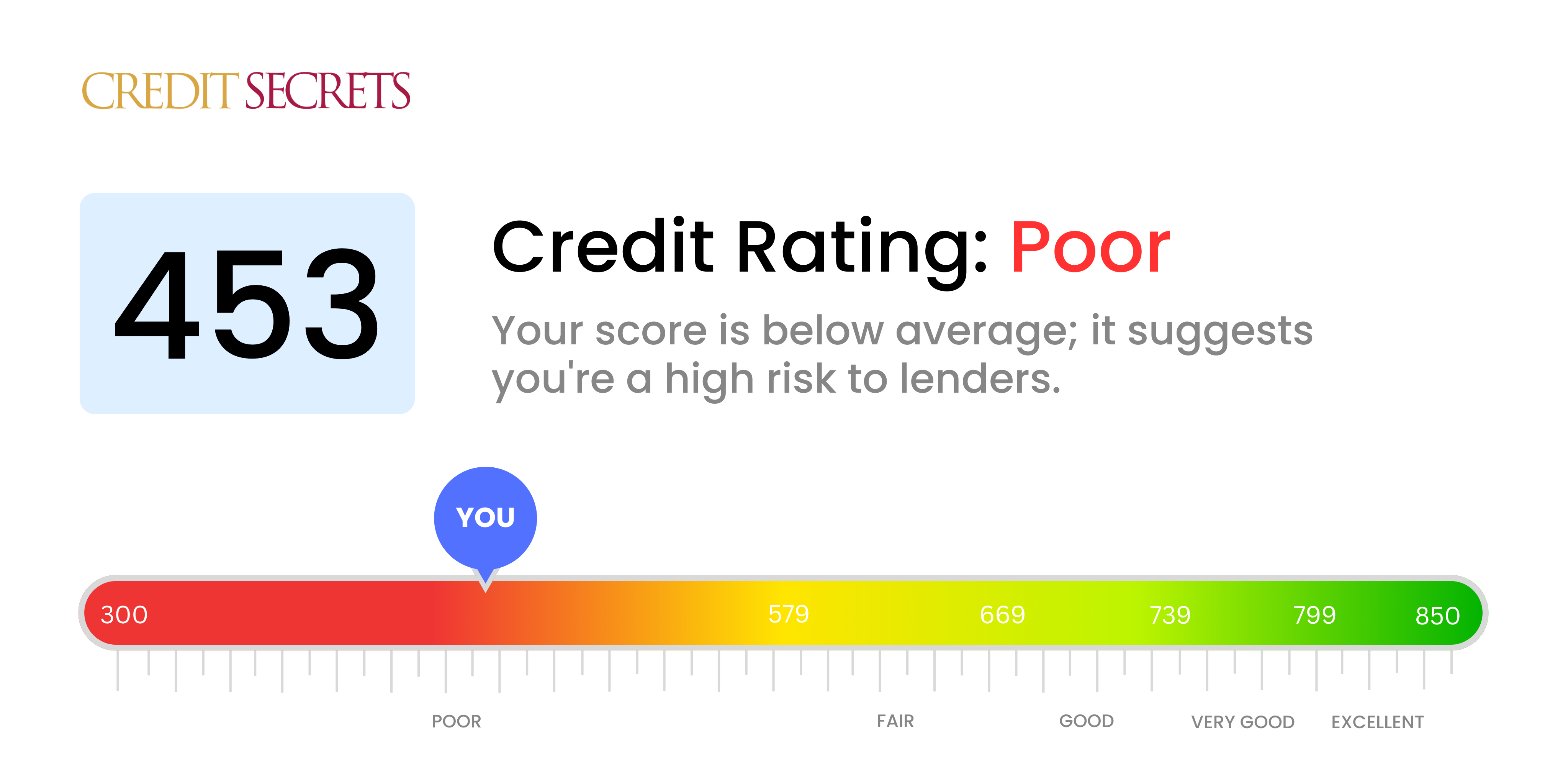

Is 453 a good credit score?

With a credit score of 453, unfortunately, this falls into the 'Poor' category. This typically means lenders and creditors see you as a high-risk borrower, and as a consequence, you may find it challenging to get approved for new credit, or may face higher interest rates on loans and credit cards.

However, don't lose hope. Improvement is always possible and it's essential to understand that bad credit doesn't last forever if you take steps to improve it. Begin by reviewing your credit report for any errors, paying your bills on time, reducing your debt, and keeping your credit card balances low. Remember, your credit score is not a reflection of your worth—it's just a tool lenders use. You have the power to change it.

Can I Get a Mortgage with a 453 Credit Score?

With a credit score of 453, it's not likely that you're going to be approved for a mortgage. This score is significantly lower than the minimum score that most mortgage lenders look for. A score in this range suggests a history of financial hardship, such as missed payments or defaults. But don't lose hope, there's still room for improvement.

It's important to know that a low credit score doesn't mean you're out of options. One potential alternative could be saving up for a larger down payment to offset your score. Some mortgage programs, like the Federal Housing Administration (FHA) loans, are designed for people with lower credit scores. You may also want to explore the possibility of a co-signer, someone with a good credit score who is willing to share the responsibility of the mortgage. It might be beneficial to take time to improve your payment history and reduce your debts, as responsible credit behavior can slowly but surely help to improve your credit score and thereby your chances of being approved for a mortgage.

Can I Get a Credit Card with a 453 Credit Score?

Having a credit score of 453 typically makes it difficult to get approved for a standard credit card. This score is seen as high-risk to lenders as it often indicates past financial struggles or mismanagement. While this may be hard to hear, it's crucial to be realistic and acknowledge your credit standing. This is your first step on the path to financial recovery, even if it means dealing with difficult realities.

Given the challenges of having a low credit score, you might look into other options such as secured credit cards. These cards require a security deposit which sets your credit limit and may be easier to obtain, helping in rebuilding your credit over time. Other possibilities include finding a co-signer or using pre-paid debit cards. Even though these options won't correct the situation immediately, they can be helpful steps towards financial stability. It's important to note, however, that any credit available to you with this score may come with higher interest rates due to the increased risk lenders perceive.

With a credit score of 453, acquiring a traditional personal loan might be difficult. This score is considerably below the accepted range for most lenders, making it problematic to gain approval. This is because a score this low signals a high risk to lenders. While admittedly tough, it's crucial to understand the financial implications of a credit score in this range.

Even so, don't lose heart. There are alternatives that could potentially work for you. Secured loans, for instance, request for collateral to secure against the loan. Another viable option might be co-signed loans, where an individual with a higher credit score gives you their endorsement. Additionally, there are peer-to-peer lending platforms. They might sometimes have more lenient credit requirements. However, be aware that these alternatives usually have higher interest rates and less friendly terms due to the increased risk to the lender.

Can I Get a Car Loan with a 453 Credit Score?

Having a credit score of 453 may pose a considerable challenge when it comes to getting approved for a car loan. Lenders commonly require scores above 660 to offer good loan conditions. Unfortunately, a score under 600, like yours, is often deemed subprime. The term "subprime" refers to borrowers who are seen as a risk due to their credit history, which might signal potential repayment issues. So, your 453 credit score might result in higher interest rates or even place car loan approval out of reach.

Regardless, remember that your current credit score isn’t the end-all. There are lenders who cater to individuals with lower credit scores. However, it's important to note that these loans often carry a high-interest rate. The increase in rate is compensation for the risk they're taking on. So, while purchasing a car with a credit score of 453 might mean journeying on a rocky financial road, it's certainly not impossible. You can make it happen with caution, thorough research, and a clear understanding of the loan terms.

What Factors Most Impact a 453 Credit Score?

Coming to grips with a credit score of 453 is a crucial step towards a brighter financial future. Exploring the elements that contribute to such a score could provide the path to financial stability. Remember, every financial journey is unique and comes with its challenges and opportunities for growth.

Prior Negative Information

Detrimental information like foreclosures, bankruptcies, or collections can have a devastating impact on your credit score. These are likely heavy contributors to your current score.

How to Check: Scruthe your credit report carefully for past negative information. Reflect on any past financial disruptions, as these could be pulling your score down.

Credit Usage

High utilization of credit, especially getting close to your credit card limits, plays a significant role in lowering your score. It indicates an increased level of risk to lenders and may contribute to your score.

How to Check: Scan through your credit card statements. If your balances tend to be high or approach their limits, this could be a culprit. By having a lower balance compared to your available credit, you could improve your score.

Frequent Applications for New Credit

Regular applications for new credit can generate hard inquiries on your credit report which can result in lowering your score, particularly if declined.

How to Check: Review your credit report for evidence of multiple credit applications within a short period. Reflect on your recent credit behavior. Was there a spree of credit applications? More judiciousness with new credit applications may help to lift your score.

Outstanding Debts

Holding high levels of debt can hamper a good credit score. Lenders may see this as an inability to manage your finances, contributing to your score.

How to Check: Check your credit report or bank statements for high levels of outstanding debt. If your debt load is significant, strategizing to pay it down may be beneficial for your score.

How Do I Improve my 453 Credit Score?

Having a credit score of 453 puts you in the poor credit category, but don’t worry – with the right steps, upgrading your score is within reach. Focus on these accessible and impactful actions tailored for your current credit situation:

1. Take Care of Outstanding Debts

Begin your credit improvement journey by focusing on any outstanding debts – especially ones that are considerably overdue. These have the most significant harmful effect on your credit score. Communicate with your creditors and construct a repayment plan that suits your financial capabilities.

2. Lower High Credit Card Balances

Credit card balances that are close to your limit can damage your credit score significantly. Make it your goal to bring your balances below 30% of your limit. If you are able to, aim to keep the balances even lower, at below 10%. Start with the cards you’ve utilized the most.

3. Utilize a Secured Credit Card

Obtaining a regular credit card with your present score may be difficult. An alternative is to apply for a secured credit card. The credit line for this type of card is a cash deposit that you provide. Use this card responsibly for minor purchases and ensure you settle the balance every month. This will help create a positive payment history.

4. Benefit from Positive Credit History as an Authorized User

Consider becoming an authorized user on a credit card held by a trusted person who has managed their credit well. Their responsible use of credit can contribute to a better score for you. Make sure the card issuer reports to the credit bureaus the activities of all authorized users.

5. Broaden the Types of Credit You Use

Once you’ve built good history with a secured credit card, consider adding variety to your credit portfolio. Different types of accounts – such as a retail credit card or a credit builder loan – can positively influence your credit score when managed responsibly.