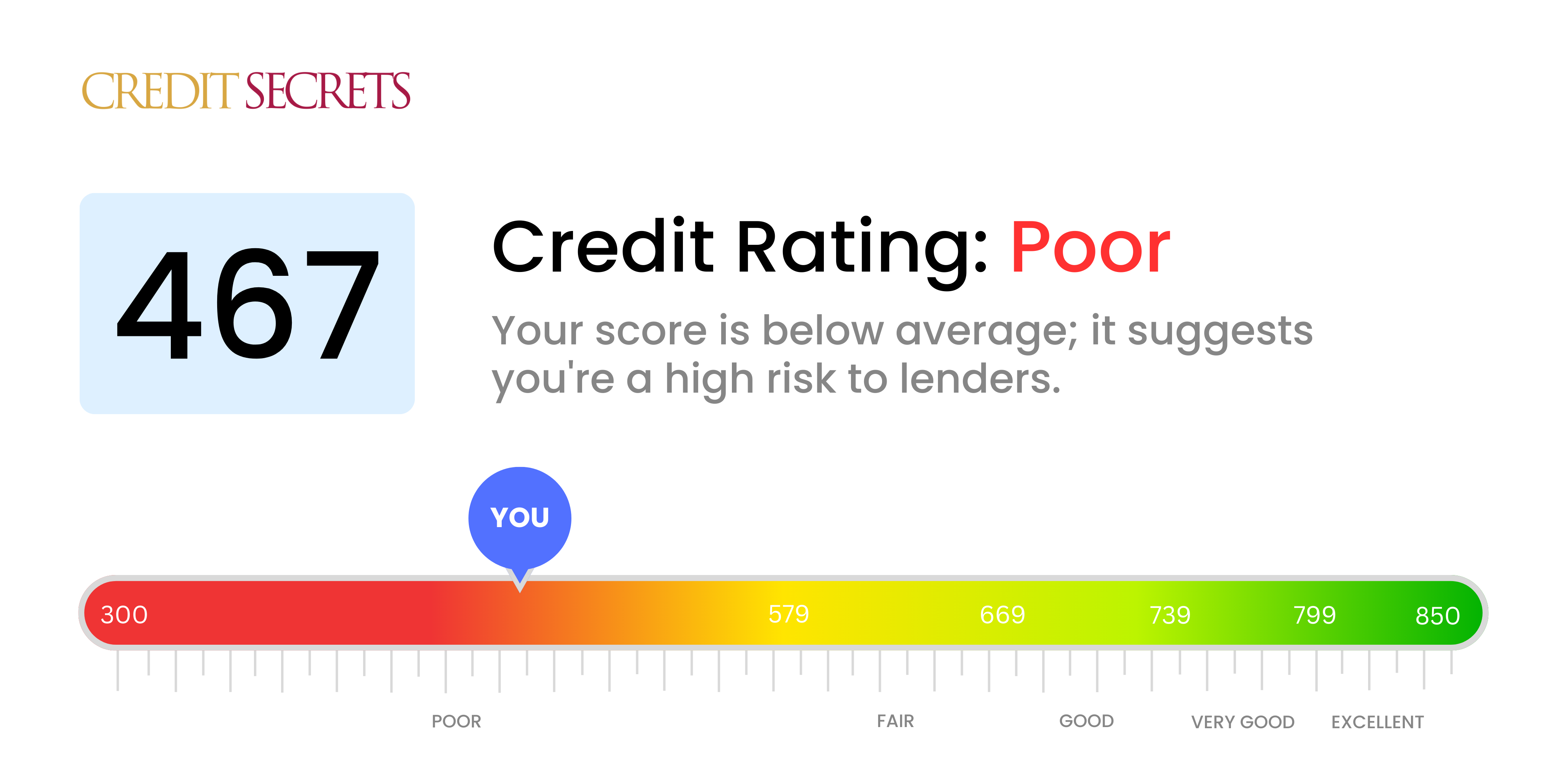

Is 467 a good credit score?

A credit score of 467 is unfortunately in the "Poor" range. This means that you may find it quite challenging to obtain new credit or loan approvals, and if you are approved, you'll likely face higher interest rates and less favorable terms.

However, remember that a low credit score is not permanent. There are many strategies you can implement, such as ensuring timely repayment of debts, maintaining low balance on credit cards, and avoiding unnecessary hard inquiries on your credit report, to help improve your credit score over time. Stay positive, consistent and proactive towards improving your financial health.

Can I Get a Mortgage with a 467 Credit Score?

With a credit score of 467, obtaining a mortgage approval will likely prove challenging. This score is significantly below the requirement set by most mortgage lenders who generally prefer applicants. Such low credit score often reflects past financial struggles, which implies potential risk for lenders.

Don't be disheartened, options do exist. Secure credit cards and small personal loans for people with poor credit can be pathways to gradually restoring your credit health. Paying these consistently and in full can build a stronger payment history which is vital in improving your score. Consider saving a significant down payment - while this doesn’t directly influence your credit score, it could make you a more attractive candidate for a mortgage. Rehabilitation programs for credit scores also exist, and while they take time, they could be a helpful resource for you. Remember, improving a credit score is a journey that takes commitment, but every step brings you closer to your financial goals.

Can I Get a Credit Card with a 467 Credit Score?

With a credit score of 467, it is quite difficult to receive approval for a standard credit card. This score is seen as a high risk by lenders, hinting at a past filled with financial hardships or mistakes. While this fact may seem discouraging, it's crucial to approach the situation with realism and understanding. Being aware of your credit dilemma is the initial move towards financial recovery, even if it involves acknowledging some hard truths.

Given this credit score, alternative options such as secured credit cards could be a way forward. These cards need a deposit, which essentially becomes your credit limit. They are more accessible and can help in rebuilding your score gradually. Another option could be getting a co-signer or considering pre-paid debit cards. Remember that these options don’t offer an immediate fix, but can aid in your journey towards financial solidity. Keep in mind that any form of credit accessible at such a score level often comes with higher interest rates, mirroring the increased risk perceived by lenders.

With a credit score of 453, it's quite challenging to receive approval for a personal loan from most traditional lenders. Considering this score as a high-risk factor, lenders hesitate to offer loans. The reality of your credit score may be difficult to accept, but understanding it is the foundation for exploring alternative options.

Should conventional loan options not be available for you, don't lose hope. Other viable choices like secured loans, co-signed loans, or peer-to-peer lending platforms might be worth considering. In a secured loan, you provide collateral to back up the loan. A co-signer with a strong credit score can vouch for you in a co-signed loan. Peer-to-peer lending platforms can be more flexible with credit score requirements. However, remember these options typically involve higher interest rates and stringent terms due to the increased risk. This is just a reality of the lending landscape when dealing with low credit scores.

Can I Get a Car Loan with a 467 Credit Score?

With a credit score of 467, the likelihood of being approved for a car loan might present some hurdles. Most lenders typically seek credit scores above 660 to offer their most favorable terms. Unfortunately, a score of 467 is below this threshold and is generally considered to be in the subprime category. What does this mean? Essentially, it suggests to lenders that there is a higher risk associated with approving a loan due to past credit history, which can indicate difficulties with repayment.

Yet remember, every cloud has a silver lining. Having a lower credit score doesn't mean buying a car is out of reach. There are lenders who specialize in navigating these credit challenges, although this often means dealing with higher interest rates. These elevated rates are linked to the higher perceived risk that lenders undertake with below average credit scores, which serves as their way to protect their investment. Please be careful and ensure you understand the loan terms. Despite the challenges, securing a car loan is entirely possible, with careful planning and thought.

What Factors Most Impact a 467 Credit Score?

Underlining the factors leading to a credit score of 467 is integral to empowering you towards financial progress. Every step on this journey is an opportunity to improve, ultimately leading to a stable financial life.

Payment History

Consistent and timely payments significantly influence your credit score. Late payments or defaults could be largely responsible for your current score.

How to Check: Scrutinize your credit report for any missed payments or defaults. Retrospect on past payment difficulties that could potentially have contributed to your score.

Credit Utilization Rate

High credit utilization could be having an adverse effect on your score. Maxing out your credit card limits is a likely explanation.

How to Check: Inspect your credit statements. Are you reaching or surpassing the limits? Strive to maintain low balances relative to your credit limit.

Length of Credit History

Short credit history can negatively affect your score. This could be a significant factor if you've had credit for only a short time.

How to Check: Check your credit report to gauge the duration of your oldest and newest accounts, as well as the mean age of all your accounts. Also, consider whether you've opened new accounts lately.

Diversity of Credit and New Credit

An assortment of credit types and handling of new credit is a vital aspect of maintaining a good score.

How to Check: Assess your variety of credit accounts, including credit cards, retail accounts, installment loans, and mortgage loans. Also, consider how much new credit you've recently applied for.

Public Records

Public records such as bankruptcies or tax liens can have significant effects on your score.

How to Check: Inspect your credit report for any public records. Address any unresolved items that come up as necessary.

How Do I Improve my 467 Credit Score?

With a credit score of 467, you’re definitely facing some challenges, but don’t lose hope. Here are the most effective steps suitable for your current financial situation to start rebuilding your credit:

1. Attend to Delinquent Accounts

Delinquent accounts likely exist at this score level. Tackling these overdue debts should be your immediate focus. Getting these accounts up to date can provide a swift boost to your credit score. Make arrangements with your lenders to devise a feasible payment plan, if required.

2. Minimize Credit Utilization

At this juncture, any outstanding credit card debts are likely eating into your credit score. Strive to bring your balances down to less than 30% of your total credit limit. Over time, aim to maintain them under 10%. Begin by paying off the cards with the highest relative balances first.

3. Consider a Secured Credit Card

With a score of 467, getting approved for a traditional credit card may be hard. A secured card, which requires a cash deposit that serves as your credit limit, can be a beneficial step. Use it wisely – make modest purchases and settle the balance each month to demonstrate a consistent payment history.

4. Request to Become an Authorized User

With permission from a trusted friend or family member with solid credit, becoming an authorized user on their credit card can boost your score. Make sure the card company reports authorized users’ activities to the credit bureaus.

5. Broaden Your Credit Portfolio

Diversifying your range of active credit accounts can have a positive effect on your score. After you’ve demonstrated responsible payment behavior with a secured card, look into further credit options like a credit-builder loan or store credit card, and manage them responsibly.