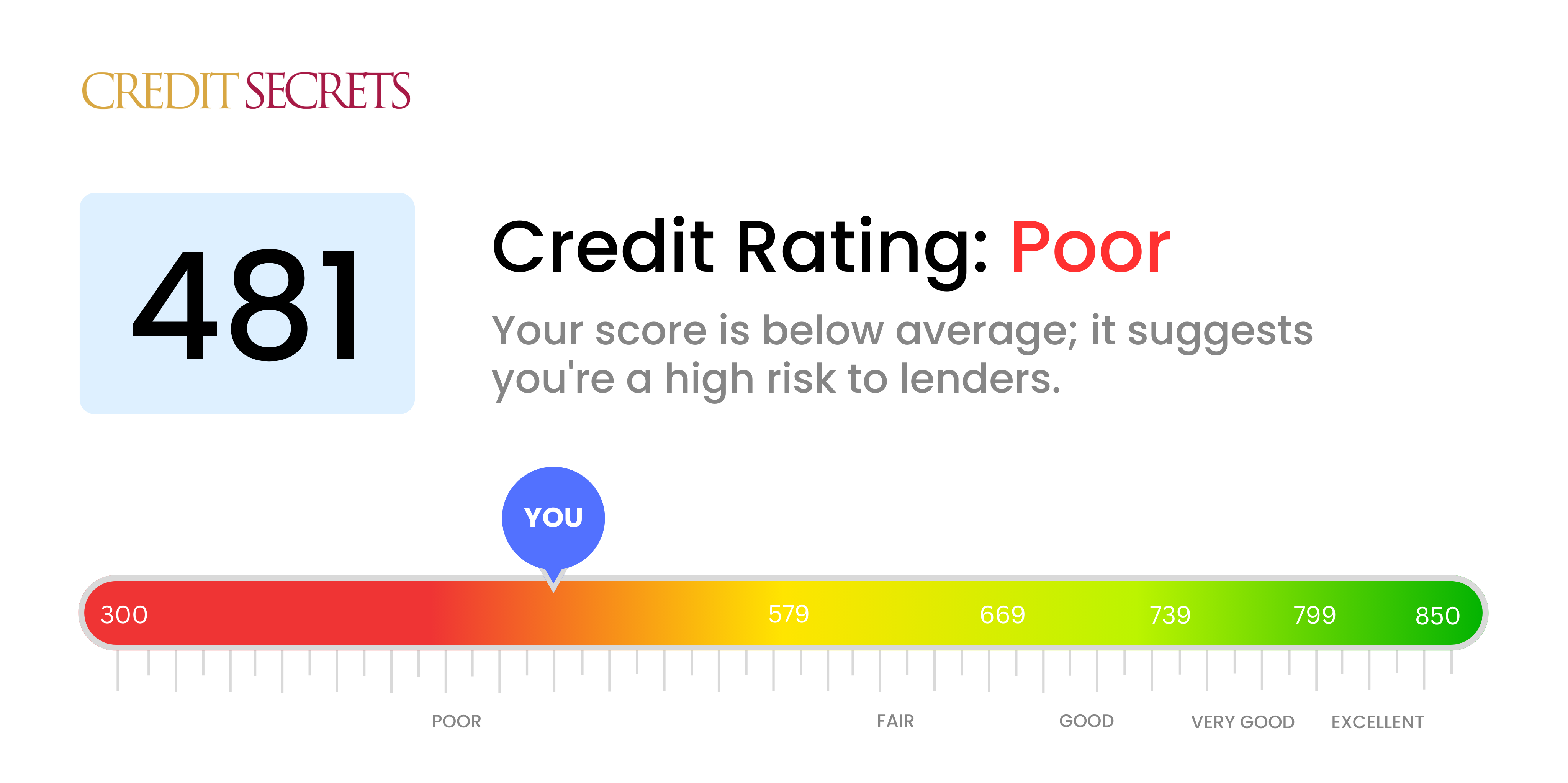

Is 481 a good credit score?

A credit score of 481 falls within the 'poor' range. This score may make it challenging to get approval for loans and credit cards, and if approved, you may face higher interest rates. But remember, your credit score isn't set in stone; you can take steps to improve it over time.

It is important to understand the factors influencing your credit score. These often include payment history, the amount of debt you owe, the length of your credit history, the types of credit you're using and the number of new credit accounts. By focusing on these areas, you can start making improvements to your score.

Can I Get a Mortgage with a 481 Credit Score?

Having a credit score of 481 places you in a less-favorable bracket when seeking a mortgage approval, as most lenders consider this score significantly below the preferred range. Possessing such a score usually conveys a narrative of past financial challenges, perhaps missed payments or delinquency on loans.

However, this is not a dead end. There exist certain alternatives you may consider, such as applying for a Federal Housing Administration (FHA) loan, known for its flexibility regarding credit scores. Remember, though, that a poor credit score could also mean higher interest rates, bringing larger monthly payments and increased costs over the life of your loan. Thus, a crucial first step would be working to gradually improve your credit score. Commit to timely payments and responsible utilization of credit. Fortunately, credit scores are not static, and with diligent effort, you can increase yours over time, progressively strengthening your position for future opportunities.

Can I Get a Credit Card with a 481 Credit Score?

Having a credit score of 481 may pose challenges when trying to secure a traditional credit card. The score, unfortunately, is seen as high-risk to lenders, possibly due to past financial struggles or missteps. This can be a tough pill to swallow, yet facing it head-on with pragmatism and awareness is a crucial first step towards regaining financial health.

Bearing in mind the hurdles tied to a lower score, it could be beneficial to consider alternatives like secured credit cards, which can be easier to obtain. In this scenario, a deposit establishes the credit limit. A co-signor or pre-paid debit cards may also be worth exploring. Although these options won’t provide an immediate solution, they are critical tools in your journey towards financial stability. Interest rates on any credit offerings for those with such scores are often notably higher, reflecting the increased risk perceived by lenders.

A credit score of 481 falls significantly short of what most conventional lenders consider for personal loan approvals. This score suggests a high degree of financial risk, which can make securing a personal loan quite tricky. It may seem like a difficult hurdle, but it's crucial to recognize and accept what this score implies for your borrowing capabilities.

Should traditional loan paths be currently out of reach, considering alternative routes may be beneficial. Secured loans, which require collateral, or co-signed loans, where someone with a healthier credit score guarantees the loan, could be potential options. Another possibility could be peer-to-peer lending platforms, as they can offer more flexible credit requirements. Bear in mind, these alternatives often carry higher interest rates and terms that may not be as favorable due to the increased risk to the lender.

Can I Get a Car Loan with a 481 Credit Score?

With a score of 481, getting a car loan might seem like a steep hill to climb. Most lenders usually look for credit scores above 660 to grant a loan with favorable terms. Unfortunately, a score of 481 is considered subprime, indicating a lower credit sculpted from possible challenges with debt repayment. This places you at a higher risk from a lender's perspective and may lead to higher interest rates or even a loan denial.

But don't lose heart. Your journey to secure a car loan is not completely off the road. There are certain lenders who may still work with individuals possessing lower credit scores. However, it's essential to bear in mind that these loans will most likely include higher interest rates. These rates are set to counterbalance the risk perceived by the lenders. It may be a bit of a bumpy ride, but with meticulous planning and an in-depth review of the loan terms, your dream of owning a car could still come true.

What Factors Most Impact a 481 Credit Score?

Interpreting a score of 481 is vital to plan your path towards financial betterment. Addressing factors influencing this score can guide you towards financial stability. Every economic journey is unique and presents multiple learning experiences.

Payment History

Payment history greatly influences your credit score. Late payments or defaults might be the primary reason behind your score.

How to Check: Analyze your credit report for delayed or defaulted payments. Consider any incidents of late payments which might have impacted your rating.

Credit Utilization Ratio

Elevated credit utilization can adversely impact your score. If you're utilizing credit to its limit or close, it could be negatively influencing your score.

How to Check: Review your credit card statements. If your balances are nearing their limits, try to lower them for a more favorable credit utilization ratio.

Credit History Length

Short credit history may negatively influence your score.

How to Check: Evaluate your credit report for the age of your oldest, newest accounts, and the average age of all your accounts. Reflect on whether you've opened new accounts recently.

Credit Mix and New Credit

Managing various types of credit responsibly and acquiring new credit sparingly can help improve your score.

How to Check: Review your variety of credit accounts like credit cards, retail accounts, installment loans, and mortgage loans. Consider if you've been sparingly acquiring new credit.

Public Records

Public records, such as bankruptcies or tax liens, can significantly affect your score.

How to Check: Review your credit report for any public records. Address and resolve any listed items

How Do I Improve my 481 Credit Score?

With a credit score of 481, you’re situated in the ‘poor’ credit range. There’s room for improvement and specific steps are essential at this level to lift your score. Follow these recommended strategies:

1. Rectify Late Payments

Delays in loan repayments are likely hurting your credit score. Consequently, it’s crucial to rectify these payments. Strategy involves getting in touch with your respective lenders and agreeing to a suitable payment plan. Regularizing the most delinquent accounts could notably boost your score.

2. Manage Credit Utilization

If your credit cards are maxed out, it’s negatively influencing your credit score. A downwards shift in balance to below 30% of your limit can boost your score. Always pay off the cards reflecting highest utilization first.

3. Apply for a Secured Credit Card

Obtaining an unsecured credit card might prove difficult at this score level. A solution may be a secured credit card, which needs a cash collateral deposit as credit line. Remember to use it responsibly — small transactions paid off consistently each month can help rebuild your score.

4. Seek Authorised User Status

Being an authorized user on a relative or friend’s credit card can lift your credit score, provided their credit card issuer reports to credit bureaus and they possess a good payment history. This allows for their positive record to reflect on your credit report.

5. Expand Your Credit Variety

Multiple credit types can enhance your score. After proving a consistent payment history with your secured card, consider other credit avenues like retail credit cards or credit builder loans. Be cautious and manage them responsibly.