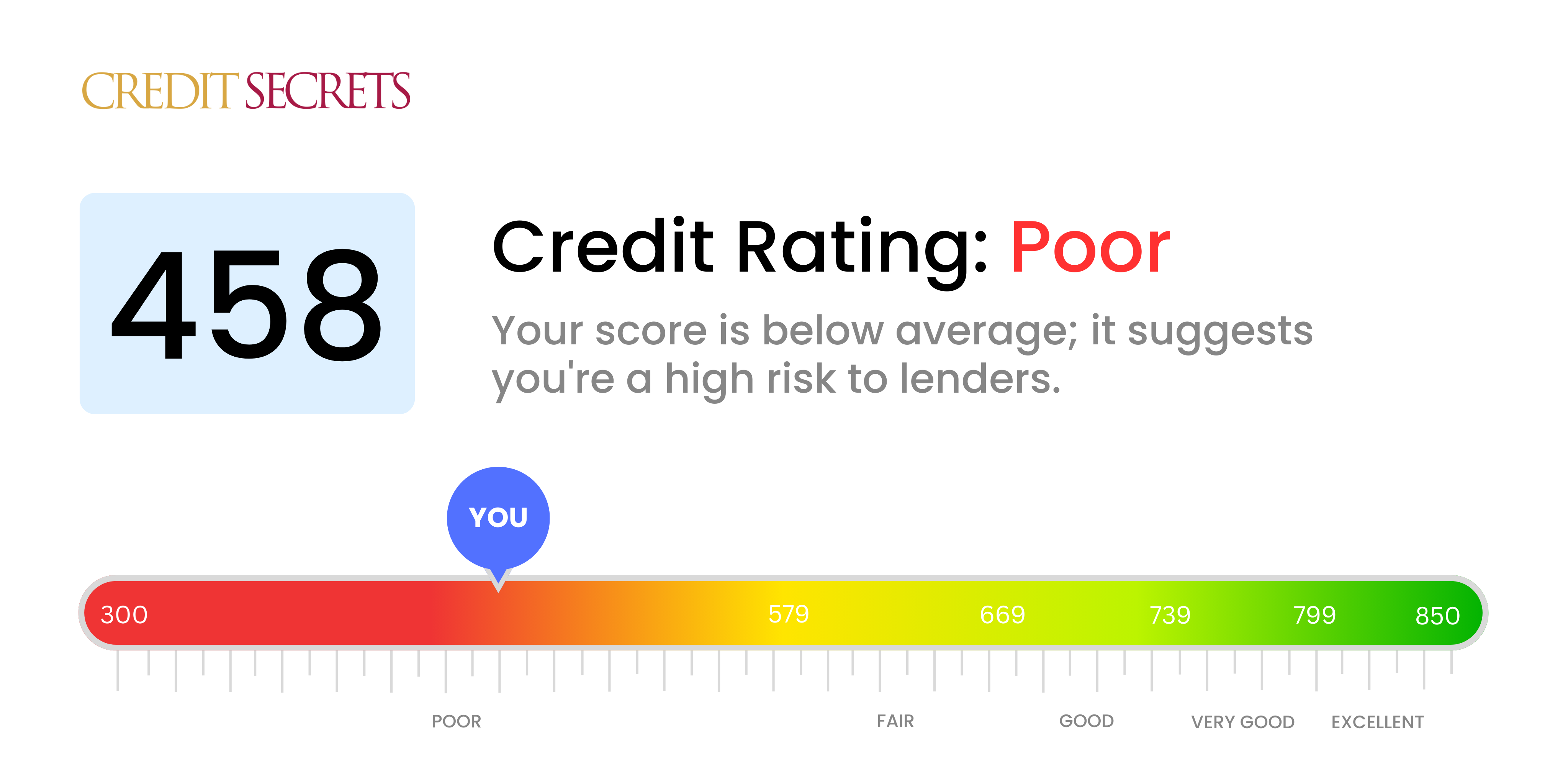

Is 458 a good credit score?

A credit score of 458 registers as poor on the credit spectrum. But hold your head high, better financial days can certainly be ahead. With this score, it's likely that obtaining new credit will be challenging and interest rates may be high, but don't let that dishearten you. You can take control and make positive strides towards improving your credit health.

Start by understanding the factors that contribute to your score. This is not a dead-end, but rather a starting point to show you what improvements can be made. And remember, your credit score is just a snapshot, it can and will change, so don't let a temporary setback define your financial future. With the right tools and knowledge in place, including Credit Secrets’ guidance and resources, you can chart a course towards a healthier credit score.

Can I Get a Mortgage with a 458 Credit Score?

If your credit score is 458, obtaining a mortgage might prove to be a challenge. This score is quite below the minimum score that most lenders typically seek. A credit score at this level often signifies a past of financial struggles, such as late payments or defaulted loans. This can make lenders hesitant, as they may see it as a potential risk.

However, a low credit score is not the end of the road. There is always room for improvement. Start by addressing your current debts and negative marks on your credit report. Make a point to consistently pay your bills on time and manage credit wisely. As a part of our Credit Secrets program, you can learn about various strategies to enhance your credit score, which can ultimately help put you in a better position for mortgage approval down the line. Remember, this process takes time, but every positive change you make can bring you closer to your goal.

It's essential to know that even if you do get approved for a mortgage with a lower score, you may face higher interest rates. Lenders charge higher rates to consumers with lower credit scores to offset their risk. Hence, improving your score can also help you secure lower interest rates on loans and credit cards.

Can I Get a Credit Card with a 458 Credit Score?

With a credit score of 458, securing a traditional credit card approval would be quite a feat. This score is typically seen as high-risk by lenders, pointing towards past instances of financial strain or issues with money management. Although this might be a hard pill to swallow, understanding your current financial situation is a key step towards recovery and growth. Accepting the state of your credit is foundational in charting a way forward.

In light of the challenges that come with a low credit score, you may want to consider different options such as secured credit cards. These cards call for a deposit which serves as your credit limit. This option often has a higher rate of approval and could help rebuild your credit score bit by bit. Pre-paid debit cards, or getting a co-signer for your credit card application may also be worth exploring. Remember, these strategies will not instantly solve your credit score issues, but they are effective tools in paving the path towards financial resilience. Bear in mind though, the interest rates attached to any credit you manage to secure will likely be steep, reflecting the increased risk seen by lenders.

With a credit score of 458, your chances of qualifying for a traditional personal loan are unfortunately slim. This score is notably lower than the range typically acceptable to lenders. From a lender's perspective, this low score signifies a higher risk of non-repayment, making the approval of a loan less likely. Understanding your credit score's implications is essential to outlining your future steps surrounding borrowing options.

Though traditional personal loans might be less attainable, there are still options. For instance, secured loans, which require an asset as collateral, or co-signed loans, where another person with good credit vouches for your repayment, could be potential options. Additionally, peer-to-peer lending platforms may be more forgiving in their credit requirements. It's crucial, however, to note that these alternatives often carry higher interest rates and less favorable repayment terms. This is because they are designed to manage the lender's increased risk.

Can I Get a Car Loan with a 458 Credit Score?

A credit score of 458 is well below considered optimal by most lenders, who generally prefer scores over 660. Scoring 458 places you squarely in the 'subprime' range, presenting loan approval difficulties. A low score signifies a higher lending risk, as it indicates previous challenges in repaying borrowed money. This can affect loan terms, resulting in higher interest rates, or even outright denial.

Despite this, your car financing hopes are not entirely dashed. There are lenders skilled in dealing with those possessing lower credit scores. However, tread gently herein, as such loans typically carry significantly elevated interest rates to offset the lender's increased risk. As they strive to protect their investment, you might end up paying more. It's critical to study the terms meticulously before agreeing to anything. The journey may have a few bumps, but, with careful assessment, you can ultimately achieve your dream of owning a car.

What Factors Most Impact a 458 Credit Score?

Grasping the implications of a credit score of 458 is a critical beginning to your credit improvement journey. It is vital to uncover and address the factors that have resulted in a low score to work towards improving it. It's a journey marked by growth and valuable lessons.

Payment History

One significant aspect to consider with a credit score of 458 is your payment history. If defaulted or late payments exist in your history, they could be a major reason for your current score.

How to Check: Go through your credit report diligently and look for any late or defaulted payments. Reflect on these and determine if they've impacted your score considerably.

High Level of Debt

High levels of overall debt could be directly influencing your score. This high financial liability can negatively affect your creditworthiness.

How to Check: Consider your overall debt by reviewing loan balances both retail and mortgage, credit card debts, and any personal liabilities. An effort to decrease your total debt can improve your credit score.

Length of Credit History

If you have a short credit history, it may be contributing to your lower score.

How to Check: Check your credit report to understand the age of your oldest and recent accounts along with the average age of all your accounts. If there is a pattern of new accounts, such behavior could have lowered your score.

Public Records and Collection

Public records such as tax liens, bankruptcies, or collections can have a profound impact on your credit score.

How to Check: Scrutinize your credit report closely for any public records or collections. Rectifying any such errors can help improve your score.

How Do I Improve my 458 Credit Score?

With a credit score of 458, it’s crucial to undertake immediate, targeted actions to uplift your score. Remember, the journey towards a higher credit score begins with the first step. Here’s what you can specifically do from your standpoint:

1. Rectify Outstanding Debts

Late or missed payments are the primary culprits for a low credit score. Try to rectify these issues by paying off your late dues. Reach out to your creditors and request a restructuring of your payment schedule if required. Timely settlements of overdue debts positively influence your score.

2. Downsize Credit Card Debts

A heavily utilized credit card can hinder your score. Aim to curtail your credit card debt, ensuring it stays below 30% of your total credit limit. As a long-term plan, strive to maintain it under 10%. Focus on paying off the cards with the most substantial debts first.

3. Contemplate A Secured Credit Card

When your credit score is as low as 458, obtaining a regular credit card might be tough. In such situations, consider a secured credit card requiring a refundable deposit which doubles up as your credit limit. Initiate small purchases and pay off the entire balance every month to foster a solid payment history.

4. Explore Being an Authorized User

Request a loved one with healthy credit to add you as an authorized user on their card. This initiative enhances your credit score through the inclusion of their positive repayment history in your report. Ensure that the credit card company records the authorized user activity to the credit bureaus.

5. Diversify Your Credit Portfolio

Having a mix of credit accounts can enhance your score. Once you demonstrate responsible handling of a secured card, consider adding different types of credit, such as a retail card or a credit builder loan, to your portfolio. Ensure you manage all accounts responsibly.