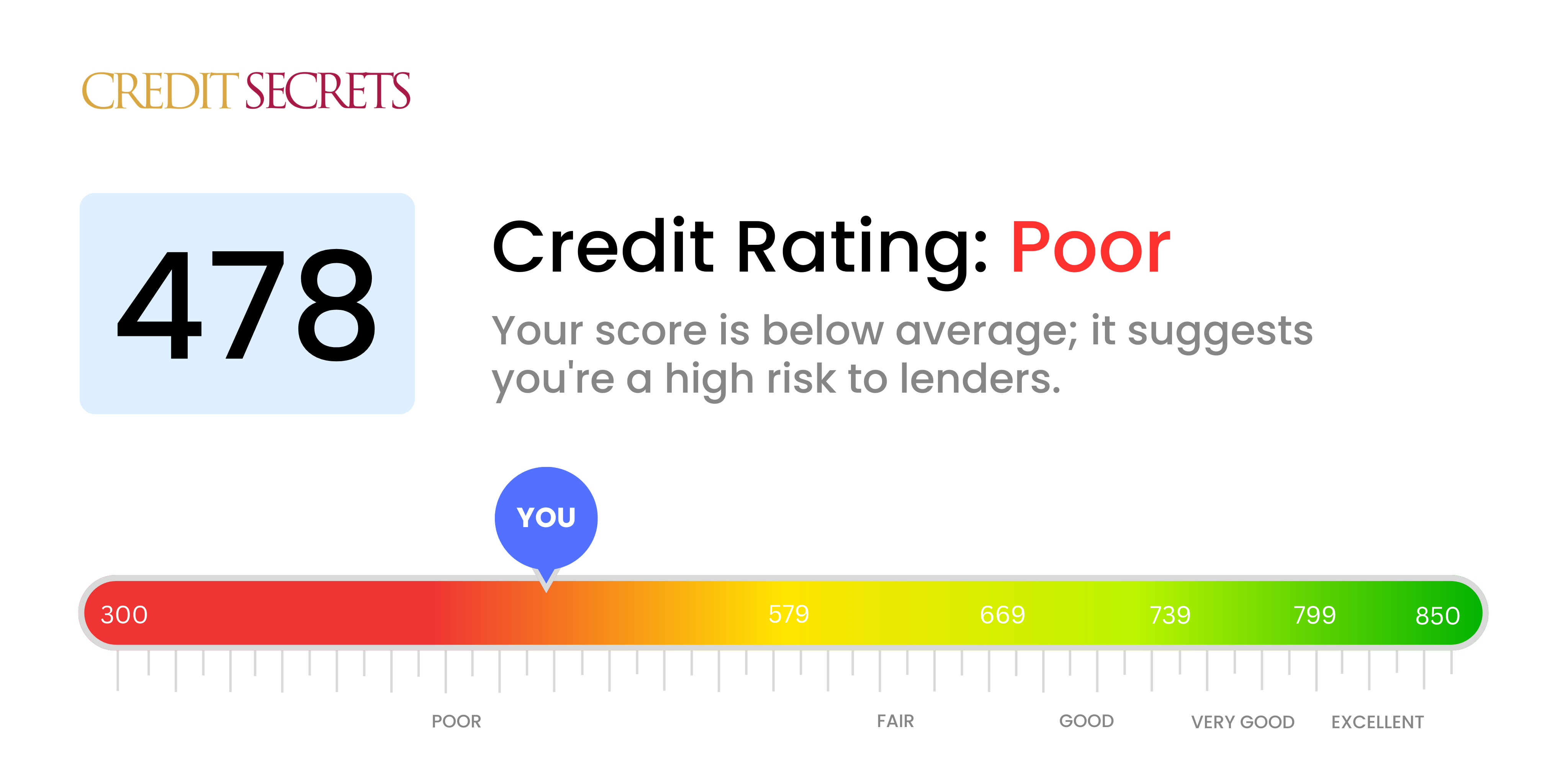

Is 478 a good credit score?

From a close look at your score of 478, it's clear that your credit standing falls into the 'Poor' rating range. It's not an ideal scenario, but remember, this is not the end of the road for you, and a change is totally achievable.

With a score in this range, you might encounter hurdles in obtaining new credit or loans, and if approved they might come with higher interest rates. However, worry not - your fate isn't sealed. By maintaining a positive outlook and taking diligent steps to improve your credit habits, you can begin to rebuild your score and reach your financial goals.

Can I Get a Mortgage with a 478 Credit Score?

A credit score of 478, unfortunately, will likely hinder you from obtaining mortgage approval. This figure is significantly below the threshold that most lenders have set as a minimum credit rating. Such a score points towards past financial setbacks such as late payments or loan defaults, which lenders interpret as a higher risk.

Despite this being a tough spot, there are still possible alternatives to consider. One may be to consider federally backed loans which often have lower credit requirements. Another option could be saving for a larger down payment, making your application more appealing to lenders by lowering the amount you need to borrow. Be aware, however, that borrowing with a lower credit score can come with higher interest rates, increasing the overall cost of the mortgage loan. The most important thing, however, is to actively work on improving your credit score. The process takes time, but each on-time payment and each debt tackled will inch you closer to a better financial future.

Can I Get a Credit Card with a 478 Credit Score?

A credit score of 478 is certainly low, and it generally makes obtaining a traditional credit card a tough task. This score indicates a history of financial challenges and often makes lenders see you as a high-risk candidate. Although this may feel discouraging, recognizing this fact is a crucial part of your journey to financial health.

Why is it so difficult? It's simple. Credit card issuers take on a risk when they approve somebody for a card. When your score is as low as 478, this risk is deemed too high. This is because a lower score indicates you may have had issues repaying debts in the past.

However, there are some alternatives you could consider. Secured credit cards require a deposit functioning as your credit limit and may be a viable option for this situation. Prepaid debit cards or having a creditworthy co-signer can likewise be worthwhile considerations. Be mindful, though, that the interest rates for these alternatives are typically higher to offset the increased risk. Remember, these options are not immediate fixes but can serve as effective stepping stones towards a stronger financial status.

With a credit score of 478, securing a personal loan from most traditional lenders could be a difficult task. Lenders are likely to see a credit score this low as a representation of heightened risk, which makes them reluctant to approve loan applications. It's indeed quite a tough situation, but it's crucial to acknowledge the implications of this credit score on your borrowing prospects.

Should mainstream lenders deem your application unfit, there are still alternative routes to consider. Secured loans, where you offer collateral, are one such route; or co-signed loans where you have the backing of someone with better credit. Peer-to-peer lending platforms sometimes have more forgiving credit criteria permitting individuals with lower credit scores. However, it's vital to note that these alternate routes often come with steeper interest rates and stricter terms, reflecting the augmented risk that lenders undertake.

Can I Get a Car Loan with a 478 Credit Score?

With a credit score of 478, getting a car loan can be more challenging. Credit score is a key factor that lenders use to decide whether or not to lend money. They frequently seek scores that exceed 660, considering scores under 600 as subprime. Your present score of 478 falls into this subprime group. This means you could face more hurdles in receiving a loan as this score indicates a higher risk to lenders with a history of potential repayment issues.

However, a low credit score does not utterly hinder your pursuit of a car. There are lenders that cater to those with lower credit scores. But be aware, such loans typically carry much higher interest rates. These are to offset the risk lenders see in lending to someone with a lower credit score. It's not as smooth a road, but if you're careful and understand the conditions of the loan, achieving a car loan remains a viable option.

What Factors Most Impact a 478 Credit Score?

Decoding a score of 478 is an important step towards financial betterment. Understanding the factors causing this score can be the key to rebuild your financial health. Remember, your financial journey is personal, filled with opportunities to learn and grow.

Payment History

Payment history significantly influences the credit score. Past delays in payments or defaults could be one of the main reasons behind your score.

How to Check: Scrutinize your credit report for any history of late payments or defaults. Remember, frequent lapses in payments could have lowered your score.

Credit Utilization

High credit utilization can put a dent in your score. If your credit card balances are touching their limits, this may be pushing your score down.

How to Check: Analyze your credit card statements. If your balances are nearing their limits, it's time to put a plan to reduce them.

Length of Credit History

A short credit history could have a negative impact on your score.

How to Check: Inspect your credit report to check the age of your oldest and latest accounts and calculate the average age of all accounts. High frequency of new accounts may lower your score.

Credit Mix and New Credit

Having diverse types of credit and judiciously managing new credit can boost your score.

How to Check: Check your mix of credit accounts - credit cards, retail accounts, installment loans, and mortgages. Too many new credit accounts could be affecting your score.

Public Records

Public records like bankruptcies or tax liens can seriously lower your score.

How to Check: Check your credit report for any public records. Work towards resolving the issues listed that may be pulling down your score.

How Do I Improve my 478 Credit Score?

Coping with a credit score of 478 calls for specialized strategies. While this score is regarded as poor, there are practical steps for mending the situation.

1. Tackle Outstanding Balances

First and foremost, focus your energy on clearing any outstanding balances you owe. These debts cast the biggest shadow on your credit score, especially if any of them are past due. Get in touch with your creditors and see if you can formulate a feasible payment plan.

2. Manage Your Credit Card Utilization

Highly utilized credit cards pull down your credit score significantly. Aim at keeping balances below 30% of your credit limit, whilst working towards a long-term goal of below 10%. This strategy should prioritize cards with highest utilization rates.

3. Apply for a Secure Credit Card

Your current situation might limit you from acquiring a regular credit card, but pursuing a secured credit card is a valid alternative. You guarantee this card by depositing cash collateral, which also serves as your credit line. Through small purchases paid off in full every month, you can start to build a positive credit payment history.

4. Join a Credit Account as an Authorized User

Family members or friends with a stronger credit history can assist by adding you as an authorized user to their credit card. Your credit score benefits from their credit history, but be certain the card issuer reports authorized user’s activities to credit bureaus.

5. Widen Your Credit Types

Incorporating various types of credit in your portfolio also aids in boosting your credit score. Once secure with your card history, look for additional credit options like a credit builder loan or a store card. Use these responsibly too.