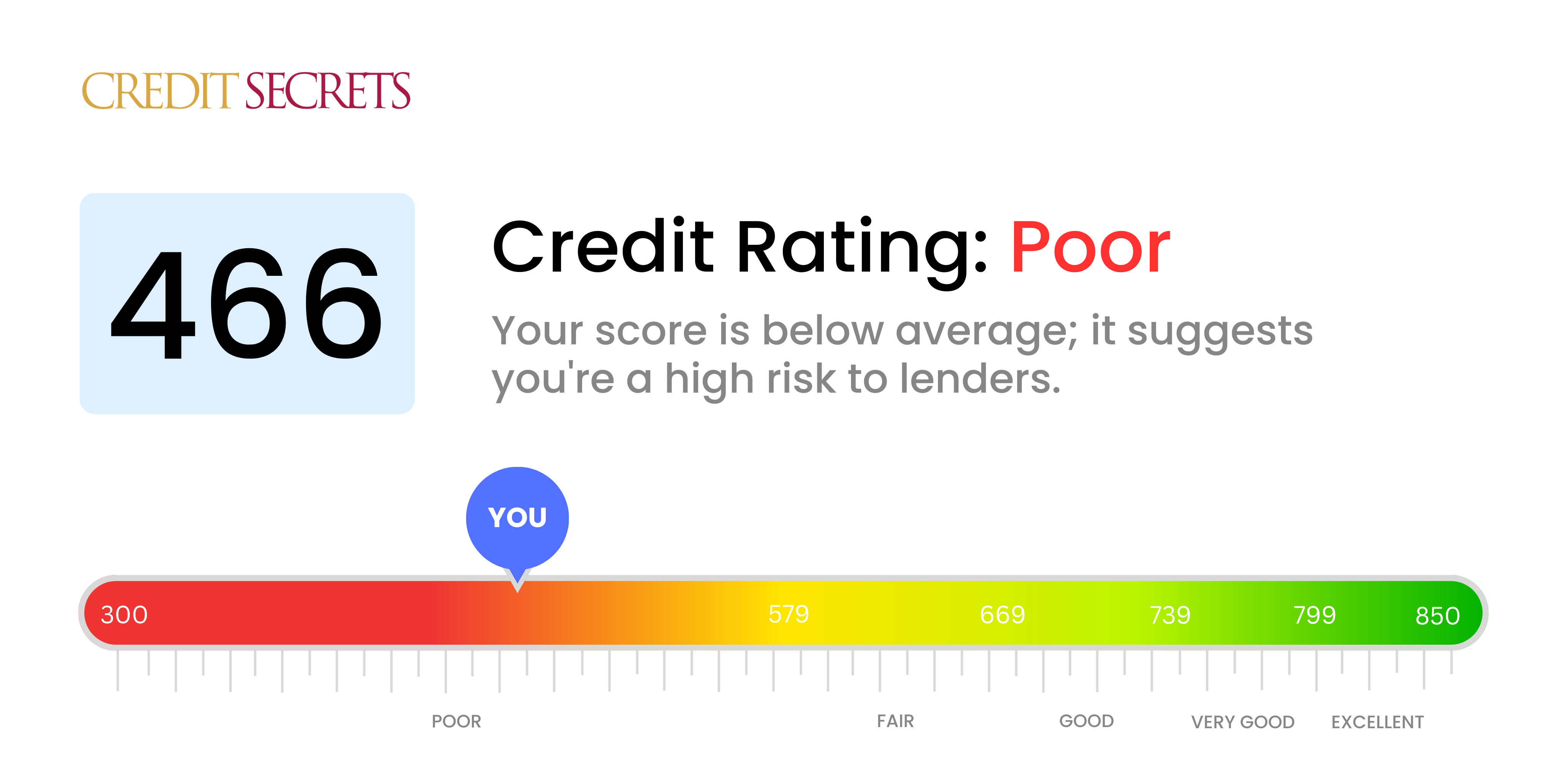

Is 466 a good credit score?

A credit score of 466 is classified as poor according to standard credit score ranges, but it doesn't have to stay that way. Creditors and lenders will likely view you as a high risk, which might make it challenging to get new credit lines, loans, or obtain favorable interest rates.

However, remember that credit scores are not permanent and can be improved over time. Through steady efforts, such as paying your bills promptly, reducing debts, and consistently reviewing your credit report for errors, you can start the journey of improving your credit score. It won't happen overnight, but every positive step brings you closer to your financial goals. Be patient, be consistent, and believe in your capacity to change your financial future.

Can I Get a Mortgage with a 466 Credit Score?

With a credit score of 466, unfortunately, your prospects for mortgage approval are quite slim. This score is significantly lower than the standard requirement for most lenders and may reflect past financial hardships such as overdue payments or other defaults. It's essential to understand that while this might be a challenging situation, there's always room for improvement.

The good news is there are alternatives available. You may want to consider a loan backed by the Federal Housing Administration, as they have more relaxed credit requirements. Alternatively, a co-signer with better credit can also improve your chances. While these are not ideal solutions, they can be initial stepping stones as you work to raise your credit score. Higher interest rates and more stringent loan terms are common with lower credit scores, so improving your score can open up more favorable offerings in the future. The journey may be long, but every step brings you closer to your financial goals.

Can I Get a Credit Card with a 466 Credit Score?

When faced with a credit score of 466, you may find securing a traditional credit card a hefty challenge. To creditors, a score like this often indicates high-risk lending, potentially reflecting past financial mishaps or mismanagement. Confronting this reality may be a tough pill to swallow, but recognizing the state of your credit is a pivotal initial stride towards financial improvement.

Given the roadblocks associated with such a low score, considering alternatives may be the most effective solution. Options such as secured credit cards could be more feasible to attain as these require a deposit equal to your credit limit. These cards can contribute to the rebuilding of your credit over time. Other alternatives might include thinking about involving a co-signer or possibly utilizing pre-paid debit cards. While these pathways don't provide an immediate remedy, they serve as stepping stones towards attaining a stronger financial standing. One thing to note, credit options accessible to those with lower scores tend to carry higher interest rates due to the increased risk perceived by lenders.

With a credit score of 466, it's quite unlikely for you to get approved for a personal loan. Traditional lenders tend to view a score like this as a risky proposition that is indicative of potential future repayment issues. It's a tough pill to swallow, but facing the truth of what your current credit score means for your borrowing potential is crucial.

Yet, don't lose hope. You may need to explore different avenues, like secured loans or peer-to-peer lending platforms. Secured loans require collateral, something of value you offer up to the lender if you can't repay the loan. Co-signed loans involve someone with a higher credit score venturing to support you. Lastly, peer-to-peer lending, driven by regular individuals willing to lend to others, may have less stringent credit score stipulations. But remember, they usually come with increased interest rates and less favorable terms due to the higher risk assumed by the lender.

Can I Get a Car Loan with a 466 Credit Score?

Having a credit score of 466 can make obtaining a car loan difficult. Most lenders prefer approving loans for those with credit scores above 660, as scores under 600 are typically seen as subprime. Unfortunately, your 466 credit score falls into this lower tier category. This score might result in hefty interest rates or even loan denial because lenders see it as a sign of higher risk based on previous repayment patterns.

Nonetheless, the current score doesn’t spell the end for your car buying goals. There are lenders who work primarily with individuals having lower credit scores. Be mindful though, the interest rates they offer may be steeper. Lenders charge higher interest rates to mitigate their risk when lending to individuals with lower credit scores. Although it might make the journey trickier, with careful examination of the loan terms, procuring a car loan can still be possible. Worry not, and take a determined step forward towards achieving your dream.

What Factors Most Impact a 466 Credit Score?

Understanding a Score of 466

A deeper look into your credit score of 466 can help clarify the specific factors impacting your score and how to work on improving it. Recall, each financial journey is personal and a chance for financial growth and development.

Deliqnquent Payments

Your payment history highly influences your credit score. Late or missed payments could be a major factor lowering your score.

Verification Method: Check your credit report for any delinquent payments. Ponder over periods of financial difficulty, as these could coincide with the missed payments that have dinged your score.

Credit Usage Proportion

Maintaining high balances relative to your available credit — a factor called Credit Utilization — could be dragging down your score.

Verification Method: Go through your recent credit card statements. If your balances are high compared to your credit limit, reducing this ratio could help boost your score.

Short Credit Life

Having a brief credit history can adversely affect your score.

Verification Method: Assess the age of your oldest and newest credit lines by reviewing your credit report. Contemplate if there were any recently opened accounts.

Variety of Credit Types and New Applications

Not having a diverse mix of credit types or applying for new credit frequently can also lower your score.

Verification Method: Investigate the types of credit accounts you currently have, such as credit cards, loans or mortgages. Also, consider your frequency in applying for new credit.

Derogatory Public Records

Public records containing negative information such as bankruptcies or court judgments can drastically lower your score.

Verification Method: Scrutinize your credit report for negative public records. Any listed items that need resolution should be promptly handled for your score’s improvement.

How Do I Improve my 466 Credit Score?

A credit score of 466 is viewed as substandard, but rest assured, it’s not stagnant. Changing this status quo requires focused actions. Here are some achievable strategies tailored for your current credit score:

1. Make Timely Payments

Start transforming your credit score by maintaining timely payments on your existing credit commitments. If you’re challenged with remembering due dates, automate your payments or set reminders. Your payment history is a leading factor impacting your score; thus, consistent and prompt payments are critical.

2. Mitigate Your Debt Load

Work methodically to lower your total debt. A high level of debt relative to your income can harm your score. Create a reasonable budget, cut down discretionary spending, and consistently apply that money towards your debts.

3. Secure Credit Builder Loans

At this credit score level, credit builder loans can be a feasible option. These loans are aimed at building a positive credit history. The loan amount is held in a bank account while you make payments. Timely completion of payments demonstrates responsible credit behavior and enhances your score.

4. Engage Credit Monitoring Services

Take advantage of free credit monitoring services. These help track your credit score changes, providing insight into the effects of your financial decisions on your score and speeding up your credit improvement journey.

5. Limit New Credit Applications

Limit the number of times you apply for new credit. Each new application can reduce your credit score. Show restraint and only apply when necessary. When you do apply, ensure it’s for a credit product suited to your circumstances.