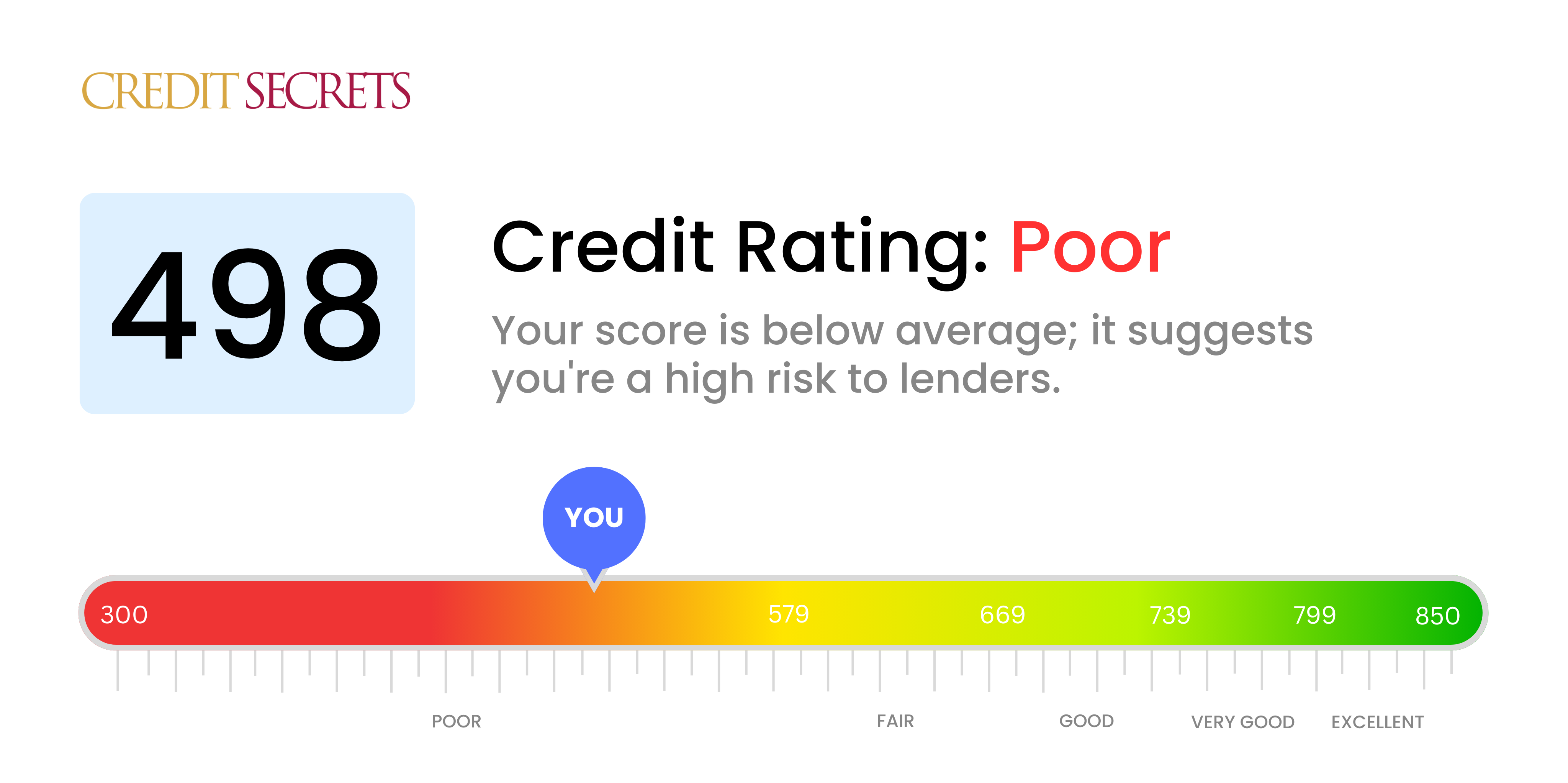

Is 498 a good credit score?

With a score of 498, you're currently within the 'Poor' credit range. This isn't the place you want to be, but don't lose hope; it's important to remember that improving your credit position is possible.

In practical terms, a credit score in this range may make obtaining new lines of credit more challenging. You may also find that when you do qualify for a loan or a credit card, your interest rates will likely be quite high. However, by understanding and applying certain credit improvement techniques, you can start the process of boosting your score and upgrading your financial health.

Can I Get a Mortgage with a 498 Credit Score?

Carrying a credit score of 498 can be concerning when you're contemplating a mortgage application. Odds are, with such a score, getting approved for a mortgage is unlikely. This score is below the benchmark most lenders consider for approving mortgages. It could be an indication of past financial struggles such as late or missed payments, or other default behaviors on your borrowings.

Dealing with a low credit score might feel daunting, but remember, it's not a dead-end. Alternatives could include exploring FHA loans that can accommodate lower credit scores, yet these loans may come with high-interest rates and additional costs. Another potential route is bringing in a co-signer with a good credit score to strengthen your application. Always recall that fortifying your credit score is a process that requires time and consistent effort. Thus, beginning to timely settle outstanding debts and establishing responsible usage of credit should be your prime focus.

Can I Get a Credit Card with a 498 Credit Score?

With a credit score of 498, chances are high that approval for a regular credit card will be tough. This score is often seen as risky by lenders, indicating a past history of financial difficulty or potential mismanagement. It can be a tough pill to swallow, but accepting and understanding your financial position is a necessary first step on the road to financial health. It might not be easy, but remember, it's never too late to start improving your situation.

Possibly, applying for a secured credit card could be the best alternative for you. These cards require a cash deposit, which often serves as your credit limit. Eventually, your responsible use of one such card can help rebuild your credit history. Additionally, getting a cosigner for a new card or opting for a prepaid debit card can also be beneficial. These options may not offer an immediate resolution, but they are instrumental in your journey towards monetary stability. Do remember, the interest rates of any credit that you can access with a score of this kind tend to be higher due to the perceived risk lenders take on.

With a credit score of 498, it's unlikely that your application for a personal loan will go through if you choose traditional lenders. This score is considered low, denoting a high risk of default according to lenders' standards. Acknowledging this open-eyed is crucial while exploring your lending choices and it's significant to maintain an optimistic attitude.

Let's explore alternatives that can fill the gap when traditional personal loans aren't an option. Secured loans might be one option, as they allow you to present collateral, reducing the lender's risk. Additionally, a cosigned loan could be feasible if you have someone with a strong credit profile willing to vouch for you. Peer-to-peer lending platforms might be another possibility, providing a platform with potentially less stringent credit requirements. However, it's important that you are cognizant of the fact that lenders often charge higher interest rates for these types of loans as compensation for taking on a greater level of risk.

Can I Get a Car Loan with a 498 Credit Score?

Having a credit score of 498 could make it tough to secure approval for a car loan. Normally, lenders seek scores over 660 for more advantageous terms. Unfortunately, your 498 credit score is considered subprime, which could lead to steeper interest rates or even denial of your loan application. This is due to the fact that a low credit score shows you might pose a higher risk in the eyes of lenders, as it reflects potential difficulties in repaying debt.

Still, there is hope. A low credit score does not mean the absolute end to your aspirations of purchasing a vehicle. You'll find that some lenders specialize in working with lower credit scores, but it's crucial to tread carefully, as these loans usually pair with extraordinarily high interest rates. The reason for these inflated rates is the increased risk lenders assume. By understanding the terms thoroughly and proceeding wisely, there's still a chance to secure a car loan, despite a challenging credit score.

What Factors Most Impact a 498 Credit Score?

Deciphering a score of 498 is the first step on your pathway towards financial prosperity. Understanding the significant factors influencing this score is key to designing your brighter monetary future. Know that every financial odyssey is individual and provides plentiful opportunities for personal growth.

Degree of Indebtedness

Your level of indebtedness can profoundly affect your credit score. Numerous outstanding debts, particularly if they're late applications, could be a primary source.

How to Check: Analyze your credit reports. Are there many listed outstanding debts? Consider whether you've been able to maintain a regular payment schedule.

Credit Use Ratio

A high use of available credit could negatively sway your score. If you are overly reliant on credit facilities, this might be a major factor.

How to Check: Scrutinize your credit statements. Are they always near their upper limit? It's better to keep balances low in reference to the credit limit.

Duration of Credit History

A limited credit history can negatively impact your score.

How to Check: Check your credit report. Measure the age of your oldest and newest credit accounts, and the overall average. Reflect on newly opened accounts that may have influenced your score.

Credit Variety and Fresh Credit

Possessing a diverse range of credit types and judicious management of new credit are pivotal for a healthy score.

How to Check: Review your mix of credit accounts. Are they varied enough? Contemplate if you are parsimonious in applying for new credit.

Legal Filings

Public filings like bankruptcies or tax liens can take a toll on your score.

How to Check: Throughly peruse your credit report for any legal filings. Work towards resolving any outstanding issues.

How Do I Improve my 498 Credit Score?

With a credit score of 498, you’re currently dealing with a challenging financial situation, but there’s no need to feel overwhelmed. Let’s roll up those sleeves and start focusing on practical steps you can take for improvement:

1. Square Off Delinquent Accounts

Prioritize any accounts in arrears. It’s critical to regularize these as they have a substantial impact on your credit rating. If you’re struggling, seek an arrangement with your lender to make repayments more manageable – it’s in their best interest too.

2. Maintain Low Credit Card Usage

High balances on your credit cards, compared to their limit, are detrimental to your score. Strive to keep these balances below 30% of your limit and ideally, aim to get them below 10% in the long run. Start with the card having the highest usage first.

3. Consider a Secured Credit Card

Getting a new credit card might be difficult, yet a secured credit card could be an option for you. Your credit limit is based on a refundable deposit you make. Use it wisely—small, regular purchases paid off on time each month—to rebuild your score through positive financial behavior.

4. Get Added as an Authorized User

If you have a close friend or family member willing to let you be an authorized user on their credit card, this can bolster your score. This could allow the good financial habits of the card owner to reflect positively on your credit profile, provided the card company reports to credit bureaus.

5. Broaden Your Credit Portfolio

Once you’ve demonstrated responsible usage of a secured card, you could gradually apply for different types of credit– like a retail card or credit-builder loan. Variety in your credit portfolio can help lift your credit score, provided each account is handled responsibly.