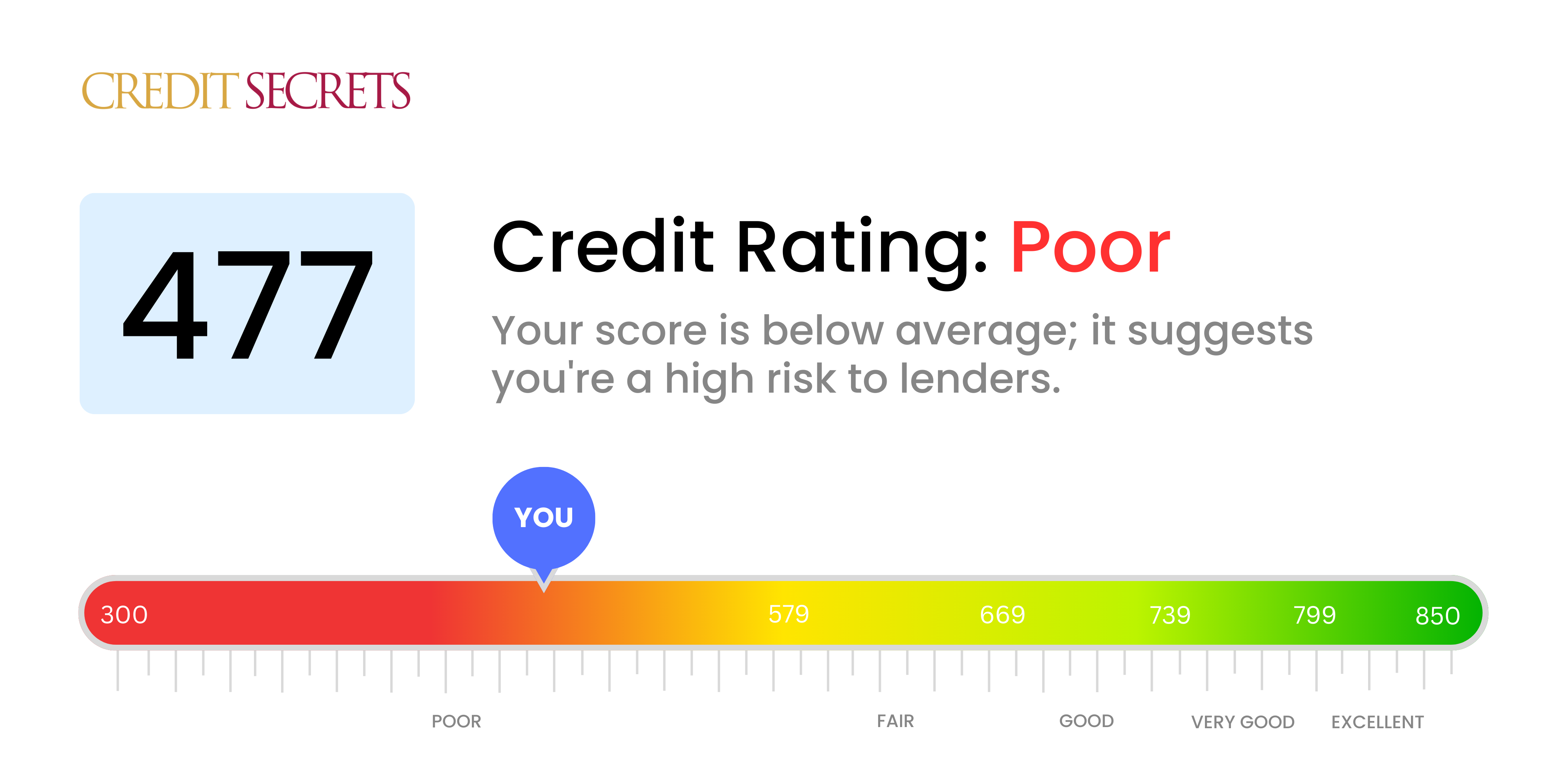

Is 477 a good credit score?

Having a credit score of 477 is in the 'poor' range, which can make it challenging to obtain some financial services. However, it's important to remember that your credit score is not fixed and can be improved.

A score of 477 can suggest to lenders that you've had serious financial difficulties in the past, such as a history of missed payments or defaulting on previous loans. This might limit your options for credit and result in higher interest rates. However, by taking proactive steps, such as consistently making payments on time and reducing the amount of debt you owe, you can start to build a better credit history.

Can I Get a Mortgage with a 477 Credit Score?

Having a credit score of 477 makes it rather challenging to secure a mortgage approval. This score lies significantly below the minimum requirement set by most lenders, which often signals a past marked by considerable financial struggles, including delayed payments or even defaults.

But all hope is not lost. There are ways to harness this situation into a positive outcome. Start by focusing on rectifying any existing delinquencies or unpaid debts which could be weighing down your score. From there, emphasize on being consistent with your payments and using your credit responsibly. Under these circumstances, seeking alternatives such as a cosigner or considering a lesser expensive house could also be helpful options. Acknowledge that elevating your credit score will take time, and requires patience and diligent effort. With dedication and wise financial decisions, it is entirely possible to put yourself in a position that makes you a more appealing candidate to lenders in due course.

Can I Get a Credit Card with a 477 Credit Score?

With a credit score of 477, it is highly unlikely to secure approval for a standard credit card. This score often suggests a past filled with financial challenges, which lenders view as a high-risk candidate. Understanding and acknowledging this is a crucial first step towards improving your financial health, even if it means digesting some harsh realities.

Instead of losing hope, you can look into other alternatives, like secured credit cards that operate based on a deposit that determines your credit limit. These cards can be simpler to get and could help improve your credit score over time. Another option might be to consider a trusted co-signer or explore the possibility of pre-paid debit cards. Remember, although these options aren't a quick fix, they are strategic tools to guide you in your journey towards financial stability. However, keep in mind that the interest rates on credit options available for people with low scores tend to be much higher due to the increased risk perceived by the lenders.

Having a credit score of 477 means you face significant obstacles when seeking approval for a traditional personal loan. For a lender, a score this low equates to a considerable risk of default, making them unlikely to offer you loan under normal conditions. It's certainly a tough situation, but it's vital to confront the meaning of this credit score and its effect on your borrowing situation.

Despite the challenges, there are other options you could consider. Secured loans, where you provide an asset as collateral, or co-signed loans, where a third party with a better credit rating acts as your guarantor, could be possible avenues. Another potential solution could be peer-to-peer lending platforms that are sometimes more forgiving with regards to credit requirements. However, these options often carry higher interest rates and come with less favorable conditions due to the high risk anticipated by the lender.

Can I Get a Car Loan with a 477 Credit Score?

Having a credit score of 477 puts you in a challenging position when it comes to getting approved for a car loan. The reality is that most lenders seek borrowers with credit scores above 660. Unfortunately, anything beneath 600 is frequently categorized as subprime, and your score of 477 comfortably falls into this bracket. This could result in you facing higher interest rates or even experiencing outright denial. This is because lenders view a lower credit score as symbolizing a greater risk, implying potential repayment issues.

Don't get disheartened, though. A low credit score doesn't entirely close the door on the prospect of owning a car. Certain lenders specialize in working with people who have lower credit scores. But it's vital to approach with caution, as these loans often carry substantially higher interest rates. These rates are essentially the lender's safety net to protect their investment. The road to securing a loan may be less smooth, but with careful consideration and a comprehensive understanding of loan terms, there's still hope.

What Factors Most Impact a 477 Credit Score?

With a score of 477, understanding the elements influencing your credit can be instrumental to shaping your financial health and progress. Each financial path is different, filled with distinct opportunities for advancement and knowledge.

Payment Performance

Payment behavior greatly affects your credit score. If there are cases of overdue payments or non-payments, they're likely contributing to your current score.

How to Check: Scan your credit report for any overdue or missed payments. Reflect on any periods where your payments may not have been punctual.

Credit Use Ratio

An elevated credit use ratio can deteriorate your score. If your credit balances are approaching their limits, this might be a contributing element.

How to Check: Look over your credit card statements. Are the amounts owed nearing the limits? Keeping balances low relative to the limit can be advantageous.

Credit History Duration

A less extended credit history might have a negative impact on your score.

How to Check: Scrutinize your credit report to gauge the age of your newest and oldest accounts along with the average age of all your accounts. Reflect on whether you've recently initiated new accounts.

Credit Diversity and Recency

Boasting a diverse array of credit types and managing new credit conscientiously are imperative for a commendable score.

How to Check: Assess the variety in your credit accounts, comprising credit cards, retail accounts, installment loans, and mortgage loans. Consider whether you're applying for new credit judiciously.

Public Records

Public filings like insolvencies or tax liens can wield a powerful influence on your score.

How to Check: Look over your credit report for any public filings. Address any entries that require resolution.

How Do I Improve my 477 Credit Score?

Having a credit score of 477 is quite challenging, but it’s not the end of the road. There are focussed actions you can take to start elevating your score.

1. Rectify Credit Report Errors

Begin by obtaining a copy of your credit report and meticulously checking it for any discrepancies or errors. Even the smallest error can negatively affect your credit score. Contact the relevant credit bureaus to correct any inaccuracies found.

2. Take Control of Outstanding Debts

Dealing with debts – specifically, those passed to collections – should be next. Start by organizing them based on their sizes and create a payment plan that gives priority to the highest debts. Keep in mind, it’s important to maintain the minimum payments on your other accounts.

3. Seek a Secured Credit Card

Considering your present credit score, a secured credit card might be your best option. Procure one and handle it responsibly, it can help emphasize a good payment habit. Build a history of prompt monthly repayments to steadily upgrade your credit score.

4. Promotion of Credit Diversity

A mixture of different credit types can boost your credit score healthily. Start by using a secured card responsibly, then move on to manageable credit types such as a credit builder loan.

5. Maintain Low Credit Utilization

Keeping your credit utilization low – ideally below 30% of your total credit limit – can greatly benefit your score. Consistently pay more than the minimum payment each month to gradually decrease your balance.