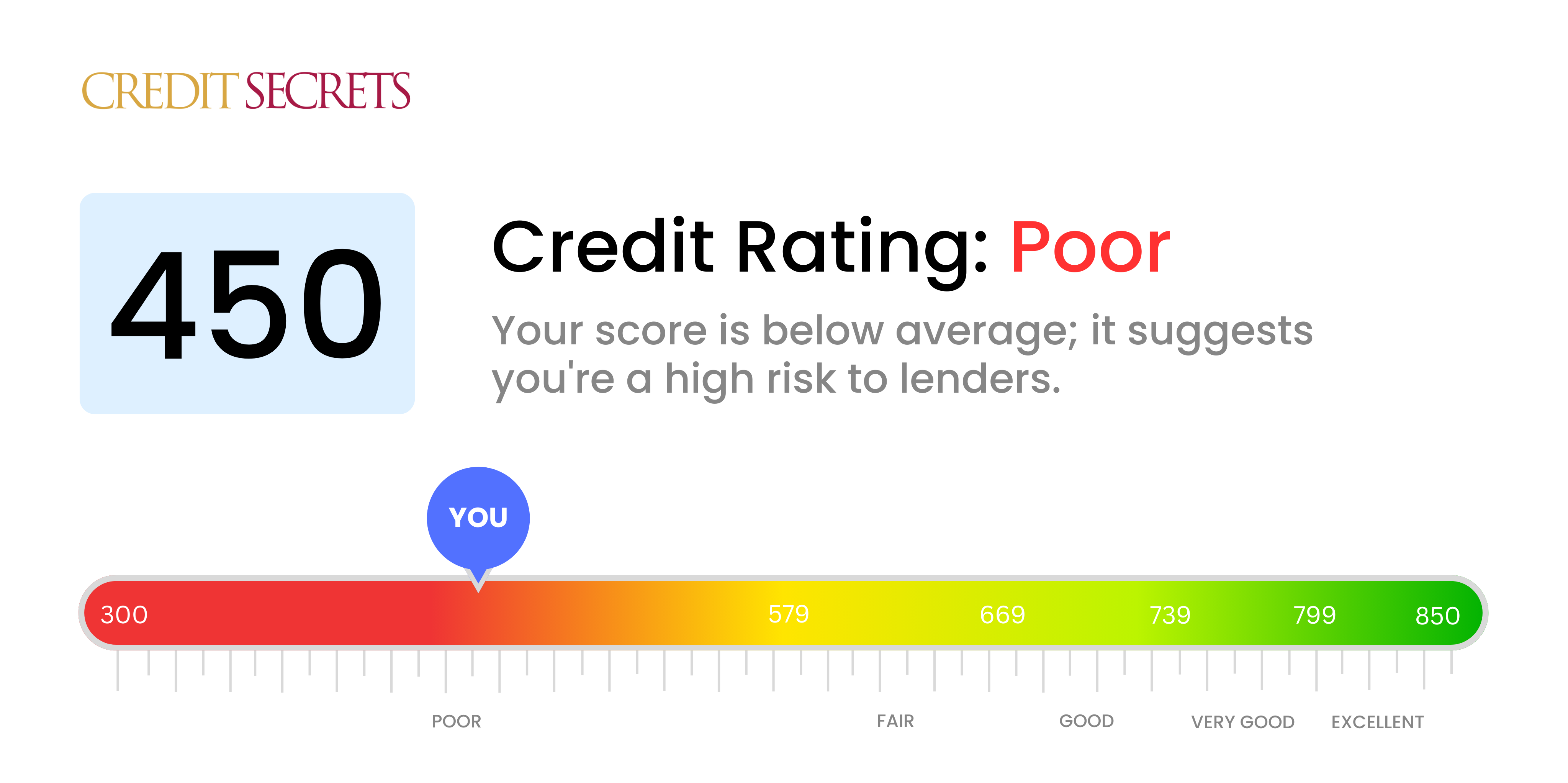

Is 450 a good credit score?

If your credit score is currently at 450, it unfortunately falls into the 'poor' category. This kind of score might make it difficult for you to get approved for loans or credit cards, and even if you can, you're likely to face higher interest rates.

While this reflects your present situation, remember, it's just a snapshot and not a life sentence. With the right knowledge, strategy, and discipline, you can elevate your score and expand your financial opportunities. It's never too late to start the journey towards improving your credit score and achieving a healthier financial future.

Can I Get a Mortgage with a 450 Credit Score?

A credit score of 450 is unfortunately not likely to yield approval for a mortgage. The majority of lenders consider this to be a low score, often associating it with significant financial challenges, such as missed payments or a history of debt issues. It's important to remember that this does not reflect on your worth as a person or your future ability to achieve a better score.

It may seem daunting right now, but the path to a better financial future is not out of reach. Identifying and paying off existing debts is a good starting point while avoiding any new credit-based commitments can prevent your score from dropping further. Use new financial habits such as timely bill payments and responsible spending to work on increasing your credit score. This process will take time, but with sustained effort, you can improve your score and put yourself in a stronger position for applying for a mortgage in the future. Interest rates are typically higher for individuals with lower credit scores, but that doesn't mean homeownership is out of your reach - it may just take a bit more time and determination to achieve.

Can I Get a Credit Card with a 450 Credit Score?

Having a credit score of 450 may present some challenges when applying for a traditional credit card. This score is typically seen by lenders as high-risk, indicating past financial obstacles or mishaps. It could be a hard pill to swallow, but being honest about your financial situation is the first crucial step towards a better financial future.

In light of the restraints tied to a lower score, you might want to explore other options such as secured credit cards, which require a deposit equal to your credit limit. They might be simpler to acquire and can help in rebuilding your credit with time. As alternatives, think about getting a co-signer or a pre-paid debit card. Whilst these options may not provide an immediate remedy, they nevertheless represent stepping stones on your path to financial stability. And it's important to bear in mind, if any form of credit becomes accessible to individuals with this score, the interest rates are likely to be much higher due to the elevated risk seen by lenders.

With a credit score of 450, getting approved for a traditional personal loan is a tough task. Lenders view this low score as a sign of high risk, making it less likely for them to extend loan offers. Understandably, this can feel discouraging and difficult. But remember, it's crucial to be aware of what a credit score of this level means for your borrowing ability.

When traditional loans are not an option, there are other routes you might consider. Secured loans, where you put up an asset as a guarantee, or co-signed loans, where a person with a stronger credit standing cosigns your loan, could be potential alternatives. Peer-to-peer lending is also an option, where ordinary people instead of banking institutions invest money in your loan. However, please be aware that these have their own challenges. They often charge higher interest rates, and terms may not be as flexible as with a traditional loan. This is because these methods still represent a higher risk to the lender because of your credit score.

Can I Get a Car Loan with a 450 Credit Score?

With a credit score of 450, securing approval for a car loan might be a serious challenge. Lenders are usually looking for scores above 660 for the best terms and conditions, and any score below 600 is often deemed subprime. Within this scenario, your score of 450 is seriously subprime, which could lead to higher interest rates or outright denial of a loan. The reasoning is straightforward: a lower credit score suggests a higher lending risk based on past struggles with paying back borrowed money.

However, bear in mind that a challenging credit situation does not totally close the door on your dreams of car ownership. There are some lenders who specialize in working with individuals with lower credit scores. But remember, these loans typically come with particularly high-interest rates. These higher rates account for the increased risk taken by lenders. Yes, the journey to getting a car loan might be tougher, but with diligent research and understanding of the terms, it's possible to secure a car loan with a lower credit score.

What Factors Most Impact a 450 Credit Score?

Understanding your credit score of 450 can prove critical to paving the path towards better financial health. Interpreting this number accurately involves considering key factors specific to your financial conduct. Each financial journey is filled with lessons, presenting prime opportunities for growth.

Payment Activity

Your payment activity plays a massive role in determining your credit score. Your score may be significantly impacted by late or missed payments.

Checking Your Score: Look over your credit report and identify any late or missed payments. Consider your payment habits and if you've had instances of overdue payments.

Credit Utilisation Ratio

A high credit utilisation ratio can be damaging to your credit score. If your credit usage is often close to or at your limit, your score might be negatively affected.

Checking Your Score: Review your credit card statements. Are you frequently close to your limit? Strive to maintain a low balance relative to your limit.

Duration of Credit History

A shorter credit history may have an adverse role in shaping your score.

Checking Your Score: Go through your credit report to evaluate the ages of your oldest and newest accounts, and the overall average age of all your accounts. Weigh it against any recent accounts you may have opened.

Range of Credit Types and New Credit

Having an assortment of credit types and properly managing new credit is key to a robust credit score.

Checking Your Score: Assess your range of credit accounts, such as credit cards, retail accounts, and loans. Think about your recent credit applications.

Public Records

Public records such as bankruptcies or tax liabilities can have a dramatically negative impact on your credit score.

Checking Your Score: Look into your credit report for any public records. Resolve any such items to improve your score.

How Do I Improve my 450 Credit Score?

With a credit score of 450, you’re confronting a challenge. But don’t fret, there are practical ways to progress from here:

1. Settle Delinquent Accounts

Outstanding bills or loans that are late impact your credit score considerably. Start by identifying and settling these accounts. If needed, have a dialogue with your lenders to work out an achievable repayment arrangement.

2. Minimize Credit Card Debt

If your credit cards are near their limits, it can harm your score greatly. Aim to keep your card balances under 30% of their limits, and eventually work towards reducing them to less than 10%. Pay more towards the cards with the highest balance proportions first.

3. Secure a Secured Credit Card

Obtaining a traditional credit card may be challenging with a 450 score. Look into a secured credit card as an option. With these, a cash deposit that you provide will set your limit. Use it responsibly, ensuring to pay off the balance in full each month, to establish a positive payment record.

4. Request to be an Authorized User

Speak to someone you trust with sturdy credit about becoming an authorized user on one of their cards. This can have a positive effect, particularly if they have a healthy payment history. Make sure the card provider reports authorized user activities to the credit bureaus.

5. Broaden Your Credit Portfolio

Having different types of credit can help improve your score. Once your payment history starts to look better with a secured card, consider diversifying your credit mix, with options like a credit builder loan or retail credit card. Remember to handle these new additions responsibly.