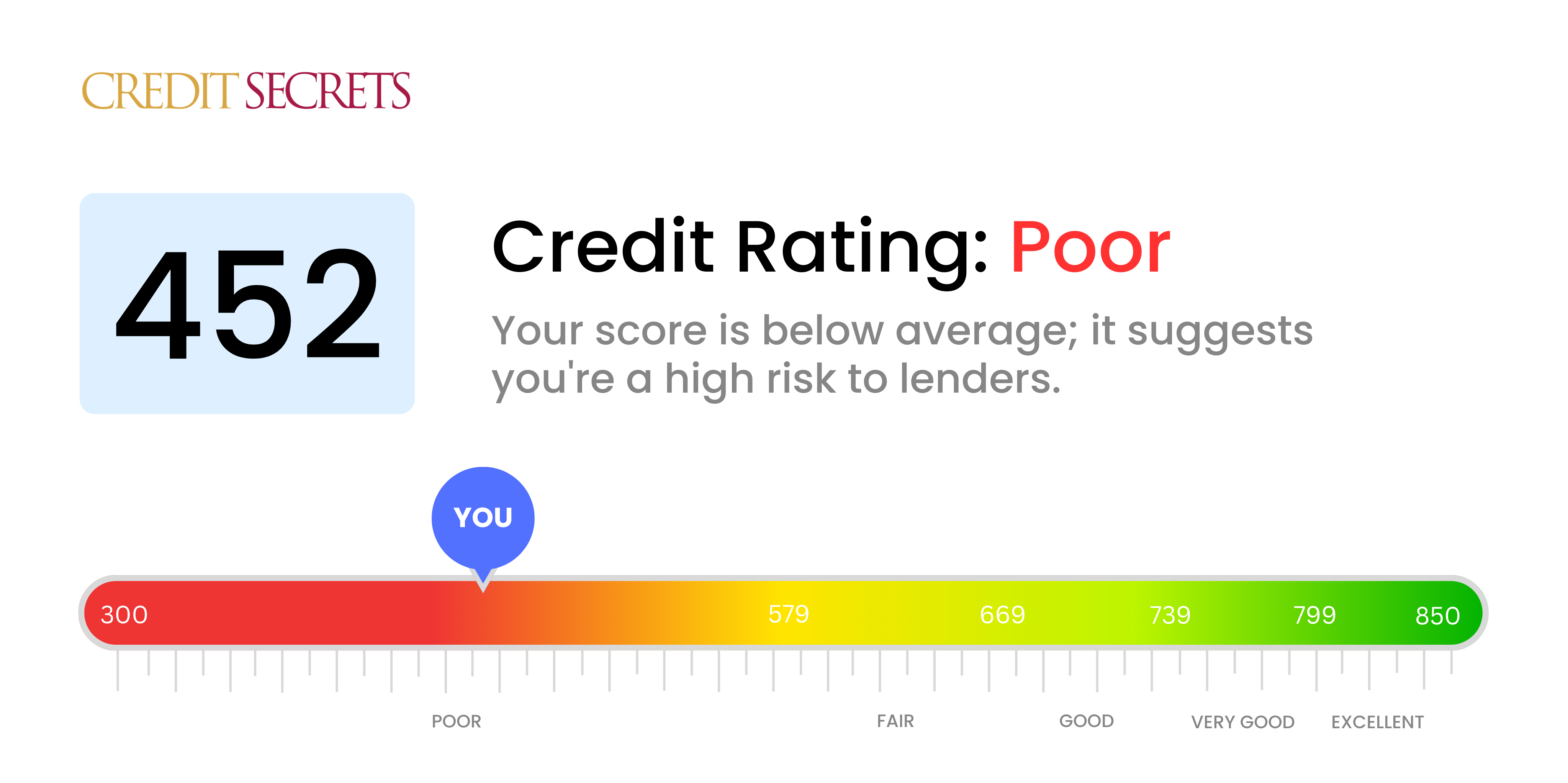

Is 452 a good credit score?

Having a score of 452 falls within the 'Poor' credit score range. This means that your chances of accessing favorable credit terms are quite limited and generally, the cost of borrowing will be higher as lenders consider you a high credit risk.

However, remember that your current credit score doesn't have to be permanent. You can take charge and positively transform your credit health using smart strategies such as consistently paying your bills on time, reducing your debt, and regularly monitoring your credit. Step by step, you can improve your score and bring financial stability into your life.

Can I Get a Mortgage with a 452 Credit Score?

If your credit score is 452, it's quite challenging to secure approval for a mortgage. This score is meaningfully below the threshold that most mortgage lenders consider. Usually, a score in this ballpark implies some substantial financial struggles such as missed repayments or loan defaults.

Though this can be a difficult position to be in, there are alternative options that you might explore. One option might be looking into "bad credit" mortgages, which are designed for people in your position, though these often come with higher interest rates. Alternatively, you could explore federal assistance programs like FHA loans, which are often more forgiving towards individuals with lower credit scores. It's also essential to start working towards improving your credit score, through actions like managing existing debts better and consistently making payments on time. Remember that increasing your credit score is a slow and steady process, but with perseverance, it is possible to improve.

Can I Get a Credit Card with a 452 Credit Score?

With a credit score of 452, being approved for a traditional credit card might prove to be difficult. This score is often considered high risk by lenders, suggesting that there may have been past financial issues or cases of mismanagement. Though it can feel disheartening to confront this, understanding your financial picture is a crucial step towards a better financial future.

Building a stronger credit score from 452 is possible, and part of that might involve utilizing alternatives to conventional credit cards. Secured credit cards, which use a refundable deposit as the card's credit limit, are often more accessible to those with lower scores. Applying for a card with a co-signer or using pre-paid debit cards are other options that might work for your situation. It's important to bear in mind that while these solutions won't magically improve your situation overnight, they are pivotal steps along the road to a healthier financial life. Additionally, remember that any credit options open to you with this score will likely come with higher interest rates, given the potential risk seen by lenders.

Having a credit score of 452 can create a hurdle in your quest for a personal loan. It is mostly recognized as a high risk by typical lenders, making it challenging to acquire a loan according to standard protocols. It's a stumbling block, no question, yet it's important to remain clear-eyed about your borrowing stance associated with this credit score.

Exploring other avenues could be helpful when traditional loans appear inaccessible. Secured loans are one such path where you can put forth collateral. Another way is getting a co-signed loan, where someone with superior credit supports your application. You might also think about peer-to-peer lenders, which could be a little more forgiving when it comes to credit scores. But bear in mind that these potential alternatives often carry higher interest rates and less attractive terms, due to the considerable risk they take on. Always ensure that you're informed and prepared for these conditions if choosing these alternative loan routes.

Can I Get a Car Loan with a 452 Credit Score?

Having a credit score of 452 could make obtaining a car loan a bit challenging. Most lenders prefer to work with people who have a credit score over 660 because high scores signal a lower financial risk. Unfortunately, a score below 600, like yours, is generally seen as subprime. This could mean facing higher interest rates or having your loan application denied as lenders may question your ability to repay the borrowed amount.

Yet, there is a silver lining—with careful planning and thoughtful decision-making, a car loan is not out of your reach. Some lenders cater specifically to those with lower credit scores. But remember to be cautious as these loans usually carry much higher interest rates due to the increased risk perceived by the lenders. However, if you're diligent in comparing terms and conditions and making calculated decisions, you can navigate this journey to secure a car loan successfully.

What Factors Most Impact a 452 Credit Score?

Attaining a clear understanding of your current credit score of 452 can significantly help you embark on a journey to financial improvement. Comprehending the individual factors that contribute to your score will empower you to take the necessary steps towards a more robust financial future.

Consistency in Payments

Your payment history often has a profound influence on your credit score. If your record shows any cases of late payments or unfulfilled obligations, this could be vital in explaining your score.

How to Verify: Look through your credit report to establish if there are any late payments or defaults, denote any periods of missed payments or any unfulfilled financial obligations.

Utilization of Credit

Excessive use of available credit can affect your score adversely. If you are often close to maxing out your credit card, this might contribute to your low score.

How to Verify: Check your credit card statements. If your balances are consistently high relative to the limit, this might be a focal point for your low credit score.

Length and Uniformity of Your Credit History

A short or unstable credit history may compromise your score.

How to Verify: Revisit your credit report to ascertain the age of your oldest and latest accounts. See if you have started new credit accounts recently.

Variety of Credit and Fresh Credit

Maintaining an assortment of credit types and handling new credit judiciously is central to a solid score.

How to Verify: Analyze your array of credit, including credit cards, retail accounts, personal loans, and home loans. Reflect on how frequently you've been taking on additional credit.

Legal and Public Records

Your score can be heavily damaged by public records such as bankruptcies or tax liens.

How to Verify: Inspect your credit report for such public records, address any identified concerns promptly.

How Do I Improve my 452 Credit Score?

With a current credit score of 452, you are in a challenging spot, but don’t worry, we have pinpointed some accessible and impactful steps that can help you make changes to improve your score right away.

1. Clearing Outstanding Debts

Focus on your most overdue accounts; these have the biggest influence on your credit score. Paying them off should be your top consideration. If needed, negotiate a flexible payment scheme with your lenders.

2. Manage Credit Card Utilization

High balances on your credit cards can lower your score. Aim to keep your balances below 30% of your card’s limit, and if possible, strive to be under 10%. Pay off the cards with the highest balances first.

3. Secured Credit Card

Getting a regular credit card may be a stretch at this stage; a secured credit card can be a viable alternative. This card needs a cash deposit as a form of collateral, which will act as your credit for that account. Regularly use this card, but ensure to pay off the full balance monthly to cultivate a positive payment track record.

4. Explore Being Authorized User

A trusted family member or friend with a good credit history may assist you by adding you as an authorized user to their account. This approach can give your score a boost by integrating their good payment behavior into your credit record. Yet, ensure the card issuer reports activity of authorized users to the credit bureaus before going down this path.

5. Enhance Your Credit Diversity

Utilize a range of credit types to improve your credit score. Once you’ve established disciplined payment habits with a secured credit card, consider other credit forms like credit building loans, or department store cards and use them cautiously.