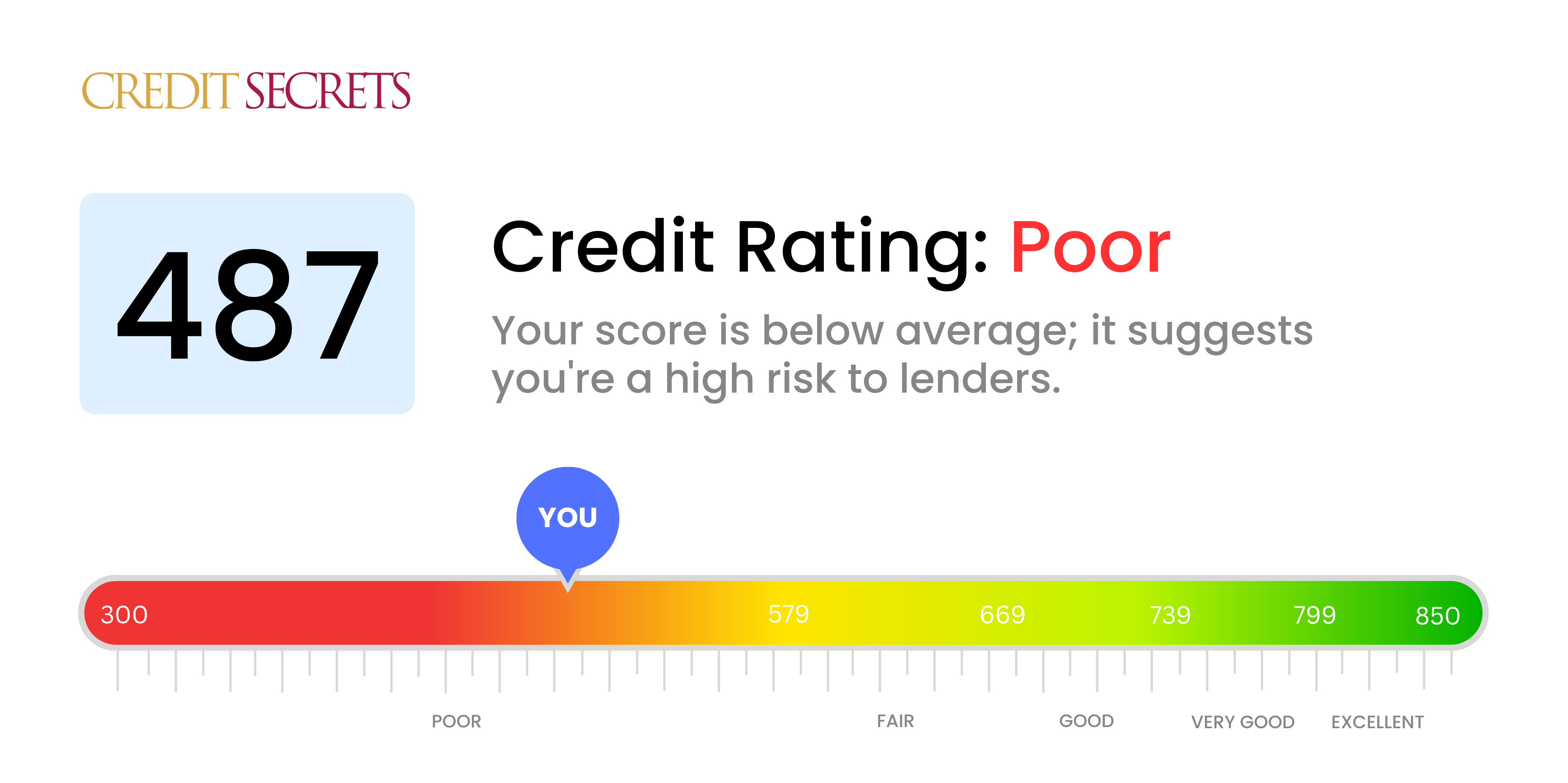

Is 487 a good credit score?

With a score of 487, your credit score is considered poor. This might make it tougher for you to get approval for loans or credit cards, but remember, it's never too late to build back your score.

A credit score within this range might lead to higher interest rates or larger security deposits. But don't worry, with persistence and a solid credit strategy, you have the ability to hit the road to financial recovery and improve your credit score.

Can I Get a Mortgage with a 487 Credit Score?

Carrying a credit score of 487, it's highly unlikely you will be approved for a mortgage. This score is markedly below what most lenders consider to be an acceptable range. A credit score at this level usually points to past financial troubles like late or missed payments, or even defaults.

This isn't an easy position to be in, but it's not an end road. Priority now is to focus on improving your credit score. You'll need to resolve any existing debts, particularly those causing the most damage to your credit standing. Steadily building a record of timely payments and prudent credit use is also crucial. Keep in mind that enhancing your credit score isn't instant, it takes time and consistent commitment. But rest assured, every positive action you take moves you closer to a better credit future.

Until you're able to uplift your credit score, consider alternative home buying methods. Contract for deed, rent-to-own, or securing a cosigner might be potential options to explore. While these alternatives come with their own pros and cons, they might help you achieve your goal of homeownership.

.Can I Get a Credit Card with a 487 Credit Score?

With a credit score of 487, it might be difficult to get approved for a typical credit card. Credit card issuers often view this score as risky which indicates some past financial strains. This can feel like a letdown, but it's crucial to face this situation with a realistic and understanding view. Recognizing your credit standing is the initial stage towards financial recovery. Facing these challenges will only make you stronger.

A low score like this often calls for exploring other alternatives. One option that could work is a secured credit card. This type of card requires a deposit which becomes your credit limit. They're generally easier to get and can assist in slowly repairing your credit. Consider options such as finding a co-signer or exploring pre-paid debit cards as well. Although these alternatives won't immediately rectify the situation, they're helpful tools on the path to financial stability. It should also be noted, any credit options accessible to those with lower scores often carry higher interest rates due to lenders' increased perception of risk.

With a credit score of 487, securing a personal loan through traditional lending methods may prove challenging. Lenders often view a score of this nature as highly risky, lessening the likelihood of approval. However, despite the challenge, accepting this reality can steer you towards exploring viable alternatives that match with your current credit score.

When typical lending is not an option, other routes such as secured loans where collateral is supplied, or co-signed loans that involve a third party with a better credit score are options to consider. Platforms that support peer-to-peer lending can also provide opportunities, as they at times maintain less stringent credit requirements. Yet, you should note that these alternatives often present higher interest rates and not-so-favorable terms, a consequence of the heightened risk perceived by the lender.

Can I Get a Car Loan with a 487 Credit Score?

Your credit score of 487 poses significant challenges for securing a car loan. Typically, lenders prefer credit scores that exceed 660. Scores under 600 are often placed into what is known as the 'subprime' category meaning they are riskier for lenders due to a higher probability of loan repayment issues. Unfortunately, your score of 487 falls into this subprime group, which could result in higher interest rates or even rejection of the loan application. Be aware, this doesn't mean car ownership is out of reach.

While it may be difficult, there are some lenders who are willing to work with individuals who have lower credit scores. These deals usually come with elevated interest rates due to the higher perceived risk to the lender. With thoughtful research and a thorough understanding of the loan's terms, obtaining a car loan is not impossible. It's essential to proceed with caution and make sure the rates and repayment terms are agreeable and within your means. Your road to car ownership might be slightly rough but it's not a dead end.

What Factors Most Impact a 487 Credit Score?

Unlocking the factors behind a credit score of 487 is the first step to improving your financial health. Recognizing and addressing these elements will guide you toward a brighter financial future. It's important to remember, everyone's financial journey varies, offering room for growth and personal development.

Late Payments

Your credit score can be heavily influenced by your payment history. If your report identifies late payments or defaults, these could be significant reasons for your current score.

Checking Method: Scrutinize your credit report for any sign of late payments or defaults. Take note of any previous instances of unpaid bills or missed payments.

High Credit Card Balance

A high credit card balance compared to your limit, otherwise known as high credit utilization, might play a significant role in your score.

Checking Method: Look over your credit card records. Are your balances nearing their caps? Lowering them in relation to your limit is typically advantageous.

Short Credit History

A limited credit history might be pulling your score down.

Checking Method: Examine your credit report to discern the lifespan of your oldest and newest accounts and the average age of your overall credit accounts.

Collection Accounts

Having debts in collections can have a drastic impact on your score.

Checking Method: Look through your credit report for any collection accounts and take immediate actions to address these.

Public Records

Public records such as bankruptcies or tax liens can notably lower your credit score.

Checking Method: Go through your credit report for any public records or legal actions against you.

How Do I Improve my 487 Credit Score?

Having a credit score of 487 may be discouraging, but it’s not a permanent situation. With a determined, step-by-step approach, you can begin to rehabilitate your credit standing. Here are key measures specific to your score range to help you start:

1. Prioritize Defaulted Accounts

Defaulted accounts can significantly bring down your credit score. Your primary objective should be to settle these accounts. Contact your creditors to broker a settlement plan. Remember to request a formal agreement in writing, outlining the negotiated payment terms.

2. Limit Your Credit Utilization

Restricting your credit card utilization to less than 30% of your credit limit on each card is one of the easiest ways to improve your credit score. This shows potential lenders that you are responsible with your credit usage.

3. Consider a Secured Credit Card

Obtaining an unsecured credit card with your present credit score may be tough. However, you could apply for a secured credit card. This card requires a cash deposit which serves as your credit line. Make sure to use it wisely and regularly to demonstrate a consistent payment history.

4. Seek Authorized User Status

Try getting added as an authorized user on a credit card belonging to someone with a good credit score. This could add to your credit history and possibly boost your own score. Keep in mind that not all card issuers report authorized user activity to credit bureaus, so check beforehand.

5. Expand Your Credit Portfolio

An effective strategy to increase your credit score is to create a varied mix of credit. Once you’ve established a good history with your secured card, consider incorporating other types of credit like installment loans or personal lines of credit.