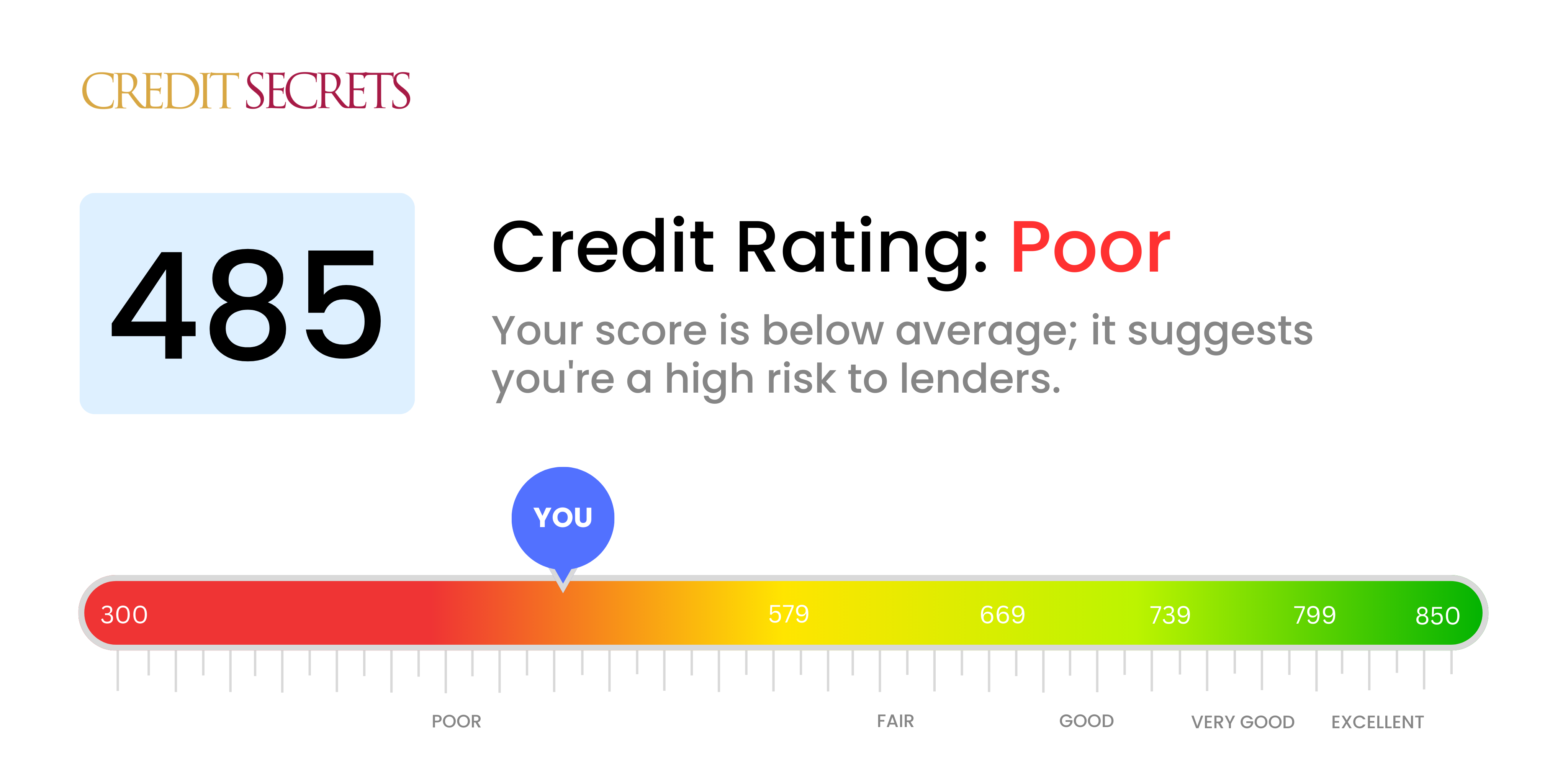

Is 485 a good credit score?

With a credit score of 485, unfortunately, your credit health is in the 'poor' range. This might hinder you from availing various financial benefits, as lenders might see you as a high-risk borrower, potentially resulting in denied loan or credit card applications, higher interest rates, and additional fees.

However, being at 485 isn't the end of the world. There are opportunities available for you to improve your credit score. Start by understanding what impacts your score and work on measures such as paying bills on time, reducing outstanding debt and reviewing your credit reports for any errors. With responsible financial habits and time, you can see a significant increase in your score and along with it, your credit worthiness.

Can I Get a Mortgage with a 485 Credit Score?

With a credit score of 485, it's unlikely that you would be readily approved for a mortgage. This score is significantly below the minimum requirement set by most lenders and may pose a challenge in securing the necessary financing for a home. This level of credit score often reflects a history fraught with financial challenges, such as missed payments, defaults, or habitual late payments.

While the current situation may seem tough, it's important to understand there are possibilities to embrace going forward. Some options could include seeking out non-traditional lending sources or exploring government-backed loans which often have more lenient credit requirements. Alternatively, consider postponing your home purchase and take some time to focus on improving your credit health. By regularly making on-time payments and working to clear outstanding debts, you can significantly improve your credit score over time. The journey ahead may be a long one, but with determination and proper financial habits, a more appealing credit score – and that dream home – can be within reach.

Can I Get a Credit Card with a 485 Credit Score?

Having a credit score of 485 is, no doubt, a challenging situation. This score is typically seen as risky by lenders, suggesting a past of financial hurdles or missteps. It may seem tough, but knowing your credit situation is a crucial step towards better financial health. It's vital to face these realities with courage and understanding.

Considering the challenges tied to a low score like 485, you might want to explore other options, such as secured credit cards. These cards necessitate a deposit to establish your credit limit. They're usually easier to get approved for and can be beneficial in rebuilding your credit progressively. Another alternative could be looking into prepaid debit cards or finding a co-signer. While these can't fix your credit instantly, they're instrumental in your journey towards financial stability. However, it's essential to remember that a low credit score often means higher interest rates as lenders see you as more of a risk.

With a credit score of 485, it's difficult to be approved for a typical personal loan. Given that your score is significantly lower than the average range, most traditional lenders perceive you as high-risk. Your credit score, unfortunately, poses a considerable barrier to obtaining loans under standard terms. However, it's essential to bravely face what this means for your borrowing possibilities.

Despite this hurdle, alternative financing options exist. Consider secured loans, which require collateral, or co-signed loans, where someone with more favorable credit co-signs with you. Peer-to-peer lending might be another avenue, as these platforms can sometimes be more flexible on credit score conditions. Do bear in mind, these alternatives are often associated with higher interest rates and less desirable terms, reflecting the increased perceived risk to the lending party. Yet, in a challenging situation, these could be potential paths to explore.

Can I Get a Car Loan with a 485 Credit Score?

With a credit score standing at 485, the road to securing approval for a car loan could be quite challenging. This is due to finance companies typically searching for credit scores above 660 to offer more agreeable terms of lending. Placing a credit score of less than 600 into the so-called 'subprime' category, yours unfortunately falls into this bracket too. This can often result in more expensive interest rates or possibly a complete denial of the loan, as they likely perceive a higher risk based on your credit history.

Despite the gloomy scenario, don't lose hope. There are lenders who would still consider granting a car loan to individuals with lower credit scores. But there's a word of caution — such loans may come with substantially higher interest rates since lenders use them as a buffer against the potential risk. Hence, it's vital to carefully understand the lending terms and consult with a reliable source before proceeding. Always remember, a bumpy road can lead to a beautiful destination, and in this case, it could be the car of your dreams.

What Factors Most Impact a 485 Credit Score?

Grasping the factors that contribute to a credit score of 485 is of paramount importance to embark on your path toward financial betterment. Tackling the elements that influence this score can set the stage for a more secure financial landscape. Bear in mind, every financial story is different, brimming with potential for growth and insight.

Past Payment Record

Your past payment record greatly sways your credit score. Missing or delayed payments or any defaults could be critical factors in shaping your current score.

What to do: Scrutinize your credit report for any negative entries such as late payments or defaults. Reflect on any episodes of non-payment, as they can hamper your score.

Credit Card Usage

Excessive credit card use can adversely influence your credit score. If your credit card balances are precariously high, it may be impeding your score.

What to do: Review your credit card accounts. Are your balances nearing their ceilings? Striving to maintain lower balances can positively affect your score.

Duration of Credit History

Limited credit history can negatively affect your score.

What to do: Evaluate your credit report to ascertain the longevity of your oldest and most recent accounts, and the cumulative age of all your accounts. Reflect on any recent credit inquiries or openings.

Diversity in Credit and Recent Credit

Maintaining a mix of different types of credits and prudent handling of new credit can enhance your credit score.

What to do: Check your different forms of credit accounts like credit cards, store cards, installment loans, and mortgage loans. Contemplate on whether you've been making any recent credit applications.

Public Records

Public records consisting of bankruptcies or tax liens can wield significant impact on your credit score.

What to do: Look at your credit report for any public records. Resolve any entries that may need attention.

How Do I Improve my 485 Credit Score?

With a credit score of 485, considered to be low, you face some challenges. However, making well-directed efforts can uplift your score. We promote the following effective and attainable strategies:

1. Pay off Delinquent Accounts

Having accounts in arrears prominently affects your credit score. We highly recommend prioritizing these accounts to prevent further damage. Connecting with your lenders to arrange a feasible payment plan can be a solution.

2. Limit Your Credit Usage

A crucial step to uplift your score involves curbing your credit card usage. Strive to keep your credit card balances below 30% of your total limit initially, gradually aiming below 10%. Focus more on cards with higher usage.

3. Opt for a Secured Credit Card

With your current score, obtaining a customary credit card could be tough. A secured credit card could be a sensible choice. These cards require a refundable deposit, becoming your credit line. Consistent, full payments on this card can reinforce your credit standing.

4. Request to be an Authorized User

Having a trusted acquaintance with excellent credit to add you as an authorized user on their credit card might uplift your score. This introduces their established credit history to yours. Ensure they report user activity to credit bureaus for maximum effect.

5. Expand Your Credit Types

Handling different credit types judiciously can help you to elevate your credit score. Start with a secured card, but consider retail cards or builder loans once you have a proven payment history.