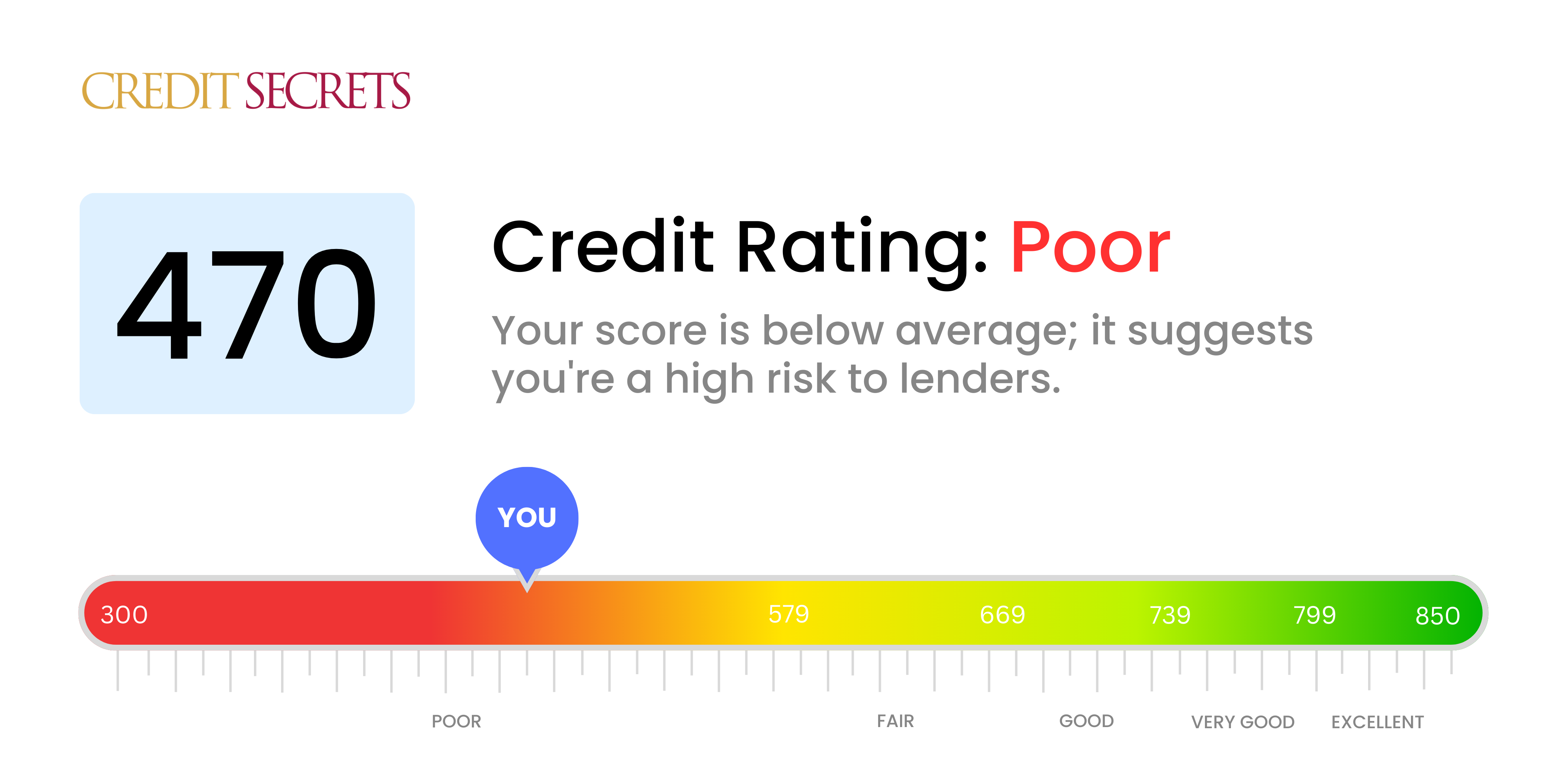

Is 470 a good credit score?

With a credit score of 470, unfortunately, your credit is considered poor. However, it's important to remember that your situation is not hopeless and improvements can be made with time and effort.

Having a score in this range may make it difficult to get approved for loans or credit cards as you're seen as quite a high risk to lenders. If you are approved, it's likely that you'll face higher interest rates and less favorable terms. However, rest assured that your score isn't fixed and can change over time if you prove yourself responsible with credit. Improving your score to a better credit range may open up more financial opportunities in the future.

Can I Get a Mortgage with a 470 Credit Score?

With a credit score of 470, obtaining a mortgage might prove to be a challenge. This score is significantly below the typical threshold most lenders look for, and it suggests a record of financial hiccups, such as late payments or outstanding debts.

Although this situation might feel daunting, know that there are alternative paths to consider. An option could be seeking out a lender who offers loans to people with low credit scores, but keep in mind that these loans often come with high interest rates. Another approach could be to wait and work on boosting your credit score by ensuring you pay all your bills on time, and balances are kept low compared to your credit limit. Progress can be slow, but each small step brings you closer to your goal of owning a home.

Can I Get a Credit Card with a 470 Credit Score?

With a credit score of 470, obtaining a traditional credit card may be a difficult task. This lower credit score is often perceived by lenders as risky, signifying previous financial troubles or mishandling of funds. It might feel disheartening, yet the knowledge of your credit status is crucial, providing valuable insight and a starting point to regain financial health.

Given these circumstances, you might want to consider alternatives such as a secured credit card. These cards necessitate a deposit that then becomes your credit limit, making them somewhat easier to acquire. Additionally, you might want to think about finding a co-signer or using pre-paid debit cards. Bear in mind that these options don't instantaneously remedy the situation, but they're part of a strategic process towards financial stability. Also, remember that any credit available for a score like 470 will undoubtedly come with higher interest rates, reflecting the increased level of risk for the lender.

A credit score of 470 is considerably below the average lending threshold, and it signals a high-risk profile in the eyes of traditional lenders. Unfortunately, this score might significantly impede your chances of securing a personal loan through conventional means. It's not the news anyone wants to hear, but it's essential to have a clear grasp of your borrowing limitations with this particular credit score.

But don't lose heart. Other lending avenues still exist even with a low credit score. You could consider a secured loan where you put up collateral, or a co-signed loan where someone with a solid credit history vouches for you. Peer-to-peer lending platforms might also offer a solution, as some of these platforms have more flexible credit requirements. Remember though, these alternatives may have higher interest rates and tougher terms to balance out the risk to the lender.

Can I Get a Car Loan with a 470 Credit Score?

If you have a credit score of 470, obtaining a car loan might be a tough road. Ideally, lenders look for credit scores above 660 for favorable loan conditions. Any score below 600 often falls into the subprime category, and 470, unfortunately, aligns with this category. Due to this, you may face high interest rates or even loan rejection. This situation arises because lenders perceive a low credit score as a high risk, suggesting that you might struggle with making payments on borrowed money.

But don't lose hope, with a credit score of 470, there are still potential pathways to secure a car loan. Be warned, however, that interest rates may be higher due to the increased perceived risk on the part of lenders. Make sure to thoroughly assess all loan terms and conditions before proceeding. With due diligence and a keen eye on fine print, a car loan is not entirely off the table.

What Factors Most Impact a 470 Credit Score?

Navigating your path towards financial wellness is easier when you understand a credit score of 470. There could be several reasons your score is impacted, but stay optimistic - each step can bring progress.

Late Payments

Your score could be impacted by late payments or defaults on loans or credit cards.

How To Investigate: Check your credit report for any missed payments. This could include anything from credit cards to utilities. Reflect on past transactions, as delayed payments might have impacted your score.

Over-Utilized Credit

Excessive utilization of your credit limit can negatively impact your score. A critical factor might be a high balance on your credit card(s).

How To Investigate: Look over your credit card statements. If you're nearing your spending limit, it could be affecting your score. Strive to keep balances low.

Short Credit History

A short credit history can cause lower scores.

How To Investigate: Check your credit report. Note the age of your oldest and newest accounts along with the average age. Recent account openings can affect your score.

Over-Extension of Credit

Often applying for new credit or having several types of loans can influence your score.

How To Investigate: Verify your mix of credit accounts. If you’ve been seeking more credit too frequently, this could negatively affect your score.

Public Records

Public records such as bankruptcies, collections, or tax liens can substantially impact your score.

How To Investigate: Audit your credit report for any public records. If listed, connect with the necessary entities to resolve.

How Do I Improve my 470 Credit Score?

With a credit score of 470, significant work is required, but the journey to improving your financial standing is absolutely possible. Here are tangible and viable actions suited to your situation:

1. Clear Off Collection Accounts

Having debts in collections can severely damage your credit score. Contact the debt collectors and establish a repayment plan. In some cases, you might even be able to negotiate down the amount you owe. Getting these debts cleared should be a top priority.

2. Use a Secured Credit Card Responsibly

Acquiring a regular credit card may be difficult with your present score. A secured credit card, where a refundable deposit is made up front, could be a good alternative. Ensure you keep your utilization low and clear the balance monthly to establish a pattern of responsible credit usage.

3. Set Up Payment Reminders

Late or missed payments can significantly impact your credit score. Use online calendars or banking apps to remind you when payments are due to ensure timely payments, contributing towards a better payment history.

4. Limit Your Credit Applications

Each new credit application can potentially reduce your credit score. So, try to minimize credit applications until your score is healthier.

5. Check For Credit Report Errors

Errors on credit reports can happen, and they could be hurting your score. Keep a routine of regularly checking your credit reports from the three major bureaus for any inaccuracies, and dispute any you find immediately.