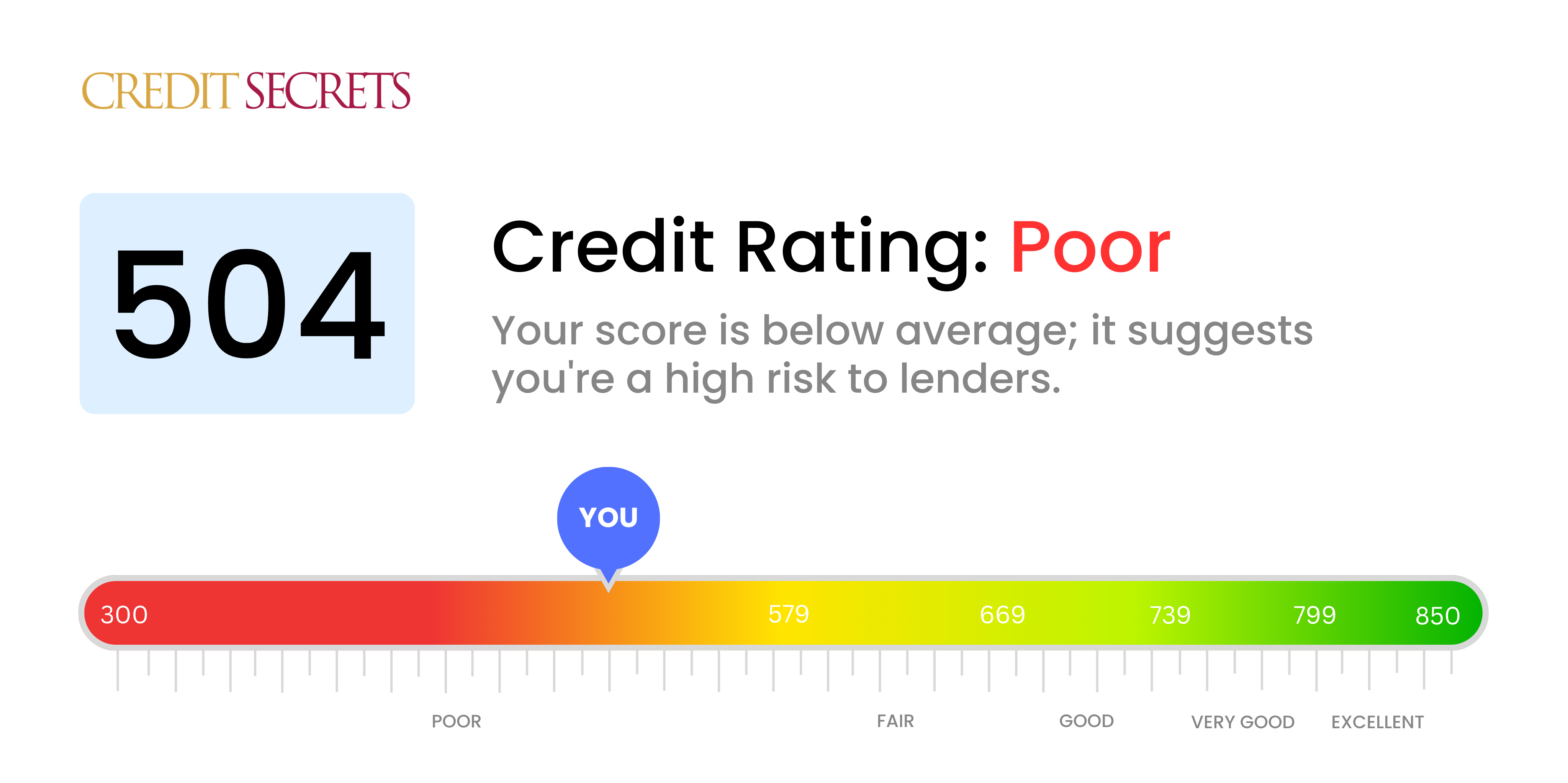

Is 504 a good credit score?

A credit score of 504 falls within the 'Poor' category. Regrettably, this isn't a good credit score, but don't lose hope or feel discouraged; it's just a point on a map, showing where you are now, not where you're ultimately capable of going financially.

Having a 504 score might make it challenging to secure loans or credit cards, and when you do, they might come with higher interest rates. But remember, this isn't a life sentence. It's entirely possible to boost your score and move forward towards a brighter financial future. Let's start this journey together and turn things around with strategic steps to improve your credit score.

Can I Get a Mortgage with a 504 Credit Score?

If you have a credit score of 504, it's unlikely that you'll be approved for a mortgage. This score falls below the threshold that most mortgage lenders require, which usually stands around the mid-600 range. A score at this level suggests issues such as late payments, or possibly, a previous default, that could cause lenders to view you as a high-risk borrower.

Despite this setback, there are alternative options to consider. Exploring government-backed mortgage programs, for instance, can be a viable route as they often cater to borrowers with lower credit scores. Alternatively, saving for a larger down payment can sometimes offset the risk a lender takes on, thus increasing your chances of approval. As you review these options, it would also be beneficial to steadily work on enhancing your credit by ensuring timely payment of your debts and maintaining responsible credit behavior. Securing a healthier credit score can open up more opportunities for favorable interest rates in the future.

Can I Get a Credit Card with a 504 Credit Score?

With a credit score of 504, it's unfortunately unlikely that you would be approved for a traditional credit card. This lower score commonly signifies to lenders that there's been past financial difficulties, making you a higher risk borrower. It's essential to view this with understanding and a touch of realism. Recognizing where your credit currently stands is the initial step in your journey towards better financial health and stability even if it involves accepting some hard realities.

Despite these challenges, do not lose hope. There are still financial options at your disposal. A secured credit card, which includes a deposit that acts as your credit limit, may be a viable route to consider. Other options could include finding a co-signer or even using pre-paid debit cards. Don’t forget, these aren't quick-fix solutions, but they are beneficial steps on the path towards financial stability. And keep in mind that any credit available to you, with a score like this, will likely carry higher interest rates. This reflects the higher risk lenders perceive. Remember, every journey begins with a single step, and improving your credit is no different.

A credit score of 504 is significantly below the average level that most traditional lenders consider good enough to approve a personal loan. This low score suggests to lenders that there is a high risk involved, thus reducing the likelihood of getting your personal loan approved. It may feel difficult to navigate these financial waters, but it's crucial to understand what this credit score means for your borrowing capabilities.

When mainstream methods aren't an option, alternatives like secured loans or co-signed loans may be considered. Secured loans require collateral, while co-signed loans require someone with a better credit score to co-sign on the loan. Another possible avenue is peer-to-peer lending platforms, who often have more lenient credit requirements. However, remember that these alternatives usually come with higher interest rates and less advantageous terms due to the heightened risk to the lender. Grasp the full implications of these alternatives before proceeding, as they are often costlier.

Can I Get a Car Loan with a 504 Credit Score?

A credit score of 504 can make it quite complex to secure a car loan. Most lenders prefer scores above 660, due to a lower risk of default. Your score of 504 is seen as 'subprime', indicating a higher risk to lenders based on past credit history. This score might lead to a steeper interest rate or, in some cases, denial of the loan application.

But it's important not to lose hope. There are lenders out there who can work with people with lower credit scores. However, keep in mind that dealing with such lenders usually means facing substantially higher interest rates, since these lenders need to protect their investment against the increased risk. Don't let these hurdles discourage you; with careful planning and thoughtful evaluation of loan terms, buying a car is still within your reach.

What Factors Most Impact a 504 Credit Score?

If you're seeing a score of 504, don't worry, there's room for improvement. Let's dissect the factors likely impacting your score.

Late Payments

On-time payments account for a significant segment of your credit score. For a score around 504, late or missed payments could be playing a major role.

Check Method: Evaluate your credit report thoroughly for any payment inconsistencies and delinquencies. Consider aiming towards consistent, on-time payments.

Credit Utilization

High credit utilization can drag down your score significantly. If you're using a high amount of your available credit, it may be hurting your score.

Check Method: Study your credit card statements. Are they approaching their maximum limits? Strive to maintain a balance that's lower than 30% of your limit.

Length of Credit History

If your credit history is relatively short, it may be affecting your score.

Check Method: Analyze your credit report to get an idea of the duration of your accounts. Be patient as building a long credit history takes time.

Public Records

Public records such as bankruptcies or foreclosures can lead to a significant dent in your credit score.

Check Method: Inspect your credit report for any public records that might need addressing. It may take time, but working towards resolving these can gradually improve your score.

How Do I Improve my 504 Credit Score?

Your credit score of 504 may seem daunting, but steps can be taken to improve it. Let’s focus on the most straightforward and impactful actions that can make a real difference at your current level.

1. Take Care of Outstanding Charges

Accounts with outstanding charges are a red flag for credit score algorithms. Tackle these first, particularly those with the most overdue payments. Reach out to the respective institutions and see if a payment plan can be arranged for these charges.

2. Manage Your Credit Card Debt

Pay keen attention to your credit card balance-amounts close to or exceeding your limit can have a substantial negative impact on your score. Strive to reduce balances to less than 30% of your credit limit, ideally lower than 10%. Push to pay off cards with the highest levels of debt first.

3. Opt for a Secured Credit Card

Given your current score, getting a standard credit card might be tricky. Consider a secured credit card. The deposit you put for this very card acts as its credit limit. Using this for minor expenses and diligently paying it off could help improve your credit history.

4. Consider becoming an Authorized User

You could potentially ask someone you trust with a good credit history if it’s possible for you to be added as an authorised user on their card. Their good credit behaviour could help uplift your credit score, provided the credit card issuer reports this activity.

5. Diversify Your Credit Usage

A varied mix of credit accounts can aid your credit score. Once a positive pay history is established with a secured card, look into other types of credits accounts, like credit builder loans or retail cards. Always remember, responsible management is key.