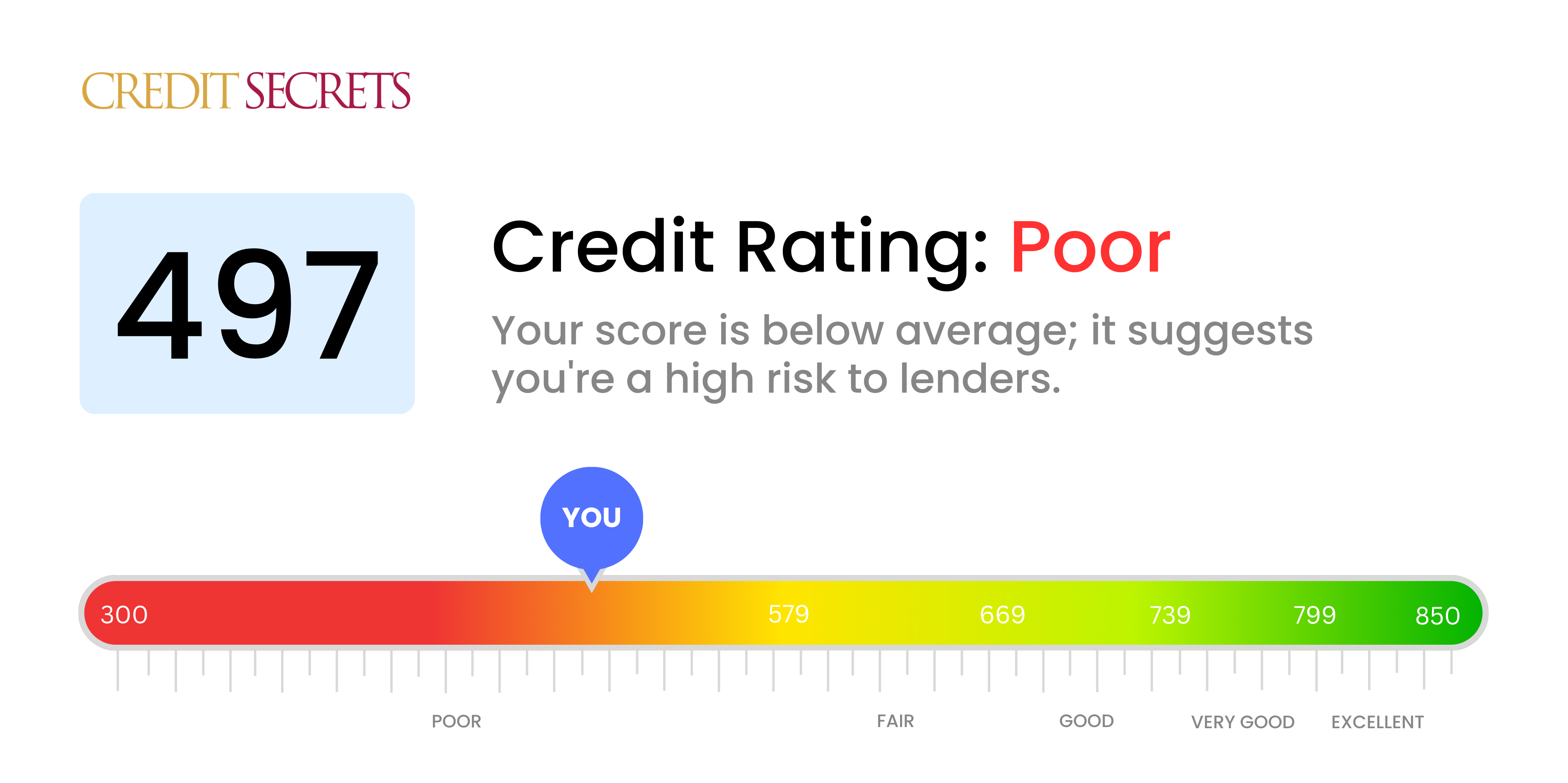

Is 497 a good credit score?

With a credit score of 497, you unfortunately fall into the 'Poor' category. This isn't the news you were hoping for, but it's important to know and understand where you stand.

Having a score in this range could potentially make it challenging to secure loans or credit cards, and if you are approved, you're likely to face higher interest rates due to perceived risk. However, remember this is not a permanent state and improvement is completely achievable. You have the power to make positive changes to your credit health that can see your score rise and open up more financial opportunities in the future.

Can I Get a Mortgage with a 497 Credit Score?

Having a credit score of 497 means getting a mortgage approval can be quite challenging. This score is significantly lower than what most lenders consider the minimum acceptable, reflecting a past of potential financial struggles like late payments or defaults. Being in this position isn't easy, and we understand your concerns. The good news is that each day offers a new opportunity for improvement.

If you're dead set on homeownership, considering alternatives may be beneficial. One possibility is exploring government-backed loans like FHA or VA loans, which have more relaxed credit requirements, albeit with higher interest rates. Another option might be working with a cosigner who has a better credit score. There's also the choice of waiting, and using this time to steadily improve your credit score. The path towards a better credit score isn't easy, but it's completely achievable with patience and diligence.

Can I Get a Credit Card with a 497 Credit Score?

If you have a credit score of 497, unfortunately, getting approved for a traditional credit card can be quite difficult. This score is often seen by lenders as risky, representing past financial struggles or poor money management. However, it's essential to face this situation honestly and with realism. Accepting the state of your credit today is an integral part of improving your financial future despite the short-term inconveniences.

The obstacles associated with a score of this magnitude open the door to consider alternative credit options. Secured credit cards, for example, require a deposit that sets your credit limit and can be more accessible for individuals with lower scores. These types of cards can serve as a stepping stone towards credit recovery. Opting for a person to co-sign or considering a pre-paid debit card may offer another route. These aren't immediate solutions, but they are instrumental aspects of the journey towards improved financial stability. And remember, it's standard for interest rates to be significantly higher on any credit options available to those with lower scores due to the higher risk posed to lenders.

Having a credit score of 497 significantly decreases your likelihood of receiving approval for a personal loan from traditional lenders. These lenders often view a low score as a substantial risk, signaling a higher possibility of defaulting on the repayments. This reality might be tough, but acknowledging it is a crucial step towards improving your financial situation.

Yet, there's no need to lose hope as there are other alternatives available. You may explore secured loans, an arrangement in which you pledge an asset as collateral, potentially making lenders more receptive. Co-signed loans, where someone with a higher credit score effectively 'backs up' your application, could also be a viable option. Another possibility is considering peer-to-peer lending platforms that tend to be more accommodating in terms of credit requirements. Remember, though, these alternatives generally have higher interest rates and less flexible terms due to the higher risk the lender is accepting, so you must carefully evaluate each option against your specific needs and financial capabilities.

Can I Get a Car Loan with a 497 Credit Score?

Unfortunately, a credit score of 497 does make it difficult to be approved for a car loan. Most lenders look for credit scores above 660 to provide favorable loan terms. With a score of 497, you fall into what is considered a subprime category. This classification can result in either higher interest rates or outright denial of the loan. The reason behind this is the perceived risk lenders see in lower scores, as they might indicate potential challenges in repaying the borrowed amount.

Luckily, the situation isn't entirely hopeless. There are lenders who are experienced in working with buyers with lower credit scores. Be aware though, these types of loans often come with notably higher interest rates. This is the lender's way of offsetting the potentially higher lending risk. Despite the tough conditions, with careful planning and detailed analysis of the loan terms, you do have a chance of obtaining a car loan. Just remember to navigate this path with lots of caution.

What Factors Most Impact a 497 Credit Score?

Decoding your credit score of 497 is a significant first step towards improving your financial health. Learning and addressing the factors likely causing this rating will guide you towards better financial stability. Remember, every individual's financial path is unique and comes with multiple prospects for personal transformation.

Delayed or Defaults on Payment

Payment history largely impacts your credit score. The presence of delayed or defaults on payments might be one of the reasons for your current score.

How to Check: Scrutinize your credit report carefully looking for any missed or late payments. Think back to any occasions when you might have delayed your payments as they might have influenced your score.

High Credit Utilization

Maximized credit utilization can adversely affect your credit score. If you are regularly maxing out your credit cards, it could be pushing your score down.

How to Check: Look through your credit card statements. Are you regularly reaching your credit limit? Try to keep your balances low compared to your limit.

Brief Credit History

A limited credit history can negatively impact your score.

How to Check: Examine your credit report to determine the length of your credit history, considering both your oldest and newest accounts. Also, think about any new accounts you might have opened recently.

Diversity of Credit & New Credit Management

The variety in types of credit and the efficient management of new credit plays a pivotal role in maintaining a good score.

How to Check: Look at the types of credit you're managing, it could be credit cards, retail accounts, installment loans, or mortgage loans. Consider if you have been prudent in applying for new credit.

Public Records

Public record details such as bankruptcies or tax liens can have a substantial impact on your score.

How to Check: Review your credit report for any public records. Deal promptly with any items listed that could negatively affect your score.

How Do I Improve my 497 Credit Score?

With a credit score of 497, it’s clear you have some financial obstacles to navigate. Thankfully, there are impactful steps you can take to begin lifting your score from this level.

1. Tackle Delinquent Accounts

If there are accounts listed as delinquent on your credit reports, it’s vital for your score improvement that you work to clear these as soon as possible. Start by focusing on the ones with the longest overdue payments, which have a high impact on your credit score. Consider establishing a payment plan with creditors if you’re unable to clear the entire amount in time.

2. Lower High Credit Utilization Rates

If you’re using a large percentage of your available credit, this can weigh down your score. Aim to bring your credit utilization down to less than 30% of your limits. Pay off the cards with the highest percentages first, for the most immediate positive effect on your score.

3. Consider a Secured Credit Card

Getting a traditional credit card with your present score might be tough. A secured credit card could be an option for you. These require a deposit that acts as your credit line. Use this card wisely, by making manageable purchases and paying off monthly balances in full, to create a favorable payment history.

4. Request to be an Authorized User

If you have trusted individuals in your life with strong credit, consider asking them to add you as an authorized user to their credit card account. Their positive payment behaviors will be mirrored in your credit report, potentially boosting your score. Ensure their card issuer reports authorized user activities to credit bureaus.

5. Expand Your Credit Portfolio

A variety in your credit accounts can benefit your score. Once you’ve created a consistent payment pattern with a secured card, look into other forms of credit like a small personal loan or a department store card. Remember to use and manage these added lines of credit responsibly.