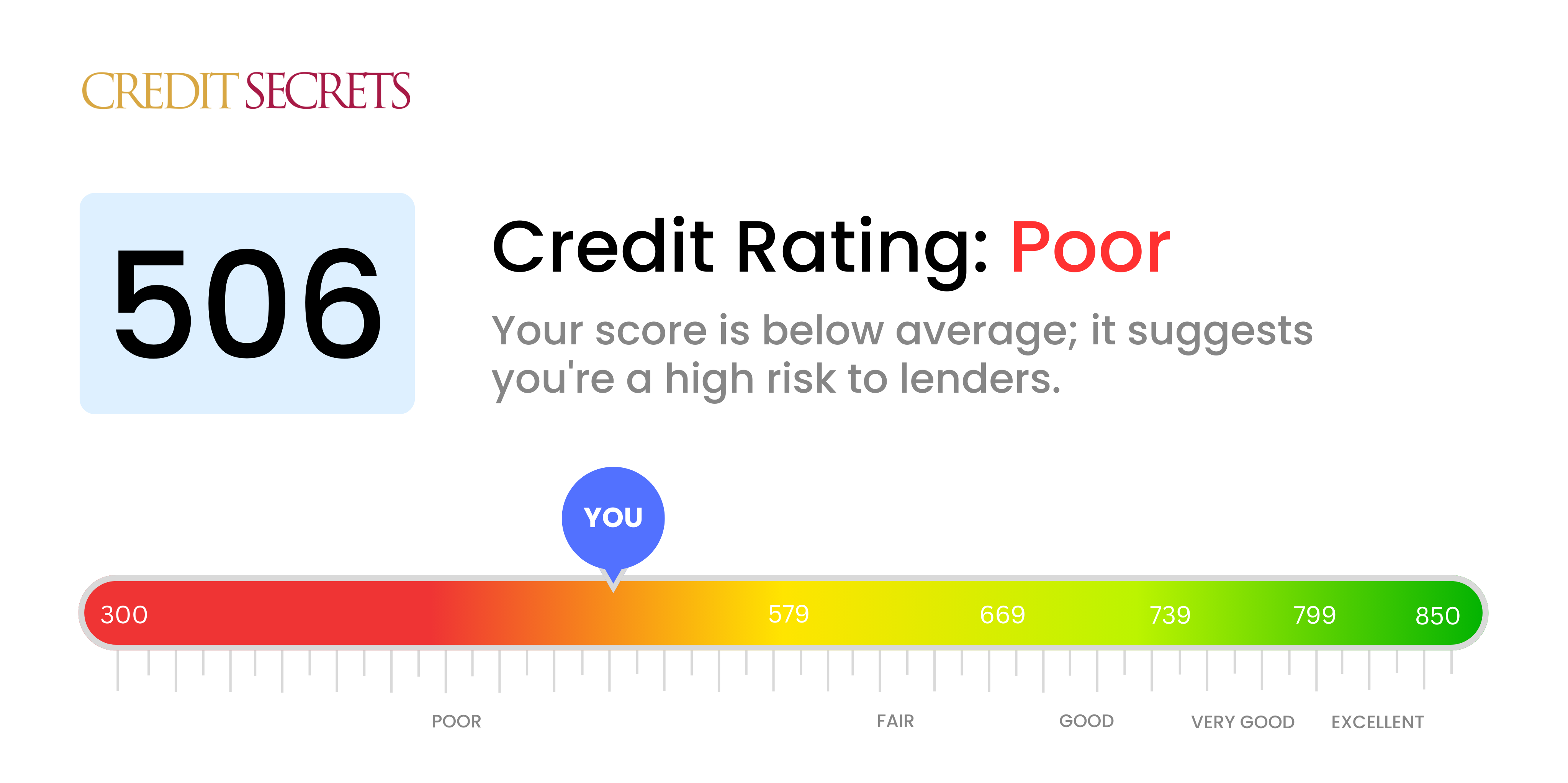

Is 506 a good credit score?

A credit score of 506 falls into the category of being 'poor,' indicating that your credit health needs attention and improvement. Aspiring for a higher score is crucial, as this current standing may make it challenging to secure loans or receive favorable terms from lenders.

Given your current score, you may face higher interest rates, might be asked for collateral, or could even be turned down when applying for credit cards, mortgages, or other types of loans. However, don't lose hope; improving your credit score is possible with dedication and the right financial behaviors. Remember, the path to improved credit health begins today, step by step.

Can I Get a Mortgage with a 506 Credit Score?

With a credit score of 506, it's unlikely that you'll be approved for a mortgage. Most lenders require a higher score in order to feel confident in your ability to repay the loan. Having a credit score in this range often signifies some credit difficulties in the past, such as missed payments.

Despite being in a difficult credit situation, there are other paths you can take. One potential alternative is looking at government-insured loans like the FHA mortgage, which may have a lower required credit score. Try to find ways to increase your score starting from today, such as making on-time payments and eliminating any outstanding debt. Remember that improving your credit isn't an overnight process. It's a journey that requires commitment and persistence, but over time, positive changes can occur which may eventually make mortgage approval more likely.

Can I Get a Credit Card with a 506 Credit Score?

Holding a credit score of 506 often makes securing a traditional credit card a tall order. Banks and other lenders might see this figure as a risky proposition due to past financial issues or poor money management. This may feel discouraging, but it's crucial to acknowledge the situation with a clear eye and upfront honesty. Recognizing your credit status is a stepping stone towards rebuilding your financial health, even if it requires confronting some uncomfortable realities.

The challenge of obtaining a credit card with a score of 506 might lead you down alternative paths. One such option is a secured credit card that requires a deposit equivalent to your credit limit. These cards are typically easier to qualify for and can help rebuild credit over time. You might also contemplate adding a co-signer or perhaps choose to utilize pre-paid debit cards. It's crucial to remember that while these alternatives don't provide an immediate solution, they lay the groundwork for your journey towards financial stability. It's important to note, though, that any form of credit available for those with lower scores will likely come with higher interest rates, reflecting the increased risk for lenders.

Having a credit score of 506 can be daunting when considering applying for a traditional personal loan. Typically, lenders view this score as a high-risk indication, making it challenging to secure a loan with regular terms. It's a tough spot, but acknowledging your credit score and understanding what it signifies for your finance options is essential.

While traditional personal loans may not be within reach, alternative routes could still be explored. Secured loans, where you provide assets as a guarantee, or co-signed loans, where a person with a more favorable credit score backs your application, are possibilities. Peer-to-peer lenders sometimes have less stringent credit score demands. Yet, remember that these options usually have higher interest rates and less favorable terms due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 506 Credit Score?

Having a credit score of 506 places you in a position where getting approval for a car loan might be difficult. Lenders generally consider a score above 660 for better terms, and any score below 600 is looked upon as subprime. Your score of 506 certainly fits into this subprime bracket, which can lead to higher interest rates or even outright loan rejection because it signals a higher risk to lenders, suggesting possible challenges in loan repayment.

Even so, having a low credit score does not entirely shut the door on the possibility of a car loan. There are lenders who cater specifically to those with lower credit scores. Just remember to be cautious, as these high-risk loans usually carry significantly higher interest rates. This is a strategy used by lenders to offset the increased risk they’re taking. So, while the journey may seem daunting, with informed decision-making and careful exploration of loan terms, getting a car loan is not an impossibility.

What Factors Most Impact a 506 Credit Score?

Uncovering the specifics influencing your score of 506 is vital to creating a healthier path for your financial growth. Here are the impactful factors that could be playing a significant role in your current score.

Payment Reputation

Payment history contributes significantly to your credit score. Late payments or instances of non-payment might be affecting your current score.

How to Check: Look over your credit report meticulously for any delayed or missed payments. These can negatively impact your score.

Credit Consumption

Close-to-limit credit card balances may be a culprit in your current score. High credit utilization ratio affects your score adversely.

How to Check: Inspect all your credit card statements. If the balances are near the maximum limits, it is advisable to aim for a lower utilization ratio.

Credit Lifespan

A limited or short credit history might be weighing down your score.

How to Check: Thoroughly examine the duration of your oldest and most recent accounts. Be attentive to the average age of all your accounts and any recent credit openings.

Diversity of Credit

Having a varied mix of credit types and responsible management of new credit impacts your score positively.

How to Check: Look at the different types of credit accounts you have. Balancing the right mix of credit cards, retail accounts, personal loans, and mortgages can assist in improving your score.

Public Record

Public records like bankruptcies or unpaid taxes deeply affect your score.

How to Check: Scrutinize your credit report for any public records or unresolved issues, as these could be harming your current score.

How Do I Improve my 506 Credit Score?

A credit score of 506 isn’t the best, but it’s a starting point and you can absolutely improve from here. Here’s how:

1. Identify and Clear Overdue Debts

Your foremost step should be to clear any delinquent accounts or debts. These late or missed payments can heavily impact your credit score. If necessary, negotiate a feasible repayment plan with your creditors.

2. Lessen Credit Card Utilization

Keeping high balances on your credit cards can hinder your credit score improvement. Aim to bring down your balances to less than 30% of your card limit. Start with the card that’s closest to its limit.

3. Consider a Secured Credit Card

A secured credit card could be a beneficial tool for you at this stage. You’d need to provide a security deposit, which then becomes your credit limit. Responsible usage of this card can enhance your credit history over time.

4. Enlist as an Authorized User

If someone in your circle has a well-maintained credit card, you can ask to be added as an authorized user. This way, their positive credit behavior can indirectly boost your credit score, as long as the card issuer reports authorized user info to the credit bureaus.

5. Explore Varied Types of Credit

Diversifying the types of credit you have can positively impact your credit score. Once you’ve proven your creditworthiness with a secured credit card, consider other options like a credit builder loan or a department store credit card.