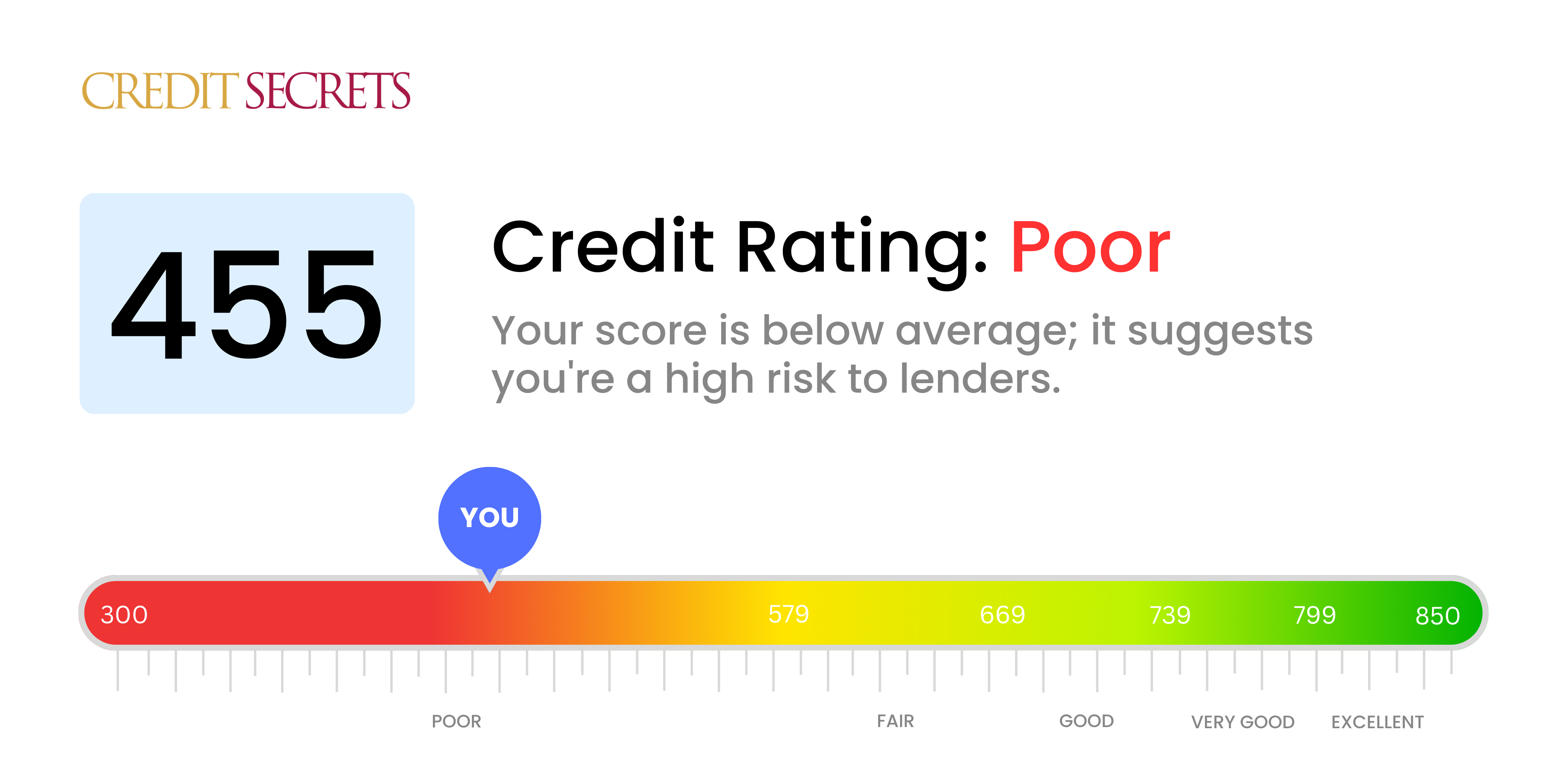

Is 455 a good credit score?

A credit score of 455 is within the 'Poor' category. This indicates that credit agencies and lenders may view you as having a high risk for borrowing and might be less likely to approve you for offerings such as loans, credit cards or mortgages.

However, don't lose heart - there's always room for improvement. By following guidelines to steadily enhance your credit habits, you can overcome this hurdle. Always remember that Rome wasn't built in a day, and similarly, credit repair is an ongoing process that requires patience and consistent efforts. Remember, you've got this!

Can I Get a Mortgage with a 455 Credit Score?

Unfortunately, with a credit score of 455, acquiring a mortgage approval is likely to be a significant challenge. This score is well below the threshold most lenders consider safe for approving mortgages. It suggests a history of financial instability, such as late repayments or financial defaults.

Exploring alternatives could prove helpful in this situation. For instance, some lenders and programs specifically target individuals with lower credit scores. These options, known as subprime mortgages, may be available to you. However, they often come at the cost of higher interest rates and fees. You can also consider non-traditional paths to homeownership, such as renting-to-own.

Lastly, it's important to steadily work on improving your credit score. Regular, timely payments on all credit accounts and minimizing existing debts can gradually elevate your score. Better credit practices now can lay the foundation for a brighter financial future. While progress may be slow, your dedication will eventually open up better financial opportunities.

Can I Get a Credit Card with a 455 Credit Score?

Having a credit score of 455 brings difficulty in securing a traditional credit card. This score widely reflects financial struggles or mishandling of finances in the past, which introduces a level of risk lenders aren't comfortable with. As disheartening as it may seem, recognizing these facts helps pave the way towards financial recovery. Acknowledging your credit status is the first big step, and although the truth might be tough, it is key in your journey towards improving your financial standing.

You can consider other avenues, like obtaining a secured credit card. These require a security deposit that serves as your credit limit. Compared to traditional credit cards, these can be more accessible to those with low scores and can assist in gradually improving credit. Alternatively, looking into options like getting a co-signer or using pre-paid debit cards can potentially be helpful. Understand that these options aren't quick-fix solutions, but are valuable aids to regain financial stability. Please bear in mind that any available lines of credit for individuals with such credit scores usually have significantly higher interest rates, due to the elevated risk to lenders.

Having a credit score of 455 is not ideal when seeking a personal loan. This is significantly below the common preferred range for many traditional lenders. A score this low indicates a high level of risk for any lender, making it more unlikely to achieve loan approval. While this is a difficult situation, it's vital for you to understand the reality of your borrowing situation and know the options you have available.

Even with a score of 455, other borrowing options are available. Consider secured loans, where you would provide an asset as collateral or loans co-signed by someone with a stronger credit history. Peer-to-peer lending platforms may be another avenue as they often have more relaxed credit demands. However, bear in mind that these alternatives typically come with higher interest rates and less favorable terms due to the increased risk for the lender. Remember, it's always important to stay well-informed to make the best decisions for your financial health.

Can I Get a Car Loan with a 455 Credit Score?

Having a credit score of 455 does pose significant difficulties in getting approved for a car loan. This number is below average and fits into a category called subprime, which lenders generally see as high risk. Because of this, they might decide not to offer a loan, or they could offer a loan with a significantly elevated interest rate. This is their way of making sure their investment is protected, even though it makes the loan more expensive for you.

Nevertheless, there is still a glimmer of hope. Some lenders are willing to work with those who have lower credit scores, although caution should be exercised. These loans are usually accompanied by higher interest rates, due to the level of risk the lender is undertaking. Therefore, it's crucial to weigh your options carefully and make sure you understand all the terms before agreeing to any loan. It might be a challenging process, but acquiring a car loan isn't entirely impossible even with a 455 credit score.

What Factors Most Impact a 455 Credit Score?

Assessing a credit score of 455 is significant to your financial development journey. Determining the reasons for this score can guide you towards a more advanced financial future. Your financial journey is exclusive to you and filled with opportunities for growth and improvement.

Past Payment Performance

Your history of payments greatly influences your credit score. Late payments or loan defaults might be significant influencers of your score.

How to Check: Scrutinize your credit report for late or missed payments. Contemplate any occasions where your payments were delayed as they might have been detrimental to your score.

Debts Owed

Owing significant amounts of debt could hurt your credit score. If you're approaching your credit limit, this might be a factor.

How To Check: Check your credit card statements and note if your balance is nearing your limit. Aim to maintain a low balance to help improve your score.

Credit History Duration

A shortage in credit history can negatively affect your score.

How to Check: Study your credit report to see the age of your oldest and most recent accounts and the combined age of all your accounts. Reflect on whether you have opened new accounts lately.

Type of Credit Used

Utilizing various forms of credit and managing new ones effectively is important for a nice score.

How to Check: Evaluate your credit accounts, including credit cards, retail accounts, installment loans, and home mortgages. Make sure to apply for new credit sparingly.

Public Records

Records of bankruptcy or tax liens can have a pronounced effect on your credit score.

How to Check: Look at your credit report for public records of financial difficulties and address any matters that need to be resolved.

How Do I Improve my 455 Credit Score?

Considering a credit score of 455, which is regarded as a poor credit rating, it is clear that definitive, accessible actions are needed for improvement. The following feasible steps are tailored to address this specific credit situation:

1. Rectify Late Payments

It’s crucial to address any late payments promptly as they may severely affect your current score. Begin by identifying accounts with overdue amounts and bringing them up-to-date. If you’re unable to pay in full, reach out to your creditors to set up a payment arrangement.

2. Minimize Credit Utilization

Sustain your credit card balances below 30% of your available credit limit. This step decreases your credit utilization ratio, a significant component of your credit score. Prioritize diminishing the balance on cards with the highest utilization.

3. Apply for a Secured Credit Card

With your present credit score, a secured credit card could become an effective tool. It needs a refundable deposit, which often serves as your credit limit. Ensure to make modest purchases and pay your total balance monthly to prove your creditworthiness.

4. Seek Authorized User Status

Ask a trusted person with exemplary credit if you can become an authorized user on their credit card. This can boost your credit score by gaining from their positive credit behavior. Verify that the card issuer communicates authorized user activity to the credit bureaus.

5. Expand Your Credit Portfolio

Maintaining a varied set of credit types positively influences your score. Once you demonstrate a good payment history with your secured card, consider adding to your credit portfolio, through methods like retail store cards or credit building loans- making sure to manage them responsibly.