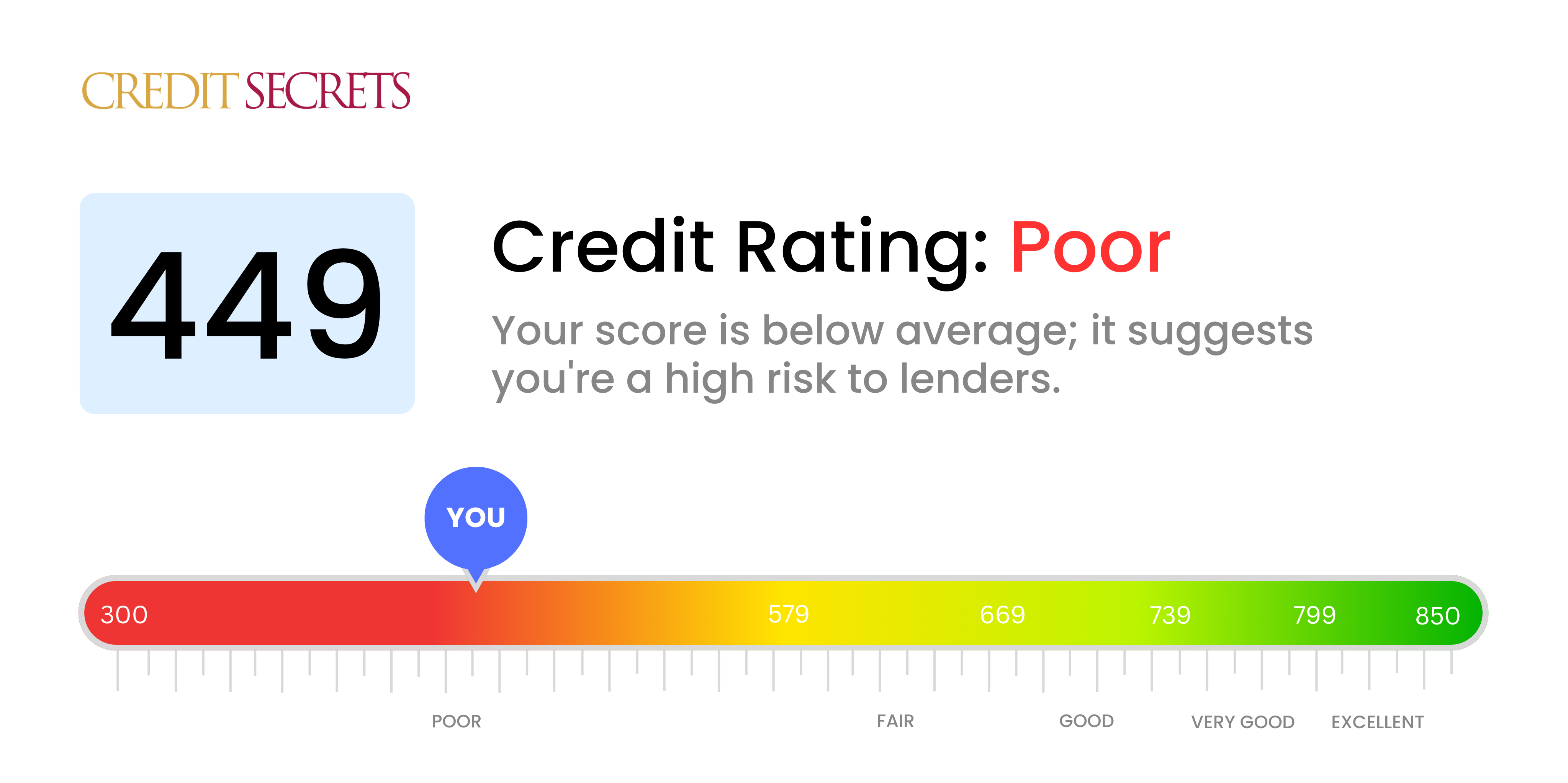

Is 449 a good credit score?

With a credit score of 449, your standing falls into the 'poor' range. That usually means obtaining new credit could be problematic, and you may face higher interest rates or stricter terms on existing accounts.

However, don't lose hope - improving your score is never out of reach. By focusing on reducing debt and consistently punctual payments, you can start taking steps towards better credit. Remember, progress may seem slow, but with time and responsible financial behavior, changes will be noticeable. There's always room for improvement.

Can I Get a Mortgage with a 449 Credit Score?

With a credit score of 449, chances of getting a mortgage approval are slim. This score is considerably below the threshold lenders typically seek, suggesting a track record of financial struggles such as consistent late payments or defaulted loans.

This might seem like a tough spot to be in, but it's important to remember that it's not impossible to improve your situation. Start by focusing on settling any open debts that are negatively affecting your score. From there, concentrate on building a consistent history of timely bill payments. Be patient, as ameliorating your credit score will take time and practice of good financial habits. Although it may seem daunting, with sustained effort, you'll be better placed to fulfill your financial goals in the future.

If your immediate need for housing is crucial, consider alternatives like renting. Engaging in regular, timely rent payments can potentially help you establish a more favorable credit history over time. Additionally, there are mortgage programs specifically designed for individuals with low credit scores that you might want to explore.

Can I Get a Credit Card with a 449 Credit Score?

With a credit score of 449, it may be considerably tough to secure a traditional credit card. Lenders usually see this as a high-risk score, indicative of previous financial struggles. While this is rather disheartening, it's essential to face the situation head-on. Recognizing and accepting your current credit standing is the crucial first step towards improving your financial position, even if it entails acknowledging some hard truths.

Given the difficulty of securing a traditional credit card with such a low score, other options might be worth investigating. Consider a secured credit card which requires a deposit that serves as your credit limit. This could be easier to acquire and can support your goal of improving your credit score over time. Moreover, considering a creditworthy co-signer or prepaid debit cards might be a viable alternative too. Remember, these options aren't a quick fix solution, but they can serve as valuable tools in your journey towards financial responsibility. Bear in mind, any form of credit available to individuals with such a low score typically come with considerably higher interest rates, which speaks to the higher level of risk for lenders.

Having a credit score of 449 does present certain challenges when applying for a personal loan. Traditional lenders often view this score as representing high risk, which could make your approval chances significantly lower. It's essential to face these facts honestly, recognizing the impact this score has on your potential borrowing options.

However, there are alternate routes available for obtaining loans. Secured loans, which require collateral, or co-signed loans, where an individual with a stronger credit profile guarantees your loan, could be viable options. Peer-to-peer lending platforms may also be a possible avenue, as they occasionally have more generous credit requirements. It's crucial to note that such alternatives typically come with higher interest rates and less favorable terms due to the elevated risk for the lender. Though challenges exist, your situation is not hopeless and you do have options to consider.

Can I Get a Car Loan with a 449 Credit Score?

A credit score of 449 creates some hurdles in securing a car loan. Most lenders look for a score of at least 660, and typically view scores below 600 as subprime. At 449, your score falls into this lower group. This could result in higher interest rates or even a loan denial because to lenders, a lower score suggests a higher risk based on past credit history.

Despite the challenges, a car loan is not entirely out of reach. Some lenders are willing to work with those who have lower credit scores. But be aware, the interest rates from these lenders often can be considerably higher to offset the increased risk they're taking on. It's important to scrutinize the loan terms carefully. It may be a more difficult journey, but with diligence and careful consideration, obtaining a car loan is a possibility.

What Factors Most Impact a 449 Credit Score?

Coming to terms with a credit score of 449 is the first step towards improving your financial footing. Let's pinpoint the factors which are likely causing your score to be this low, so you can strategize your route to a brighter financial future.

Prior Defaults or Collections

Defaults or collections are a major blow to credit scores. If you've had accounts default or sent to collections, this is likely pulling your score down.

How to Check: Scrutinize your credit report for any collections or defaults and take measures to handle these, such as paying off debt or setting up manageable repayment plans.

High Outstanding Debts

Carrying large amounts of debt can negatively impact your score. If your total debt is high, this could be a significant factor.

How to Check: Examine your loan and credit card statements. Paying off debt progressively can help improve your credit score.

Frequency of Credit Applications

Applying for credit frequently can harm your credit score. If you've made several applications within a short timeframe, this might be affecting your score.

How to Check: Inspect your credit report for recent credit inquiries. Aim to limit the number of applications you make and only apply for credit when necessary.

Presence of Legal Judgments

Public records such as legal judgments can have a severe impact on your score.

How to Check: Review your credit report for any legal judgments. If present, consult a legal or consumer advocate to discuss possible solutions.

Remember, your credit path is your own to shape, act based on understanding your unique scenario. Let's progressing towards better financial health.

How Do I Improve my 449 Credit Score?

With a score of 449, your credit is deemed poor. Yet, don’t feel disheartened as our systematic approach can help you to steadily enhance it. Allow us to guide you through the most applicable and influential steps for your current circumstance:

1. Confront Past Due Balances

If you have any overdue balances, it’s essential to make them up-to-date. Defaulted accounts drag your score significantly downwards. Contact your lenders offers to arrange a feasible repayment plan, if essential.

2. Trim Down Credit Card Debts

Your credit score dips when your credit card balances soar closer to your credit limit. As an initial step, aim to lower them to less than 30% of your available credit limit.

3. Start with a Secured Credit Card

Given your present score, you might find it hard to qualify for a regular credit card. Consider opting for a secured credit card. This card, which requires a deposit that serves as your credit line, could help you build a strong payment history when managed responsibly.

4. Enlist as an Authorized User

Locate a trusted acquaintance with a good credit history and request they add you as an authorized user on their credit card. This could boost your score by merging their good payment history into your report. However, verify that the card issuer reports authorized user behavior to credit bureaus.

5. Broaden Your Credit Variety

A wide-ranging mix of credit accounts can positively impact your score. Once you’ve gained a firm footing with your secured card, diversify into other forms of credit such as installment loans or a retail credit card. Always remember to handle them cautiously yet optimistically.