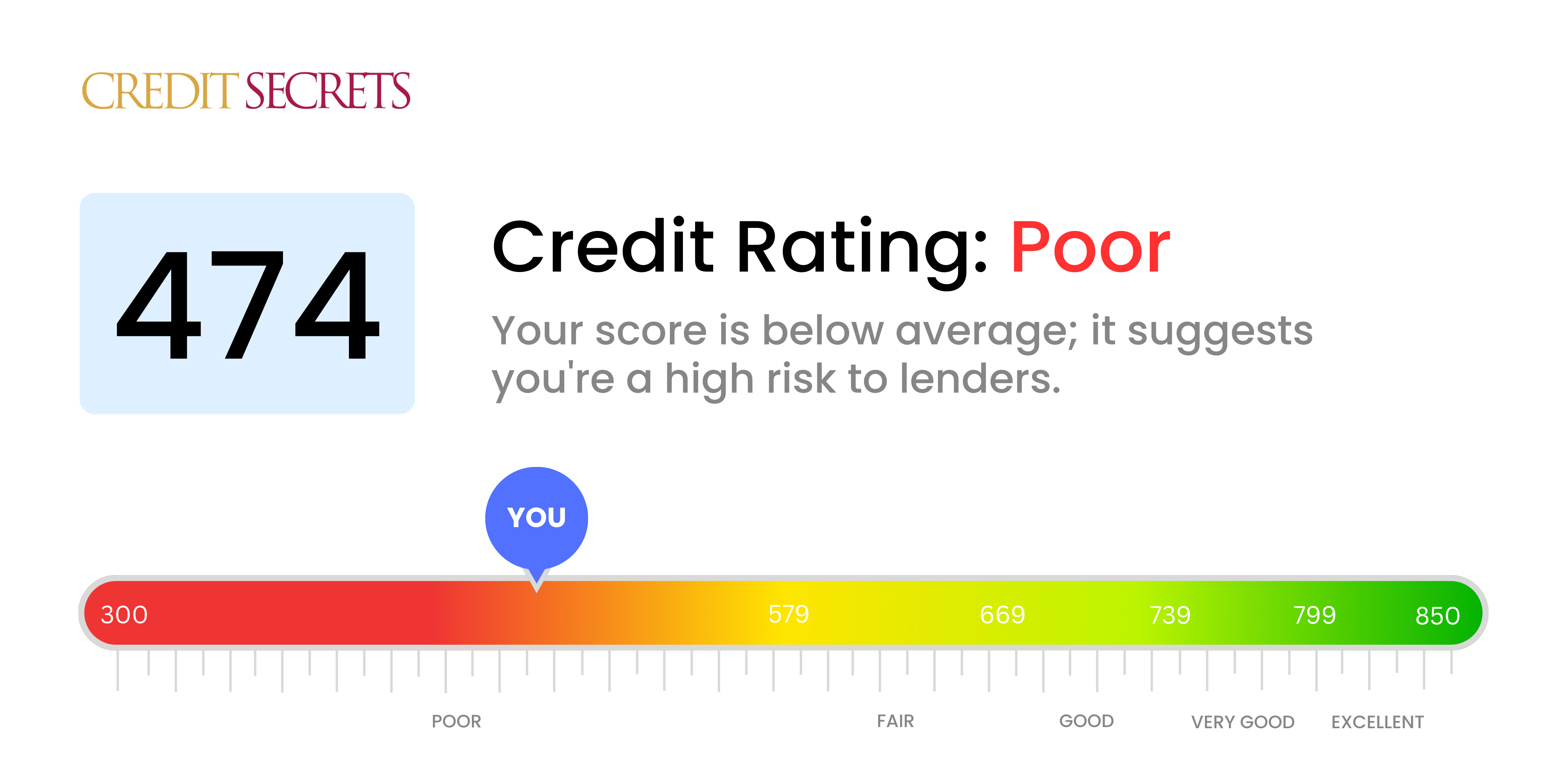

Is 474 a good credit score?

With a credit score of 474, you're firmly in the "poor" range. This isn't an ideal place to be, as it can make getting approvals for loans or credit cards challenging. However, this isn't a life sentence - with the right steps, you can start improving your credit.

Being in the "poor" range can mean higher interest rates and less favorable terms when you do get credit. But don't lose heart - every journey begins with a single step. With discipline, patience, and the right financial behaviors, you can begin to see your score climb towards the "fair" and beyond.

Can I Get a Mortgage with a 474 Credit Score?

Carrying a credit score of 474 indeed puts one in a challenging situation when it comes to securing a mortgage. Lenders typically ask for higher scores as a sign of trustworthiness in repaying loans. A score in the 474 range often indicates that there may be some financial setbacks in your history, such as late bill payments, defaults, or even bankruptcy.

However, it's vital to remember that while the situation may seem dire, it's not a permanent place. You have the power to improve your situation starting today. Credit scores can be improved over time. This might mean paying off overdue debts, setting up payment plans, or ensuring all future bills are paid on time. Moreover, you might want to explore alternatives such as seeking out lenders who cater to individuals with lower credit scores or considering government-backed loans which may have more lenient credit requirements. Yes, interest rates might be higher, but with disciplined repayments, you can enhance your credit standing, making it easier to refinance to a better rate in the future.

Can I Get a Credit Card with a 474 Credit Score?

With a credit score of 474, it's likely to be tough to receive approval for a traditional credit card. This number often gives lenders pause, as it suggests a history of financial hardship or difficulty staying on top of payments. This can feel tough to face, but honesty about the situation is the first stride on the road toward financial recovery.

Considering this dilemma, alternatives such as secured credit cards could be the right choice for you. These types of cards require a deposit equal to your credit limit, making them easier to access. Aside from secured credit cards, enlisting a willing co-signer or using pre-paid debit cards are options to think about. It's crucial to remember, these alternatives are not quick fixes. However, they provide a viable path towards ultimately increasing your credit score. One thing to keep in mind is that any form of credit that's available to you at this point will likely come with higher interest rates due to the lender's perceived risk.

Having a credit score of 474 indeed poses some difficulties when it comes to obtaining a traditional personal loan. Banks and other lenders tend to see this as a high-risk score, making approval for standard loans more challenging. It can be a tough situation, but acknowledging the reality of what this credit score means for your borrowing options is a crucial step.

While traditional personal loans may not be easily accessible, alternative options are worth considering. Secured loans, where you back the loan with assets, or co-signed loans, where someone with a higher credit score acts as your guarantor, are possible choices. Platforms providing peer-to-peer lending could also offer a viable opportunity, as they often have more relaxed credit score requirements. However, bear in mind that these alternatives typically come with higher interest rates and less advantageous conditions due to the increased level of risk perceived by the lender.

Can I Get a Car Loan with a 474 Credit Score?

If your credit score is 474, getting approved for a car loan might feel like an uphill battle. But know that it's not an impossible task. Car loan providers generally prefer borrowers with a score above 660 because it indicates a lesser risk. Your credit score, being below 600, puts you in what is often seen as the subprime category. This might mean higher interest rates or, in some instances, a denial of your loan application. Your credit history suggests to lenders that there might be challenges in receiving their loan repayments on time.

Even with a credit score of 474, all hope is not lost. Some lenders specialize in dealing with people who have lower credit scores. However, be aware that loans from these sources can come with hefty interest rates as a means for them to shield themselves from loan repayment risks. So, tread lightly and examine the loan conditions closely. With a combination of patience, caution, and diligence, owning a car can still be a reality despite the temporary hurdles.

What Factors Most Impact a 474 Credit Score?

Understanding your credit score of 474 is the first step in improving your financial health. The most impactful factors contributing to this score predominantly include payment history, credit utilization, length of your credit history, the diversity of your credit accounts, and the existence of any public records.

Payment History

Regularly making late payments or defaulting on loans can dramatically affect your credit score - it is possibly a key factor for your current score.

How to Check: Check your credit reports for any late or missed payments. Think back on instances where you might have delayed payments, as these will impact your score.

Credit Utilization

Your credit utilization ratio might be quite high, implying your credit balances are almost up to their limits - this negatively influences your score.

How to Check: Look into your credit card statements. Are your balances regularly close to or at the limit? Aim to maintain lower balances in relation to your limits.

Length of Credit History

Your credit history might be relatively short, negatively affecting your score.

How to Check: Review your credit reports for the age of your earliest and latest accounts, as well as the overall average age of all your accounts. Consider if you've recently opened new accounts.

Credit Mix and New Credit

Possessing a diverse range of credit types and responsibly managing new credit are crucial for maintaining a good credit score.

How to Check: Evaluate the variety of your credit accounts. Have you been applying for new credit slowly and responsibly?

Public Records

Public records, such as bankruptcies or tax liens, can significantly harm your credit score.

How to Check: Scrutinize your credit reports for any public records. Devise a plan to resolve any listed items that need attention.

How Do I Improve my 474 Credit Score?

A credit score of 474 falls into the poor range, but don’t be disheartened; it’s never too late to work towards better financial health. Here are immediate and effective courses of action suitable for your current credit situation:

1. Settle Unpaid Debts

Unresolved liabilities carry the most negative weight on your credit score. Pay off any delinquent debts promptly. If it’s too hefty, contact your creditors to negotiate a feasible repayment plan that can allow you to start gradually clearing your debts.

2. Lower Credit Card Utilization

High balances on your credit cards can substantially affect your score. Strive to maintain your credit utilization below 30% of your credit limit. If possible, aim to eventually keep it under 10%. Start with paying down cards with the top utilization rates.

3. Consider a Secured Credit Card

Your credit score may limit your access to traditional credit cards. An alternative is a secured card, backed by a deposit that you provide and is equivalent to your credit limit. Make small, regular purchases, paying the complete balance monthly to cultivate a positive transaction history.

4. Leverage as an Authorized User

Have a conversation with a trusted person who has a good credit history, about adding you as an authorized user on their credit card. This can boost your score via their well-established credit behavior, provided the card issuer reports authorized user activities to the credit bureaus.

5. Enhance Your Credit Portfolio

Once you’ve exhibited consistent payment with your secured card, consider diversifying your credit spectrum. Look into other types like a credit builder loan, student loan, and manage them with care to improve your credit score.