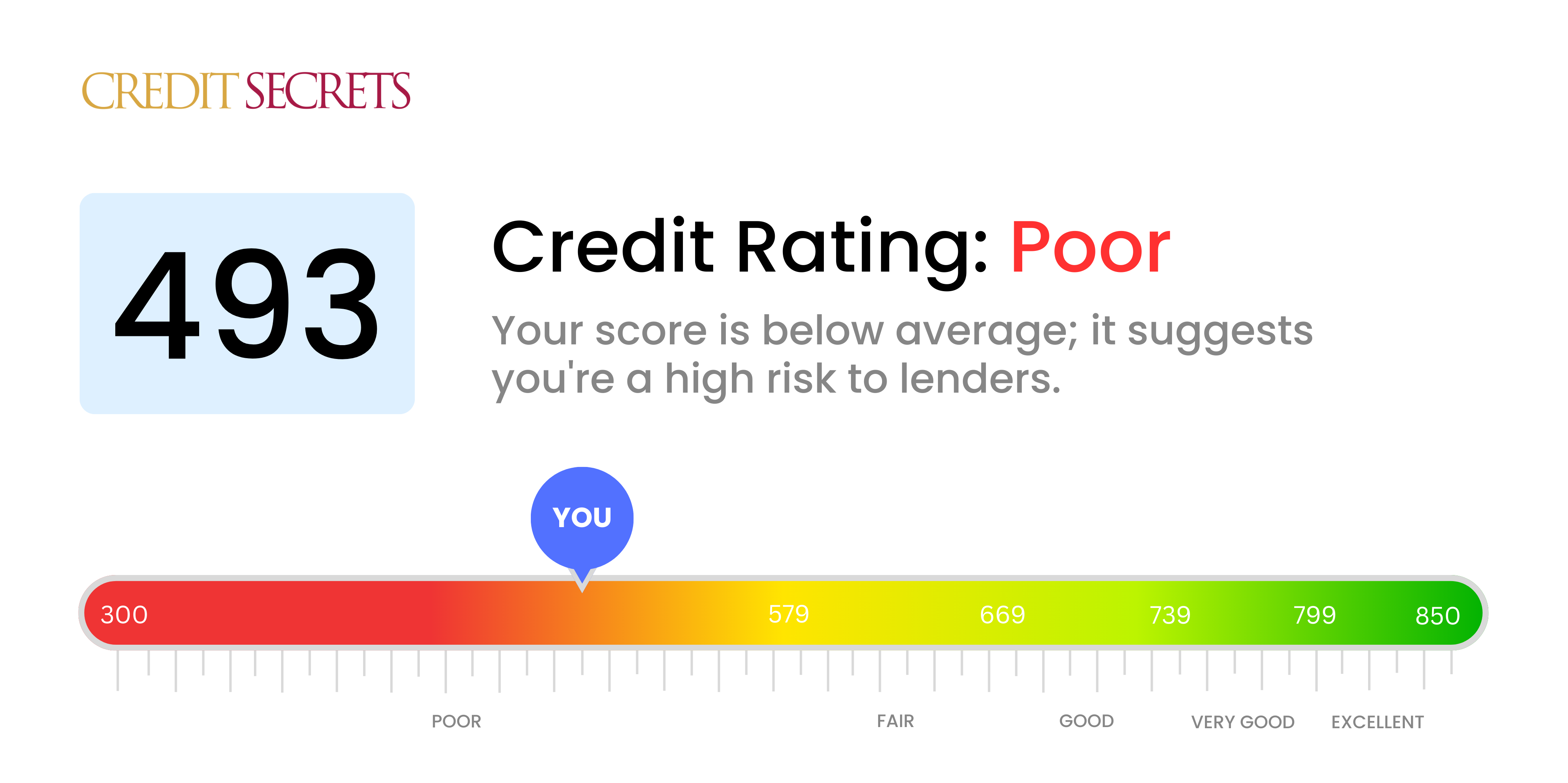

Is 493 a good credit score?

With a credit score of 493, you are unfortunately within the 'Poor' range, indicating a low credit standing. However, it's crucial to remember that this doesn't define your financial future. There are many opportunities to enhance your score for the better.

You may face some challenges, such as higher interest rates or difficulty getting approved for credit cards or loans. This is because lenders view a lower score as a greater risk. But don't lose hope, credit scores are not static, and with deliberate plans and effort, improvement is very much possible.

Can I Get a Mortgage with a 493 Credit Score?

Carrying a credit score of 493, it is unfortunately not likely that you will be approved for a mortgage. A score in this range is significantly below what most lenders seek and tends to indicate issues such as repetitive late payments or defaults. This doesn't suggest you're permanently stuck, but does mean you may face challenges seeking out traditional home loans.

Seeking alternative options is a logical next step. For instance, you might consider applying for government programs like FHA loans - designed specifically for low credit scores. Alternatively, you might find it helpful to look for co-signers or less traditional home buying methods such as rent-to-own. It's also crucial to keep working on improving your credit score by reducing debts and maintaining on-time payments. While your journey towards a mortgage might be a bit longer than others, remember that every step counts towards reaching your financial goals. In time, you'll see your efforts reflect in your credit score.

Can I Get a Credit Card with a 493 Credit Score?

With a credit score of 493, getting approved for a classic credit card may prove to be quite challenging. A score in this range signifies higher risk to lenders, possibly due to past financial complications or difficulties managing money. This might not be easy news to receive, but it's essential to be realistic about your credit status while keeping a positive outlook.

In response to this, you could explore fruitful alternatives such as secured credit cards - these require a deposit equivalent to your credit limit and may be easier to acquire. This type of card, while it may not resolve all credit issues, can help start the process of mending your credit. Additionally, you could also consider options like obtaining a co-signer or investing in pre-paid debit cards. These could be great steps towards regaining financial stability. However, do keep in mind that with a low credit score, the interest rates on any credit you may obtain are likely to be considerably higher, representing to lenders the elevated risk involved.

With a credit score of 453, obtaining approval for a personal loan from traditional lenders is very unlikely. To lenders, this score signifies a high risk, meaning conventional loan terms are likely out of reach. While this may not be what you were hoping to hear, it's essential to understand the implications of this credit score on your borrowing opportunities.

Despite this setback, there are a few non-traditional borrowing options you might consider. These include secured loans, which require collateral, and co-signed loans, where someone with a higher credit score co-signs on the loan. Peer-to-peer lending platforms may also be an option as they sometimes have more lenient credit score requirements. However, keep in mind that these alternatives often come with higher interest rates and less favorable loan terms due to the increased risk assumed by the lender.

Can I Get a Car Loan with a 493 Credit Score?

Having a credit score of 493 may make securing approval for a car loan a tough task. Typically, lenders prefer credit scores that sit above 660 for optimal terms. If your credit score is below 600, it's generally considered to be subprime. Your credit score of 493 unfortunately falls into this less favorable category, which could lead to steep interest rates or even outright rejection of your loan application. This is because a lower score represents a greater credit risk to the lenders, indicating that you may possibly have issues repaying the money you borrow.

But, don't lose heart. Possibilities still exist. Some lenders are willing to work with those who have lower credit scores. However, it's important to be wary, as the loans offered often come with significantly higher interest rates. These increased costs are the result of the risk these lenders are taking on. By thoroughly weighing the terms of the agreement, you can still find a way to secure a car loan. Though the path might be a bit rocky, driving your dream car isn't completely out of reach.

What Factors Most Impact a 493 Credit Score?

Your Payment Schedule

Regular and timely payments massively affect your credit score. If you've made delayed payments or missed a few, these might be crucial reasons for your low score. How to Inspect: Go through your credit report meticulously to spot any delayed or missed payments. They are possibly impacting your score.Usage of Credit

High rate of credit utilization could be affecting your score negatively. If your credit cards are maxed out or near their limit, this might be a prime reason. How to Inspect: Check over your credit card statements. Is your outstanding balance close to the limit? Lowering this helps your credit score.Duration of Credit History

A relatively recent credit history might be a factor for your score. How to Inspect: Go through your credit report to find out the age of your oldest and most recent credit lines, along with the average age of all your credit lines. Consider whether you've opened new accounts recently.Variety of Credit and New Credit

Handling a diverse range of credit effectively is crucial for a positive score. How to Inspect: Examine your credit portfolio, are you diversely invested in credit cards, retail accounts, installment loans, and mortgage loans? New credit should be applied for cautiously.Public Records

Public records involving bankruptcies, tax liens significantly pull down your score. How to Inspect: Review your credit report for any public records. Address any pending issues that need to be resolved.How Do I Improve my 493 Credit Score?

A credit score of 493 is considered low. Don’t be disheartened; you have many options to help improve it. Here are the most effective strategies for your current situation:

1. Prioritize Late Payments

Consider starting with any overdue accounts. Update these accounts by settling them; start by the most overdue, which easily affect your score. Contact your creditors, create a payment plan and make sure not to miss another payment.

2. Lower Your Credit Utilizations

High credit utilization significantly impacts your credit score. Strive to reduce your credit card balances to below 30% of your credit limit, with a long-term goal of keeping it under 10%. Start paying off the cards with the most accentuated usage first.

3. Consider a Secured Credit Card

Your current score might make it difficult to get a regular credit card. Apply for a secured credit card instead. This card requires a cash deposit that would be your credit line. Gradually establish a good payment history by making timely payments on small purchases.

4. Ask to be an Authorized User

If you have family members or a friend with a good credit score, approach them to add you as an authorized user on their credit card. This helps to piggyback on their positive credit habits. Validate whether the card issuer will report authorized user activity to credit bureaus.

5. Enhance Your Credit Portfolio

A balanced credit portfolio reflects well on your score. Once you have a positive payment record with a secured card, expand your credit types with a retail credit card or credit builder loan, and ensure you manage them prudently.