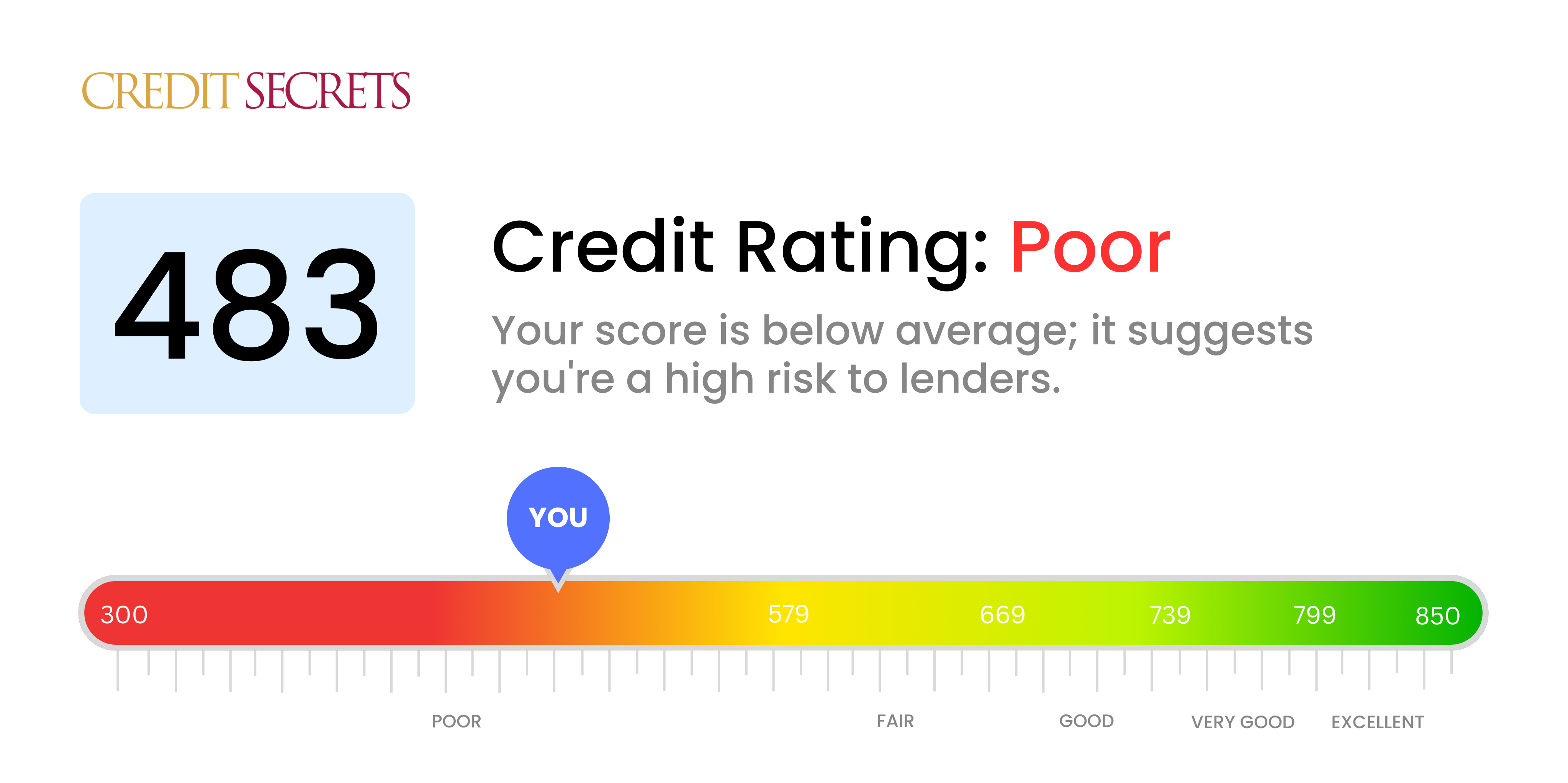

Is 483 a good credit score?

With a credit score of 483, you're currently sitting within the 'Poor' credit range. This isn't an ideal place to be, as it can make it more challenging to access beneficial financial resources, like loans or credit cards, and you may face potentially higher interest rates when you do.

However, it's important to remember that this isn't a stagnant situation. Credit scores can change and there are steps you can take to improve your situation. Exploring credit-building strategies and focusing on maintaining consistent, on-time payments can gradually bring improvement to your credit score. Remember, your present circumstances don’t have to dictate your financial future.

Can I Get a Mortgage with a 483 Credit Score?

With a credit score of 483, real-world experience tells us that securing a mortgage would be a considerable challenge due to the fact most lenders look for higher scores to extend home loans. A score in the 483 bracket may indicate past financial struggles such as an accumulation of late payments, defaults, or other negative information on your credit report.

While this might seem disheartening, it's important to remember that it's not an insurmountable situation. You can consider exploring alternative housing options, like renting or lease-to-own, while you methodically improve your credit score. This could involve reducing your debt load, making consistent and timely bill payments, and possibly using other methods to affirm your credit responsibility. Just like a garden, your credit score requires time and care to grow. As you maintain these good habits progressively, you incrementally set yourself up for better financial options and potentially lower interest rates in the future.

Can I Get a Credit Card with a 483 Credit Score?

Having a credit score of 483 means your chances of getting approved for a regular credit card are quite low. This score demonstrates to lenders that there has been some financial struggles or mismanagement in the past. It might seem like a tough pill to swallow, but understanding your credit score is a crucial part of getting back on track financially.

Fortunately, there are other options. A secured credit card, which uses a deposit as your credit limit, is often a more achievable option. This type of card can help rebuild your credit over time. You might also consider getting a co-signer or using a pre-paid debit card as an alternative. Though these options may not seem ideal, they can be instrumental in your journey towards financial recovery. Please remember, that the interest rates for any credit obtained with such a credit score will likely be quite high due to the increased risk lenders perceive. Stay optimistic and take control of your financial future today.

Understanding that a score of 483 is well below the credit range most lenders look for when assessing loan eligibility can be a difficult realization. This score tends to make lenders hesitant, signaling a substantial risk of default which could result in denial of personal loan applications. Handling this type of situation demands serious consideration and an open approach to alternative solutions.

Despite the sting of traditional loan roadblocks, there are other borrowing options to explore. One possibility might be a secured loan, where you provide something of value as collateral. You could also look into co-signed loans which involve having someone with a higher credit score backing your loan request. Another solution could be peer-to-peer lending, a platform where personal investors may have slightly more accommodating standards regarding credit scores. Do be mindful though, these alternative paths often carry higher interest rates and more stringent terms, a reflection of the enhanced risk assumed by the lender due to the lower credit score.

Can I Get a Car Loan with a 483 Credit Score?

With a credit score of 483, the chances of being approved for a car loan can be quite slim. In general, lenders usually require a score above 660 to consider the borrower a good risk. Your score normally implies that you fall into a category referred to as 'subprime,' which suggests that borrowing could pose higher risks. Consequently, this may increase the interest rates or even result in loan denial. This occurrence stems from the understanding that a lower credit score typically represents a higher repayment risk for lenders.

However, all hope is not lost. While obtaining a car loan may be difficult, it isn’t entirely impossible. Certain lenders specialize in dealing with borrowers with lower credit scores. It's vital, however, to remain cautious as these loans typically come with considerbaly higher interest rates. This is the lender's way of managing the perceived risk in the transaction. It might not be a smooth journey, but with thoughtful planning and an understanding of the terms and conditions, obtaining a car loan is still achievable.

What Factors Most Impact a 483 Credit Score?

Grasping a credit score of 483 is the first step towards reforming your monetary history. Carving out a pathway to financial stability begins with understanding the core reasons behind your current credit score. Each financial journey is individually tailored, brimming with opportunities for growth and understanding.

Payment Behaviour

Paying bills late or defaulting on loans could greatly influence your credit score. This may be a primary factor causing your score to be 483.

How to Check: Skim through your credit report and identify any delayed or missed payments. Reflect on past payment circumstances that could have affected your score.

Credit Usage

High credit card balances, in relation to limits, can have a negative impact on your score. If your credit cards are maxing out, this could be a factor contributing to your score.

How to Check: Review your credit card statements. Are the outstanding amounts on any of them near the limit? Strive to keep balances low to maintain a healthy credit score.

Duration of Credit History

Whilst a well-aged credit history can help improve your score, a younger one may negatively affect it.

How to Check: Evaluate your credit report to gauge the existence of your oldest and newest credit accounts. Consider if opening new accounts recently caused a slump in your score.

Diverse Credit and Fresh Credit Handling

Handling a variety of credit types and responsibly managing new credit can substantially boost your score.

How to Check: Assess the variety of your credit accounts. Have you been responsibly applying for new credit?

Public Records

Public records such as bankruptcies or tax liens greatly affect credit scores. Resolving these can help alleviate your present score of 483.

How to Check: Scan your credit report for any public records. Address any issues encountered to aid in score recovery.

How Do I Improve my 483 Credit Score?

With a credit score of 483, it’s time to embark on a journey of financial health improvement. This might seem tough, but with focused strategies, it’s well within reach. Here’s where you should concentrate your efforts:

1. Assessing Your Credit Report

Pull your credit report and thoroughly review it for accuracy. Dispute any errors you find with the respective credit bureaus, since inaccuracies can dramatically impact your score.

2. Address Collection Accounts

If you have collection accounts, contact the collectors to negotiate a payment plan or a pay-for-delete agreement. Settling these debts can remove negative marks and boost your score.

3. Secured Credit Card

Take into consideration applying for a secured credit card. This type of card requires a deposit that becomes your spending limit. Utilizing this responsibly can start building your credit.

4. Bill Prioritization

Ensure that all your bills, even the non-credit ones (like utilities), are paid on time. Late payments can result in a credit score dip. Setting up automatic payments can help manage this process.

5. Establish and Nurify Credit History

Building a solid, long-term credit history is critical for elevating your score. This involves taking on credit and diligently maintaining it. A retail card, or a low limit unsecured card are potential starters once you’ve seen improvement with your secured card.

These focused strategies stand to significantly impact your current credit score, improving your creditworthiness and paving the way to your financial goals. Stay patient and diligent, success won’t be immediate but will be attainable.