score. If you only have a few types of credit or have recently opened several new accounts, this could be driving down your score.

How to Check: Assess your credit report to determine the age and diversity of your credit. Reflect as to whether you recently applied or opened new accounts.

Negative Public Records

Negative public records, like bankruptcies or tax liens, could be another key factor affecting your score.

How to Check: Scan your credit report for any public records. Aim to resolve any lingering affairs.

How Do I Improve my 547 Credit Score?

A credit score of 547 isn’t the best, but don’t despair – it can be managed upwards. Here are some focused and realistic strategies tailored to this score tier:

1. Resolve Delinquent Accounts

Delinquent accounts can seriously damage your credit score. Prioritize settling these accounts first. Don’t hesitate to communicate with your creditors to discuss potential payment plans.

2. Lower Credit Utilization

High credit card utilization – how much of your credit limit you’re using – can impact your credit score. Aim to bring it down below 30%, ultimately aiming for less than 10%. Focus on lowering the debt on cards with the highest utilization rates first.

3. Opt for a Secured Credit Card

Obtaining a regular credit card might be difficult due to your current score. A secured credit card, aided by a cash collateral deposit as your credit limit, could be a sensible decision. Manage it wisely, by making small purchases, and always clear your balance each month for a favorable payment history.

4. Consider Being an Authorized User

Enquiring with a friend or relative with a strong credit performance whether you could be added as an authorized user on their card can help. This will integrate their positive credit habits into your report. Make sure that the card provider informs the credit bureaus about authorized user activity.

5. Expand Your Credit Portfolio

A varied range of credit types can boost your score. Once you’ve built a commendable payment history with a secured card, explore other credit options, like retail cards or credit-builder loans, but remember – responsible management is key.