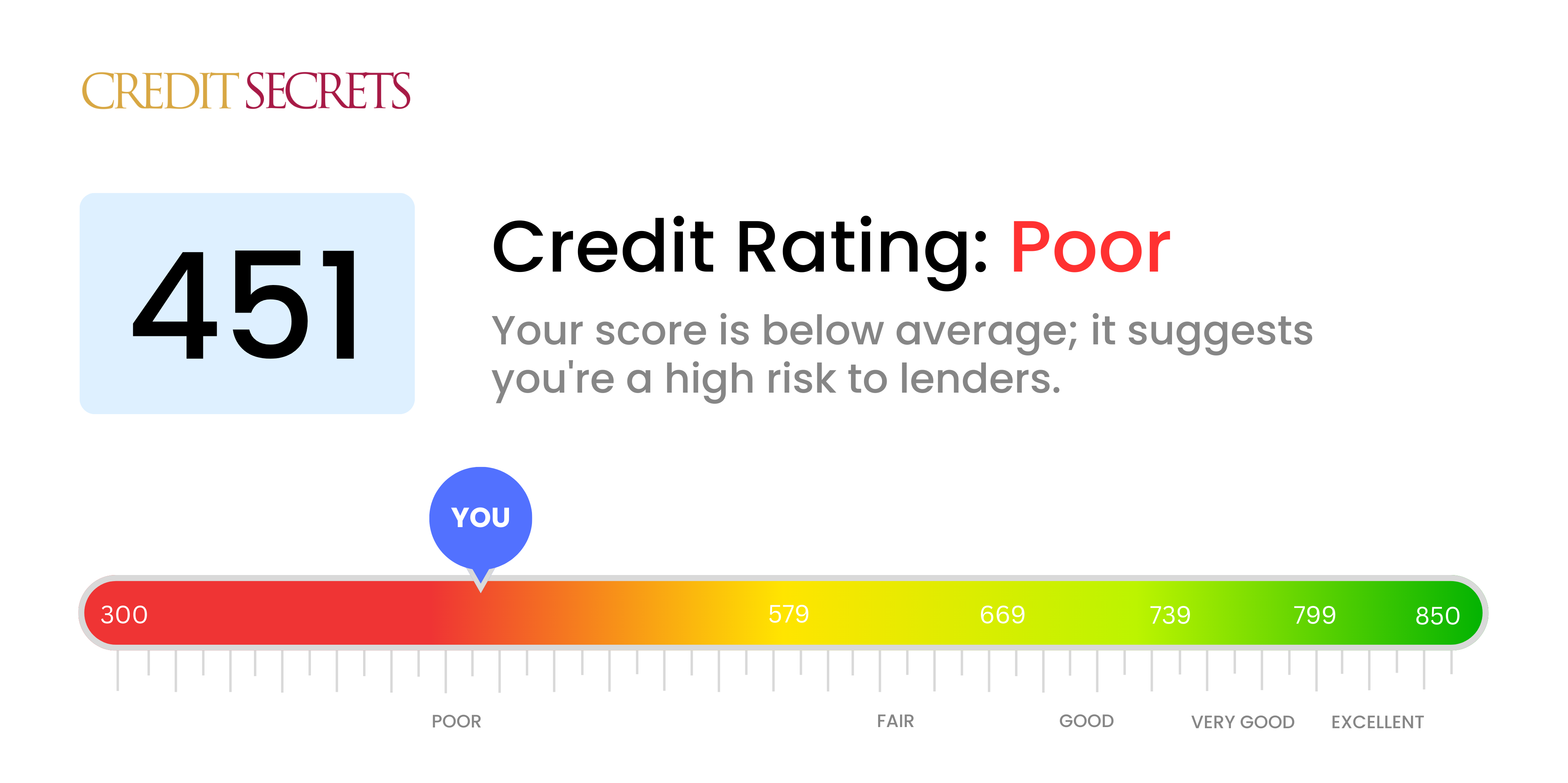

Is 451 a good credit score?

Having a credit score of 451 is classified as poor based on standard credit score ranges. While this isn't the result you might have hoped for, remember this doesn't define your financial future. It simply means you may face greater hurdles when trying to secure credit or loans, and may be offered higher interest rates compared to someone with a better score.

Nevertheless, improvements can be made. It's crucial now to focus on bolstering your score. You can do this by making payments on time, decreasing your debt, and meticulously checking your credit report for any errors. By remaining diligent about these credit positive actions, it's entirely possible to enhance your score and get back on track to a healthier financial future.

Can I Get a Mortgage with a 451 Credit Score?

If your credit score is at 451, acquiring approval for a mortgage may be a challenging task. This credit score is significantly below what most lenders generally look for and may suggest past financial hurdles such as defaulting on loans or failing to make payments on time.

Though this is a tough situation to be in, know that there are alternative paths for securing housing. You might consider looking for a co-signer with a higher credit rating to increase your chances of getting a loan. Additionally, certain types of loans, like government-backed Federal Housing Authority (FHA) loans, may have more lenient credit requirements. Lease-to-own agreements can be another feasible route to home ownership, allowing you to build your credit as you rent. Also, special loan programs from housing financial corporations may help. Be aware that with a lower credit score, your mortgage, if approved, may come with a higher interest rate, reflecting the increased risk to the lender.

Can I Get a Credit Card with a 451 Credit Score?

If you have a 451 credit score, you might find it tough to get approved for a regular credit card. This is considered a low score by lenders, indicating a past of financial mishaps or poor financial management. It might be tough to hear, but understanding and accepting your current credit status is key. This is the first step toward turning your credit situation around.

When faced with a lower score like 451, it's good to know you have other options, like applying for a secured credit card. Secured cards ask for a deposit that becomes your credit limit and are often easier to qualify for. They also offer a pathway for rebuilding your credit gradually. Having a co-signer or using prepaid debit cards could also be worth considering. While these aren't instant solutions, they are essential stepping stones towards a healthier financial future. Keep in mind that any credit that is available to you is likely to come with higher interest rates, due to the increased risk lenders perceive.

With a credit score of 451, getting approved for a personal loan through a traditional lender may indeed be a challenge. This score is considerably lower than what many lenders deem acceptable. In their view, it signifies a high risk, making it less likely for you to secure a loan under usual conditions. This isn't an easy situation, but it's essential you understand what this means for your borrowing opportunities.

Though you may face difficulties securing a standard loan, you do have alternatives. Options such as secured loans, which require collateral, or co-signed loans, where another person with a stronger credit backs you, might be feasible. Peer-to-peer lending platforms could also be potential channels, as they tend to be more flexible with credit scores. However, it's critical to remember that these options often come with higher interest rates and might not offer the best terms due to the increased risk for the lender.

Can I Get a Car Loan with a 451 Credit Score?

Having a credit score of 451 certainly presents difficulties when trying to obtain a car loan. Most lenders consider a "good" credit score to be around 700 or higher and a score under 600 could be a downturn. In fact, a score of 451 is in the category considered to be "poor". This means that lenders may see you as a high-risk borrower, which could result in higher interest rates or even a flat-out loan rejection.

However, don’t let this worry you too much. While conventional lenders might hesitate, there are still options available. Some lenders work explicitly with those who have low credit scores. These lenders, however, often offer loans with significantly higher interest rates due to increased risk. Research thoroughly, understand the terms and conditions, and never rush into a commitment. Please remember, having a lower credit score means the car purchasing journey could be a bit more challenging, but it is not impossible.

What Factors Most Impact a 451 Credit Score?

When considering a credit score of 451, there are several key variables that could be influencing this figure. Unpacking these elements will be a significant step on your financial wellness journey.

Payment Records

Your record regarding timely payments plays a pivotal role in shaping your score. If you've allowed payments to be delayed repeatedly, it’s likely causing a negative effect on your score.

What to Do: Inspect your credit report for any late or missing payments. Reflect on any cases of delayed or missed payments that could be impacting your score.

Level of Debt

If you're carrying high levels of debt particularly on your credit cards and these balances are near their maximums, this might be denting your score.

What to Do: Peruse your credit card bills. Are your balances near their maximum limits? Work towards lowering your balances relative to your credit limits.

Credit History Duration

If your credit history is relatively recent, this short timeline could be pulling your score down.

What to Do: Analyze your credit report for the duration of your credit history. Have you recently opened a lot of new accounts?

Type of Credit and Recent Credit

Having a healthy mix of different types of credit and handling new credit responsibly are vital for a good credit score.

What to Do: Examine your mix of credit types like credit cards, retail accounts, personal loans, vehicle loans. Have you been taking on new credit only when necessary?

Public Records

Public records like bankruptcies, court judgments, and unpaid tax liens can considerably lower your score.

What to Do: Scrutinize your credit report for any public records. Resolve any listed items that require addressing.

How Do I Improve my 451 Credit Score?

With a credit score of 451, you’re situated in the “poor” credit zone. However, by leveraging practical and focused strategies tailored for your specific situation, you can see significant enhancements. Here’s what you need to do:

1. Pinpoint Delinquent Accounts

Scan your credit report for accounts marked as late or unpaid. Prioritize paying down these accounts as they can deeply affect your credit score. Communicate with your lenders and negotiate for a feasible payment structure or reduction in penalties, if applicable.

2. Minimize Credit Card Debt

High credit card debt, especially if it’s close to your credit limit, can impede your credit score. Aim to lower your card balances to less than 30% of your credit limit. Focus particularly on your credit cards with the highest usage ratio.

3. Opt For a Secured Credit Card

At this point, getting a standard credit card could be difficult. Opt for a secured credit card instead, which demands a cash collateral deposit that equals its credit line. Make small, manageable purchases and pay in full monthly to cultivate a good payment track record.

4. Seek Authorized User Status

Approach a close friend or family member with healthy credit and request them to add you as an authorized user on a credit card they own. Their good credit behaviors will reflect positively on your credit report. However, ensure that their card issuer shares authorized user data with the credit bureaus.

5. Explore Different Kinds of Credit

As you improve your payment history with a secured card, consider diversifying your credit accounts with instruments like a credit builder loan or a retail credit card. Using these wisely can positively affect your credit score.