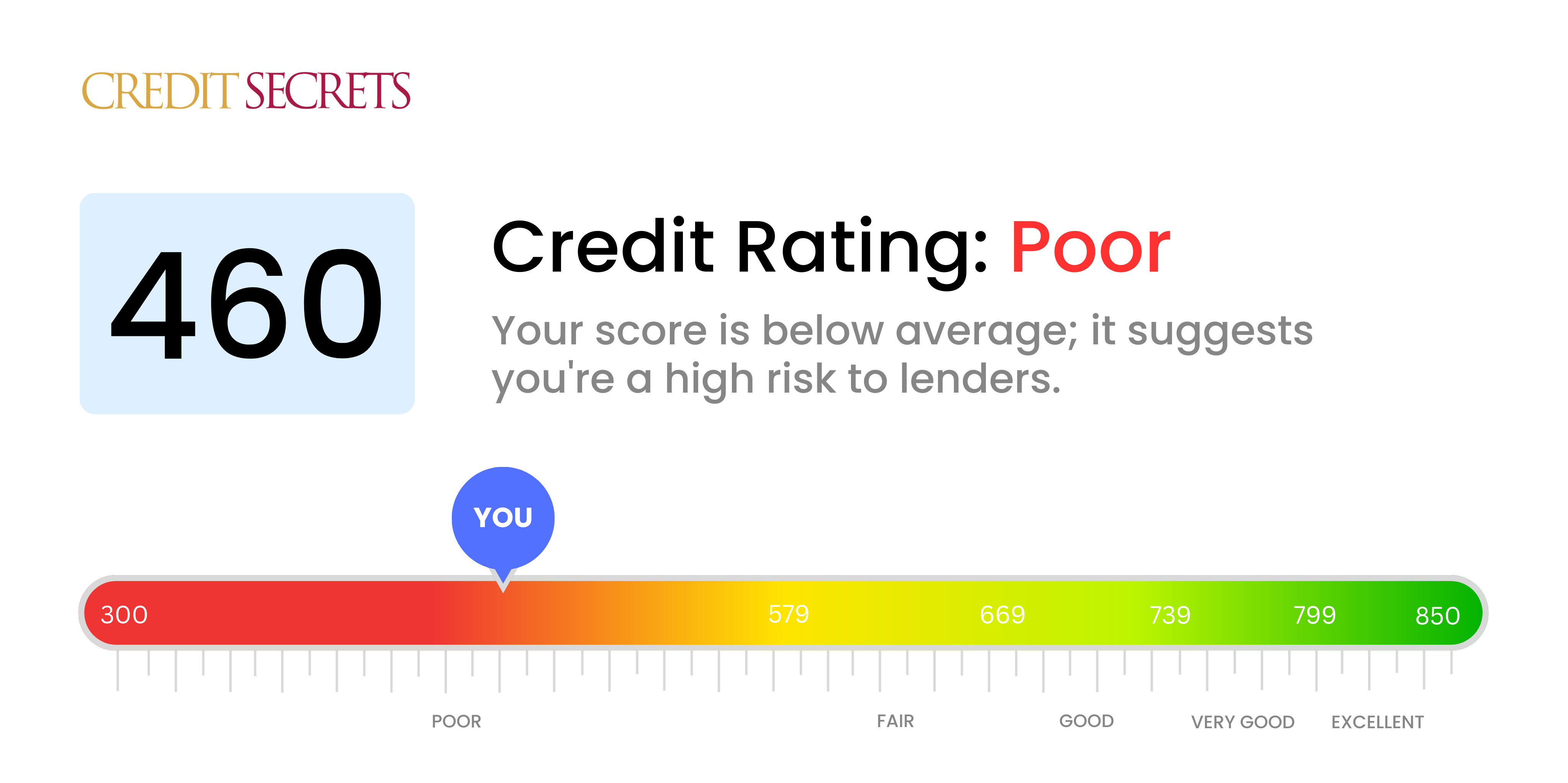

Is 460 a good credit score?

Your credit score of 460 falls within the 'Poor' category. While this isn't the ideal score, it's important to remember that you have the power to change this by making conscious financial decisions.

With a score of 460, obtaining new credit may be challenging. Lenders often view this score range as high risk, so you might find it harder to get approved for credit cards, loans, or mortgages. Also, if you are approved, you might face higher interest rates than someone with a better credit score. However, don't lose hope. With a positive mindset and smart credit habits, it's possible to improve your credit over time.

Can I Get a Mortgage with a 460 Credit Score?

With a credit score of 460, the likelihood of securing a mortgage approval is unfortunately quite low. This score is considerably lower than the typical minimum lenders are seeking. Credit scores in this range often reflect challenges such as payment delinquency or other financial setbacks. It can be frustrating to face this reality, but remember, this is a snapshot of your financial history, not a life sentence.

Your current financial situation may make traditional mortgage lending unlikely, but there are still options you could explore. Government-backed loans, like FHA loans, often have more lenient credit requirements. Although they might require a slightly higher down payment from borrowers with lower credit scores. Additionally, credit unions and smaller local banks may be willing to work around lower scores if you have a good standing relationship with them. Keep in mind, even with these alternatives, you are likely to face higher interest rates due to your lower score. It's a tough road ahead, but rest assured, every step you take towards improving your credit score brings you one step closer to your financial goals.

Can I Get a Credit Card with a 460 Credit Score?

Holding a credit score of 460 is likely to make it fairly difficult to secure approval for most conventional credit cards. This is because such a score is often perceived by lenders as high risk, hinting at a history of financial hardships or management challenges. It's not easy to hear, but understanding your credit situation is vital, even if it means facing some harsh realities.

However, there's light at the end of the tunnel. For such credit scores, secured credit cards may be a feasible alternative. These cards necessitate a security deposit, which determines your spending limit. They can be easier to get and can progressively help improve your credit. Also, a potential co-signer or pre-paid debit cards might act as suitable alternatives. Keep in mind, these options do not translate to an instantaneous solution, but they're stepping stones towards financial stability. Lastly, expect to encounter higher interest rates with any credit options accessible, which reflects the significant risk associated with such scores to lenders.

If you have a credit score of 460, getting approved for a traditional personal loan is unlikely. This score is considerably less than what many traditional lenders look for, and it implies a high-risk level for them. It might be difficult to hear, but understanding the implications of such a credit score on your loan possibilities is crucial.

Instead, you could explore other options. One of them is secured loans, where you use something valuable as collateral. Another choice could be a co-signed loan where someone with a better credit score agrees to back your loan. Peer-to-peer lending platforms could also be a feasible alternative as they might have more flexible credit requirements. However, keep in mind that these options often come with higher interest rates and tougher terms due to the greater risk carried by the lenders.

Can I Get a Car Loan with a 460 Credit Score?

With a credit score of 460, securing approval for a car loan may prove quite difficult. It's important to know that a score above 660 is generally preferred by lenders. Unfortunately, your score is classified as subprime, which is below 600. This could result in increased interest rates or even denial of your loan application. A lower score indicates a higher risk to lenders as it symbolizes potential difficulty in paying back the borrowed money.

Even so, having a low credit score doesn’t absolutely rule out the chance of obtaining a car loan. There are lending institutions who specialize in working with individuals who have low credit scores. However, exercise caution since such loans often carry significantly higher interest rates to offset the risk taken by lenders. Therefore, thoroughly understanding the loan terms and exercising prudent financial judgement can still pave the way to a car loan, albeit with a little patience and extra caution.

What Factors Most Impact a 460 Credit Score?

Navigating a credit score of 460 might seem tricky, but it’s the first step towards financial enlightenment. Identifying the elements contributing to your score can set the stage for progressive stability. Every credit journey is unique, filled with moments of insight and progress.

Payment Consistency

Punctuality in payments plays a significant role in your credit score. Existing late payments or defaults might be one of the reasons behind your score.

How to Check: Look at your credit report and check for instances of late or missed payments. Reflecting on these could give insight on how they impacted your score.

Credit Utilization Rate

A high credit utilization rate can affect your score negatively. If you are nearing your credit limit, this could be part of the reason for your score.

How to Check: Take a closer look at your credit statements. Are your credit balances close to the ceilings? Striving to keep balances comparatively low is beneficial.

Age of Credit History

A shorter credit timeline can undermine your score.

How to Check: Examine your credit report to determine the duration of your oldest and newest credit accounts, and the average length of all your accounts. Reflect on whether you've recently opened new accounts.

Diversity of Credit and New Credit Management

Holding diversified credit types and cautiously managing new credit are key factors in maintaining a good score.

How to Check: Assess your assortment of credit accounts like credit cards, retail accounts, installment loans, and mortgage loans. Reflect on recent credit applications.

Public Records

Public records like bankruptcy declarations or liens can strongly impact your score.

How to Check: Scrutinize your credit report for any public records. Tackle any flagged items that require resolution.

How Do I Improve my 460 Credit Score?

With a credit score of 460, it’s clear there are financial challenges. However, with targeted efforts, you can gradually elevate your score. Here’s the optimal plan, based on your current credit score:

1. Rectify Outstanding Debts

Outstanding debts are a critical area to focus on. Clear any late payments as they pose a significant drag on your credit score. Discuss with your creditors about tailoring a payment plan to manage these debts effectively.

2. Trim Down Credit Card Utilization

Bulging credit card balances can drastically reduce your credit score. Aim to maintain your balances under 30% of your credit limit for a start, and eventually below 10%. Start by focusing on the cards with the highest utilization.

3. Look into a Secured Credit Card

Given your present score, a secured credit card could be a viable option. This type of card requires a cash deposit as the credit limit. Use it prudently by making modest purchases and paying off the balance each month to construct a positive payment record.

4. Become an Authorized User

Request a trustworthy individual who has good credit to add you as an authorized user to their credit card. This can help to bolster your credit score by incorporating their credit-positive record into yours. Do ensure the card provider reports the authorized user activities to the credit bureaus.

5. Enrich Your Credit Portfolio

Perhaps consider diversifying your credit portfolio once you’ve proved responsible management of your secured credit card. Consider exploring different types of credit, such as retail credit cards or credit builder loans, to boost your credit score.