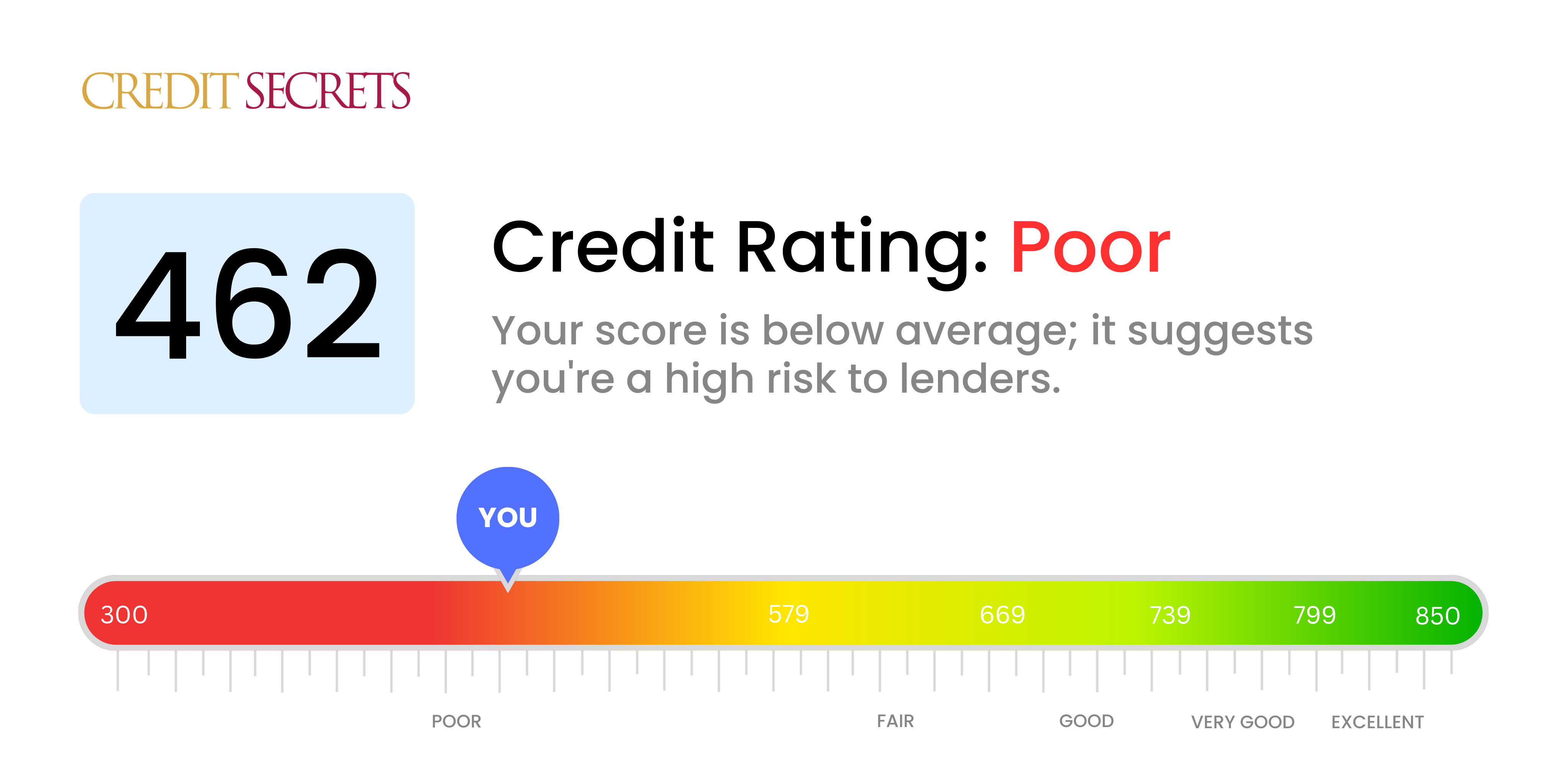

Is 462 a good credit score?

Your credit score of 462 isn't in the best range, but don't worry, there's room for improvement. This score is categorized as poor, meaning you might face challenges gaining approval for loans or credit cards, and if approved, you may be subject to higher interest rates. However, with dedicated effort and the right resources to guide you, there's potential to raise this score and improve your financial standing.

Improving a credit score can feel overwhelming, but remember, it's a step-by-step process. By regularly monitoring your score, paying bills on time, and managing debts wisely, you can start making strides towards a better credit standing. The journey might seem long, but every step you make towards improving your credit score brings you closer to financial freedom.

Can I Get a Mortgage with a 462 Credit Score?

With a credit score of 462, it's quite challenging to secure approval for a mortgage. Typically, lenders require a higher credit score, indicating the borrower's financial reliability. A 462 credit score suggests that there may have been past financial setbacks like late bill payments or defaulted loans.

A significant step to overcoming this obstacle would be to address the underlying causes of your low credit score. This may mean focusing on reducing your debts or ensuring your bills are paid on time. While you work on improving your credit score, an alternative you might consider is seeking out lenders that specialize in high-risk loans or exploring programs designed to help individuals in your situation. However, these options often come with higher interest rates, which is an important factor to consider. With dedication and smart financial decisions, you can work towards achieving a better credit profile for future lending opportunities.

Can I Get a Credit Card with a 462 Credit Score?

Regrettably, with a credit score of 462, obtaining a traditional credit card may be out of reach. This score, while disheartening, is typically regarded by lenders as an indicator of substantial financial risk due to potential past problems with managing debts. It's definitely tough to face this fact, but understanding your financial situation is vital to taking the first steps towards financial recovery.

Despite these limitations, alternatives are available that can assist in improving your credit over time. You may want to consider secured credit cards, which require a deposit that serves as your credit limit and can be easier to acquire. Another path might be seeking out a reliable co-signer or considering pre-paid debit cards. Although these choices may not provide an immediate solution, they do represent viable strategies in your journey towards better financial health. Keep in mind, though, that credit products available to people with such scores often come with higher interest rates, due to the lender's perceived risk. Be prudent and take one cautious step at a time to slowly rebuild your credit strength.

Unfortunately, a credit score of 462 falls considerably short of what's typically needed for approval of a personal loan from most traditional lenders. This low score can indicate a higher risk to lenders, thus making your personal loan application less likely to succeed. While challenging, it's crucial to understand the reality of this credit situation.

But don't lose hope. There are other avenues you might explore. Secured loans, where you provide collateral, or co-signed loans, where someone with a better score stands by your side, are possibilities. Peer-to-peer lending platforms might be an option as they sometimes have more flexible credit requirements. Keep in mind that these alternatives often come with higher interest rates and terms that might not be as favorable. This is because they represent a higher risk from the lender's perspective. Finding the best solution might take some extra research and patience, but there are options out there for you.

Can I Get a Car Loan with a 462 Credit Score?

With a credit score of 462, securing a car loan might be tough. Lenders often look for scores that are 660 or more for favorable loan terms. Unfortunately, a score of 462 is considered subprime and could create a few roadblocks in your journey to owning a car. This kind of score points to a higher-risk profile, with past patterns reflecting potential hitches in repaying borrowed funds.

Still, don't lose hope. Despite this being a tougher road to navigate, there are lenders who specialize in working with individuals with lower credit scores. However, be ready for the fact that loans from these lenders often come with steeper interest rates. This is their way of protecting their investment, given they are taking a higher perceived risk. As long as you take the time to completely comprehend the terms and approach this with caution, getting a car loan is not entirely out of reach.

What Factors Most Impact a 462 Credit Score?

Navigating the landscape of a 462 credit score may seem daunting but understanding the key contributing factors is the first step in taking control of your financial health. Let's explore the possible reasons behind such a score.

Timeliness of Payments

A major determinant of your credit score is the regularity of your payments. Recurring late payments or delinquencies greatly contribute to a low score.

To Check: Look through your credit reports for any record of late payments or delinquencies. Resolve these and make steps to ensure timely payments in the future.

Credit Utilization Ratio

An elevated credit utilization ratio, derived from maxed out credit cards or high balances, can adversely affect your credit score.

To Check: Scrutinize your credit card balances. Are you frequently close to or hitting your credit limits? Plan to keep usage well below your credit limits.

Length of Credit History

A short credit history can lead to lower credit scores. Rapidly opening new credit accounts could harm rather than help your score.

To Check: Scrutinize your credit history length and the number of recently opened accounts. Try to maintain older accounts and be cautious with new accounts.

Type of Credit Used

Having a healthy mix of different types of credit accounts can positively impact your score. Too much of the same can be detrimental.

To Check: Review your credit accounts considering the variety of types you have. Strive for a mix that includes credit card accounts, retail accounts, and loans.

Public Records

Public records such as bankruptcies and tax liens can weigh heavily on your credit score.

To Check: Examine your credit reports for any public records and strive to clear them to aid in improving your credit score.

How Do I Improve my 462 Credit Score?

Being faced with a credit score of 462 can seem disheartening, but don’t despair. With the proper steps, you can significantly enhance your score. Here are some impactful strategies tailored for your situation:

1. Prioritize Delinquent Accounts

Analyze your credit profile to identify any delinquent accounts. These add negative dings to your credit score. Make the payment of these accounts a top priority. Communicating with the respective creditor and setting up a feasible payment routine is an effective strategy.

2. Pay Off Outstanding Debt

Finding ways to consolidate or pay off outstanding debt can help bolster your credit score. Avoid taking on new debts until you’ve managed your existing ones.

3. Responsibly Use a Secured Credit Card

At this score, procuring a regular credit card may be challenging. Opt for a secured credit card that requires a refundable deposit. By making timely monthly payments, and ideally in full, it asserts you’re capable of managing credit effectively.

4. Enlist As an Authorized User

Plead a trustworthy person with good credit to add you as an authorized user on their credit card. This helps improve your score and can provide a boost to your credit history.

5. Manage Diversified Credit Accounts

Once you have shown a pattern of timely payments on your secured credit card, consider adding a mix of credit. This might include a credit builder loan or retailer-specific card. Diversifying your credit and managing it well could give your score a significant boost.