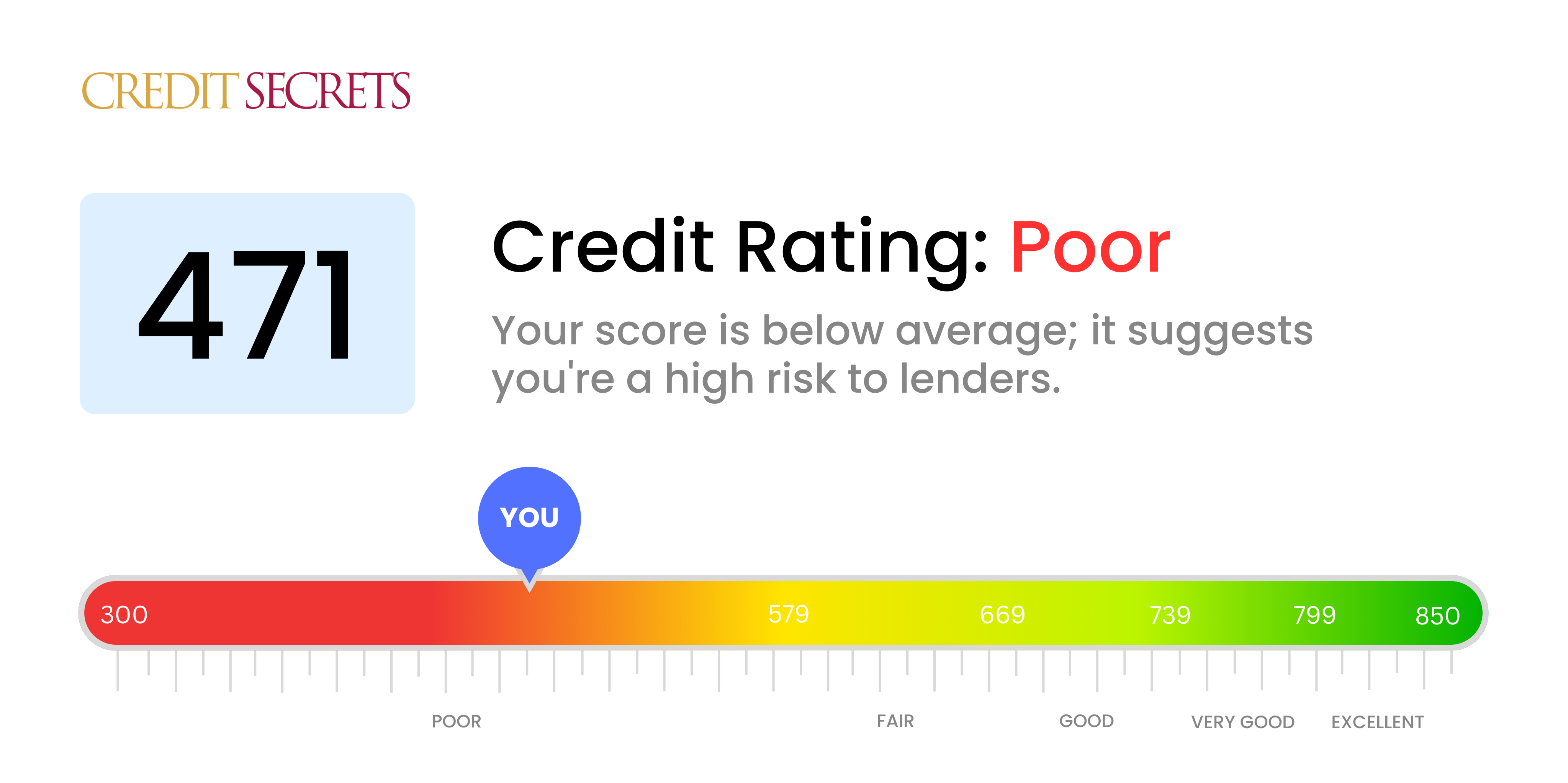

Is 471 a good credit score?

A credit score of 471 unfortunately falls into the 'poor' category. This doesn't mean you should lose hope - everyone has the ability to improve their credit score over time.

With a score of 471, it may be currently difficult to get approved for new credit, and if you are approved, the terms likely won't be as favorable as they would be with a higher score. That said, the potential to improve is always there. Start by making timely payments, reducing your debt load, and avoiding new debt where possible. Moving forward, make sure to check your credit report regularly and correct any errors that might be bringing your score down. Don't be discouraged, with persistence and the right decisions, you can positively influence your credit score.

Can I Get a Mortgage with a 471 Credit Score?

If you're currently dealing with a credit score of 471, securing a mortgage is likely going to be a difficult journey. Lenders often look for a higher number indicating a pattern of responsible financial behavior. A credit score of 471 often indicates past financial issues, which can make lenders hesitant to offer a mortgage due to perceived risk.

While this news might be tough to hear, keep in mind there are indeed other paths for homeownership. One such option could be looking into federal housing programs, such as those offered by the Federal Housing Administration (FHA). These programs are designed to help individuals with lower credit scores become homeowners. Alternatively, you might consider a co-signer on your loan, which could provide lenders with the assurance they need to approve your mortgage. Your interest rate might be high, reflecting the risk associated with lower credit scores, but it's important to remember that every step brings you closer to your goal of homeownership. Keep pushing, remain patient, and stay focused.

Can I Get a Credit Card with a 471 Credit Score?

With a credit score of 471, securing approval for a conventional credit card might prove to be a challenge. This score is typically seen as risky by lenders, indicating past financial strain or mishandling. It's understandably upsetting to be in this situation, but it's crucial to face it with honesty and a desire for improvement. Realizing and accepting your credit status is the initial stride towards a brighter financial future.

Given the challenge of securing credit with a low score, one could consider alternatives such as secured credit cards. These cards require a security deposit that becomes your credit limit. This type of card can be easier to obtain and can assist in gradually rebuilding your credit. Moreover, contemplating having a co-signer or exploring the idea of pre-paid debit cards could provide other possible solutions. While these options won't provide an immediate turnaround, they serve as essential tools in your pursuit of financial equilibrium. It's important to remember that any credit options that might be available with this score will often entail higher interest rates. These rates mirror the heightened risk perceived by lenders.

With a credit score of 471, obtaining a traditional personal loan may pose a significant hurdle. This score is viewed by most lenders as indicative of high risk, making it less likely that you would be accepted for the loan you need. This may feel daunting, but it's important to face the reality of your financial situation—addressing this concern is the first step toward financial progress.

That being said, there are other financial avenues you could explore. Secured loans—which are protected by collateral—or co-signed loans, where you have the assurance of another individual with a better credit score, could be feasible alternatives. Peer-to-peer lending platforms could also be a consideration as they can sometimes have more flexible credit score requirements. However, please be aware that these alternatives tend to carry higher interest rates and less favorable loan agreements—this is because lenders need to balance out the greater risk they are taking on.

Can I Get a Car Loan with a 471 Credit Score?

Having a credit score of 471 can make it tough to secure approval for a car loan. Most lenders are more comfortable granting loans to individuals with scores above 660, and often view scores below 600 as subprime. Your score of 471 falls into this lower range, possibly resulting in a higher interest rate or even denial of your loan application. This is because lenders regard lower credit scores as indicative of greater risk, on the basis that your past credit behaviour suggests you might have difficulty repaying debts.

That said, your credit score of 471 doesn't completely eliminate the chance of getting a car loan. Some lenders cater to people with lower credit scores. However, beware, as these loans can carry significantly higher interest rates. The amplified rates reflect lenders' perception of risk - a method of protecting their investment. Although securing a car loan might take some determined efforts, with careful evaluation and a detailed look at the terms, it's still entirely possible. Remember, a low score doesn't mean a locked door.

What Factors Most Impact a 471 Credit Score?

A score of 471 indicates the need for financial improvement. Let's take a closer look at the factors most likely contributing to this score.

Delinquent Accounts

Your score suggests past due amounts. These are adverse indicators on payment history which reflect heavily on your credit score.

To Check: Carefully analyze your credit report for delinquent accounts, late payments or any collections.

Credit Card Utilization

A high credit card utilization ratio could be another contributing factor. The proportion of your credit card balances to your credit limits is significant.

To Check: Evaluate your credit card statements. If your credit use is high, consider ways to pay down your balances.

Credit History

A shorter credit history might be a reason for your score. Length and recently opened accounts are important for a healthy score.

To Check: Examine your credit report for the duration of your credit history, existence of any new accounts might have influenced your score.

Credit Type Diversity

Lack of diverse types of credit can affect your score negatively.

To Check: Review your credit report, consider if you have a sufficient mix of credit like credit cards, installment loans, and mortgage loans.

Derogatory Public Records

If you have derogatory public records such as bankruptcies, foreclosures, or tax liens, these can significantly lower your score.

To Check: Thoroughly review your credit report for any public records, and address them promptly if possible.

How Do I Improve my 471 Credit Score?

With a credit score of 471, you’re in need of direct measures to elevate your financial standing. Here are the most practical and influential steps you can take:

1. Check Your Credit Report

Firstly, get a hold of your credit report and check for any inaccuracies. You can dispute any errors you find with the respective credit bureau.

2. Tackle Outstanding Balances

Any payments you have missed or that are late need to be addressed promptly. Start by settling the most overdue balances, as these typically harm your credit score the most. Be proactive and arrange a viable payment plan with your creditors if needed.

3. Apply for a Secured Credit Card

Qualifying for a regular credit card may be difficult with your current credit situation. A secured credit card can offer a powerful tool for building a positive credit history. Ensure you use it wisely, generating only small expenses and paying the complete balance each month.

4. Request to be an Authorized User

You can ask a trusted person with superior credit to add you as an authorized user for one of their credit cards. Make sure the credit card company reports the accounts of authorized users to credit bureaus. This strategy helps to elevate your credit score with their timely and responsible credit activity.

5. Gradually Diversify Your Credit

Once you’ve solidified positive payment behaviors, you can consider cautiously broadening the types of credit you use, such as a credit builder loan or a department store card. Handle these accounts prudently to aid your credit score recovery.