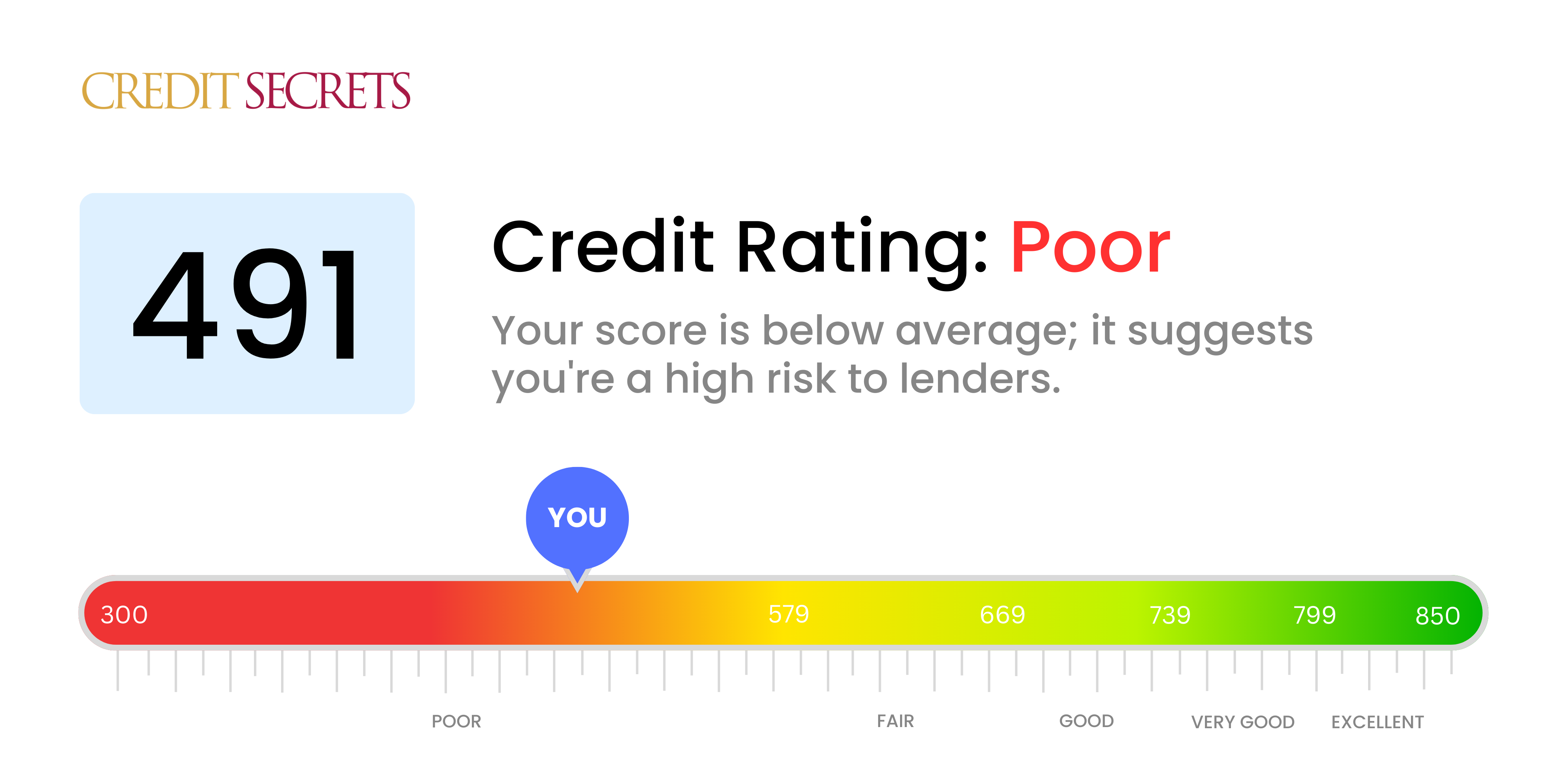

Is 491 a good credit score?

A credit score of 491 is unfortunately in the 'Poor' category. This can typically lead to challenges, such as higher interest rates and difficulties in securing loans or credit, but remember, it's not a life sentence, it's possible to improve one's credit score over time.

But don't be disheartened, many have walked in your shoes and significantly improved their credit situation. With determined steps and wise financial decisions, you can gradually elevate your credit score into higher categories. With time, persistence, and the right knowledge, you can take control of your financial future.

Can I Get a Mortgage with a 491 Credit Score?

A credit score of 491 unfortunately sits well below the threshold typically required by lenders to secure a mortgage. It's understood that a credit score within this range signifies a pattern of financial blemishes, which may include late payments or dependence on credit. This is likely to deter lenders from granting a substantial loan such as a mortgage.

It might seem devastating if obtaining a mortgage is a current goal, but there are other possible routes to homeownership. A rent-to-own agreement could serve as a viable alternative, allowing you to gradually build equity in a home albeit on a longer timeline. You might also consider reaching out to a housing counselor approved by the U.S. Department of Housing and Urban Development to discuss other suitable options for your situation.

Simultaneously, endeavor to reduce any outstanding debt and establish a record of prompt repayments. This will gradually improve your score, opening more doors to financial opportunities in the future. Patience, persistence, and diligent financial management can yield impressive results over time.

Can I Get a Credit Card with a 491 Credit Score?

With a credit score of 491, getting approved for a traditional credit card may pose a formidable challenge. A score in this range is often perceived as high-risk by lenders, suggesting a past of financial hurdles or perhaps lack of credit management. This might seem disheartening, but acknowledging your credit state is crucial to making strides towards financial wellness, even if it implies recognizing some inconvenient facts.

Considering the potential obstacles related to a lower score, you may need to think about alternatives such as secured credit cards, which call for a deposit that serves as your credit limit. These types of cards could be easier to acquire and can assist in reconstructing credit gradually. Perhaps ponder on getting a co-signer, or exploring pre-paid debit cards as other potential options. While these strategies won’t provide an immediate solution, they can potentially pave the path towards financial stability. Bear in mind that any credit made accessible to individuals with such scores typically carries a substantially higher interest rate, mirroring the increased risk perceived by lenders.

With a credit score of 491, securing approval for a personal loan from traditional lenders is likely to be challenging. This score is considerably lower than the usual acceptable range for most lenders. It signifies a high level of risk, leading lenders to be hesitant about approving your loan. Don't be disheartened, as this is a realistic view of how your current credit score impacts your borrowing abilities.

Although personal loans from conventional sources might be out of reach, there are still alternative options. Consider secured or co-signed loans. In a secured loan, you provide an asset as collateral, and for a co-signed loan, someone with a reputable credit history co-signs the loan with you. While these alternatives provide an opportunity for borrowing, they typically come with higher interest rates due to the perceived lender risk. Peer-to-peer lending platforms may also be worth exploring, as these often have less stringent credit criteria. Keep in mind, though, that each alternative means different interest rates and repayment terms. Always be aware of the potential costs before making any financial decisions.

Can I Get a Car Loan with a 491 Credit Score?

With a credit score of 491, it can be quite difficult to get approved for a car loan. The scores that most lenders favor are typically above 660, so a score of 491 is quite a bit below this threshold, pushing it into what is known as the subprime category. A subprime score tends to signal to lenders that there could be some risk involved, as it suggests you might have had challenges repaying loans in the past.

Nonetheless, a low credit score does not mean you absolutely cannot obtain a car loan. Some lending companies do work with those who have lower credit scores, but beware— car loans from these organizations usually come with significantly higher interest rates. These rates are often increased as a mechanism for lenders to protect themselves from the high level of risk that is associated with lower credit scores. Even though it may be more challenging, securing a car loan with a 491 credit score is not impossible with careful consideration and due diligence.

What Factors Most Impact a 491 Credit Score?

Having a credit score of 491 typically flags a few immediate areas of concern. Getting a grip on these key elements can lead to healthy financial progress. Your fiscal journey is yours to embark on - full of learning and opportunities for growth.

Payment Default

Defaults on your payments can significantly impact your credit score. This could be a major reason behind the lower score.

How to Check: Scrutinize your credit report for any defaults in payment. Evaluate your past payments which could have affected your score.

Debt Balance

If your loans and credit cards are encumbered with high balances, this could have contributed to your low score.

How to Check: Inspect your loan statements and credit card bills. Are the balances high? Reduce your balances for better score health.

Age of Credit History

Your credit age might be short, which can contribute to a low credit score.

How to Check: Go through your credit report to check the length of your credit history. Keep an eye out for recently opened accounts.

Credit Variety and New Credit Applications

The lack of a mix of credit types or repeated new credit applications can adversely affect your credit score.

How to Check: Check your credit report for the type and number of different credit accounts you have. Limit your credit applications to improve your score.

Legal Judgments, Tax Liens or Bankruptcies

Public records such as legal judgments, liens and bankruptcies can significantly ruin your score.

How to Check: Look for any public records on your credit report. Work to resolve any issues you find.

How Do I Improve my 491 Credit Score?

Your credit score of 491 is certainly a challenge, but it is definitely not impossible to improve! Here are your best, achievable strategies for success at your current score:

1. Review your Credit Report

Order your credit reports from all three credit bureaus, examine them for mistakes, and dispute any inaccuracies you discover. Errors can considerably lower your credit score.

2. Catch up on Missed Payments

Any neglected payments on your report should be immediately addressed. By doing so, you’re stopping your score from falling further. If unable to clear your debts, contact your creditors and seek out a manageable repayment plan.

3. Lower Credit Utilization

Try to lower your credit utilization by paying off balances. Using more than 30% of your credit limit on any card can hurt your score. Target the cards with the highest balance-to-limit ratio first.

4. Apply for a Secured Credit Card

Secured cards are more accessible with lower scores and help in building credit history. Make small purchases and promptly pay the balances to prove creditworthiness.

5. Credit Builder Loans

Consider exploring Credit Builder Loans. Such loans allow you to borrow against your own money, establishing secure payment history on your report.

Remember, improving your credit score requires patience and disciplined financial actions. In time, your score will reflect all your hard work!