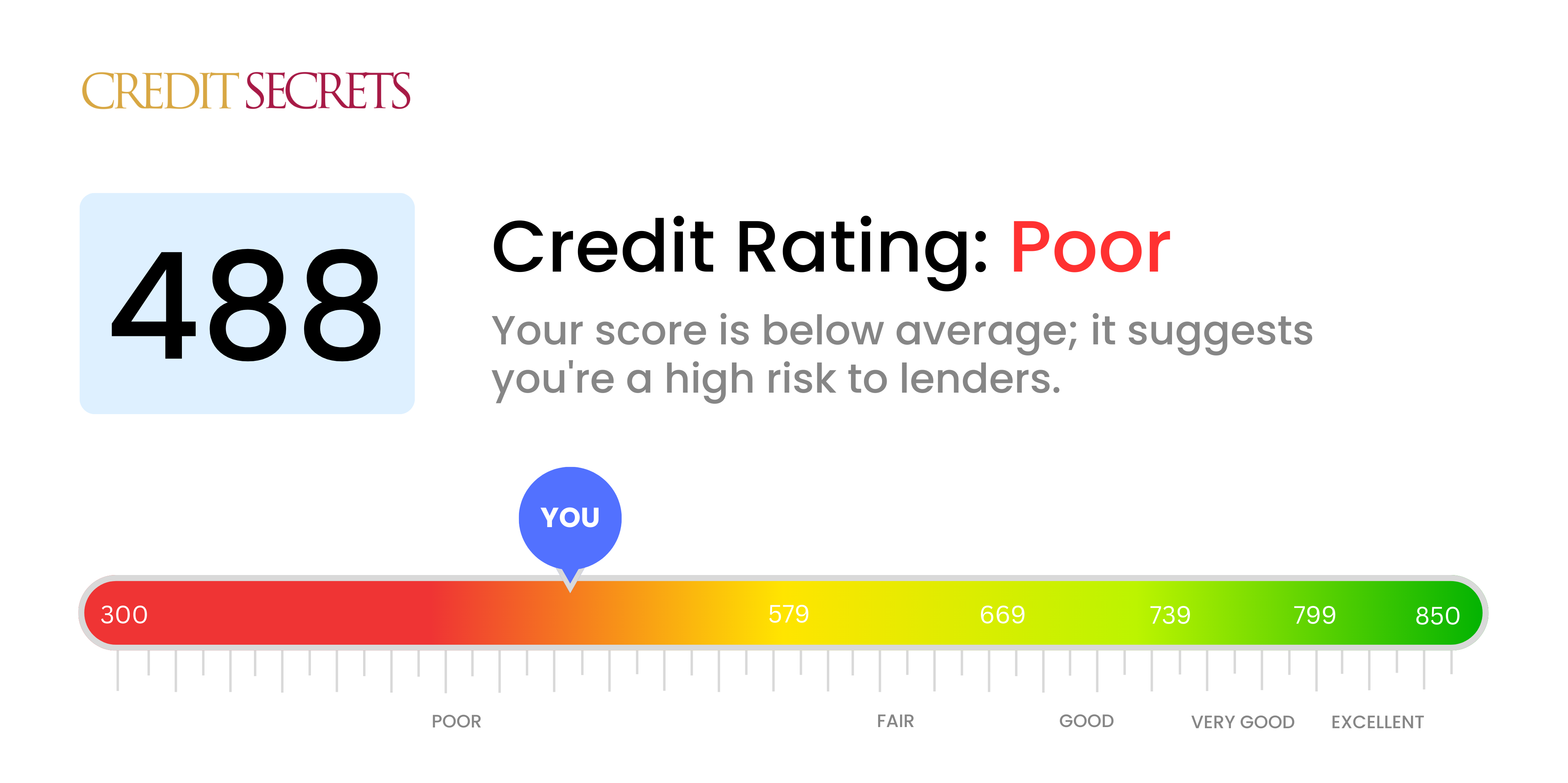

Is 488 a good credit score?

With a credit score of 488, you are in the 'poor' range. It's not a sugar-coated fact, but it's the start point for your journey to improve. Living with this score can often mean higher interest rates, fewer credit options and more difficulties in securing loans. But don't lose hope, your financial situation can absolutely be elevated with disciplined effort and smart strategies.

Recognising a low score is the first step towards repairing it. It's crucial to understand what factors have contributed towards this score – it could be due to missing bill payments, maxing out credit cards, or not having a long-enough credit history. Once these factors are identified, creating and maintaining healthy financial habits can gradually improve your credit score and help you secure a financially stable future.

Can I Get a Mortgage with a 488 Credit Score?

With a credit score of 488, it is unfortunately unlikely that you will be approved for a mortgage. Most lenders typically seek applicants with a minimum credit score in the range of 600-620, and a score of 488 falls considerably below this range. A score in this bracket indicates potential financial struggles and risks, such as late payments, defaults or a high debt-to-income ratio.

Although this is a difficult situation, fear not, there are alternative solutions available. One option could be to consider a Federal Housing Administration (FHA) loan. These loans are designed to help those with lower credit scores, and you may qualify with a score as low as 500. But remember, credit scores directly affect interest rates. With a lower score, you may face higher interest rates, resulting in a more expensive loan overall. Self-improvement of your credit score should be your long-term strategic goal to increase your likeliness of securing loans with better terms in the future.

Can I Get a Credit Card with a 488 Credit Score?

A credit score of 488 can make it quite tricky to get approval for a typical credit card. This score is often seen as risky by lenders, pointing to past financial hardship or missteps. It's not the news you'd hope for, but it's crucial to face it with a clear head and honesty. Being in the know about your credit status is step one on the road to financial recovery, even though it involves accepting some uncomfortable facts.

With such a score, it might be worthwhile to consider other options, such as secured credit cards. These require a deposit that acts as your credit limit and can be simpler to get. Over time, they can also assist in re-establishing your credit. Additionally, you might explore the possibility of getting a co-signer or even using prepaid debit cards. Although these choices don't provide an immediate fix, they are beneficial tools in your effort to regain financial stability. Lastly, bear in mind that the interest rates on any type of credit that may be available to you will likely be notably high due to the increased risk perceived by lenders.

With a credit score of 488, it's unlikely that most traditional lenders will approve a personal loan application. These lenders generally consider this credit score to be an indication of high risk. We understand this might not be the news you hoped to hear, but it's best to have clear understanding of your lending options.

While conventional loans may not be accessible, alternatives such as secured loans and cosigned loans might be an avenue to investigate. With these types of loans, either collateral or a cosigner with a higher credit score makes the loan less risky to the lender. Additionally, peer-to-peer lending platforms are a consideration, as they can be more forgiving regarding credit scores. However, be aware these alternatives often have higher interest rates and terms that aren't as favorable due to the increased risk to the lender.

Can I Get a Car Loan with a 488 Credit Score?

Having a credit score of 488, you might face some hurdles while applying for a car loan. Lenders often lean towards approving applicants with scores higher than 660, viewing these as less risky. Unfortunately, a score under 600 slots into the subprime category, and 488 falls quite a bit below this mark. Your lower score signals a higher risk to lenders because it hints at potential troubles in repaying a loan.

Does this mean your dream of buying a car is over? Absolutely not. Some lenders focus on helping those with lower credit scores. However, approach these lenders with caution. The loans they offer can carry significantly higher interest rates to compensate for the perceived risk they are taking. It's important to scrutinize all terms and conditions thoroughly. Despite the challenges your 488 credit score presents, the possibility to secure a car loan still exists. It just might require a bit more patience, careful thought, and wise decision-making.

What Factors Most Impact a 488 Credit Score?

Navigating your path towards better financial health means understanding a score of 488. Recognizing and rectifying the elements attributing to this score can setup the foundation for a stronger financial status. Remember, every financial lifecycle is distinctive, rife with progress and educational moments.

History of Payments

The records of your payments carry significant weightage in your credit score. The presence of any delayed payments or defaults might be a crucial component affecting your score.

Procedure to Check: Inspect your credit report for any delayed or missed payments. Analyze any occasions of overdue payments, which could have impacted your score negatively.

Rate of Credit Usage

A high credit usage rate can lower your score. If your credit card balances are almost reaching their maximum limits, this could be causing your score to dip.

Procedure to Check: Review your credit card bills. Do you observe the outstanding balances reaching their upper limits? Striving to keep balances at minimum in comparison to the limit can do wonders.

Duration of Credit History

Having a brief credit history can reduce your score.

Procedure to Check: Inspect your credit report to measure the duration of all your accounts, considering the oldest and most recent ones. Contemplate if you have initiated any new accounts recently.

Diversity of Credit and New Credit

It is crucial to have an assortment of credit types and manage new credit responsibly for a favourable score.

Procedure to Check: Take a structural look at your array of credit accounts including credit cards, retail accounts, personal loans, and mortgage loans. Reflect on how frequently you have been applying for new credit.

Public Records

Public records such as bankruptcy or tax liens can dramatically influence your score.

Procedure to Check: Go through your credit report for any public records. Resolve any items listed that require attention.

How Do I Improve my 488 Credit Score?

A credit score of 488 is viewed as poor, but don’t worry, there are practical, effective steps you can take to begin increasing it based on your current situation:

1. Handle Delinquent Accounts

If there are any accounts in collections on your credit report, it’s important to pay them off as soon as possible. These accounts tend to be the biggest drain on your credit score. If necessary, contact the collections agency or creditor to discuss a feasible payment plan.

2. Lower Outstanding Debt

Reducing your overall debt can significantly improve your credit score. Focus on your high-interest debts first, such as credit cards, to avoid the accumulation of additional interest. Aim for a credit utilization rate of under 30% for each card you own.

3. Opt for a Secured Credit Card

At this stage, obtaining a conventional credit card might be difficult. Consider a secured credit card instead. This type of card, backed by a refundable security deposit, can help create a consistent payment history that is beneficial for your credit score.

4. Request to Be an Authorized User

See if a trusted person with good credit would add you as an authorized user on their credit account. This can help your score as their positive account activities will be reported on your credit report. Make sure their card company reports authorized user activities to the credit bureaus.

5. Broaden Your Credit Variety

Once you’ve shown responsible use of a secured card, consider diversifying the types of credit you use. This might include retail cards or a loan. Different types of credit can contribute positively to your credit score if managed well.