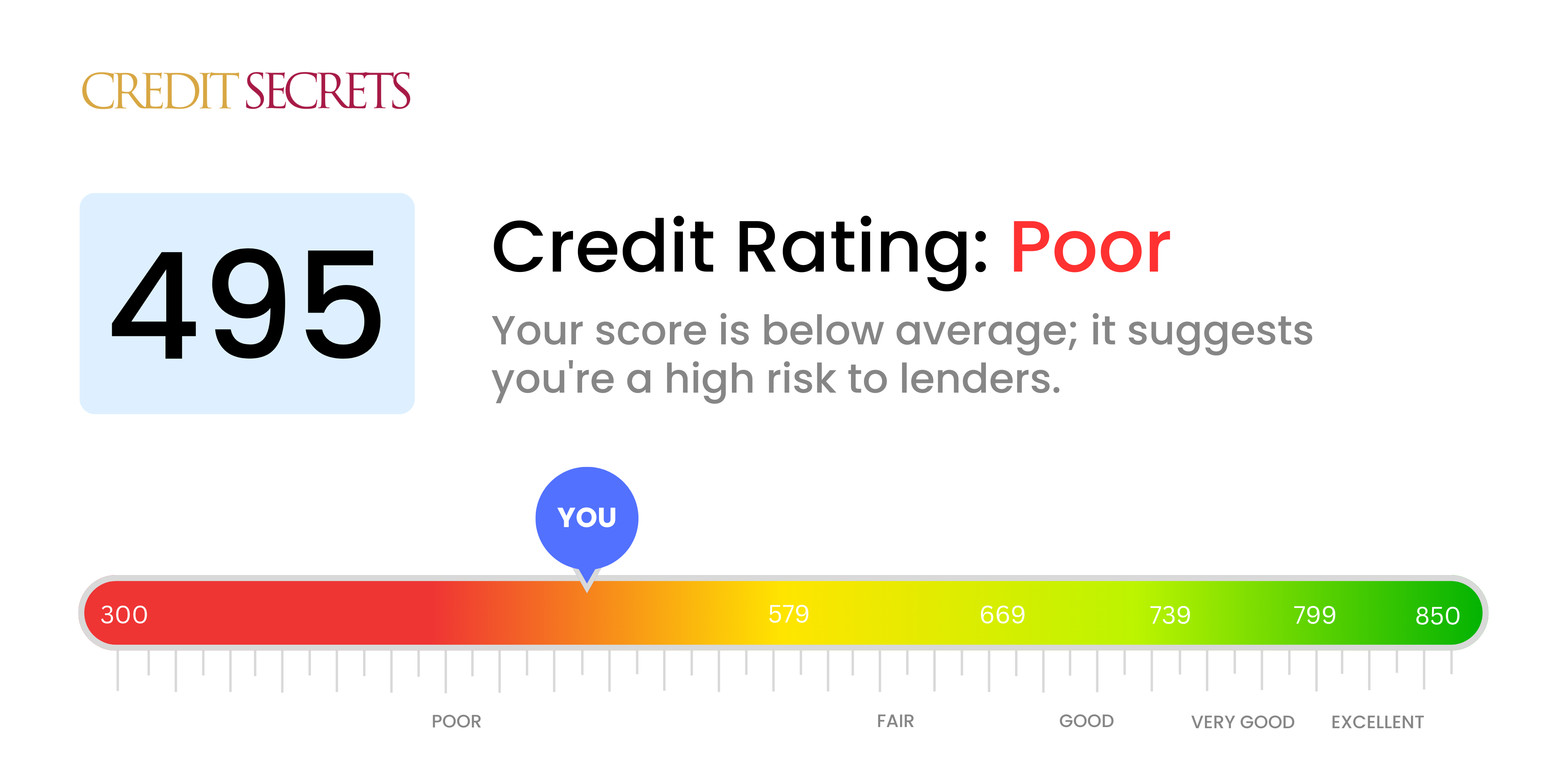

Is 495 a good credit score?

A credit score of 495, unfortunately, falls into the 'Poor' category. It's a significant hurdle, but not an insurmountable one as there are specific strategies that can set you on the path to better credit health.

With a score of 495, you'll likely face challenges in obtaining new credit or loans, and may encounter higher interest rates than those with better scores. However, it's crucial to remember that credit scores aren't static and can, with diligence and responsible financial habits, be improved.

Can I Get a Mortgage with a 495 Credit Score?

Having a credit score of 495 places you in a difficult position when it comes to mortgage approval. This score is well below the threshold most lenders consider acceptable. It suggests a history of financial struggles, including late payments or defaults, which can make lenders hesitant to extend credit.

This can be a tough reality to face, but it's important to remember that your financial health isn't solely defined by your credit score. There are other ways to secure housing. For example, renting can be a viable alternative while you work on boosting your credit score, or you might consider a lease-to-own agreement. Also, some lenders specialize in loans for those with low credit scores, but these usually come with much higher interest rates. It's a difficult position, yet not hopeless. While working to improve your credit score, remember to keep your options open and explore all potential avenues.

Can I Get a Credit Card with a 495 Credit Score?

With a credit score of 495, it may seem like an uphill climb to secure approval for a traditional credit card. This score is often viewed by lenders as a risk, indicating a history of financial hurdles or instability. It's undoubtedly tough to hear, but admitting the truth of the situation is crucial. Recognizing your credit score is the groundbreaking step towards financial recovery, even if it comes with some uncomfortable realities.

Addressing this low score, you might want to think about alternatives like secured credit cards. These cards necessitate a deposit which serves as your credit limit. They're usually more accessible and could help rebuild your credit slowly. Another option could be finding a trusted co-signer, or perhaps using pre-paid debit cards. Bear in mind, these choices don't offer an immediate fix. However, they can be invaluable tools in the pursuit of financial security. It's important, though, to remember that any credit offered to you may come with significantly elevated interest rates. This is due to the lenders trying to buffer the higher risk associated with your low score.

Understanding that your credit score of 453 may not meet the standard criteria for a loan can be tough to acknowledge. Be aware that this score suggests a high risk to lenders, making it less likely that you'll be approved for a personal loan under typical circumstances. Let's discuss some potential options that could help in your situation.

Such traditional means might not provide a solution, but alternatives exist. Secured loans and co-signed loans are two considerable methods; these include providing something of value as a guarantee or having a co-signer with good credit backing your loan. Peer-to-peer lending could be a viable option too, as they may have softer requirements for credit scores. However, it's essential to remember that these alternatives may come with higher interest rates and less favorable conditions due to the increased risk posed to the lender.

Can I Get a Car Loan with a 495 Credit Score?

When it comes to the question of securing a car loan with a credit score of 495, the answer is likely to be tough. Lenders typically require a minimum score of 660 for the most favorable conditions. Your 495 score falls into what's considered a subprime category, which can lead to higher interest rates, or even being denied a loan. This is because your credit score suggests to lenders that there may be a higher risk involved. The lower score indicates past challenges with repaying borrowed money.

But don't lose hope. A lower credit score doesn't completely close off possibilities. There are lenders who specialize in offering loans to individuals with lower credit scores. However, caution is important, as these loans often carry substantially high interest rates. These are a result of the increased risk the lenders are taking to help you. Always understand the terms before accepting a loan. So, while the journey may not be as smooth as one would hope, getting a car loan with a credit score of 495, though challenging, is not impossible.

What Factors Most Impact a 495 Credit Score?

A credit score of 495 indicates there are significant areas for improvement. It's crucial to address the factors that majorly contribute to this score to embark on the path towards financial wellness. Each credit journey is marked by unique opportunities for learning and growth.

Debt Collections

Accounts sent to debt collections drastically impact your credit score. Your financial history might contain these, leading to the score of 495.

How to Check: Look at your credit report for any entries from debt collection agencies. These could be due to unpaid accounts or bills.

Charge-offs

When a lender writes off your account as a loss, it is known as a 'charge-off', adversely affecting your credit score.

How to Check: Review your credit report for any charge-offs. These would typically be accounts that have been unpaid for several months.

High Credit Card Usage

Using a high percentage of your available credit card limit can negatively affect your score. This could be a contributing element to your current score.

How to Check: Check your credit card statements. Are the balances almost maxed out? It's beneficial to keep balances well below the limit.

Poor Credit Variety

Lack of diversity in types of credit such as personal loans, installment loans, and credit cards can reflect on your score.

How to Check: Review your credit report for the different types of credit accounts you have. It's important to have a diverse credit portfolio.

Bankruptcy Filings

Present records of bankruptcy can have a significant negative effect on your score.

How to Check: Check your credit report for bankruptcy filings. It's crucial to address these and work towards their clearance for a positive impact on your score.

How Do I Improve my 495 Credit Score?

A credit score of 495 falls within the ‘poor’ category but don’t be discouraged. By focusing on specific strategies crafted for your current situation, you can initiate your journey towards bettering your credit situation.

1. Prioritize Past-Due Accounts

Addressing any past-due accounts should be at the forefront of your financial agenda. These can heavily impact your credit score, thus bringing them to a current state is vital. If necessary, negotiate a reasonable payment plan with your creditors. Prioritize those that are most overdue to alleviate their negative effect on your score.

2. Lower Credit Card Balances

Your credit score can be significantly impacted by high credit card balances. Strive toward maintaining your balances under 30% of your total credit limit, with a longer-term goal of reducing them below the 10% mark. Make it a priority to pay down the cards with the highest rates of utilization.

3. Consider a Secured Credit Card

Obtaining a regular credit card might be difficult with your current score. A secured credit card could be a viable alternative, requiring a refundable cash security deposit as your line of credit. Ensure responsible use to generate a positive payment history.

4. Seek Authorized User Status

Ask a trusted family member or friend with good credit to add you as an authorized user on their credit card. This action can boost your score by incorporating their healthy payment habits into your own credit report. However, ensure that the card issuer reports this to the credit bureaus.

5. Enhance Your Credit Diversity

Varying credit accounts can also boost your credit score. Once you’ve built a consistent payment history with a secured card, consider exploring other types of credit like a retail card or credit builder loan and continue to maintain them responsibly.