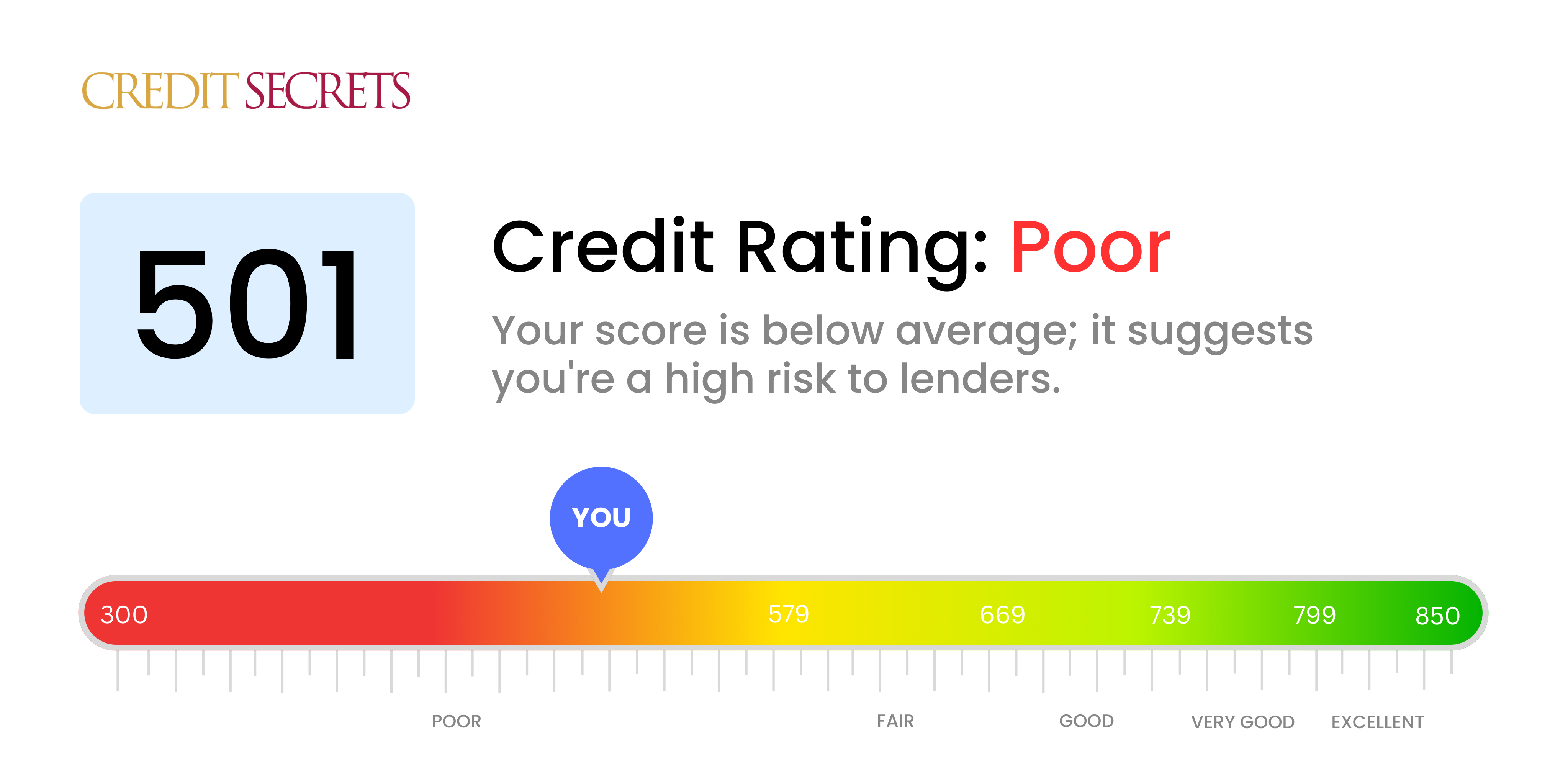

Is 501 a good credit score?

With a score of 501, you're in the 'poor' credit range, unfortunately. This means you may face challenges obtaining credit and, if approved, it's typically at much higher interest rates.

But don't despair—your credit score isn't fixed. You're capable of improving it over time by making consistent, on-time payments and keeping your credit utilization low. Remember, better financial times are not out of reach. You can take control of your credit situation and start your journey towards a better score today.

Can I Get a Mortgage with a 501 Credit Score?

With a credit score of 501, securing a mortgage approval could be extremely challenging. This grade not only falls below the conventional minimum credit score that lenders usually prefer, but it also signifies a history of financial issues, such as consistently late or missed payments. It's important to know that lenders often view low scores as an indicator of high financial risk.

However, don't lose hope. Though difficult, there are alternative options available designed specifically to accommodate individuals with lower credit scores. Certain government-insured loans, such as FHA or VA loans, could be viable alternatives. These loan types are often more flexible with credit requirements, but be aware, the potential downside could include higher interest rates. It's a challenging position, but by exploring various possibilities and consistently working towards improving your creditworthiness, positive changes can occur. Be patient with yourself, taking on the task of improving your credit score might feel like an uphill battle, but the reward of a secure financial future is worth the fight.

Can I Get a Credit Card with a 501 Credit Score?

Having a credit score of 501 can make it tough to secure approval for a standard credit card. Most lenders often interpret this score as a high risk, perhaps indicating a past of financial hiccups or difficulties managing personal finances. Although this may be a hard pill to swallow, acknowledging this situation is the initial step to moving towards financial improvement. It's crucial to deal with such situations realistically and remember that it doesn't reflect on your personal worth.

In light of such a low score, it might be wise to consider other routes, such as a secured credit card. These cards necessitate a deposit which then becomes your credit limit and can be simpler to acquire, enabling you to rebuild credit gradually. Alternatively, seeking a co-signer or exploring pre-paid debit cards could be viable options. Bear in mind that these alternatives don't offer an instant fix, but they can help to navigate the road to a better financial future. Interest rates for any credit options available to you are likely to be high, which is reflective of the increased risk assumed by the lender.

A credit score of 501 can be difficult to navigate in the lending landscape. With traditional lenders, this score often indicates a sizeable risk, making personal loan approval unlikely. Nevertheless, this does not mean there are no options available to you.

You might still have alternatives to traditional lending. Secured loans, which require a collateral, or co-signed loans, where a person vouches for you with their stronger credit, could be an option. Technology has also fostered peer-to-peer lending platforms, some of which may operate with more forgiving credit requirements. However, keep up your optimism while also considering that these choices often come with higher interest rates and terms less favorable for you, since it is seen as a higher risk for the lender.

Can I Get a Car Loan with a 501 Credit Score?

Having a credit score of 501 can make it a bit tough to get approved for a car loan. Most lenders prefer a score of 660 or above when offering good terms, and anything under 600 generally falls into what they consider a subprime category. Unfortunately, your score of 501 is in this area. This could result in higher interest rates or even loan denial, largely because this score signals a higher risk to lenders. They could worry about struggles with repaying the borrowed amount in the future.

But don't worry, all is not lost. Even with a lower credit score, there are lenders who may still work with you, though these loans usually carry much higher interest rates. These costs are higher because the lender is taking on more risk, and it's one way they protect their investment. It might not be the smoothest route, but with some careful planning and examining loan terms closely, getting a car loan can still be a possibility.

What Factors Most Impact a 501 Credit Score?

Grasping the implications of a 501 credit score, significantly influences your stride towards financial progression. Unearthing and addressing particular influential aspects can set you on a path to a prosperous financial future. Bear in mind that every financial journey is distinct with potential for growth and learning.

Payment Consistency

The regularity of your payments significantly influences your credit score. Defaulting or late payments may have contributed substantially to your current score.

How to Check: Delve into your credit report, scrutinizing for late payments or defaults. Reflect on past instances of delinquency in payment as these may have contributed to your score.

Credit Utilization Ratio

Maintaining high credit utilization can adversely affect your score. Using your credit cards to their maximum limits can be a considerable factor.

How to Check: Evaluate your credit card statements. Are your card balances high compared to their limits? It is advantageous to keep balances lower relative to the limit.

Duration of Credit History

Your credit history's length can influence your score negatively. Shorter credit history is not deemed favorably.

How to Check: Peruse your credit report to determine the age of your oldest and newest accounts and the average age of all your accounts. Reflect if you have recently opened new accounts.

Diversity and New Credit

Managing an assortment of credit types and new credit without issues is integral to a good credit score.

How to Check: Analyze your mix of credit accounts, like credit cards, retail accounts, installment loans, and mortgage loans. Review if new credit has been applied for judiciously.

Public Records

Public records such as bankruptcies or tax liens could drastically affect your score.

How to Check: Explore your credit report for any public records. Address any listed items that need resolution, this will positively affect your score.

How Do I Improve my 501 Credit Score?

A credit score of 501 indicates a need for diligent efforts and strategies to enhance this score. Let’s explore the actionable steps you can take for your specific situation.

1. Rectify Defaults and Late Payments

Your first step should be to tackle any defaults or late payments that have led to this score. Communicate with lenders about arranging a flexible repayment schedule. It is important to make these repayments consistently, as it directly affects your credit score.

2. Maintain Lower Credit Utilization

High credit utilization is a common cause of low scores. To address this, you should strive to keep your credit card balances below 30% of your credit limit and ultimately aim for under 10%. Prioritize reducing the balances on cards with the highest utilization rates first.

3. Application for a Secured Credit Card

Given your current score, consider applying for a secured credit card. This card operates with a cash deposit acting as your credit limit. By using it carefully—making minor purchases and paying the balance every month—you can create a strong payment history.

4. Seek to Become an Authorized User

If possible, ask a trusted person with a robust credit history to add you as an authorized user on one of their cards. This tactic can positively boost your score by reflecting their reliable payment history on your report. Ensure the card issuer reports the activity of authorized users to credit bureaus.

5. Expand Your Credit Variety

Utilize a variety of credit types to enhance your score. After establishing a solid history with a secured card, consider options like credit builder loans or department store cards, and remember to manage them responsibly.