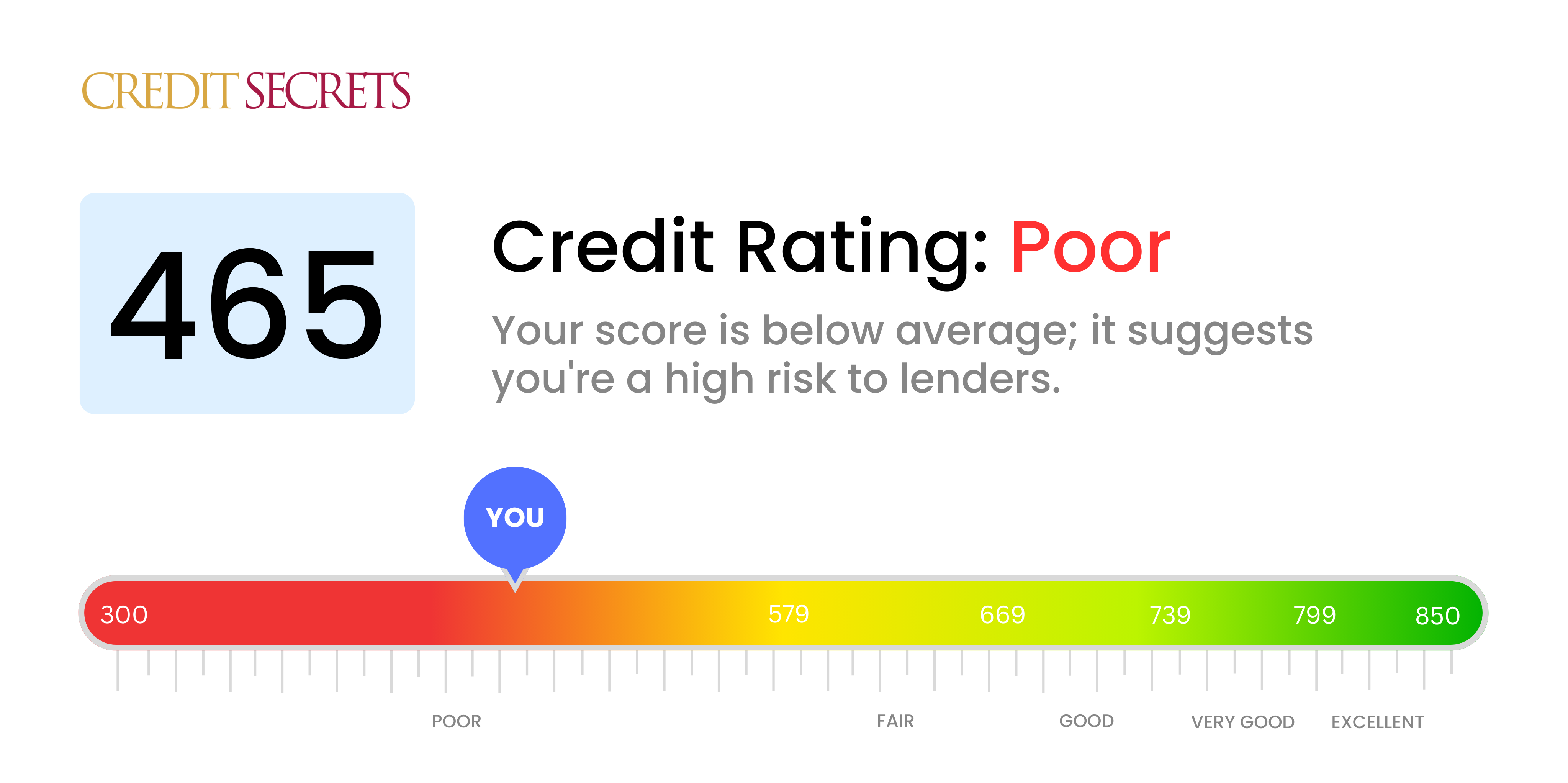

Is 465 a good credit score?

With a credit score of 465, it's clear there are some challenges that need to be addressed as this falls within the 'Poor' range. This understandably might be causing some concern, yet it's important to remember that no financial situation is permanent and there are always steps one can take to improve.

A score of 465 will likely make it difficult to get approval for loans or credit cards, and if approved, the interest rates are generally higher. However, there is no need to lose hope. With determination and the right guidance, it's completely possible to raise your score and work towards your financial goals. Remember, it's not about where you start, but the action you take towards improvement.

Can I Get a Mortgage with a 465 Credit Score?

A credit score of 465 is unfortunately considered to be a poor rating. This score is not typically high enough to meet the minimum requirement of most lenders to qualify for a mortgage. In practical terms, this means it's unlikely for you to get approved for a home loan with such a score. Typically, scores in this range may suggest past financial struggles such as defaulted or consistently late payments.

Even if some lenders are willing to take the risk, the terms might be unfavorable, including high interest rates that could make your home much costlier in the long run. Alternatively, you could consider other options such as HUD's Federal Housing Administration loans or 'bad credit' home loans, but these also come with certain terms and conditions. However, remember that improving your credit score is entirely possible with proper financial behavior and patience. Start by paying off any outstanding debts and make an effort to ensure timely payments in the future to gradually build up your score.

Can I Get a Credit Card with a 465 Credit Score?

If your credit score is sitting at 465, unfortunately, getting approval for a conventional credit card can be a challenging venture. Companies offering such cards may see this score as indicative of a high-risk profile due to prior financial setbacks. This scenario can indeed be disheartening, but it's essential to tackle it with a realistic mindset. Realizing your credit status is the initial step in making progress towards fiscal soundness, even if it means acknowledging somber facts.

At this credit score range, looking into options such as secured credit cards could be considered a good move. These kinds of cards necessitate a deposit which serves as your credit limit, therefore, they may be more accessible and prove instrumental in gradually improving your credit. It may also be worth considering the addition of a co-signer or even investigating pre-paid debit cards as potential alternatives. Do keep in mind, though, that interest rates on any form of borrowing available at this level are typically higher, reflecting the degree of risk lenders associate with this score. Even though these solutions don't promise an immediate improvement, they're valuable tools that can aid in your journey towards regaining financial stability.

Having a credit score of 465 is quite a challenging situation. This score is significantly lower than what lenders typically consider to be desirable. Seeing such a score, lenders may perceive you as a high-risk borrower and may be hesitant to approve a personal loan. It's a tough pill to swallow, but it's crucial to understand what this score means regarding your borrowing prospects.

Even with a low score, there are still some alternatives to traditional personal loans. You might want to look into secured loans, which involve providing collateral. Another option could be a co-signed loan, where a person with a higher credit score can help bolster your application. Or, you could explore peer-to-peer lending platforms, which may be a bit more lenient with their credit requirements. Be aware, though, that these alternatives often require higher interest rates and their terms might not be as favorable as those of standard loans. This is because the lender considers the loan to be more risky.

Can I Get a Car Loan with a 465 Credit Score?

With a credit score of 465, it's usually quite hard to secure a car loan. Lenders commonly prefer to see scores over 660. A score under 600 often categorizes you in the subprime range, and your score of 465 falls into this area. This scenario might mean steeper interest rates or even loan rejection. The reason behind this is such a low credit score poses a higher risk to lenders, since past behaviors hint at potential trouble paying back the money.

Yet, having a low credit score doesn't completely crush your chances of buying a car. Certain lenders cater to folks with lower credit scores, but tread carefully. Loans from this type of lenders tend to carry noticeably increased interest rates. This is their way of ensuring their risk is balanced. The journey might not be as smooth as you wish, but by scrutinizing the terms and weighing your options, attaining a car loan is still a plausible objective.

What Factors Most Impact a 465 Credit Score?

With a credit score of 465, understanding what impacts this number is fundamental to improving your financial health. Your path towards a better credit score is distinctive, filled with opportunities for progression and enlightenment.

Payment History

Payment history heavily influences your credit score. Missed or late payments might be contributing to your current score.

Checking Your Payment History: Inspect your credit report for any missed or late payments. Think about any circumstances where payments may have been delayed, as this may be causing an impact.

Credit Utilization

Overuse of available credit might be bringing your score down. If you're continually reaching or exceeding your credit limits, this could be a factor.

Checking Your Credit Utilization: Look at your credit card statements. Are your balances frequently reaching the maximum limit? A lower balance relative to your limit will help improve your score.

Length of Credit History

A limited credit history may be negatively affecting your score.

Checking Your Credit History Length: Go over your credit report to determine the longevity of your oldest and newest accounts, as well as the average age of all your accounts.

Credit Variety and New Credit Management

Holding different types of credit and responsibly handling new credit are vital for a healthy score.

Check Your Credit Mix and New Credit Applications: Reflect on your mix of credit types such as credit cards and various loans. Additionally, consider whether you've been opening new credit accounts frequently.

Public Records

Public records like defaulted accounts or court judgements could be severely affecting your score.

Checking For Public Records: Look through your credit report for any public records. Pay attention to any listings that may need addressing.

How Do I Improve my 465 Credit Score?

With a credit score of 465, you fall in the category of a bad credit score, but don’t worry, you can still improve if you take the right steps. Consider these following actions to help elevate your score:

1. Clear Up Old Debts

If you have any outstanding debts, focus on clearing them up as they can weigh heavily on your credit score, particularly if they’ve gone into collections. Reach out directly to the creditor to set up a repayment plan that fits your financial situation.

2. Keep Your Credit Card Balances Low

Your credit utilization ratio can impact your score. Aim to keep your credit card balances below 30% of your total available credit. This shows you’re capable of managing credit responsibly.

3. Responsible Use of Secured Credit Cards

Secured credit cards can be an excellent tool to help improve your credit score. These cards require a deposit that dictates your credit limit, thereby mitigating the risk for the card issuer. Use this to make small purchases and pay them off in a timely manner to build a solid payment history.

4. Leverage the Credit of Trustworthy Persons

Consider becoming an authorized user on a credit card belonging to a loved one with good credit. Their responsible credit behavior could potentially improve your own credit record. Make sure to confirm with the credit card company that they report authorized user activity to credit bureaus.

5. Create a More Diverse Credit Profile

Fostering a varied landscape of credit types can positively impact your score. Once you’ve proven yourself with a secured credit card, consider other forms of credit such as installment loans or retail cards, and responsibly sensitize them.