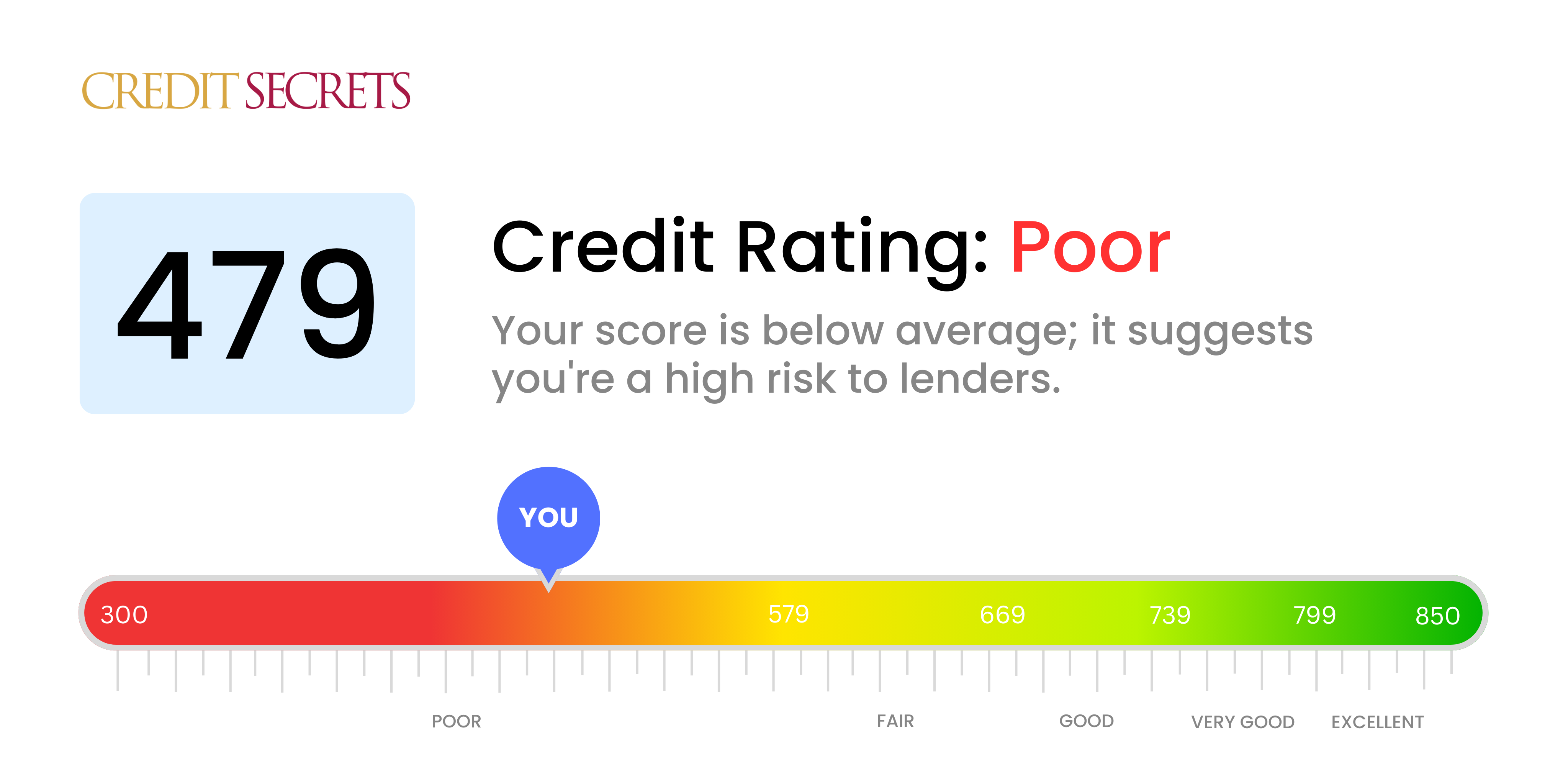

Is 479 a good credit score?

Regrettably, a credit score of 479 falls into the 'Poor' category. Having this score might make it difficult for you to obtain credit, and if you do manage to get credit, you'll likely face higher interest rates. However, remember that your credit score isn't written in stone and can be improved with effort and time.

With a thorough understanding of your credit score situation, you can focus on actions that might prove beneficial. Monitor your credit reports regularly, promptly pay your bills, and keep your credit balances low to help gradually raise your score. Remember that progress might be slow, but every step you take towards your financial goals should be seen as a victory.

Can I Get a Mortgage with a 479 Credit Score?

With a credit score of 479, securing a mortgage is unlikely, as your score is well below the threshold most lenders consider. A score in this region typically reflects a history of repayment issues or adverse financial incidents. This can make loan providers apprehensive about your ability to meet monthly mortgage repayments.

It's important to understand that this isn't an easy spot to be in, but there are alternative paths you can explore. One option could be government-backed loans, like the FHA loan program, which allows borrowers with lower credit scores. Furthermore, making a larger down payment may also persuade lenders to offer a mortgage in exceptional cases. However, these alternatives usually come with higher interest rates due to increased lending risk, so ensure you explore all options and make an informed decision.

Remember, credit scores aren't set in stone – you have the power to take control and with time and diligence, you can work towards raising your score.

Can I Get a Credit Card with a 479 Credit Score?

With a credit score of 479, getting approved for a regular credit card could be a tough hill to climb. This score may indicate to lenders that there have been some financial hiccups in the past. It's a hard truth to face, but understanding where you stand is an immense first step in the right direction. Be aware that the journey towards financial recovery never happens overnight. Bumps in the road may be disappointing, yet they're ultimately part of the learning process.

At this point, it might be best to consider certain alternatives such as secured credit cards. These cards need a cash deposit which would act like your credit limit. They are typically a more feasible option and can contribute towards slowly improving your credit score. Other alternatives include co-signing arrangements or prepaid debit cards. It's crucial to note in all of these options, the interest rates tend to lean into the high-end. This reflects lenders' increased perceived risk. Even though none of these alternatives offer an immediate resolution, they can be helpful stepping stones towards building a stronger financial foundation.

A credit score of 453 is considerably below what many traditional lenders consider satisfactory for a personal loan approval. This level of score suggests a high risk from the viewpoint of a lender, making it doubtful that you would be approved for a personal loan through standard means. Your situation may be challenging, but it's crucial to understand what this score means in terms of your borrowing potential.

Should conventional loans not be an option, thinking about alternatives like secured loans, where you offer collateral, or co-signed loans, where a person with a healthier credit score supports you, might be beneficial. Another feasible alternative could be peer-to-peer lending platforms which sometimes have a more relaxed attitude towards credit requirements. Still, it's important to know these options often bring along higher interest rates and less favorable conditions, reflecting the increased risk for lenders.

Can I Get a Car Loan with a 479 Credit Score?

With a credit score of 479, getting approval for a car loan can be quite a hurdle. Lenders consider a score of 660 or more as stable, whereas a score below 600 is generally seen as risky. In your case, a score of 479 is viewed as less than ideal, potentially leading to higher interest rates or loan refusal. This seemingly low number represents a higher risk to the lender and suggests a history of some repayment difficulties.

No need to despair though as a lower credit score doesn’t immediately end your journey to securing a car loan. Though it might be slightly more complex, there are lenders who are willing to work with lower credit scores. However, exercise caution as these loans can come with substantial interest rates because of lenders trying to mitigate their risk. The road may be a touch challenging, but with good understanding and thoughtful examination of the terms, achieving a car loan with a score of 479 is not entirely out of question.

What Factors Most Impact a 479 Credit Score?

Interpreting a score of 479 aids in building your path to financial advancement. Pinpointing the reasons behind your current score and addressing them sets the stage for an improved financial standing. Each fiscal journey is unique and filled with possibilities for growth and insight.

Payment Performance

Your credit score is heavily influenced by your payment performance. In the event of missed or delayed payments, these could be primary reasons behind your score.

How to Check: Scan your credit report for any late or missed payments. Consider any periods where you may have deferred payments as these can impact your score.

Credit Usage

Excessive credit usage can be detrimental to your credit score. If your credit cards are almost maxed out, it could be a significant contributing factor.

How to Check: Evaluate your credit card statements. Is your balance nearing the limit? Aiming to maintain a low balance compared to the limit is advisable.

Term of Credit History

A brief credit history will likely negatively impact your score.

How to Check: Examine your credit report to determine the age of your oldest and newest accounts, as well as the average age of all your accounts. Reflect on whether you've opened new accounts recently.

Variety of Credit and New Accounts

Maintaining various types of credit and handling new credit responsibly are key to maintaining a good score.

How to Check: Look into your mix of credit accounts, which may include credit cards, retail accounts, and loans. Make sure that you're applying for new credit judiciously.

Legal Notices

Legal notices such as tax liens or bankruptcies can weigh heavily on your credit score.

How to Check: Check your credit report for legal notices. Resolve any pending issues that might be listed.

How Do I Improve my 479 Credit Score?

With a credit score of 479, you’re facing a significant uphill climb. Fear not, as transformation is within your grasp – here are actionable and effective steps to start the journey.

1. Rectify Overdue Payments

Begin by managing any overdue payments. These are particularly damaging to your credit score, so take immediate steps to make these accounts current. Connect with your creditors to construct a manageable payment plan that aligns with your financial condition.

2. Curb Credit Utilization

High credit utilization can profoundly affect your credit score. Strive to lower your card balances to under 30% of your card limit. A long-term target should be to maintain it under 10%. Start by concentrating on the cards with the highest utilization ratios.

3. Apply for a Secured Credit Card

With the present score, securing a conventional credit card could be tough. Contemplate getting a secured credit card, which mandates a cash collateral deposit functioning as the credit line. Utilize it wisely to build a positive payment narrative.

4. Nominate Yourself as an Authorized User

Look for a trusted person with good credit and ask if you could be added as an authorized user on their card. This aids in enhancing your credit score as their steady payment chronicle gets incorporated into your credit history. Make sure the card provider reports authorized user activities to the bureaus.

5. Diversify the Types of Credit

Once your payment history with the secured card improves, consider other credit forms such as credit builder loans or store credit cards. Diversification of credit types contributes positively towards an increased score. However, remember to manage these accounts sensibly.