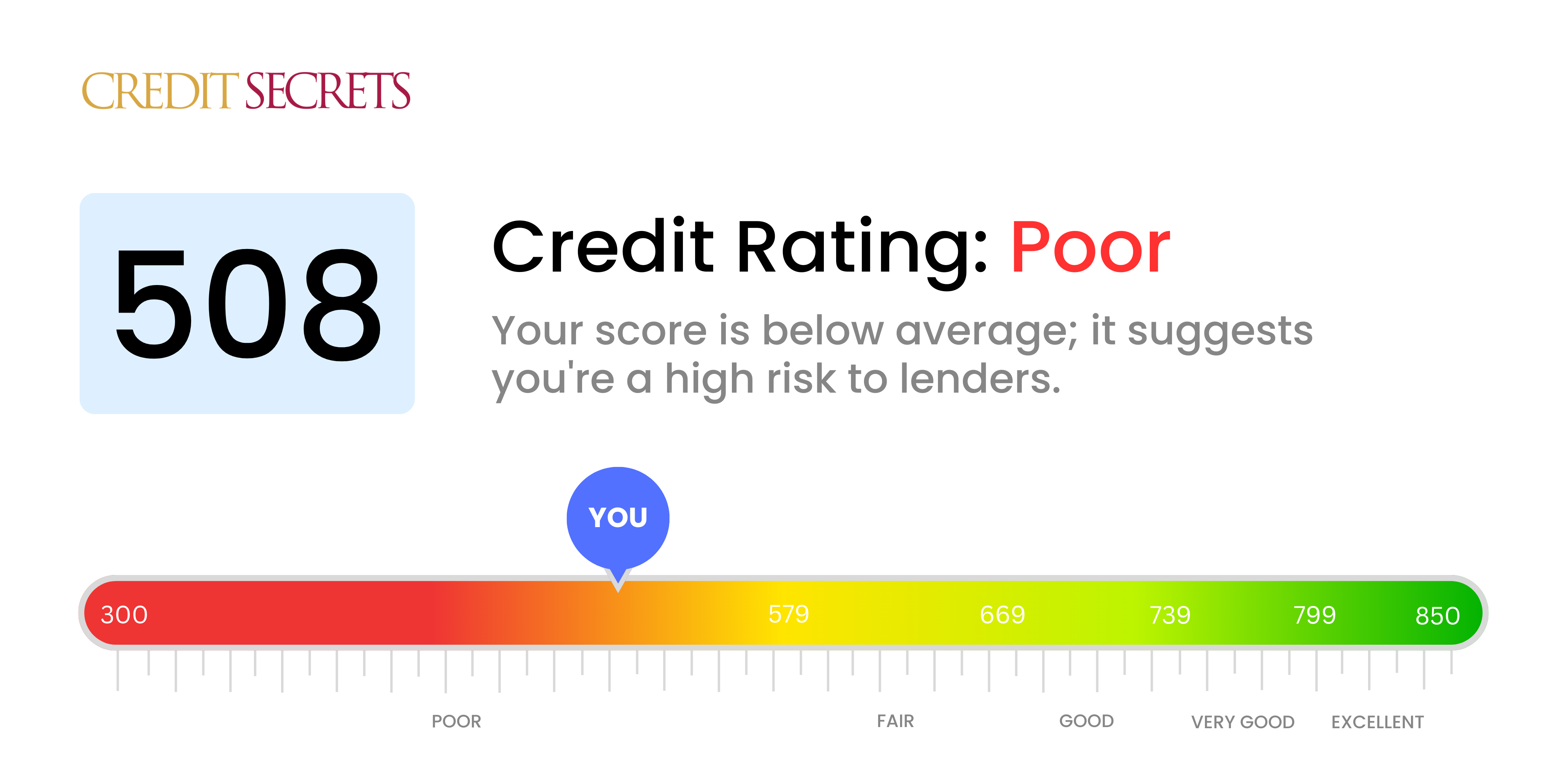

Is 508 a good credit score?

With a credit score of 508, you're unfortunately sitting in the 'poor' category. This might make acquiring loans or credit more challenging and could result in higher interest rates, but it's important to stay positive and remember that there are always opportunities to improve your financial situation.

A score of 508 might make certain financial objectives difficult, usually requiring substantial security deposits for utilities or being denied for certain loans. But don't be disheartened; with diligent efforts and financial discipline, you can gradually boost your credit score over time.

Can I Get a Mortgage with a 508 Credit Score?

With a credit score of 508, it is unlikely you would qualify for a mortgage. This score is significantly lower than the minimum typically required by most lenders. A score in this range often signals a past marked by financial challenges, including missed payments or defaults. While this is a difficult time, there's no need to despair.

You should consider looking for alternatives such as rent-to-own options, seeking a co-signer, or potentially looking into federal housing programs like the FHA. You're not alone in this journey, many people face credit difficulties. Exploring these alternatives can provide a pathway to homeownership while you work on improving your credit score. Remember, improving your credit score is not a sprint, it's a marathon. But with time, patience and disciplined financial habits, you can increase your score and move closer to your financial goals.

Can I Get a Credit Card with a 508 Credit Score?

With a credit score of 508, it might be tough to be approved for a standard credit card. This lower score may indicate to lenders that there could be some risk involved. It might feel tough hearing this, but recognizing your current credit status is a stride towards better financial control.

For a credit score at this level, you might need to look at other options. Consider a secured credit card, where a deposit will generally be your credit limit. This type of credit card might be easier to get and can assist you in rebuilding your credit over time. Other possibilities include finding a co-signer or investigating pre-paid debit cards. While these choices may not offer an immediate solution, they can provide a stepping stone to a healthier financial future. Be aware, the interest rates on any form of credit available to someone with a credit score of 508 will generally be high due to increased perceived risk by lenders.

With a credit score of 508, the prospect of securing a personal loan from traditional lenders may seem somewhat bleak. Traditionally, this score is considered well below the range that lenders deem acceptable. This is because a score such as this reflects a considerable financial risk from the lender's viewpoint, and as such, the chances of obtaining approval for a personal loan are slim. It's undoubtedly a daunting predicament, but it's crucial to understand exactly what this score means for your borrowing capabilities.

Nevertheless, even with such a score, alternate routes still exist. Consider exploring options such as secured loans which require collateral, or co-signed loans where a trustworthy individual with better credit vouches for you. You may also want to look into peer-to-peer lending platforms, which sometimes have more lenient credit requirements. Bear in mind, however, that these alternatives typically involve higher interest rates and more stringent terms due to the increased risk from the lender's perspective.

Can I Get a Car Loan with a 508 Credit Score?

Navigating the car loan landscape with a credit score of 508 can feel daunting. Lenders often look for credit scores exceeding 660, viewing anything under 600 as a sign of high risk. Unfortunately, a score of 508 falls within this high-risk category, which may lead to adverse loan terms, high-interest rates, or even outright refusal for a car loan. This largely stems from the assumption that a lower credit score correlates with higher risk for lenders, based on past loan repayment patterns.

Even though having a low score can be a hurdle, don't lose hope entirely. You can still find lending institutions that work with people with lower credit scores. Bear in mind, any car loan you get might come attached with a hefty interest rate. This is a lender's protective measure against the perceived risk that accompanies lending to individuals with a lower credit score. So, while the process might seem challenging, with a bit of due diligence and understanding of the loan terms, a car loan is not entirely out of your reach.

What Factors Most Impact a 508 Credit Score?

Understanding your credit score of 508 is an essential step towards improving your financial health. Knowing what factors could be negatively affecting your score will help you to create a personalized plan for improvement.

Payment History

Your payment history greatly influences your credit score. If you've had a habit of missing or delaying payments, this could be a critical factor leading to your current score.

How to Check: Inspect your credit report for instances of late or defaulted payments. These instances could be hurting your credit dramatically.

Credit Utilization

Using a significant portion of your available credit, also known as high credit utilization, can negatively impact your score. If your credit cards are often maxed out, this might be lowering your score.

How to Check: Check your credit card balances relative to their limits. If you're frequently close to the limit, this could be a detrimental factor.

Length of Credit History

If you haven't been using credit for very long, your lack of credit history could be affecting your score.

How to Check: Look at your credit report to see the ages of your oldest and newest accounts. A short credit history with newly-opened accounts could be pulling down your score.

Types of Credit

Your score can be negatively affected if you only have one type of credit, like credit cards. Diversity in credit types helps improve your score.

How to Check: Review your credit report to see if you have a mix of credit cards, installment loans, and other types of accounts. Lack of diversity could be hurting your score.

Public Records

Public records like bankruptcies or tax liens can severely lower your credit score.

How to Check: Scan your credit report for any public records. If such items exist, they may require attention to improve your credit score.

How Do I Improve my 508 Credit Score?

With a credit score of 508, it’s clear there are some troubling financial issues, but it’s also a point where progress can be made. Here are some concrete measures you can take to begin enhancing your credit:

1. Rectify your Late Payments

Existing late payments have a significant impact on your score. Pay off this debt as soon as possible and work out a payment plan if required. It’s important to bring your account to a current status as it can drastically improve your score.

2. Limit your Credit Utilization

Your credit card balances influence your score. Strive to card balances under 30% of your credit limit, with an eventual goal of having them below 10%. Focus on paying off cards with the most significant utilization rates.

3. Apply for a Secured Credit Card

With a 508 credit score, securing a conventional credit card may be difficult. Consider a secured card, which uses a cash deposit as collateral for the account’s credit line. Use this card wisely to create a reliable payment record.

4. Seek to Become an Authorized User

Contact a relative or friend with a strong credit standing and ask if you can be added as an authorized user on their card. This strategy can improve your score, as it factors in their reliable payment history to your credit report.

5. Expand your Portfolio

Having a variety of credit types can enhance your score. Once you’ve maintained a good standing with a secured card, try other forms of credit like retail credit cards or a credit-builder loan, and manage them responsibly.